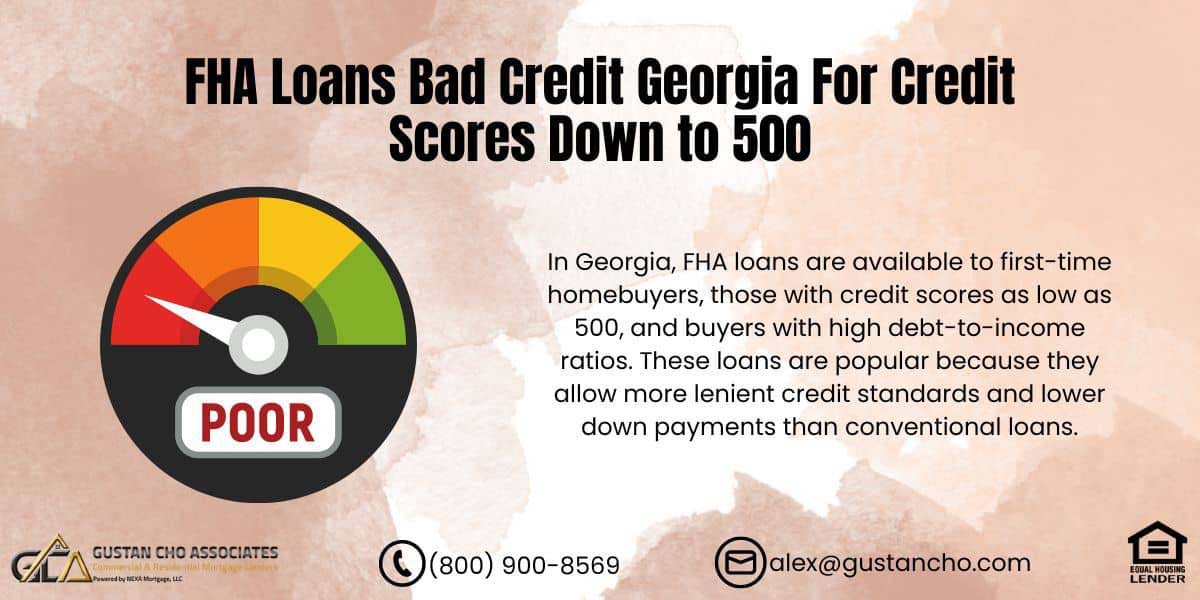

FHA loans bad credit Georgia mortgage requirements and guidelines make FHA home mortgages the most popular loan program for first-time homebuyers, borrowers with credit scores down to 500 FICO, and homebuyers with high-debt to income ratios. HUD, the parent of FHA, is the federal government agency in charge of the administration of FHA loans.

Alex Carlucci, a senior loan officer at Gustan Cho Associates, talks about the bidding war in the Atlanta, Georgia, housing market:

As with other states, Georgia is experiencing an inventory shortage of homes. There are bidding wars and sellers are often decide to get the combination of the best price and strongest homebuyers. Sellers prefer a cash offer and are careful not to go over the list price in the event the buyer does not have the cash to come up with the difference between contract price and appraised value.

First-time homebuyers with little or no credit and buyers with bad credit and lower credit scores have a better chance of getting an approve/eligible per automated underwriting system on FHA loans than conventional loans. Throughout this blog, We will cover the Georgia FHA loan requirements in more detail. Gustan Cho Associates has no lender overlays on FHA loans bad credit Georgia.

FHA Loans Bad Credit Georgia Loan Limits For 2024

HUD, the parent of FHA, has been increasing the loan limits on FHA loans for the past six years due to increasing home prices. HUD announced the 2024 FHA loan limit at $498,257. Despite historic high mortgage rates, out-of-control inflation, all-time high home prices, and a volatile economy, the housing market forecast in Georgia is stronger than ever, says John Strange of Gustan Cho Associates:

The housing market in Georgia is strong. Georgia homebuyers have been facing fierce competition when shopping for homes. Bidding wars seem to be the new normal. Home prices have been increasing at an alarming rate. Despite home values being at historic highs, homes are still affordable.

Due to skyrocketing home prices, the standard FHA loan limit is $498,257, but it can go up to $649,750 in high-cost areas within Georgia. These limits are adjusted annually based on home price changes. Homebuyers in high-cost counties throughout the United States in high-cost areas are eligible to qualify for a high-balance FHA loan.

Bad Credit? You Can Still Qualify for an FHA Loan in Georgia!

Even with a 500 credit score, homeownership is still possible. Get Pre-Approved Today—No Lender Overlays!

FHA Loans Bad Credit Georgia Agency Guidelines For 2024

Georgia is a Southern State bordered by Florida and one of the country’s fastest-growing states. The state is to the east of the Atlantic Ocean. It is East of South Carolina and West of the state of Alabama. Georgia borders the north by the state of Tennessee and the state of North Carolina.

Suppose you are considering buying a single-family home in Georgia. In that case, the FHA loan limits allow you to borrow up to $498,257 in most counties. For homes in higher-cost counties, the loan limit increases to $649,750. These amounts are contingent upon meeting the necessary down payment and credit score criteria.

Booming Housing Market With Strong Demand For Homes

It is one of the fastest-growing states for people migrating and homebuyers. Housing prices have been increasing throughout the whole state of Georgia with no signs of a correction. There is more demand for housing in Georgia than there is inventory. Many Home Builders set up shops in Georgia, and mortgage lenders with no overlays are in demand.

Gustan Cho Associates is licensed in the State of Georgia and has no overlays on government and conventional loans in Georgia. This article will cover and discuss FHA loans bad credit Georgia.

How To Apply For An FHA Loan In Georgia?

We have written many blogs about getting a home loan with bad credit. FHA loans are the most popular loan program in the nation. HUD, the parent of FHA, sets up agency mortgage guidelines for FHA loans. HUD is not a lender. HUD is a government agency that insures private lenders who originate and fund loans in the event their borrower’s default on their FHA loans.

Homebuyers can apply for an FHA loan with any HUD-approved lender. Banks, credit unions, and mortgage companies that are HUD-approved originate, process, underwriters, fund, and service FHA loans.

Do All Georgia FHA Lenders Have The Same FHA Loan Requirements?

Not all Georgia FHA lenders have the same FHA loan requirements. Lenders need to meet the minimum agency HUD mortgage guidelines. However, lenders can have higher FHA loan requirements that are higher than HUD agency guidelines which are called lender overlays.

It is very important for borrowers to understand the basic HUD agency FHA loan requirements and guidelines if they get denied an FHA loan by a lender with overlays. If a lender denies a borrower, but the borrower meets the minimum agency HUD guidelines, the borrower can qualify at a different lender without lender overlays.

The Mission And Role Of HUD On FHA Loans In Georgia

HUD is a government agency that insures and guarantees FHA Loans that are originated and funded by banks and private mortgage companies. One of HUD’s most important guidelines is the mandatory waiting period requirement after Chapter 7 Bankruptcy and Foreclosure. Georgia home prices have been appreciating over 10% yearly for the past few years.

FHA Loans With Credit Scores Down To 500 FICO

FHA loans benefit first-time homebuyers, buyers with prior bad credit and lower credit scores, and those with bankruptcy or foreclosure. Borrowers can qualify for an FHA loan with credit scores down to 500 FICO. You need a 580 credit score to be eligible for a 3.5% down payment FHA loan. Borrowers with under 580 FICO have a 10% down payment. Historic record mortgage rates are one of the main reasons the housing market is booming.

2024 Georgia FHA Loan Application Process For Homebuyers

Potential homebuyers need to get qualified and pre-approved before shopping for a home. Homebuyers need to consult with a licensed loan officer from a mortgage company licensed in Georgia. FHA loan applicants do not have to pay anything to get qualified and pre-approved.

The loan officer will review your loan application and request certain documents, including your income and employment information, to process your FHA loan application. Once qualified, the loan officer will issue you a pre-approval letter. A pre-approval letter lets you shop for a home and enter a real estate purchase contract.

Best Bad Credit Mortgage Lenders For FHA Loans With Bad Credit

Not all Georgia FHA lenders have the same mortgage requirements. The best Georgia FHA lenders are mortgage companies with stellar reviews. Research the lender’s reputation online. Find out what type of lender overlays they have. If you have lower credit scores and prior bad credit but meet the minimum FHA loan requirements and guidelines, look at Georgia FHA lenders with no lender overlays.

Gustan Cho Associates is one of the few mortgage companies licensed in multiple states with no lender overlays on FHA loans. Over 80% of the borrowers at Gustan Cho Associates could not qualify at other mortgage companies due to their lender overlays. Interview a few loan officers and choose the mortgage professional you feel most comfortable with.

Can You Buy A House With FHA Loans With Low Credit Scores?

Homebuyers can buy a home with bad credit, lower credit scores, bankruptcy, foreclosure, and high debt-to-income issues. There are many different types of home mortgage loan programs. Despite a recent uptick in rates, there does not seem to be any slowdown. HUD and the FHFA have increased FHA and Conforming loan limits for the past six years.

Credit Score 500? We Can Help You Buy a Home in Georgia.

Don’t let bad credit hold you back—FHA loans are designed for you. Apply Now with a Lender That Gets You Approved!

FHA Loans After Bankruptcy in Georgia

In August 2013, HUD launched the FHA Back to Work Mortgage Program, which did not last long. The FHA Back To Work Mortgage Program was a disaster and did more damage than good. Countless qualified home buyers went through Hell with the Back To Work Loan Program. Mortgage Companies were afraid to touch it. Many that did and issued loan commitments ended up retracting the loan approvals and not closing the loan.

The FHA Back To Work no longer exists, but I would like to cover the program on this BLOG. There is a three-year waiting period after foreclosure, a deed-in-lieu of foreclosure, and a short sale to qualify for FHA Loans. The waiting period is two years after the Chapter 7 Bankruptcy discharge date. Homebuyers can qualify for an FHA loan during the Chapter 13 Bankruptcy repayment plan with trustee approval and a manual underwrite.

The Now Extinct FHA Back To Work Mortgage Loan Program

Although the Back To Work Program no longer exists, we will cover briefly what the program entailed. There is an alternative to the Back To Work Mortgage that Gustan Cho Associates launched this year called Non-QM Loans. There is no waiting period after foreclosure, deed-in-lieu of foreclosure, and short sale with NON-QM loans.

There is no waiting period after the Chapter 7 Bankruptcy discharge date with non-QM loans. A 20% to 30% down payment is required depending on the borrower’s credit score and how long the bankruptcy or foreclosure was. Mortgage Rates are higher than traditional FHA loans.

FHA Loans Bad Credit Georgia With The Extinct FHA Back to Work Guidelines

Here is how the FHA Back To Work Program worked. FHA Back to Work is no longer available. Still, this section is for the archives: HUD’s FHA Back to Work mortgage program is a special program enabling borrowers to get an FHA Loan after a Chapter 7 Bankruptcy or housing event.

Alex Carlucci shares his disastrous experience with the FHA Back to Work due to a significant economic event where he submitted 100 files but could not close a single one:

FHA Back to Work mortgage loan program shortened the waiting period after bankruptcy, foreclosure, deed-in-lieu of foreclosure, and short sale to a one-year waiting period. Traditional waiting periods are two years after a bankruptcy discharge, three years from the recorded date or sheriff’s sale date of foreclosure, or a deed-in-lieu of foreclosure. Or three years after the HUD’s settlement date of the short sale.

However, HUD’s FHA Back to Work Extenuating Circumstances due to an economic event has strict mortgage underwriting guidelines since it is a manual underwrite. It is a great program for those who need a home loan with bad credit, especially first-time home buyers.

First time home buyers who had a prior bankruptcy and have their credit re-established can get an opportunity to participate in HUD’s FHA Back to Work mortgage program after one year of the discharge date of their bankruptcy. Unfortunately, this loan program became a major flop and has been discontinued.

Georgia FHA Loan Requirements in Georgia

Georgia home buyers seeking FHA loans with bad credit Georgia can now qualify with Gustan Cho Associates. Georgia first-time homebuyers or homeowners with prior bankruptcy can qualify for FHA loans with bad credit Georgia. There are other loan programs besides the now-defunct Back to Work mortgage program Gustan Cho Associates has launched with no waiting period after bankruptcy or a housing event.

FHA Loans Bad Credit Georgia For Borrowers With 500 to 620 FICO Scores

We will briefly discuss how to qualify For FHA loans bad credit Georgia after bankruptcy, foreclosure, deed-in-lieu of foreclosure, short sale, and periods of bad credit. With the Back To Work Program, the borrower needs to have been unemployed or underemployed six months before filing bankruptcy, or the initiation of the foreclosure, deed-in-lieu of foreclosure, or short sale.

Can I get a Loan with a Credit Score Below 500?

Securing a loan with a credit score below 500 can be difficult. However, there are still some options available, albeit with certain limitations. Traditional lenders like banks and credit unions may hesitate to approve your application due to the higher risk associated with lower credit scores. If approved, expect higher interest rates and fees, as lenders use these to mitigate risk.

Alternatively, you could consider secured loans, where you provide collateral such as a car or real estate, which may make lenders more willing to offer you a loan. However, be wary of payday or car title loans. At the same time, they are easier to obtain; they come with very high-interest rates and can trap you in a debt cycle.

Consider a credit builder loan if you want to improve your credit score. Unlike payday loans, these loans come with better terms. Getting a cosigner with a higher credit score can also lead to better loan terms. However, if you have a low credit score, you should carefully evaluate the loan terms and potential financial impact.

What Constitutes Extenuating Circumstances on FHA Loans

Households needed a 20% reduction in their household income. Proof needs to be provided via W-2s and tax returns. A Back to Work Mortgage loan applicant cannot have resigned or voluntarily quit their jobs. They must have been terminated or laid off, or the business has to be out of business.

A voluntary termination will automatically disqualify the mortgage loan applicant from qualifying for FHA Back to Work Extenuating Circumstances due to an economic event.

Quitting Job Does Not Constitute Extenuating Circumstances

For example, suppose an employee quits their job because a member of the family member was ill, and you had a 20% reduction in their household income. This will not qualify home buyers for the Back to Work Extenuating Circumstances due to an economic event mortgage program. The reason is that they voluntarily left their job.

Even though the reason they left their job was due to the medical illness of a family member. Reduction of income due to a divorce will also not be a qualifier for the Back to Work mortgage program, even though half the income is reduced due to the other spouse leaving.

What is the Minimum Credit Score to Buy a House in Georgia?

Gustan Cho Associates is a national lender with no overlays on FHA loans. Here are the FHA Guidelines On Qualifying For a 3.5% down payment home purchase FHA Mortgage.2-Year Waiting Period After Chapter 7 Bankruptcy. Georgia Home Buyers can qualify for FHA Loans one year into a Chapter 13 Bankruptcy Repayment Plan with Trustee Approval.

There are no waiting period requirements after the Chapter 13 Bankruptcy discharge date. Three-year waiting period after the recorded foreclosure date or deed-in-lieu of foreclosure. Three-year waiting period after a short sale date to qualify for FHA loans. 580 minimum credit score to qualify for 3.5% down payment FHA loans.

Outstanding Collections And Charge Off Accounts do not have to be paid off. The maximum debt-to-income to qualify for FHA loans is 46.9% front-end. 56.9% back end for approve/eligible per AUS Findings with 620 credit scores: 43% DTI with under 620 credit scores.

FHA Home Loans in Georgia for Buyers with Low Credit Scores

We approve borrowers others turn away. Start Your Application Now—Get Closer to Homeownership!

How Mortgage Underwriters Analyze Borrowers With Bad Credit

Georgia home buyers can qualify for FHA loans bad credit Georgia without needing to pay off outstanding collections and charge off accounts. Meeting the minimum credit score requirements and income does not automatically qualify a person for an FHA loan.

The borrower’s credit history will be reviewed, especially for borrowers with a Chapter 7 Bankruptcy and housing event. However, the mortgage loan borrower’s credit history will be scrutinized and analyzed. The credit history background check is one of the biggest reasons mortgage loans get denials.

The Mortgage Underwriters Manually Underwrite FHA Loans

FHA and VA loans are the only mortgage programs allowing manual underwriting. The main difference between the automated underwriting system approval and manual underwriting is lower debt-to-income ratio caps, and a human underwriter scrutinizes the file with pins and needles. Even though mortgage borrowers meet all of FHA lending guidelines on manual underwriting, the credit history needs to be the following:

- Credit payment history will be reviewed:

- Borrowers must have had good credit and timely payment history before the loss of employment or underemployment in cases of bad credit due to loss of job or business

- Credit will drop because of bankruptcy, foreclosure, deed-in-lieu of foreclosure, or short sale

- Maybe credit scores will plummet 100 plus points

- After bankruptcy, foreclosure, deed-in-lieu of foreclosure, or short sale, borrowers cannot have any late payments and need re-established credit where the credit report will reflect an increase in credit scores.

- At Gustan Cho Associates, we do 203k loans in the state of Georgia as well

Even if borrowers get no new or re-established credit, credit scores will increase in bankruptcy, foreclosure, deed-in-lieu of foreclosure, and short sale. Borrowers’ credit will slowly improve as it ages.

The Importance of Timely Payments In The Past 12 Months

Georgia Homebuyers who need to qualify for FHA Loans after bad credit with a national lender with no overlays, please get in touch with us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com. Gustan Cho Associates has a national reputation for not having any lender overlays on government and conventional loans.

We are mortgage brokers and correspondent lenders and have the ability to broker non-QM and alternative financing loan programs. Over 80% of our borrowers could not qualify at other lenders or have been denied by another mortgage company. The team at Gustan Cho Associates is available seven days a week, on evenings, weekends, and holidays. Gustan Cho Associates is one of the fastest-growing national lenders with no overlays.

FAQ: FHA Loans Bad Credit Georgia For Credit Scores Down to 500

- 1. What are FHA loans? FHA loans aid first-time homebuyers and low to moderate-income individuals with government-backed mortgages managed by HUD.

- 2. Who can qualify for an FHA loan in Georgia? In Georgia, FHA loans are available to first-time homebuyers, those with credit scores as low as 500, and buyers with high debt-to-income ratios. These loans are popular because they allow more lenient credit standards and lower down payments than conventional loans.

- 3. What are the FHA loan limits in Georgia for 2024?

For 2024, the standard FHA loan limit is $498,257, but it can go up to $649,750 in high-cost areas within Georgia. These limits are adjusted annually based on home price changes. - 4. How does the FHA handle bad credit borrowers? FHA-guaranteed loans are intended to have less stringent criteria regarding credit scores and prior financial challenges, including bankruptcy or foreclosure. FHA loans can be available for people with credit scores starting from 500. However, if your score is below 580, you must make a down payment of 10% instead of the usual 3.5%.

- 5. What should you do if an FHA loan application is denied? Suppose your application is denied due to lender overlays. In that case, you may still qualify by applying with a different lender that strictly follows HUD’s minimum guidelines without additional requirements.

- 6. What is the process for obtaining an FHA loan in Georgia? To obtain pre-approval, consult a licensed loan officer who works for a HUD-approved lender. Provide the necessary financial documents and submit your loan application. A pre-approval letter from your lender can increase your chances of making competitive home offers.

- 7. Are there special FHA loans available in Georgia for those with recent bankruptcies or foreclosures? Yes, although traditional FHA loans require a waiting period after significant credit events like bankruptcy or foreclosure, there are specialized programs, such as the now-defunct FHA Back to Work program, with shorter waiting periods. Other non-traditional financing options might be available, such as non-QM loans that do not require these waiting periods.

- 8. How do Georgia FHA lenders differ in their loan requirements? Not all lenders in Georgia follow the same requirements for FHA loans. While all must meet HUD’s minimum guidelines, some may impose stricter criteria, known as lender overlays, including higher credit score requirements or lower debt-to-income ratios.

- 9. What is the role of HUD in FHA loans? HUD insures FHA loans, which protects lenders against losses if borrowers default. This insurance enables lenders to offer FHA loans with attractive terms, including low down payments and rates, to a wider range of homebuyers.

- 10. How are FHA loans different in terms of underwriting? FHA loans can be manually underwritten, which allows underwriters to review a borrower’s application more comprehensively. This benefits those who might not qualify under automated underwriting systems due to non-traditional credit histories or other factors.

This FAQ provides an overview of FHA loans in Georgia, especially for those with bad credit. It highlights their flexibility and the opportunity they provide for home ownership despite financial challenges.

Struggling with Bad Credit? You’re Not Alone. We’ve Got Solutions

FHA loans in Georgia are perfect for buyers with less-than-perfect credit. Click Here to Check Your FHA Loan Eligibility!