Refinancing Non-QM Loans: How to Lower Your Rate and Save More

If you took out a Non-QM loan to buy your home, you’re not alone. Many borrowers turn to Non-QM (Non-Qualified Mortgage) loans when they don’t meet the strict requirements of traditional mortgages. Whether you were self-employed, had a recent bankruptcy, had low credit scores, or needed a jumbo loan, Non-QM loans helped make homeownership possible.

But here’s the good news: refinancing Non-QM loans into a government-backed or conventional mortgage is possible—it can save you thousands.

In this guide, we’ll explain how refinancing non-QM loans works, who qualifies, the benefits of refinancing, and how Gustan Cho Associates can help you lock in a better deal.

What Is a Non-QM Loan?

A Non-QM loan refers to a mortgage that does not adhere to the regulations established by the Consumer Financial Protection Bureau (CFPB). These loans are designed for individuals who:

- Are self-employed and use bank statements instead of tax returns

- Have high debt-to-income (DTI) ratios

- Had a recent bankruptcy, foreclosure, or short sale

- Need loan amounts above conforming limits (jumbo loans)

- Have credit scores down to 500

While Non-QM loans offer flexibility, they often come with higher interest rates. That’s why refinancing Non-QM loans into lower-rate options is a smart financial move when you become eligible.

Ready to Refinance Out of a Non-QM Loan?

If you’ve improved your credit or income, you may now qualify for a traditional mortgage with lower rates.

Can You Refinance a Non-QM Loan?

Yes! Refinancing Non-QM loans is possible anytime after your original mortgage closes—there’s no waiting period. If your financial situation has improved since your home purchase, you may now qualify for:

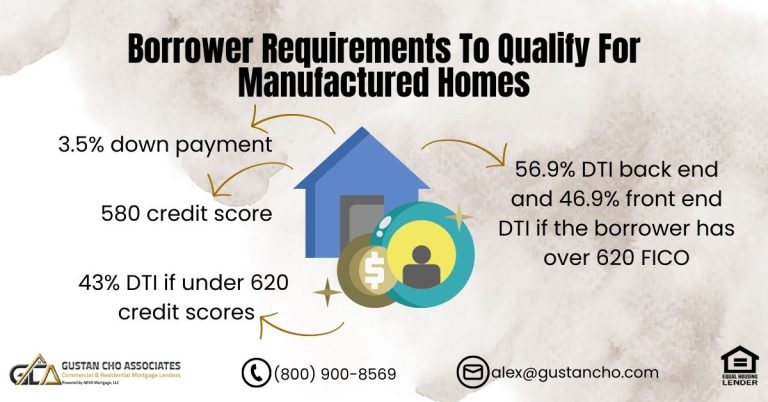

- FHA loans (as low as 3.5% down, flexible credit)

- VA loans (for eligible veterans, no money down)

- Conventional loans (with better rates and terms)

At Gustan Cho Associates, we work with borrowers nationwide to help them transition from high-cost Non-QM mortgages to more affordable options

Refinancing Non-QM Loans: Why?

If your Non-QM mortgage rate is 6%, 7%, or even higher, you could pay hundreds more monthly than necessary. Refinancing Non-QM loans offers several key advantages:

1. Lower Interest Rates

Conventional and government-backed loans generally offer much lower interest rates. If your credit has improved, you could refinance into a prime rate loan and save thousands over the life of your mortgage.

2. More Predictable Payments

Many Non-QM loans have adjustable rates or interest-only terms. Refinancing into a fixed-rate FHA, VA, or conventional loan gives you stable monthly payments and long-term peace of mind.

3. No More Non-QM Premiums

Due to increased risk, non-QM loans often have higher lender fees and rate premiums. Refinancing to a traditional mortgage removes these extra costs.

4. Easier Paperwork (for Some)

If your finances are now easier to document (like switching from self-employed to W-2), qualifying for a traditional loan may be easier than staying in a Non-QM program.

Who Can Refinance a Non-QM Loan?

If you’re considering refinancing a Non-QM loan, you may qualify under several conditions. Improvements in your credit score, seasoning from a past bankruptcy or housing event, and a more stable or easily documented income can all enhance your eligibility. Additionally, an increase in your home’s value can positively impact your loan-to-value ratio. I

t’s also important to have made on-time payments for the last 12 months. Lenders typically require a net tangible benefit, meaning the refinance should provide a financial advantage, such as lowering your interest rate or monthly payment.

Lower Your Rate by Switching From Non-QM to Conventional

Refinance into a standard mortgage with better terms and say goodbye to higher non-QM rates.

Common Scenarios for Refinancing Non-QM Loans

Self-Employed Borrower Switches to W-2 Job

When you first applied for your mortgage as a self-employed borrower, lenders used your bank statements to understand your finances. This helped them see your income, but it also had some drawbacks, especially regarding interest rates and loan options.

Now, after working for two years in a stable salaried job, your financial situation has improved. You have a steady income, which makes you more creditworthy to lenders. Because of this, you can now apply for a conventional loan. This type of loan usually has a much lower interest rate than what you could get as a self-employed borrower. This change makes homeownership more affordable and shows your greater financial stability.

Credit Score Jump from 580 to 700+

Boosting your credit score from 580 to over 700 is a huge win in your financial journey. After dealing with some credit bumps, getting a Non-QM loan lets you snag your home despite those challenges. That loan helped you secure a place and start working on your credit again.

Now that your credit score is improving, you can check out some cooler financing options. With a solid credit score, refinancing into a lower-cost FHA or conventional loan could be on the table. This means you could score lower interest rates, which might drop your monthly payments and save you cash in the long run. Refinancing may allow you to leverage your home equity or adjust your loan conditions to align with your financial objectives. A better credit score can open up new options for you as a homeowner. This gives you more financial freedom and stability.

Increased Home Equity

Owning a home has a major advantage: its value can go up over time. As property values increase, homeowners can build more equity in their homes. This equity opens up financial opportunities.

For example, you can refinance your mortgage for a better loan with lower interest rates. This can save you money over the life of the loan.

If you need cash quickly, a cash-out refinance allows you to access some of the equity you’ve built. You can use this money for home improvements, paying off debt, or investing in other opportunities, all while securing a lower rate than before. Using your home equity can be a powerful way to achieve your financial goals.

Loan Types You Can Refinance Into

- FHA Loans:Great for borrowers with credit scores as low as 580 and limited down payment or equity. Fixed rates, flexible guidelines, and lower closing costs.

- VA Loans: Eligible veterans and active-duty service members can refinance into VA loans with no down payment and no mortgage insurance.

- Conventional Loans: If your finances and credit have improved, a conventional refinance offers the best rates with no upfront mortgage insurance premium.

When Can You Refinance?

Refinancing Non-QM loans can happen sooner than you might expect; you don’t need to wait for months or years after closing. As long as you qualify for a better loan, can demonstrate a net tangible benefit, and meet the necessary documentation requirements, you are free to refinance at any time. Borrowers can take advantage of better loan terms even just a few months after getting their first mortgage.

How Gustan Cho Associates Can Help

At Gustan Cho Associates, we specialize in helping borrowers who don’t fit into the “perfect borrower” box. We’re experts in both Non-QM loans and refinancing them into lower-cost, traditional options.

- No lender overlays

- Experts in FHA, VA, Conventional, and Non-QM

- Competitive rates and fast closings

- Personalized support 7 days a week

We’ll evaluate your Non-QM mortgage, run the numbers, and tell you exactly how much you can save by refinancing.

Improved Credit or Income? You May Qualify for Traditional Terms

If your situation has stabilized, it’s time to refinance into a more affordable loan.

Ready to Refinance Your Non-QM Loan?

If you’re stuck in a high-interest Non-QM loan, now’s the time to explore your options. Refinancing Non-QM loans into traditional mortgages could save money, lower your payment, and give you more peace of mind.

Contact Gustan Cho Associates today at 800-900-8569 or email us at gcho@gustancho.com to get started. We’re here 7 days a week to help you get the best loan for your future.

Let’s refinance your Non-QM loan and put you back in control.

Frequently Asked Questions About Refinancing Non-QM Loans:

Q: Can I Refinance My Non-QM Loan Into a Regular Mortgage?

A: Yes, refinancing non-QM loans into an FHA, VA, or conventional loan is possible, especially if your credit, income, or financial situation has improved.

Q: Do I have to Wait a Certain Time Before Refinancing My Non-QM Loan?

A: Nope! There’s no waiting period. You can start refinancing Non-QM loans anytime after your first mortgage closes.

Q: What do I Need to Qualify for Refinancing Non-QM Loans?

A: You’ll need decent credit, steady income, and a financial benefit like a lower monthly payment. A good payment history on your current mortgage helps, too.

Q: Can I Refinance from a Non-QM Loan if I had a Bankruptcy Before?

A: Yes. Many people get Non-QM loans after bankruptcy. Once you’ve rebuilt your credit, refinancing Non-QM loans into better terms is absolutely doable.

Q: Will Refinancing Non-QM Loans Lower My Interest Rate?

A: Most likely, yes! Non-QM loans often have higher rates. If you now qualify for a traditional loan, your new rate could be much lower, saving you money every month.

Q: What Loan Programs Can I Refinance Into?

A: You can refinance Non-QM loans into FHA loans (low credit, flexible guidelines), VA loans (for veterans), or conventional loans (best if you have strong credit).

Q: Can I Refinance if I’m Self-Employed?

A: Yes, but it depends on how you report your income. Refinancing Non-QM loans is possible if you now have W-2 income or can show steady self-employment earnings.

Q: What if My Home Increased in Value—Can I Use That to Refinance?

A: Absolutely. More home equity means better refinancing options. You might even do a cash-out refinance when refinancing Non-QM loans.

Q: Will Refinancing Non-QM Loans Require a Lot of Paperwork?

A: Not always. If your finances are easier to document now than before, the paperwork may be less than what you needed for your original Non-QM loan.

Q: Who Can Help Me with Refinancing Non-QM Loans?

A: Gustan Cho Associates can! We’re experts at helping borrowers refinance non-QM loans into lower-rate, better-term mortgages—even if other lenders say no.

This blog about “Refinancing NON-QM Loans To Traditional Mortgages” was updated on July 1st, 2025.

From Non-QM to Mainstream—We Make It Easy

Whether you started with bank statements, DSCR, or no-doc loans—we’ll help you transition into a full-doc mortgage.