This guide at Gustan Cho Associates will cover how to increase FICO credit scores to qualify for a mortgage loan and get the lowest possible rates on your home loan. Lenders use various factors to price out mortgage rates. Not all borrowers get the same mortgage rates. The biggest factor lenders base pricing of mortgage rates on is the borrower’s credit scores.

The team at Gustan Cho Associates are experts in helping borrowers boost their credit scores to meet the minimum credit score requirements and get the best pricing on mortgage rates.

The higher the credit scores, the lower the rates. The higher the risk for the lender, the higher the rates. Mortgage companies’ price rates are based on layered risk factors. The borrower’s FICO credit score has the biggest impact on mortgage rates. Our viewers at Gustan Cho Associates frequently ask what FICO credit score is used for mortgages. Mortgage lenders use the FICO Vantage 2 Model. Various factors go into pricing mortgage rates, but there is no factor than credit scores that affect rates.

How To Increase FICO Fast To Qualify For a Mortgage

All mortgage loan programs have a minimum credit score requirement to qualify for their mortgage loan program. Besides meeting the minimum credit score requirement to meet the lending requirements, your credit score is the largest factor in pricing mortgage rates.

The higher your credit scores, the lower your rates on a mortgage loan. Getting a high mortgage rate due to a low credit score can cost you tens of thousands in interest expenses over the mortgage loan term.

Maximizing your credit scores before applying for a mortgage loan is best and highly recommended. Gustan Cho Associates team has helped thousands of homebuyers maximize their credit scores before formally applying for a mortgage loan. There are some quick fixes on how to increase FICO fast to qualify for a mortgage so you can get the best rates.

Is It Possible To Improve Your FICO Credit Scores?

Your FICO credit scores fluctuate depending on how you use your revolving credit tradelines. If you maximize your credit cards, your credit scores will decrease. Your credit scores will increase if you pay down your revolving accounts to under a 10% utilization ratio. You can increase your credit scores substantially through the step-by-step instructions of this guide on how to increase FICO to qualify for a mortgage.

Buying a house should be carefully thought out and planned. The first thing you should do is consult with a loan officer. The loan officer will advise you to maximize your credit scores by following simple steps. The next section will cover how to increase your FICO fast to qualify for a mortgage with the lowest possible mortgage rate.

Ready to Boost Your FICO Score and Qualify for a Mortgage?

Contact us today to learn strategies to quickly increase your credit score and get one step closer to homeownership.

What If I Can Not Meet The Credit Score Guidelines For a Mortgage?

In this section, we will cover the simple steps of how to increase FICO to qualify for a mortgage. The minimum credit score to qualify for a 3.5% down payment home purchase FHA loan is 580 FICO. What happens if your credit score is under 580 FICO? HUD, the parent of FHA, allow borrowers with under 580 credit scores and down to 500 FICO to be eligible for an FHA loan.

The lowest credit score you can have to qualify for an FHA loan is 500 FICO. However, borrowers with under 580 FICO and down to 500 credit scores require a 10% down payment versus a 3.5% down payment for an FHA loan.

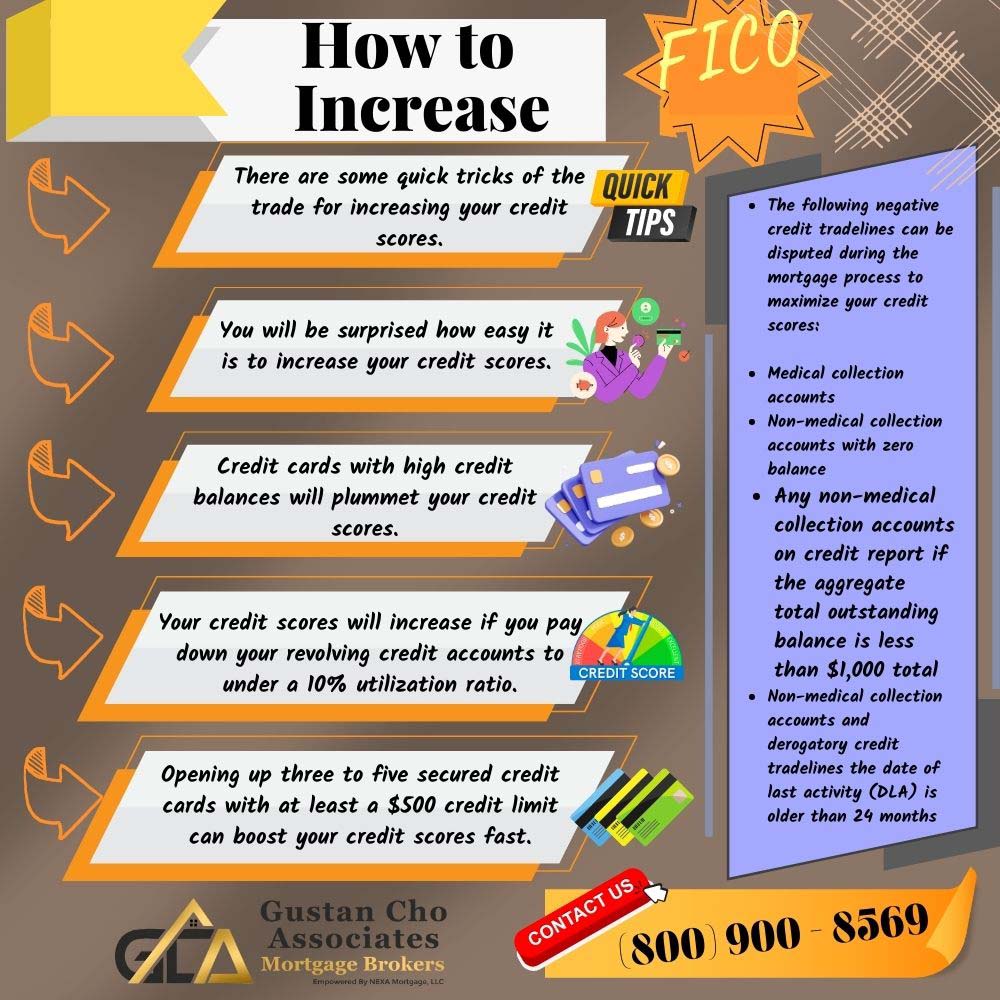

Borrowers with under a 580 FICO credit score need to put a 10% down payment versus a 3.5% down payment if their scores are at 580 FICO or higher. But what if you do not have a 10% down payment? The logical choice is to increase your credit score to a 580 FICO. The team at Gustan Cho Associates can help borrowers boost their credit scores to get to a 580 FICO. There are some quick tricks of the trade for increasing your credit scores. We also have preferred referral credit advisors we refer our borrowers needing a professional to help them with creditors misreporting accurate information or creditors in violation of the Fair Credit Reporting Act.

Steps on How To Increase FICO To Qualify For a Mortgage

In the following sections of this guide on how to increase FICO, we will discuss how to increase FICO to qualify for a mortgage loan. There are a few quick tricks of the trade on boosting your credit scores fast so you can qualify for a mortgage. You do not need to hire expensive credit repair companies to rebuild and boost your credit just by disputing derogatory credit tradelines.

Credit repair through credit disputes is no rocket science. Whatever a credit repair company can do, you can do the same at no cost. We guide our borrowers how to increase FICO credit scores to qualify for a mortgage.

If we suspect the creditor has violated any federal consumer laws, we will address our suspicion with our clients and refer them to a preferred professional who we have worked with closely in the past. You will be surprised how easy it can be to increase your credit scores. You will have low credit scores if you do not have active credit tradelines.

Opening up three to five secured credit cards with at least a $500 credit limit can boost your credit scores fast. There are other tools we can recommend our borrowers on how to increase FICO to qualify and get pre-approved for a mortgage.

How To Increase FICO By Paying Down Credit Card Balance

Many consumers use credit cards during the holiday season for presents to loved ones. Never apply for a mortgage when you have maxed out credit cards. Credit cards with high credit balances will plummet your credit scores. Credit cards with high balances can easily decrease your credit scores by 100 points on all three credit bureaus.

Always keep your credit card balances below 10% of your credit limit for maximum optimization. Having maximized credit card balances will lower your credit scores.

The good news is by paying down your credit card balances to under a 10% utilization ratio will instantly skyrocket your credit scores. If you are in a rush to submit your mortgage loan application, your loan officer can do a rapid rescore so your credit scores on your credit reports gets updated sooner than its regular cycle that updates.

Lowering Credit Utilization Ratio

Another way how to increase FICO fast to qualify for a mortgage is to pay down your credit card balance to a 10% utilization ratio. High credit card balances will drop your credit scores. However, paying the credit card balance will instantly boost your credit scores. You can also get non-traditional credit like your utilities, landline, cellular phone, cable, internet provider, and other non-traditional creditors to report with Experian Boost.

Need a Higher FICO Score to Qualify for a Mortgage? We Can Help!

Reach out now for expert tips on how to raise your score fast and get approved for a home loan.

Mortgage Guidelines Credit Disputes

This section will cover how to increase FICO artificially and get away with it. Credit disputes on non-medical collection accounts and derogatory credit tradelines are not allowed during the mortgage process on FHA loans. However, there are credit disputes that are exempt from retraction. The following credit disputes are exempt from retraction during the mortgage process.

- Medical collection accounts

- Non-medical collection accounts with zero balance.

- Any non-medical collection accounts on the credit report if the aggregate outstanding balance is less than $1,000.

- Non-medical collection accounts and derogatory credit tradelines, the last activity (DLA) date is over 24 months.

Most non-QM lenders do not require credit disputes to be removed from credit reports. This is a huge benefit for borrowers of non-QM loans that need to boost their credit scores to get a better mortgage rate.

How To Increase FICO By Disputing Credit Tradelines

If you have medical or non-medical collections with zero balance, you can dispute the credit tradelines to increase your credit scores. Also, if you have collection accounts with an aggregate balance of less than $1,000, you can dispute the derogatory credit tradelines to increase your credit scores. Here is how to dispute derogatory credit tradelines to increase your credit scores:

- Dispute Credit Report Information at Experian.com

- TransUnion Online Service Center | Online Freeze, Dispute, Fraud Alert, Credit Report, and Score

- File a Dispute on Your Equifax Credit Report | Equifax®

Why Are Credit Disputes Not Allowed By Lenders During The Mortgage Process

When a consumer disputes a derogatory credit tradeline, the credit bureaus automatically discount the negative algorithm from the credit scoring formula. Therefore, when the verbiage on the credit report states, Consumer Disputes Creditor Concerning Accuracy, the credit bureaus will not factor the derogatory tradelines on the overall credit score and count the credit disputed tradeline like it does not exist.

Credit disputes will automatically inflate consumer credit scores until the disputed verbiage remains on the credit report. When the consumer retracts the credit disputes, the negative factor gets re-factored in the credit scoring algorithm so the credit scores drops.

When this happens, the consumer credit scores increase because the derogatory credit is not factored in while the tradeline is disputed. Lenders do not want credit disputes during the mortgage process because it artificially inflates a borrower’s credit score. When the consumer removes the credit disputes, the credit scoring formula takes the negative credit tradeline back into the formula, so the credit scores drop again due to the derogatory credit tradeline factor.

How To Increase FICO By Disputing Derogatory Credit Tradelines

One quick way how to increase FICO is to dispute negative exempt credit disputes. Disputing credit tradelines that are exempt from removing active credit disputes should be disputed for maximum credit score boost. The following negative credit tradelines can be disputed during the mortgage process to maximize your credit scores:

- Medical collection accounts

- Non-medical collection accounts with zero balance

- Any non-medical collection accounts on the credit report if the aggregate outstanding balance is less than $1,000.

- Non-medical collection accounts and derogatory credit tradelines, the last activity (DLA) date is over 24 months.

All the above types of derogatory credit tradelines exempt from credit disputes should be disputed to maximize your credit scores. If you are applying for non-QM loans, all derogatory credit tradelines should be disputed to maximize your credit scores to get the best mortgage rates.

If you have any questions about the content of this guide on how to increase FICO, please get in touch with us at Gustan Cho Associates at (800) 900-8569. Text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

Frequently Asked Questions About How to Increase FICO:

Q: What Does “How to Increase FICO” Mean?

A: It means improving your credit score to get a better mortgage rate and save money.

Q: Why is Knowing How to Increase FICO Important When Getting a Home Loan?

A: Because lenders use your FICO score to decide your mortgage rate. Higher scores mean lower rates and cheaper monthly payments.

Q: What’s the Fastest Way to Increase FICO to Qualify for a Mortgage?

A: Paying down your credit card balances below 10% of your credit limit will raise your scores quickly.

Q: Can I Still Get a Mortgage if I Don’t Know How to Increase My FICO and have Low Scores?

A: Yes, but you’ll likely need a bigger down payment, such as 10% instead of 3.5% for FHA loans.

Q: Do I Need to Pay Someone to Learn How to Increase My FICO Quickly?

A: No, you can easily do it yourself with simple steps like paying off credit cards and disputing incorrect credit items.

Q: How Can I Increase My FICO Scores by Disputing Items on My Credit Report?

A: Disputing medical collections or old accounts with low balances can raise your score quickly, especially if you’re applying for a non-QM loan.

Q: Can Gustan Cho Associates Teach Me How to Increase FICO Scores for Free?

A: Yes, we help borrowers every day to boost their scores using easy-to-follow steps, free of charge.

Q: If I’m Unsure About How to Improve My FICO Score, What Credit Rating is Necessary to Purchase a Home?

A: With an FHA loan, the lowest score you can have is 500, but you’ll need a 10% down payment. It’s better to raise your score to at least 580.

Q: Will Knowing How to Increase FICO Scores Save Me Money on My Mortgage?

A: Definitely! A higher FICO score can save you a lot of money in interest over the life of your loan.

Q: Can Paying My Bills on Time Every Month Help Me Increase My FICO Scores?

A: Yes, paying all your bills on time and keeping balances low are the simplest ways to boost your FICO scores.

This blog about “How To Increase FICO Scores For a Mortgage” was updated on May 6th, 2025.

Want to Qualify for a Mortgage? Increase Your FICO Score Fast

Get in touch now to discover how we can help you boost your score and secure your home loan.