FHA Chapter 13 Bankruptcy Guidelines allow homebuyers and homeowners to qualify for FHA loans for home purchases and refinance during and after Chapter 13 Bankruptcy. Dustin Dumestre, a senior loan officer and team leader at GCA FORUMS Mortgage Group explains how borrowers can get a mortgage while in a Chapter 13 Bankruptcy repayment plan based on the FHA Chapter 13 Bankruptcy Guidelines:

FHA and VA loans are the only two loan programs allowing borrowers to qualify for a mortgage during the Chapter 13 Bankruptcy repayment plan.

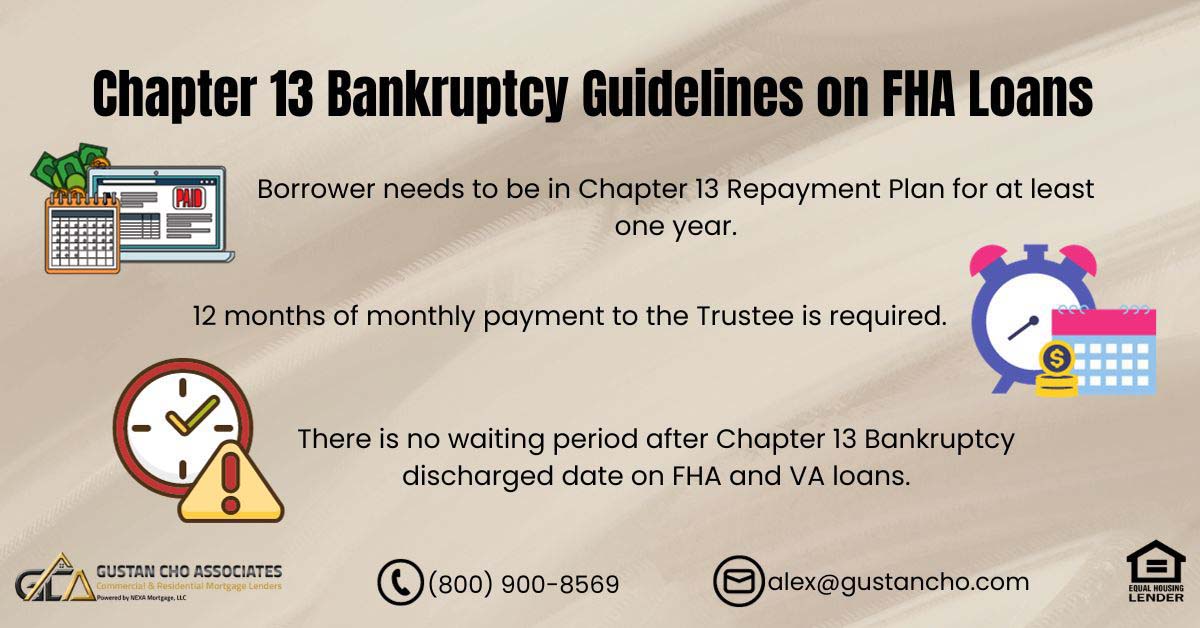

Individuals in a Chapter 13 Bankruptcy repayment plan can become eligible for an FHA or VA loan one year after entering the plan. Approval for a mortgage doesn’t hinge on the completion of the Chapter 13 Bankruptcy process. In the following paragraphs, we will cover FHA Chapter 13 Bankruptcy Guidelines on FHA loans.

How Soon Can You Qualify for FHA Loan During Chapter 13 Bankruptcy?

Borrowers need to have made 12 timely payments in the Chapter 13 Bankruptcy repayment plan and get trustee approval. This typically isn’t an issue, provided borrowers can demonstrate their capacity to repay the new loan.

VA and FHA loans stand as the exclusive mortgage programs permitting borrowers to qualify for a home loan even while in an active Chapter 13 Bankruptcy, without needing the Chapter 13 Bankruptcy to be discharged.

FHA Chapter 13 Bankruptcy Guidelines and VA Chapter 13 Bankruptcy Guidelines are nearly indistinguishable. Moreover, these loans are the sole programs that allow manual underwriting. Subsequent paragraphs will delve into the FHA chapter 13 bankruptcy guidelines both during and after the Chapter 13 repayment plan.

Comparisons of VA and FHA Chapter 13 Bankruptcy Guidelines

Chapter 13 Bankruptcy is a court-approved debt restructuring repayment plan for consumers with a steady income and assets. There are two types of bankruptcy: Chapter 7 and Chapter 13 Bankruptcy. Chapter 7 Bankruptcy is often referred to as total liquidation. Except for exempt assets, all are liquidated to pay the petitioner’s creditors. Chapter 13 Bankruptcy benefits consumers with a steady income and assets. Alex Carlucci, a senior loan officer at Gustan Cho Associates, explains how Chapter 13 works:

Petitioners opt for Chapter 13 Bankruptcy to safeguard their assets while allowing the courts to reorganize their debts across five years. A portion of their income is allocated to settle debts owed to creditors.

Once the repayment period concludes, any outstanding balance on their debts is absolved by the U.S. Bankruptcy Courts. Individuals undergoing a Chapter 13 Bankruptcy repayment plan can still be eligible for an FHA or VA loan, whether for buying a home or refinancing. However, it’s important to note that qualifying for these loans in such situations requires a manual underwriting process.

Buy or Refinance During Chapter 13

FHA guidelines allow mortgage approvals even while in repayment.FHA Chapter 13 Bankruptcy Guidelines in 2025

Learn the updated FHA Chapter 13 Bankruptcy Guidelines for 2025, including waiting periods, eligibility requirements, and how to qualify for a mortgage in or after Chapter 13 bankruptcy.

Many future homeowners think bankruptcy wipes out their mortgage dreams for good. Chapter 13 filers face even more doubt—the Federal Housing Administration (FHA).

However, offers surprisingly lenient rules for anyone in or just finishing a Chapter 13 repayment plan. Knowing these guidelines lets you know how soon you can buy a home, what papers to gather, and how to make your application shine. This blog post covers the step-by-step FHA Chapter 13 Bankruptcy Guidelines.

What Is Chapter 13 Bankruptcy?

Chapter 13 is the “wage earner’s plan.” Instead of handing over all belongings, a borrower proposes a budget-friendly repayment plan approved and watched by the court. Most borrowers make monthly payments for 3 to 5 years while keeping their property.

Learn the updated FHA Chapter 13 Bankruptcy Guidelines for 2025, including waiting periods, eligibility requirements, and how to qualify for a mortgage in or after Chapter 13 bankruptcy.

Because borrowers keep making payments on time under the guidance of a trustee, the FHA allows more room than it does with a standard Chapter 7.

FHA Guidelines While on Chapter 13

Still Making Chapter 13 Payments

- You can apply for an FHA mortgage after 12 months of on-time Chapter 13 payments.

- The trustee must give written approval before the court lets you take on a new mortgage.

- Lenders will check your Chapter 13 plan history and all debts for late payments since you filed.

Credit Conditions

- The standard FHA credit score still applies (580 for 3.5% down and 500–579 with 10% down).

- You can’t have any late payments on the Chapter 13 plan.

- You need new credit lines showing responsible use and a solid payment history.

FHA Guidelines After Chapter 13

After Your Chapter 13 Discharge

- Unlike conventional loans that wait two years, the FHA has no waiting period after your Chapter 13 discharge.

- Loans closing less than two years after your discharge must undergo manual underwriting.

- Lenders will verify your payment history, stable income, and acceptable debt-to-income ratios.

After Chapter 13 Dismissal

- You’ll need to wait 2 years after dismissal before getting approved (this is not the same as discharge).

- Show the lender that your finances have improved and your credit is back on track.

Manual Underwriting for Chapter 13 FHA Loans

Most FHA loans filed during or after a Chapter 13 need manual underwriting.

Here’s a quick guide:

- Verification of Rent (VOR): You’ll need proof of 12 full months of on-time rent or mortgage payments.

- Compensating Factors: If your debt-to-income (DTI) ratio is high, the lender may allow it if you have savings, part-time income, or a steady job.

- Income Stability: Lenders generally want a 2-year job history showing regular earnings.

Advantages of FHA for Chapter 13 Borrowers

- You face no long wait after the Chapter 13 discharge.

- FHA has looser credit rules than Conventional lenders.

- Manual underwriting lets the lender go outside automated systems that may say “no.”

- You can buy a home with a small down payment, making it more realistic.

Tips to Improve Approval Chances

Pay your Chapter 13 plan on time for at least 12 months.

- Keep debts low: Avoid new loans or credit cards unless you ask your trustee first.

- Save some reserves: Cash in the bank is a big plus in manual reviews.

- Choose a lender experienced with FHA manual reviews and Chapter 13 cases.

FHA Loans: Navigating Chapter 13 vs. Chapter 7 Bankruptcy

- Chapter 7: FHA rules say you must wait at least 2 years post-discharge.

- Chapter 13: You can qualify during the repayment plan after making 12 months of payments or after the plan is discharged.

That’s why underwriters generally prefer Chapter 13 when looking at FHA loans.

FHA Chapter 13 Bankruptcy Questions Answered

Can I Apply For an FHA Loan While Still Making Chapter 13 Payments?

- Yes, as long as you’ve completed 12 months of timely payments and have written approval from the trustee.

Is There a Waiting Period After Completing a Chapter 13 Plan?

You can apply right after discharge, although a manual underwriting review may be necessary.

What Happens if My Chapter 13 Case Was Dismissed?

- You must wait 2 years from the dismissal date before applying for any FHA financing.

Is a Bigger Down Payment Required After a Bankruptcy?

- Not at all.

- FHA’s down payment is 3.5% if your score is at least 580.

How Long Will The Bankruptcy Record Affect My Financing Options?

- Not indefinitely.

- If you keep making payments on time, rebuild your credit, and show a stable financial picture, the impact of bankruptcy will lessen over time.

FHA Chapter 13 Bankruptcy Guidelines for Homebuyers in 2025

FHA Chapter 13 Bankruptcy Guidelines are among today’s most patient and understanding routes to a mortgage. Whether you’re still making monthly Chapter 13 payments or just celebrated a discharge, the FHA allows you to buy a home much faster than most competing loan programs.

Team up with Gustan Cho Associates and you’ll partner with experts who say “yes” when traditional lenders slam the door. If you’re still inside or have a recently discharged Chapter 13, reach us at 800-900-8569 or hit Apply Now to check your eligibility in minutes.

Struggling with Chapter 13 Bankruptcy? Let’s See How You Can Qualify for an FHA Loan!

Chapter 13 bankruptcy doesn’t mean you can’t get an FHA loan. Contact us today to learn how you can meet FHA’s guidelines and get approved for your home loan.How Long Do I Have To Wait To Get a Mortgage After Chapter 13 Bankruptcy?

This guide on FHA chapter 13 bankruptcy guidelines will cover qualifying for a home loan during and after Chapter 13 Bankruptcy. We will review the FHA chapter 13 bankruptcy guidelines and compare other loan programs to FHA loans.

We will further cover qualifying for an FHA and VA loan during the Chapter 13 Bankruptcy Repayment plan. The eligibility requirements to qualify for a mortgage during a Chapter 13 Bankruptcy repayment plan.

Will we also cover the most frequently asked question at Gustan Cho Associates does Chapter 13 Bankruptcy needs to be discharged to qualify for a home mortgage loan? The following sections of the FHA chapter 13 bankruptcy guidelines will answer all the above questions.

Can You Get a Home Loan After Filing Chapter 13 Bankruptcy?

After filing Chapter 13 Bankruptcy, you can become eligible for FHA and VA loans within a year. However, meeting certain criteria is crucial: making a minimum of 12 punctual payments to the bankruptcy court without any delays is necessary, alongside trustee approval.

Interestingly, Chapter 13 Bankruptcy doesn’t necessarily have to be discharged. Both VA and FHA loans entail manual underwriting during the Chapter 13 Bankruptcy repayment phase.

The guidelines for VA and FHA chapter 13 bankruptcy guidelines are quite similar, with VA loans being slightly more flexible compared to FHA.

Chapter 13 Bankruptcy Guidelines on FHA and VA Home Loans

The FHA and VA guidelines for Chapter 13 Bankruptcy share similarities. Among traditional mortgage loan programs, only VA and FHA loans permit manual underwriting. Both HUD and VA follow identical manual underwriting criteria, encompassing factors like debt-to-income ratio, compensating elements, verification of rent mandates, trustee approval, and the waiting duration post-bankruptcy discharge.

Waiting Period Rules for FHA Chapter 13 Bankruptcy Mortgage Loans

This similarity can confuse potential homebuyers navigating Chapter 13 Bankruptcy, leading to differing responses from lenders when determining eligibility for VA and FHA loans. One common query from borrowers revolves around the variations in answers received from different lenders during the waiting period.

Do All Lenders Have Different Guidelines on The Same Mortgage Program?

Is it the case that every lender follows distinct guidelines for the same mortgage program? Absolutely. Each lender tends to have its specific set of guidelines despite having to adhere to the basic agency guidelines for FHA, VA, USDA, Fannie Mae, and Freddie Mac. While all lenders must meet the minimum agency standards, they often implement additional lending criteria known as overlays.

Lender overlays represent guidelines imposed by each lender, surpassing the basic agency mortgage requirements. Each lender can set their own higher lending requirements.

One lender may have an overlay on a certain guideline, and another may not. Just because you do not qualify with one lender does not mean you cannot qualify with a different mortgage lender. Gustan Cho Associates has zero lender overlays on government and conventional loans.

What Do Mortgage Lender Overlays Mean?

Different mortgage lenders may set varying credit score requirements for loans—for instance, one may insist on a 640 FICO for a VA loan, while another accepts a 580 FICO. Notably, the VA itself doesn’t stipulate a minimum credit score.

Many lenders add their conditions, known as overlays, to government and conventional loans. Rejection from one lender doesn’t necessarily imply ineligibility.

Another lender might approve the same borrower, lacking these additional mortgage overlays. Moreover, responses differ among lenders regarding the waiting period for FHA and VA loan qualification during and after Chapter 13 Bankruptcy. FHA Chapter 13 Bankruptcy Guidelines

Chapter 13 Bankruptcy Waiting Period Guidelines on FHA and VA Loans

The guidelines for waiting periods following Chapter 13 Bankruptcy on FHA and VA loans are subject to conflicting information.

Various loan officers offer different timelines: some advise a two-year waiting period, while others suggest a one-year wait after the bankruptcy. Yet, there are entities like Gustan Cho Associates claiming no waiting period is necessary.

Borrowers receive disparate information from loan officers, with one lender stating a one-year requirement for VA and FHA loan eligibility after Chapter 13 Bankruptcy, while another insists on two years following the discharge date.

What Are The VA and FHA Waiting Period Guidelines After Chapter 13 Bankruptcy Discharge

Many homebuyers get conflicting answers qualifying for an FHA or VA loan After the Chapter 13 Bankruptcy discharge date. They often consult with lenders and are told very different answers. Some lenders will say there is a two-year waiting period. Other lenders will say it is a one-year waiting period. Mike Gracz, a mortgage loan originator with Gustan Cho Associates and an associate contributing editor with GCA FORUMS said the following: Many confused borrowers get referred to us at Gustan Cho Associates or find us online and are told there is no waiting period to qualify for an FHA or VA loan after the Chapter 13 Bankruptcy discharge date.

FHA Loan Requirements After Chapter 13 Bankruptcy Discharge

The true and real answer per VA and FHA Chapter 13 Bankruptcy guidelines is that there is no waiting period to qualify for VA and FHA loans after the Chapter 13 Bankruptcy discharge. Borrowers can qualify for FHA and VA loans during the Chapter 13 repayment period after one year into the Chapter 13 Bankruptcy repayment plan with trustee approval.

Manual Underwriting Guidelines on FHA and VA Loans?

It needs to be a manual underwrite if the Chapter 13 Bankruptcy discharge has not been seasoned for two years on VA and FHA loans. We will detail how a borrower can qualify for VA and FHA loans per VA and FHA Chapter Bankruptcy guidelines on this BLOG. It will cover the mechanics of qualifying for VA and FHA loans for Chapter 7, and Chapter 13 Bankruptcy.

FHA Manual Underwriting Guidelines for Chapter 13 Bankruptcy Borrowers

A borrower can qualify for VA and FHA loans one year into a Chapter 13 Bankruptcy Repayment Plan per VA and FHA Chapter Bankruptcy Guidelines. The following paragraph will discuss how to qualify for FHA Loans during and after Chapter 13 Bankruptcy.

Comparing Chapter 7 Versus Chapter 13 Bankruptcy Guidelines on FHA and VA Loans

Under both VA and FHA Chapter 13 Bankruptcy Guidelines, the waiting period to qualify for an FHA loan after Chapter 7 Bankruptcy.is two years after the discharge date. After the Chapter 7 Bankruptcy discharge date, VA and FHA loans require a two-year waiting period and an automated underwriting system approval.

There is an exemption with qualifying for VA and FHA Loan After the Chapter 13 Bankruptcy Discharge date. The exception is NO WAITING PERIOD AFTER A CHAPTER 13 BANKRUPTCY DISCHARGED DATE.

It needs to be a manual underwrite. Borrowers will not get approve/eligible unless the Chapter 13 Bankruptcy discharged date has been seasoned for at least two years. That is why it needs to be manually underwritten. Remember that all manual underwrites need verification of rent.

Qualifying For FHA and VA Home Loans After Chapter 7 Bankruptcy

After meeting the mandatory waiting period requirements, borrowers can qualify for FHA loans after Chapter 7 Bankruptcy. Borrowers can qualify for VA and FHA loans two years after a Chapter 7 Bankruptcy discharge date. Here are the requirements for qualifying for VA and FHA loans after a Chapter 7 Bankruptcy discharge date. There is a two-year waiting period required to qualify for VA loans after the discharge date of the Chapter 7 Bankruptcy discharge. The borrower must re-establish credit and timely payment history after the Chapter 7 Bankruptcy discharge to qualify for VA and FHA loans.

Late Payments After Bankruptcy Mortgage Guidelines

Late payments after a Chapter 7 Bankruptcy can trigger a loan denial. Lenders will not qualify borrowers with late payments after bankruptcy and housing event.

Most lenders will not approve a borrower with any late payments after a Chapter 7 Bankruptcy discharge, no matter how small the monthly payment may be.

Late payments after bankruptcy and foreclosure are not automatic deal-killers. In some cases, borrowers with late payments can qualify for an FHA loan after late payments after the Chapter 7 Bankruptcy discharge date. Contact us at Gustan Cho Associates at 800-900-8569 or email at alex@gustancho.com if this is the case.

Buying a House While in a Chapter 13 Bankruptcy

FHA and VA loans are the only two mortgage loan programs that allow homebuyers to buy a house while in a Chapter 13 Bankruptcy. FHA Chapter 13 Bankruptcy Guidelines state that borrowers can qualify for an FHA loan if they meet the manual underwriting guidelines. It is the same with VA home loans.

A borrower can qualify for VA and FHA loans one year into the Chapter 13 Bankruptcy Repayment Plan. Proof of payment needs to be provided to the mortgage lender. The bankruptcy Trustee needs to approve of mortgage loan if the borrower is in a Chapter 13 Bankruptcy Repayment Plan.

Chapter 13 Bankruptcy Manual Underwriting Guidelines on FHA and VA Loans

In the Chapter 13 repayment plan, all mortgages undergo manual underwriting, which necessitates the verification of rent. To meet this requirement, borrowers must provide evidence of 12 months of canceled rent checks and bank statements reflecting timely payments to their landlord.

It’s important to note that not all lenders adhere to identical VA and HUD lending criteria for VA and FHA loans. However, all lenders are obligated to adhere to the guidelines established by the respective agencies, HUD and VA.

Additionally, lenders may impose additional lending requirements, known as overlays. The advantage of working with Gustan Cho Associates is our ability to waive rental verification for borrowers who have been residing rent-free with family, enabling them to save funds for their down payment on a home purchase.

Verification of Rent From Property Management Company

If the tenant is leasing from a property management firm, a Verification of Rent (VOR) Form filled out by the property manager is satisfactory in place of canceled checks and 12 months’ worth of bank statements. The lender supplies the rent verification form, and it is the responsibility of the property manager from the property management company to fill out, sign, date, and stamp the form.

All VA and FHA loans during and after the Chapter 13 Bankruptcy discharge date are all manual underwriting. There is nothing drastically different between automated AUS approved versus manual underwriting except caps on debt to income ratio.

Debt-to-income ratio is capped depending on the number of compensating factors. Compensating factors are essential for borrowers with a higher debt-to-income ratio. The debt-to-income ratio has a limit of 31% on the front end and 43% on the back end without any compensating factors. Having one or more late payments during the Chapter 13 Bankruptcy Repayment Period could result in automatic disqualification.

Best Mortgage Lenders For VA and FHA Loans While In Chapter 13 Bankruptcy

The VA and FHA Chapter 13 Bankruptcy Guidelines specify that there is no waiting period required to be eligible for VA and FHA loans after the discharge date of Chapter 13 Bankruptcy.

Some lenders may incorrectly inform borrowers that a one-year or two-year waiting period is necessary to qualify for VA and FHA loans post the Chapter 13 Bankruptcy discharge date.

However, this misinformation is often a result of Lender Overlays. Lender Overlays refer to additional and more stringent lending requirements imposed by lenders, which go beyond the minimum guidelines set by FHA and VA.

Is It Possible To Purchase a House During Chapter 13 Bankruptcy?

FHA and VA loans are the only two mortgage loan programs allowing borrowers to qualify for home loans during the Chapter 13 Bankruptcy repayment plan 12 months after starting.

Homebuyers looking for a lender with no lender overlays on government and conventional loans, contact Gustan Cho Associates at 800-900-8569. Or text us for a faster response.

Homebuyers can email us at Gustan Cho Associates at gcho@gustancho.com. Gustan Cho Associates has a national reputation of no lender overlays on government and conventional loans. We also have dozens of non-QM wholesale lenders. The Team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

How Soon Can You Get a Mortgage After Filing Chapter 13 Bankruptcy?

Mortgage Guidelines During Chapter 13 Bankruptcy state borrowers can qualify for home loans during the Chapter 13 Bankruptcy repayment plan.

Borrowers can qualify for VA and FHA loans during the Chapter 13 Bankruptcy repayment period without the bankruptcy being discharged.

They would need the approval of the bankruptcy trustee. VA and FHA Chapter 13 Bankruptcy guidelines are the same. Borrowers must be in the Chapter 13 Bankruptcy repayment plan for at least 12 months before eligibility.

Getting Bankruptcy Trustee Approval For A Mortgage

Most trustees will approve a home purchase during the Chapter 13 Bankruptcy repayment plan if the petitioner can afford the monthly housing payment. Of course, the home needs to be regular, not a mansion.

The team at Gustan Cho Associates are experts in helping homebuyers qualify for FHA and VA loans during and after Chapter 13 Bankruptcy.

Other loan programs require a mandatory waiting period after the Chapter 13 Bankruptcy discharge date. Not all lenders will do manual underwriting.

Worried About FHA Loan Guidelines After Chapter 13 Bankruptcy? Let’s Guide You Through It!

Contact us today to learn about the guidelines and how we can help you get approved.FHA and VA Loans During or After Chapter 13 Bankruptcy

FHA and VA loans stand as the exclusive mortgage loan programs permitting manual underwriting. Gustan Cho Associates specializes in the manual underwriting of FHA and VA loans. For individuals navigating the mortgage loan process amid Chapter 13 Bankruptcy, manual underwriting is a requisite for both VA and FHA loans. Eligibility for an FHA and VA loan is attainable following the discharge of Chapter 13 Bankruptcy.

FHA and VA Waiting Period Guidelines After Chapter 13 Bankruptcy

If the discharge from Chapter 13 Bankruptcy has not been established for a minimum of two years, the file is required to undergo manual underwriting.

The key distinction between manual and automated underwriting system approval lies in the fact that manual underwriting imposes lower caps on the debt-to-income ratio.

A significant proportion of our borrowers, more than one-third, are currently engaged in an active Chapter 13 Bankruptcy repayment plan or have recently completed the Chapter 13 Bankruptcy process. The following section will detail the mortgage guidelines applicable during Chapter 13 Bankruptcy repayment plans for FHA and VA loans.

Manual Underwriting Versus Automated Underwriting System Approval

FHA and VA loans are the exclusive loan programs permitting manual underwriting for home mortgages. All FHA and VA loans within the Chapter 13 Bankruptcy repayment period undergo manual underwriting.

Similarly, any FHA and VA loans that have been discharged but have not reached a seasoning period of two years are subject to manual underwriting.

While the manual underwriting guidelines for FHA and VA loans are nearly identical, it is noteworthy that lenders tend to be more flexible with VA loans compared to FHA loans in the manual underwriting process.

VA and FHA Loans After Chapter 13 Bankruptcy Eligibility Requirements

FHA, VA, and Non-QM loans don’t require a waiting period following the discharge date of Chapter 13 Bankruptcy. Lenders anticipate borrowers to make timely payments on all monthly debts post-bankruptcy filing.

The impact of late payments during and after Chapter 13 Bankruptcy varies among lenders. In certain cases, one or two late payments resulting from extenuating circumstances may not necessarily hinder the deal.

Nevertheless, late payments post-bankruptcy discharge due to neglecting credit are likely to pose significant obstacles when seeking mortgage qualification and could potentially lead to the termination of the deal.

FHA and VA DTI Guidelines During Chapter 13 Bankruptcy

The manual underwriting guidelines for FHA and VA loans closely mirror each other. This encompasses the manual underwriting guidelines for the debt-to-income ratio on both FHA and VA loans. The verification of rent, late payment, and compensating factors during Chapter 13 Bankruptcy for FHA and VA loans also exhibit similarities. Any Chapter 13 Bankruptcy that hasn’t undergone seasoning for two years following the discharge date requires manual underwriting.

DTI Guidelines on Manual Underwriting

In this article, we’ll delve into the concept of manual underwriting. It’s important to note that VA and FHA loans, specifically those obtained during the Chapter 13 Bankruptcy payment period, require manual underwriting.

Manual underwriting is exclusive to FHA and VA loans among various mortgage programs. The prescribed debt-to-income ratio guidelines for both FHA and VA loans are as follows: 31% for the front-end and 43% for the back-end without any compensating factors, 37% for the front-end and 47% for the back-end with one compensating factor, and 40% for the front-end and 50% for the back-end with two compensating factors.

FHA and VA Loan Eligibility Requirements While In Chapter 13 Bankruptcy

Here are the FHA and VA Chapter 13 Bankruptcy Mortgage Guidelines during an active repayment plan:

- Homebuyers can qualify for a VA and FHA loan during the Chapter 13 Bankruptcy repayment plan without having the Chapter 13 discharged

- To qualify, the borrower needs to be in the Chapter 13 repayment plan for at least one year

- 12 months of timely payments to the Trustee are required

- Trustee approval is required

- Most trustees will sign off on a home mortgage

- Both VA and FHA loans during an active Chapter 13 bankruptcy need to be manually underwritten

- FHA requires a 3.5% down payment

- VA offers 100% financing.

- Verification of rent is required on manual underwriting.

- If the borrower cannot verify rent because they are living with family to save for the down payment, a letter of living rent-free needs to be completed and signed.

Gustan Cho Associates are experts in helping borrowers qualify for FHA and VA loans during and after Chapter 13 Bankruptcy.

Fannie Mae Chapter 13 Bankruptcy Guidelines on Conventional Loans

In contrast to FHA and VA loans, individuals are ineligible for conventional loans while in the Chapter 13 Bankruptcy repayment phase. To be eligible for conventional loans following Chapter 13 Bankruptcy, the subsequent mortgage criteria must be met.

A waiting period of four years is required after the dismissal date of Chapter 13 Bankruptcy. There is a two-year waiting period after the Chapter 13 Bankruptcy discharge date.

There is a four-year waiting period after the Chapter 7 Bankruptcy discharge date. The team at Gustan Cho Associates are experts in helping homebuyers and homeowners qualify for a mortgage after bankruptcy. For more information about this article and other mortgage-related topics, don’t hesitate to contact us at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com.

FHA Mortgage After Chapter 13 Bankruptcy Guidelines

Qualifying for an FHA mortgage is achievable both during and after Chapter 13 bankruptcy at Gustan Cho Associates. Homebuyers can now meet the criteria for an FHA mortgage as per FHA Chapter 13 Bankruptcy Guidelines immediately after the discharge date of their Chapter 13 bankruptcy, without any waiting period. Numerous borrowers, upon the completion of their Chapter 13 bankruptcy, frequently contact me.

Traditional financial institutions such as banks and credit unions, along with other lenders that have additional requirements, are typically the primary sources for qualification.

These individuals are often informed that they cannot qualify for an FHA mortgage until two years have passed since the discharge date of their Chapter 13 bankruptcy.

Best Chapter 13 Bankruptcy Mortgage Lenders

Gustan Cho Associates are experts in helping borrowers in the Chapter 13 Bankruptcy repayment plan qualify for an FHA loan. A large percentage of our borrowers are folks who need manual underwriting during Chapter 13 Bankruptcy. Chapter 13 Bankruptcy does not need to be discharged. FHA Chapter 13 Bankruptcy Guidelines are as follows:

- states that there is no waiting period after the discharge date of a Chapter 13 Bankruptcy

- borrowers can qualify for FHA Loans during their Chapter 13 Bankruptcy repayment plan with Trustee Approval

- Trustees approve housing purchases, and we have never had a Trustee not approve a home mortgage

HUD and VA Agency Guidelines Versus Overlays on Chapter 13 Bankruptcy

Why do banks, credit unions, and most mortgage companies tell borrowers that they must meet a two-year waiting period to qualify for FHA Loan After Chapter 13 Bankruptcy?

Most banks have lender overlays when approving FHA loans after Chapter 13 Bankruptcy. Many lenders do not do manual underwriting.

Lender overlays require additional mortgage guidelines in addition to the minimum FHA mortgage lending guidelines that individual banks, credit unions, and mortgage companies set.

Why are FHA Loans Without Two-Year Seasoning After Discharge Manual Underwriting

All mortgage loan applications are submitted to the Automated Underwriting System for automated approval. The Automated Underwriting System, also commonly referred to as AUS, will render three decisions:

- Approve/Eligible per Automated Finding

- Refer/Eligible per Automated Findings

- Refer/Ineligible per Automated Findings

Approve/Eligible per Automated Findings means the mortgage loan applicant has a solid automated approval. Lenders like Gustan Cho Associates, who do not have investor overlays, can close the FHA Loan. This will be contingent on the borrower meeting all of the conditions from the automated findings.

The Automated Findings of the AUS

Refer/Eligible indicates that the borrower may or may not meet the eligibility criteria for an FHA loan. Nonetheless, the automated underwriting system is unable to provide automated approval, necessitating the assignment of a human mortgage underwriter to assess the file.

Refer/Eligible suggests that there is a possibility of approval, but automated approval cannot be guaranteed, and manual underwriting by a mortgage underwriter is required.

A referral with caution and an ineligible status implies that the applicant does not qualify for various reasons and fails to meet the FHA Chapter 13 Bankruptcy Guidelines.

Approve Eligible Versus Refer Eligible Per AUS

FHA Chapter 13 Bankruptcy Guidelines require that all applications seasoned for two years or less will be referred/eligible per Automated Underwriting System.

All refer/eligible per AUS will require manual underwriting. Banks, credit unions, and mortgage companies are not set up to do manual underwriting.

So most borrowers who consult with lenders who do not do manual underwriting often are told that they do not meet the FHA Chapter 13 Bankruptcy Guidelines.

FHA Chapter 13 Bankruptcy Guidelines To Qualify For FHA Loans

Homebuyers who have recently had a Chapter 13 Bankruptcy discharge and want to qualify for an FHA loan don’t hesitate to contact us at 800-900-8569. Text us for a faster response. Or email us at gcho@gustancho.com. Remember that HUD, the parent of FHA, allows homebuyers to qualify for FHA Loans during Chapter 13 Bankruptcy.

FHA Chapter 13 Bankruptcy Guidelines mandate borrowers need to have been in a Chapter 13 Repayment plan for at least 12 months.

Per manual underwriting of FHA loans after Chapter 13 Bankruptcy Guidelines, the borrower needs to be timely in the past 24 months on all their monthly debt obligations. Please get in touch with us with questions about FHA Loans After Chapter 13 Bankruptcy Guidelines. The team at Gustan Cho Associates is available seven days a week, on evenings, weekends, and holidays to answer your calls and questions.

Other Requirements For Borrowers Applying For a Mortgage While in Chapter 13

All manual underwriting mortgage applications will require rental verification. Verification of Rent is only valid if the renter has been paying their rental payments to their landlord with a bank check and can provide 12 months of canceled checks to the mortgage underwriter. The renter can also provide 12 months’ bank statements if the renter has paid their rental payments online.

Verification of Rent Requirements on Manual Underwrites

Rent payments must be consistently on time, with a track record of timely payments in the preceding 12 months. If the tenant leases their apartment or house through an authorized property management company, they can utilize a Verification of Rent (VOR) form provided by the lender. This form can be filled out and endorsed by the representative of the property management company. The VOR Form serves as an alternative to submitting 12 months’ worth of canceled bank checks and bank statements.

What If I Cannot Provide Verification of Rent?

Verification of rent is required on all manual underwriting by most mortgage lenders. The only way rental verification of rent is valid is by providing 12 months of canceled checks from the renter to the landlord. Or the renter can provide 12 months of bank statements showing the rent being wired to the landlord.

Gustan Cho Associates can waive verification of rent on VA and FHA manual underwrites if they are living rent-free with family to save money for the down payment and closing costs on a home purchase.

Cash rental payment with a paid receipt is not a valid rental verification form. If the renter has a lease with a registered property management company, the 12 months of canceled checks or 12 months of bank statements can be waived. The property management company must complete and sign the verification form provided by the lender.

Best Mortgage Lenders For Bad Credit With No Overlays

Borrowers who cannot provide verification of rent and are living rent-free with family do not need to provide rental verification. VOR can be waived on manual underwriting if the borrower lives rent-free with family members. The loan officer will provide a rent-free letter which needs to be signed by the person with who the borrower is living rent-free. Feel free to contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com.

FHA Chapter 13 Bankruptcy Guidelines FAQ

What Are FHA Chapter 13 Bankruptcy Guidelines?

When Can Individuals in a Chapter 13 Bankruptcy Repayment Plan Become Eligible for an FHA or VA Loan?

Do Borrowers Need the Chapter 13 Bankruptcy to be Discharged to Qualify for FHA and VA Loans?

What Are The Eligibility Requirements for FHA and VA Loans During a Chapter 13 Bankruptcy Repayment Plan?

Do All Lenders Have The Same Guidelines for FHA and VA Loans During Chapter 13 Bankruptcy?

What Are Lender Overlays?

What is Manual Underwriting, and When is it Required for FHA and VA Loans During Chapter 13 Bankruptcy?

Are the Waiting Period Guidelines the Same for FHA and VA Loans Offer Chapter 13 Bankruptcy Discharge?

What Are the Requirements for Qualifying For Conventional Loans After Chapter 13 Bankruptcy?

Can Borrowers Purchase a House While in a Chapter 13 Bankruptcy?

What is Verification of Rent (VOR), and When is it Required For Manual Underwriting?

Can Verification of Rent Be Waived on Manual Underwriting?

What Are Lender Overlays and Why Do They Affect FHA Loan Approval?

Can Borrowers Qualify For an FHA Loan Immediately After The Discharge of Their Chapter 13 Bankruptcy?

This blog about FHA Chapter 13 Bankruptcy Guidelines on FHA Loans was updated on September 9th, 2025.