In this blog, we will cover and discuss tax settlement for borrowers who have tax liens. With the advent of TurboTax, mostly everyone can become a do-it-yourself tax preparer. But as we all know, with any do-it-yourself project, there are sometimes mishaps or consequences of not being fully informed or prepared. Most people can do their own tax returns using some sort of tax software. However, the more complicated the return, the more likely one will make a mistake. In this article, we will discuss and cover Tax Settlement For Borrowers Who Have Tax Liens.

So What Happens When You Make A Mistake?

Most tax software programs run error checks and detect any red flags. These processes are not foolproof. So what happens if you make a mistake?. Well, many times if you make a calculation error, the IRS will correct the error for you and will send you a notice. Hopefully, the error is not material. More than likely, the IRS will issue a proposed assessment and allow you time to agree or disagree with their revised calculations. Once the assessment is final the IRS will send you a bill. If you owe more money than you can pay the IRS has many options available.

Fresh Start After Tax Settlement

According to the IRS, the Fresh Start Program, tax settlement, is for taxpayers who need to pay back taxes and avoid summary collection actions such as tax liens and/or bank levies. The features of the IRS Fresh Start Program are:

- The new threshold for the IRS to file a tax lien is $10,000

- This means that if you owe less than $10,000, the IRS will most likely not file a federal tax lien against you

- Installment payment agreements have been extended to 72 months from a previous 60-month plan, for taxpayers who owe less than $50,000

- Financial statements are not needed

- A payment plan can be set up entirely online and is virtually automatic provided the taxpayer is not currently on an installment payment agreement

- For taxpayers who owe more than $50,000, financial statements need to be provided

However, if a taxpayer owes more than $50,000, they have the option of paying their liability down to $50,000 so that they may qualify for the payment plan without providing financial statements to the IRS.

Offer In Compromise Tax Settlement With The IRS

Offer in Compromise-

- An Offer in Compromise is generally considered when the offered amount is the most that the IRS can expect to collect or receive from the taxpayer over a reasonable period of time

- Does this sound vague?

- What is the IRS looking for when you apply for an Offer in Compromise?

They are looking at the following:

- income, all sources, for the entire household

- including earned income

- social security

- disability

- rent received from roommates

- social services benefits such as food stamps

- other sources of financial assistance

How To Go About The Tax Settlement Process

They will want to look at your bank accounts, run asset checks, and they want to see if you own real property and whether or not you have equity in your home. It is at the discretion of the IRS and nobody really knows the magic formula, but why not apply? The most that could happen is they say no. the IRS has an Offer in Compromise pre-qualifier on their website where you enter in your financial information and your monthly debt payment. Taxpayers can find the Offer in Compromise Pre-qualifier tool here: http://irs.treasury.gov/oic_pre_qualifier/

Why Should I Pay My IRS Debt And Tax Settlement

If you owe money to the IRS and you are not on a payment plan towards paying the liability, the IRS can and will take summary collection actions such as the following:

- bank levies, federal tax liens

- earnings withhold orders

- many other drastic collection actions

Additionally, if you have unpaid tax liens and owe the IRS money, this can definitely impact the ability to purchase a new home or refinance.

Need to See Tax Advisor for Tax Settlement

The author of this article, Tax Settlement, was written by Alex Carlucci who is a senior loan officer with Gustan Cho Associates. Alex is a contributing associate editor and writer for Gustan Cho Associates Mortgage and Real Estate Informational Center. He is a licensed mortgage loan originator for Gustan Cho Associates Empowered by NEXA Mortgage, LLC, and is based in Oakbrook Terrace, Illinois. Gustan Cho Associates is a mortgage company licensed in 48 states headquartered in Chandler, Arizona. We have offices throughout the United States and are licensed in multiple states. Alex is an expert in all areas of mortgage lending and his expertise is in FHA, VA loans, and Conventional loans with no overlays.

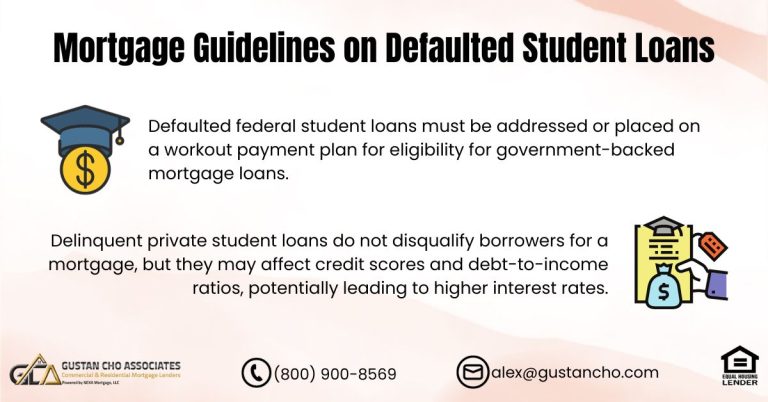

Mortgage Lender Experts With No Overlays on Tax Settlement

Gustan Cho Associates has a national reputation for helping borrowers who had prior credit issues and had a hard time qualifying for home loans due to prior credit issues and/or debt to income ratio issues. A large percentage of Alex’s borrowers are folks who could not qualify at other banks and lenders due to their lender overlays. A lender overlay is when a bank or lender has higher credit requirements than those of FHA or Fannie Mae. For example, HUD minimum credit score requirement for a buyer to purchase a home is 580 FICO. However, most banks and lenders may have FHA Lender Overlays. This holds true even though FHA only requires a 580 FICO credit score, they may require a 640. Alex Carlucci, due to not having any overlays on FHA loans, can approve, originate, and fund borrowers who just meet the minimum agency guidelines.

Agency Guidelines Versus Lender Overlays

FHA credit score requirements and other FHA Guidelines. Gustan Cho Associates has no minimum credit score requirements on VA loans. We have no debt to income ratio requirements on VA loans. Borrowers under 580 credit scores can qualify for FHA Loans with a 10% down payment. Need 580 credit scores for 3.5% down payment FHA loans. Outstanding collections and charged-off accounts do not have to be paid. Whatever the automated findings are, we just go off DU AUS findings. No additional overlays besides agency guidelines. Gustan Cho Associates also offers non-QM loans and other alternative financing loan programs. Call us at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com.