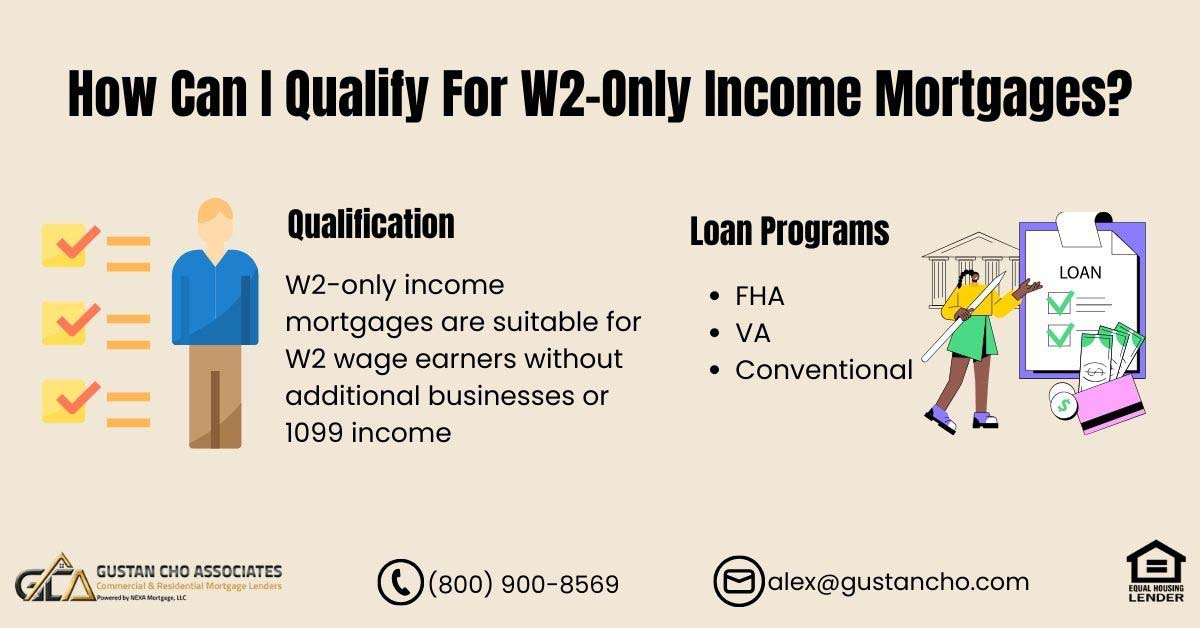

Homebuyers with pending income tax returns or significant unreimbursed business expenses may be eligible for W2-only income mortgages. Gustan Cho Associates doesn’t mandate income tax returns from borrowers unless the Automated Underwriting System specifically demands a two-year tax return for qualification. We offers W2-Only Income Mortgages on the following loan programs:

- FHA loans

- VA loans

- Conventional loans (Fannie Mae Only)

Borrowers do not have to turn in their income tax returns. Loan officers cannot submit income tax returns for W2-only income mortgages. We only need two years of W2s. We will only do a W2 income verification with the Internal Revenue Service. In the following paragraphs, we will discuss W2-only income mortgages.

Loan Programs Offering W2-Only Income Mortgages

Borrowers are eligible for W2-Only Income Mortgages through Gustan Cho Associates. These mortgages don’t require federal income tax returns specifically for W2-only income. For individuals whose sole income source is W2 and who have unreimbursed business expenses, there’s no need to factor in these expenses on their income tax returns. Strictly, W2 income will be considered. However, if there are rental properties, side businesses, or part-time 1099 income, these won’t qualify for W2-Only Income Mortgages. Those applying for FHA, VA, and Conventional loans as W2 Income Employees won’t need income tax transcripts (the 1040s).

Can I Qualify For W2-Only Income Mortgages?

If you’re a W2 wage earner without additional businesses or 1099 income, you’re eligible for W2-only income mortgages. The lending criteria for these mortgages entail specific requirements and guidelines. For FHA, VA, and Conventional loans, there’s no necessity for tax transcripts (1040s) if applicants are W2 employees and the automated underwriting system (AUS) doesn’t mandate it. Moreover, FHA, VA, and Conventional loans no longer mandate complete income tax transcripts (4506-T) for W2 employees. However, this exemption doesn’t apply if borrowers are self-employed or if over 25% of their income comes from commissions or self-employment. Additionally, individuals with rental income from multiple properties aren’t eligible for W2-only income mortgages. Get Qualify for W2-Only Income Mortgage, Click Here

How Long Do You Need W2-Income To Be Eligible For W2-Only Income Mortgages?

Mortgages that consider W2-only income prove beneficial for individuals buying a new home or refinancing their current one when their tax returns reflect losses from unreimbursed employee expenses listed on IRS TAX FORM 2106. These mortgage options offer advantages to borrowers facing self-employment losses detailed on Schedule C of their tax returns, particularly when this loss doesn’t constitute their main income source.

Mortgage Lenders That Do Not Require Tax Returns For W2 Income Wage Earners

Gustan Cho Associates does not require federal income tax returns for W2 income earners. It does not matter whether or not you filed taxes or declared substantial unreimbursed business expenses. Borrowers who have un-reimbursed employee expenses on their income tax returns are workers who need to purchase their work uniforms. Examples of such employees are the following:

- Police Officers

- Fire Fighters

- Mechanics

- Tradesman

- Nurses

- Doctors

- Dentists

- Pharmacists

- Bus drivers

- Truck drivers

- Other workers who need to purchase their uniforms for work

No Tax Returns Required For W2 Income Wage Earners on FHA, VA, Conventional Loans

W2 Income Mortgages don’t necessitate income tax returns. For this loan program, it’s acceptable if borrowers haven’t filed their income taxes. The Internal Revenue Service will only verify the W2 income transcripts. Borrowers who typically need to buy tools and equipment for their jobs often have un-reimbursed employee expenses.

Typical Jobs For W2-Only Income Mortgages On FHA, VA, Conforming Loans

Take police officers, for instance—they’re required to buy firearms, ammunition, and work gear. Similarly, plumbers and electricians have to invest in tools and equipment for their jobs. Mechanics also need specific tools and equipment for their work. Additionally, this provision benefits borrowers who generate part-time self-employment income, enabling them to demonstrate losses. Under this updated tax mortgage rule, lenders are solely responsible for verifying and confirming your W2 information with the IRS. Get Qualify for FHA, VA and Conforming Loans, Click Here

W2-Only Income Mortgages Loan Options

Here’s how you might be eligible for W2-only income mortgages: HUD, VA, and Fannie Mae permit W2-only income mortgages, while Freddie Mac does not. These mortgages cater to borrowers with significant unreimbursed expenses, enabling them to qualify for a loan. However, specific regulations govern eligibility for W2-only income mortgages. Individuals cannot operate a full-time self-employed business, own 25% or more of a business they’re employed at as a W2 earner, or generate rental income. For comprehensive guidance on W2-only mortgages across FHA, VA, and Conventional loans, Gustan Cho Associates specializes in this area.

Qualifying For W2-Only Income Mortgages With a Lender With No Overlays

Borrowers wanting to know more about our W2-only income mortgages and see if they qualify, please get in touch with Gustan Cho Associates at 800-900-8569 or text for a faster response. Borrowers can also email us at alex@gustancho.com. We are available evenings, weekends, and holidays seven days a week. Gustan Cho Associates is a 5-star national mortgage lender with no mortgage overlays on government and conventional loans. We offer non-QM loans with no waiting period after foreclosure, short sale, or deed-in-lieu of foreclosure. Gustan Cho Associates also offers bank statement mortgage loans for self-employed borrowers.

How Do The W2-Only Income Mortgages With No Tax Returns Work?

Qualified income is a crucial determinant for lenders when assessing borrower eligibility. All income considered as qualified must undergo a verification process. Lenders aim to ensure that borrowers possess the capacity to meet their new mortgage obligations. The track record of qualified income is significant as it serves as a reliable indicator of future earnings. Each lender employs its own approach in calculating qualified income. Typically, lenders mandate the submission of two years’ worth of income tax returns, two years of W2 forms, and the most recent 30 days’ paycheck stubs.

The Mortgage Process For W2-Only Income Mortgages

At Gustan Cho Associates, we do things differently. We try to streamline documents and make the mortgage process easier. You do not need to provide two years of income tax returns for all W2 wage earners with a base salary and overtime income. The only income document we go by is W2 transcript processing. This holds true only if you are a W2 salaried employee. If you have a commission or bonus income of less than 25% of your base salaried income, it can only be used, and no income tax returns will be required.

How Do Mortgage Underwriters Process W2-Only Income Mortgages

One of the crucial elements in qualifying for residential mortgage loans is income. Historically, both government and conventional loan programs mandated the submission of two years’ worth of tax returns. Nevertheless, individuals with W2 income jobs seeking qualification for FHA, VA, USDA, and Conventional loans typically find that income tax returns are not obligatory.

There are many instances where Automated Underwriting System Approval (AUS) does not require income tax returns from W2 Wage Earners. Mortgage Lenders with no mortgage overlays only go off Automated Underwriting System Approval (AUS).

If the automated findings do not require two years of income tax returns, Gustan Cho Associates will not require it. W2 income wage earners can now qualify for W2-only income mortgages with no tax returns required on FHA, VA, USDA, and Conventional loans. Only two years of W2s are required. Get Qualify for W2-Only Income Mortgage, Click Here

How Do I Start The W2-Only Income Mortgages With No Tax Returns Loan Process?

The era of no income and no documentation loans is a thing of the past. In the mortgage lending industry, cash income is no longer considered. All income must be traced and properly documented. Self-employed mortgage loan applicants or 1099 wage earners are expected to provide two years of tax returns. W2 income wage earners typically need to submit the most recent 30 days of paycheck stubs, and most mortgage lenders prefer to review two years of W2s and tax returns.

Mortgage Loans With No Income Tax Returns

We have just launched a new residential mortgage loan product for W2 wage earners. It is called W2-only income mortgages, where only two years of W2s are required, and the past two years’ tax returns are no longer required. W2-only income mortgages are available on government-backed and conventional loans:

W2-only income mortgages are available for FHA, VA, and Conventional loans.

All lenders do not offer this. Gustan Cho Associates offers W2-only income mortgages for FHA, VA, and Conventional loans. To qualify for W2-Only Income Mortgages With No Tax Returns with FHA, VA, and Conventional Loans, borrowers must be W2 income wage earners. 1099 or self-employed borrowers do not qualify.

Why Are 2 Years Tax Returns Required?

While borrowers may be W2 income wage earners and the Automated Underwriting System doesn’t require two years of income tax returns, numerous lenders still request this documentation. This is primarily attributed to the impact of tax deductions on income taxes. Borrowers with substantial unreimbursed business expenses frequently encounter challenges with debt-to-income ratios because of adjustments to their gross income.

Write-offs on tax returns offset monthly gross income. This gross income reduction will often hurt borrowers regarding debt-to-income ratio calculations.

Due to the income tax deductions, many cannot qualify for FHA, VA, or Conventional loans. Many police officers and firefighters get uniform allowances. Many write off expenses for uniforms, weapons, equipment, and other job-related write-offs on their income tax returns. Unfortunately, these write off will bite them in the rear end when qualifying for home loans because some of these write-offs can add up to several thousands of dollars.

The Impact of Unreimbursed Business Expenses on Qualified Income For a Mortgage

Numerous entrepreneurs, freelancers, real estate investors, and individuals earning income through 1099 wages find advantages in utilizing significant unreimbursed business expenses. By deducting these expenses from their gross income on tax returns, they effectively minimize their tax liabilities. While unreimbursed business expenses serve as a valuable tool for tax reduction among self-employed individuals, it frequently pose a challenge when seeking mortgage qualification. Get Qualify for W2-Only Income Mortgage, Click Here

Mortgage Loan Options With No Income Tax Returns Required

The deductions are deducted from the total monthly income, frequently surpassing the permissible debt-to-income ratios. Numerous borrowers attempt to modify their tax returns to undo these deductions. Nonetheless, amending tax returns involves a waiting period of six months before the revised returns can be utilized to meet the criteria for a mortgage. Thanks to the innovative W2-only income mortgages, no tax returns are necessary, enabling W2 wage earners to qualify for home loans. It’s important to note that W2 income earners with rental properties do not meet the eligibility criteria for W2-only income mortgages.

W2-Only Income Mortgages With No Overlays

Gustan Cho Associates is a national mortgage company with no overlays on government and conventional loans. Gustan Cho Associates offers W2-only income mortgages with no income tax returns required on FHA, VA, USDA, and Conventional loans. Borrowers who need to qualify for FHA, VA, USDA, or Conventional loans with no income tax returns, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

FAQ – How Can I Qualify For W2-Only Income Mortgages

-

What are W2-Only Income Mortgages? W2-Only income mortgages allow borrowers with W2 income, pending income tax returns, or significant unreimbursed business expenses to qualify for home loans without the need to submit income tax returns. Gustan Cho Associates offers this mortgage option on FHA, VA, and Conventional loans.

-

Who is eligible for W2-Only Income Mortgages? W2 wage earners without additional businesses or 1099 income are eligible for W2-only income mortgages. The mortgage suits those with W2 income as their sole income source and who have unreimbursed business expenses. However, individuals with rental properties, side businesses, or part-time 1099 income do not qualify for this mortgage.

-

Which loan programs offer W2-only income mortgages with Gustan Cho Associates? Gustan Cho Associates offers W2-Only Income Mortgages on the following loan programs:

- FHA loans

- VA loans

- Conventional loans (Fannie Mae Only)

-

Do borrowers need to submit income tax returns for W2-only income mortgages? No, borrowers must not submit income tax returns for W2-only income mortgages. Gustan Cho Associates only requires two years of W2s, and income verification is done directly with the Internal Revenue Service (IRS).

-

How long do you need W2 income to be eligible for W2-only income mortgages? W2-only income mortgages are beneficial for individuals buying a new home or refinancing when their tax returns reflect losses from unreimbursed employee expenses. These mortgages benefit those facing self-employment losses detailed on IRS TAX FORM 2106.

-

Can W2-only income mortgages be obtained without providing two years of income tax returns? Yes, Gustan Cho Associates offers W2-only income mortgages without requiring two years of income tax returns. Only two years of W2s are needed, and the Internal Revenue Service will verify W2 income transcripts.

-

What types of jobs are eligible for W2-only income mortgages? Jobs such as police officers, firefighters, mechanics, tradesmen, nurses, doctors, dentists, pharmacists, bus drivers, truck drivers, and other workers who must purchase work uniforms are eligible for W2-only income mortgages.

-

Why are two years of tax returns usually required for mortgage applications? While the Automated Underwriting System (AUS) may not require two years of income tax returns for W2 wage earners, many lenders still request them due to the impact of tax deductions on income taxes. Write-offs on tax returns can affect debt-to-income ratios, making it challenging for some borrowers to qualify for loans.

-

Can self-employed individuals or 1099 income earners qualify for W2-only income mortgages? No, W2-only income mortgages are specifically designed for W2 income wage earners. Self-employed individuals or those with 1099 income do not qualify for this mortgage option.

This blog about How Can I Qualify For W2-Only Income Mortgages was updated on January 11th, 2024.

Get Qualify for W2-Only Income Mortgage, Click Here