This guide covers documents required for mortgage processing and underwriting. All documents required for mortgage processing and underwriting needs to be completed in order to close a home loan on time. This includes blank pages. There are things mortgage borrowers need to know when applying for a mortgage.

The initial phase of the mortgage process is the most important.A file should not be submitted to processing and underwriting unless the file is fully complete.

Incomplete documents and missing pages are the number one reason for stress during the mortgage process. A well-experienced processor will not submit the file to underwriting unless the file is fully complete. It is better to wait a few days until borrowers submit all required paperwork than submit an incomplete file. Submitting an incomplete mortgage file is the number one reason for delays in mortgage process.

What Comes First: Underwriting or Processing?

The processing and underwriting stages are the two main steps your mortgage loan application will go through to be evaluated by the lender. Processing comes first and involves collecting and organizing all the necessary documents and information from you, such as proof of income, employment history, asset statements, credit reports, and property details.

The loan processor will check that all the information is correct and meets the lender’s requirements. They may also contact third parties, such as appraisers and title companies, for additional information.

Once the processing stage is complete and all the required documents are in order, the loan file is submitted to the underwriter. The underwriter evaluates your creditworthiness and the risk associated with the loan. During the review process of your loan application, various factors such as your financial information, credit history, property appraisal, and other relevant information will be considered to determine whether your application can be approved.

In summary, processing is the first step in the mortgage loan process, where the lender collects and verifies all the necessary documents and information. Underwriting comes next and involves evaluating the loan application to determine whether it meets the lender’s criteria for approval based on risk assessment.

Get Mortgage-Ready With the Right Documents From Day One

Speed up approval by gathering the essentials now. Download Your Free Mortgage Document Checklist TodayWhat are the Underwriting Requirements for a Mortgage?

Mortgage underwriting encompasses several key requirements that borrowers must meet to secure a loan. One critical aspect is the credit score, with different loan types having varying minimum score thresholds. Income verification is essential, typically requiring documentation such as pay stubs, tax returns, and W-2 forms. At the same time, self-employed individuals may need additional proof of income. Lenders also verify employment status to ensure stability and the capacity to repay the loan. The debt-to-income (DTI) ratio is another crucial factor when comparing monthly debt payments to gross income; each loan program has its DTI limits. Additionally, borrowers must demonstrate sufficient assets for the down payment, closing costs, and reserves as per lender specifications. Property appraisal ensures the property’s value aligns with the loan amount and lending guidelines. Documentation requirements include bank statements, tax returns, identification, rental history, and explanations for credit issues or employment gaps. Lenders assess credit history by examining payment records, outstanding debts, bankruptcies, and foreclosures. Homeowners insurance and, if necessary, flood insurance are also mandatory. Finally, a title search is conducted to confirm the property’s ownership and ensure no liens. These rigorous underwriting standards safeguard lenders and borrowers by assessing financial capability and property value to mitigate risk.

What are the 4 C’s Required for Mortgage Underwriting?

The “4 C’s” are fundamental pillars in mortgage underwriting, guiding lenders in assessing a borrower’s creditworthiness and suitability for a mortgage. First is “Credit,” examining the borrower’s credit history, payment patterns, outstanding debts, and credit score. A strong credit profile with timely payments and a good score indicates a lower risk for lenders.

Next is “Capacity,” which evaluates the borrower’s ability to repay the mortgage, considering their income, employment stability, and debt-to-income ratio (DTI). A stable income and manageable DTI are favorable indicators for loan approval. The third C, “Collateral,” focuses on the purchased property, ensuring its value aligns with the loan amount and serves as adequate security. Property condition, location, and market value are assessed through a property appraisal.

Finally, “Capital” evaluates the borrower’s financial reserves and assets, including savings, investments, and down payment funds. Having sufficient capital demonstrates financial stability and reduces lender risk. By considering these 4 C’s comprehensively, lenders can make informed decisions about loan approvals and terms. At the same time, borrowers can understand the key factors influencing their mortgage eligibility.

Importance of Documents Required For Mortgage Processing and Underwriting

As mentioned, in order for the mortgage process to run smooth and get to the closing table on time is to have complete documents required for mortgage. Every borrower’s file is unique and different. Not everyone will need the exact documents. However, there are basic documents required for mortgage processing on all files.

Depending on the individual borrower, additional documents required for mortgage processing will be required. Borrowers with bankruptcy, foreclosure, short sale, judgments, divorce will need this paperwork.

What Documentation is Needed for Underwriting?

When applying for a mortgage, you must provide several documents to the lender to verify your income, assets, and other financial details. Depending on the lender and your circumstances, the mortgage application:

Proof of Identification Documents Required For Morgage

This can include a driver’s license, passport, or other government-issued ID. Lenders want to see evidence of your income to assess your repayment ability. This may include pay stubs covering the past few months. W-2 forms or tax returns for the past two years. If self-employed, profit and loss statements and tax returns for the past two years. Additional income documentation such as bonuses, overtime, alimony, or rental income

Documents Required For Mortgage: Employment Verification

Lenders may contact your employer directly or ask for verification letters to confirm your employment status and income stability.

Bank Statements

You’ll likely need to provide bank statements for the past two to three months to verify your assets and a down payment and cover closing costs. Lenders will pull credit reports to assess creditworthiness. While you won’t provide this directly, you should be prepared for the lender to request it.

Documents Required For Mortgage: Debt Information

You may need to disclose debts, such as car loans, student loans, or credit card debt.

Documents Required For Mortgage: Proof of Down Payment

If you’re using savings for your down payment, you’ll need to provide documentation showing the source of these funds, such as savings or investment account statements.

Property

Documents Required For Mortgage

If you’ve found a property, the lender will need details, including the address, purchase price, and a copy of the purchase agreement.

Gift Letters (if applicable)

If someone is giving you money to help with the down payment, you may need a gift letter confirming that the funds are a gift, not a loan.

Additional Documents Required For Mortgage

Depending on your specific situation and the lender’s requirements, you may need to provide additional documentation, such as divorce decrees, bankruptcy discharge papers, or explanations for any irregularities in your financial history. Communication with your loan officer is essential to ensure you’re promptly promptly providing all the necessary documentation. This will help streamline the process and increase your chances of a smooth approval.

Want a Fast Mortgage Approval? It Starts With the Right Paperwork

We’ll walk you through every document you need—step-by-step. Talk to a Loan Officer and Get Your Personalized ChecklistID Verification Documents Required For Mortgage

All lenders will need the identification of borrowers. Lenders can only accept certain documents to validate the ID Verification Requirements. Here are the acceptable forms of ID Verification:

- Valid Driver’s License issued by a state that is not expired

- Military Identification

- Valid U.S. Passport

- Social Security Card – If you are missing your social security card, your loan officer will be able to send you an SSA-89 form

- This form verifies the name and social security number with the Social Security Administration’s records

- Green Card issued by U.S. INS

- ITIN

- VISA

Property Information Documents on Purchase and Refinance

Refinance Transactions

- Recent Mortgage Statement

- Mortgage Note and closing documents

- Copy of insurance contact information, declaration page, and phone number of insurance agent/company

- Recent Utility Bill under borrowers name with both the service and mailing address

Purchase Transactions

- Copy of the signed real estate sales contract including all riders, buyers and sellers agents, and title company information

- Copy of earnest money check and verification of the deposit placed on the home

Income

- Copies of recent pay stubs for the most recent 30-day period

- Copies of w-2 forms for the past two years from employer

- Names and address for all employers in the last two years

- Most recent two years federal income tax returns if applicable

Self Employed or 1099 Wage Earners

Year to date profit and loss statement and balance sheet. K-1’s for all partnerships. S-Corporations for the last two years and most K-1’s are not attached to 1040s. Completed and signed Federal Partnership (1065). Or Corporate Income Tax Returns (1120) including all schedules, statements, and addenda for the prior two years. This is required only if your ownership position is 25% or greater.

Child Support and Alimony Wage Earners

Child Support or Alimony Income can be used as qualified income as long as the continuation of income will be likely for the next three years: Provide divorce decree/court order. Divorce decree needs to state the award amount. Need to provide documentation of receiving child support and/or alimony for the past 12 months.

Social Security and Pension Income

Social Security or Pension Income can be used as qualified income. NON-Taxable income can be grossed up 15% to 25% depending on the loan program: Provide social security awards letter or pension awards letter

Documents Required For Mortgage on Asset Documentation For Down Payment and Closing Costs

If the sale of an existing home is applicable, need to provide closing docs. If the property is listed but not sold, need to provide listing agreement. Provide settlement statement if sold. Savings, checking or money market funds or all asset accounts with funds that will be used for closing needs to be provided. 60 days of bank statements or printouts. Stocks and bonds statements if borrowers are going to need asset information of qualified funds. Gift funds by donor need to have donor sign gift letter and 30 days of donor’s bank statements. Lenders will provide a gift letter.

Confused About What You Need for a Mortgage? We Make It Simple

From pay stubs to tax returns—we’ll explain what and why. Get a Clear Guide to Mortgage Document RequirementsDebt-To-Income Ratio Calculations

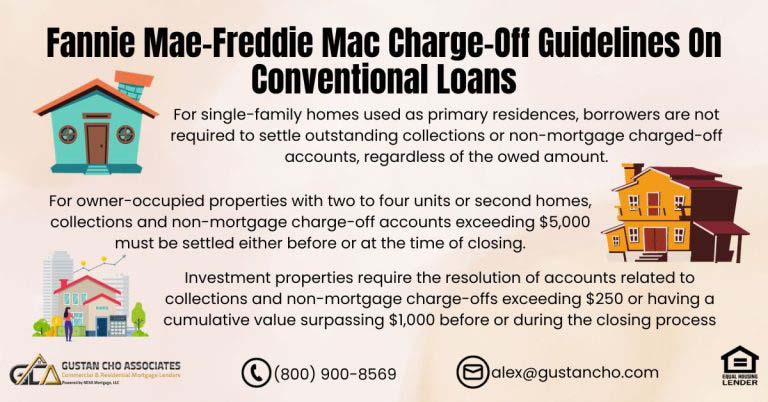

Mortgage underwriters need borrowers’ liability information to calculate DTI. This includes student loans, child support, alimony and all debt information. All minimum monthly debt reporting on the credit report will be counted. Public records such as judgments and tax-liens not reporting on the credit report will be discovered. Gustan Cho Associates offers government and conventional loans with no overlays. Contact us at 800-900-8569 or email us at alex@gustancho.com .

FAQ: Documents Required For Mortgage Processing and Underwriting

-

1. What are the key documents required for mortgage processing and underwriting? The documents required for mortgage processing and underwriting vary depending on individual circumstances, but common documents are needed for most applications.

-

These include proof of identification (driver’s license, passport, etc.), income verification (pay stubs, tax returns, W-2 forms), employment verification, bank statements, debt information, proof of down payment, property details (purchase agreement, address, etc.), and any additional documentation related to your financial situation (divorce decrees, bankruptcy papers, etc.).

-

2. Why must all documents be completed for mortgage processing? Complete documents are essential for a smooth mortgage process and timely closing. Incomplete or missing documents can cause delays and stress during the process. Experienced processors ensure that all required paperwork is gathered before submitting the file for underwriting, as incomplete files are a primary reason for processing delays.

-

3. What is the sequence of processing and underwriting in the mortgage loan process? Processing comes before underwriting in the mortgage loan process. During processing, all necessary documents and information are collected and organized. This includes income verification, employment history, asset statements, credit reports, and property details. Once processing is complete and the file is fully documented, it is submitted to the underwriter for creditworthiness and risk assessment evaluation.

-

4. What are the “4 C’s” required for mortgage underwriting? The “4 C’s” refer to credit, capacity, collateral, and capital. Credit assesses the borrower’s credit history and score. Capacity evaluates the borrower’s ability to repay the mortgage. Collateral ensures the property serves as adequate security. Capital examines the borrower’s financial reserves and assets. Lenders consider these factors comprehensively to assess creditworthiness and loan eligibility.

-

5. What additional documentation may be required for specific borrower situations? Depending on individual circumstances, borrowers may need additional documentation. For example, self-employed individuals may need profit and loss statements, divorcees may need divorce decrees, and those receiving gifts for the down payment may need gift letters. Communication with your loan officer is crucial to determine if additional documentation is needed.

This blog about the Documents Required For Mortgage Processing and Underwriting was updated on April 4th, 2024.