When Is Rental Verification Required By Mortgage Lenders

When Is Rental Verification Required? A Complete Guide for Borrowers in 2025 One of the most common questions we hear…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

When Is Rental Verification Required? A Complete Guide for Borrowers in 2025 One of the most common questions we hear…

This guide covers foreclosure in mortgage qualification lending guidelines. We will thoroughly discuss the waiting period requirements when there is…

Jumbo Loans Chapter 13 Bankruptcy Guidelines: How to Get Approved in 2025 Many homebuyers think filing Chapter 13 bankruptcy means…

Conforming Loans After Bankruptcy and Foreclosure: How to Get Approved If you’ve gone through bankruptcy or foreclosure, you might think…

Is it Possible to Refinance During Chapter 13 Bankruptcy? Yes, refinancing during Chapter 13 bankruptcy is possible! Many homeowners think…

FHA Loan During Chapter 13 Bankruptcy in Arizona: How to Get Approved in 2025 Buying a home while navigating Chapter…

Reaffirming Debts After Bankruptcy: A Complete Guide for Borrowers in 2025 Filing for bankruptcy can feel like a major setback,…

In this blog, we will discuss and cover Freddie Mac bankruptcy guidelines on conventional loans. Mortgage borrowers can qualify for…

This guide covers the ill-fated HUD’s FHA Back to Work Mortgage. The FHA Back to Work Mortgage no longer exists….

Conventional Loan After Short Sale: Your Guide to Getting Back on Track Life can throw curveballs, and for many homeowners,…

What Happens to Abandoned Pets Due to Foreclosure? Insights and Solutions for 2024 Facing Foreclosure: A Tough Reality Losing a…

In this article, we will discuss and cover manual underwriting during Chapter 13 mortgage process. Homebuyers can qualify for an…

Qualifying for a Home Loan After Deed in Lieu of Foreclosure in 2024 Life happens. Financial struggles can force homeowners…

Buying a Foreclosed Home: A First-Time Homebuyer’s Guide for 2024 If you’re considering buying a foreclosed home as a first-time…

This guide covers the waiting period mortgage guidelines after housing events and bankruptcy. Homebuyers with prior bankruptcy, foreclosure, deed-in-lieu of…

Can You Get a Conventional Loan After Chapter 13 Bankruptcy? Your Complete Guide to 2024 Requirements and Options If you’ve…

The Best Mortgage Lenders After Bankruptcy: Your Path to Homeownership in 2024 Buying a home might feel like a far-off…

Debt Settlement Versus Bankruptcy: A Guide for Mortgage Borrowers in 2024 If you’re juggling debt and trying to figure out…

Reestablishing Credit After Bankruptcy: Your Step-by-Step Guide to Homeownership in 2024 Going through bankruptcy is tough, but it doesn’t mean…

Mortgage Guidelines After Bankruptcy and Foreclosure in 2024 If you’ve been through bankruptcy or foreclosure, you might feel like owning…

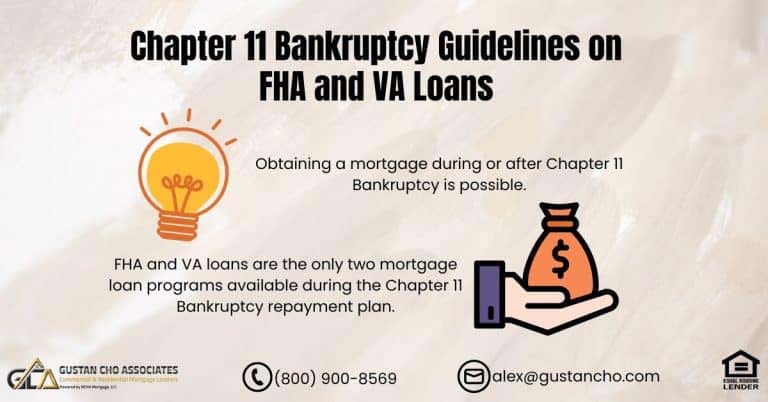

How to Get a Mortgage During or After Chapter 11 Bankruptcy (2024 Updates) If you’re recovering from Chapter 11 Bankruptcy,…

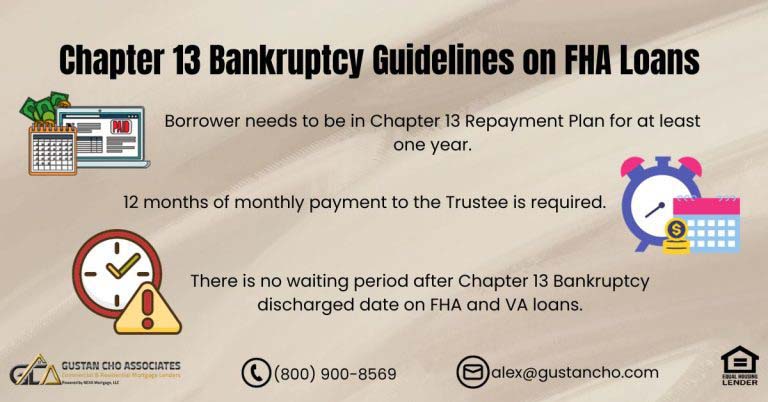

FHA Chapter 13 Bankruptcy Guidelines allow homebuyers and homeowners to qualify for FHA loans for home purchases and refinance during…