How To Get Refer To Approve-Eligible Per AUS Approval

How To Get Refer To Approve-Eligible Per AUS To Qualify For Mortgage: There are ways of trying to get a refer/eligible findings to an approve/eligible per automated underwriting system.

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

How To Get Refer To Approve-Eligible Per AUS To Qualify For Mortgage: There are ways of trying to get a refer/eligible findings to an approve/eligible per automated underwriting system.

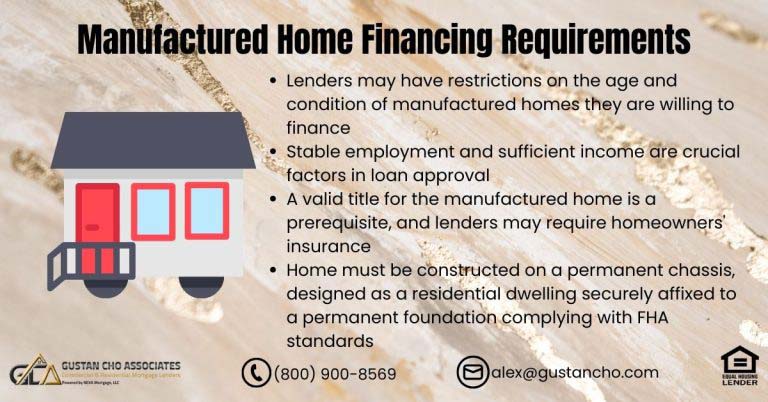

This guide covers manufactured home financing requirements. Many home buyers of manufactured home financing have a difficult time getting it….

In this article, we will cover and discuss how credit disputes affect mortgage process and cause loan denial. The pre-approval…

This guide provides clear information about Fannie Mae’s rules for Community Property States, helping people looking for mortgage information. It…

Every mortgage borrower is different. Your income, debts, credit rating, savings, and goals are unlike anyone else’s. The best mortgage for your neighbor might be the worst home loan for you.

This guide covers VA credit agency guidelines versus lender overlays on VA loans. Understanding VA Credit Score Agency Guidelines is…

This guide explains Fannie Mae second home guidelines, especially vacation properties. As of 2025, a minimum down payment of 10%…

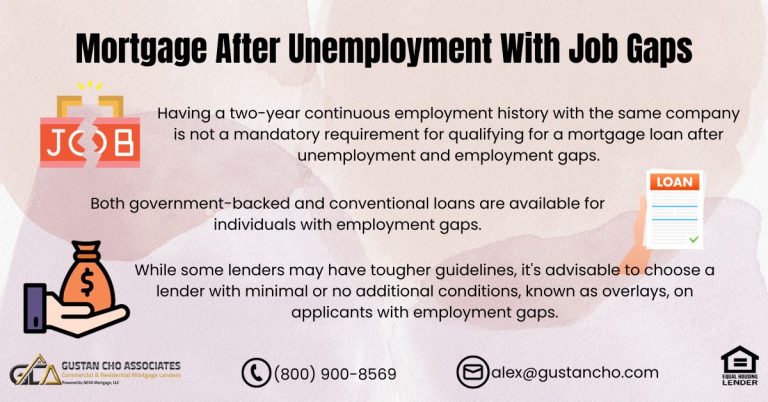

This article will discuss and cover qualifying for a mortgage after unemployment. Homebuyers do not need a two-year employment history…

In this blog, we will cover and discuss buying and moving to another owner-occupied home without selling their first home….

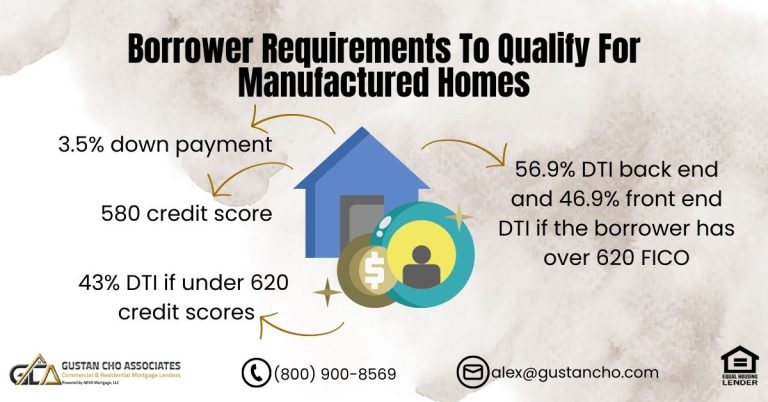

This guide covers FHA Guidelines on Manufactured Home Loans. FHA Guidelines on manufactured home loans are released. HUD, the parent…

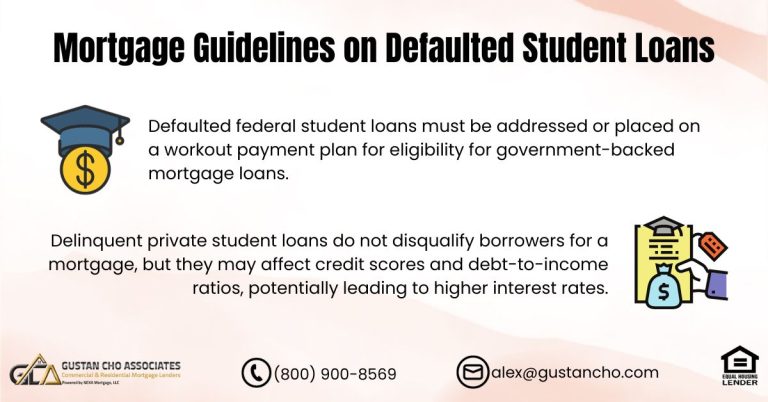

Borrowers cannot qualify for a mortgage with defaulted federal student loans until the student loans are out of default.

The primary emphasis of this blog centers around the waiting period obligations that individuals face after foreclosure, specifically those on…

This blog post will explore Fannie Mae rental income guidelines and lending requirements. We will focus on elucidating the latest…

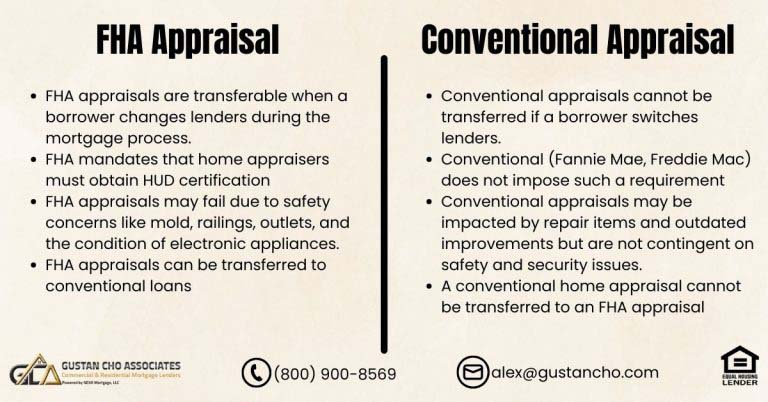

This article examines and clarifies the criteria for FHA Appraisals Versus Conventional Appraisals. There are significant differences in the guidelines…

This article delves into how underwriters analyze bank statements of borrowers. When individuals seek a mortgage loan, underwriters deem 60…

This article will delve into the mortgage guidelines for FHA DTI ratios on manual underwrites. The key distinction between manual…

In this blog, we will discuss payment shock from paying rent as a renter to paying a mortgage as a…

Mortgage lenders must adhere to the Ability to Repay (ATR) rule when underwriting. That means they must make sure that borrowers can afford the loan before they approve it.

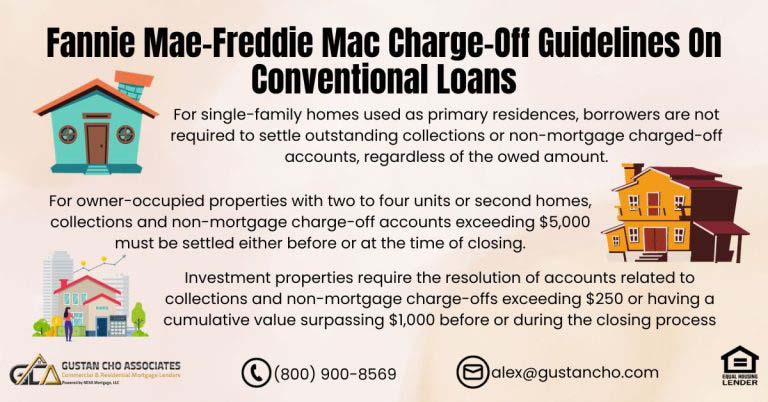

This blog post will explore the Fannie Mae-Freddie Mac charge-off guidelines applicable to conventional loans. Gustan Cho Associates has recently…

In this blog, we will be covering the QC Review Prior Clear To Close During Mortgage Process by some mortgage…

This article will delve into the HUD guidelines for gift funds in the context of home purchase transactions involving Federal…

In this blog, we will cover and discuss qualifying for a mortgage during and after divorce on purchase and refinance…