Not all Florida VA lenders have the same lending requirements on VA loans. Not all Florida VA lenders do manual underwrites. Gustan Cho Associates are Florida VA lenders with no lender overlays on VA loans. VA loans are the best loan program in the nation. At competitive rates, lenders offer VA loans with no down payment requirements and 100% financing with no mortgage insurance premium. The VA Funding Fee can be rolled into the loan balance. Not all Flordia VA lenders have the same mortgage guidelines on VA loans.

Many homebuyers often get confused about why so many Florida VA lenders have different lending requirements on VA loans. The U.S. Veterans Administration is the federal agency in charge of the agency mortgage guidelines on VA loans. The VA has more lenient agency mortgage guidelines on VA loans than any other loan program.

VA mortgages are not for everyone. Only eligible active or retired members of the United States Armed Forces and surviving spouses of eligible military members with a valid certificate of eligibility (COE) are eligible for VA loans. Mortgage rates on VA loans are lower than any other mortgage loan program due to the government guarantee from the VA. The are no maximum loan limits on VA loans. In the following paragraphs, we will cover Flordia VA lenders with no lender overlays on VA loans.

The Best Florida VA Lenders With No Overlays on VA Loans

The United States Department of Veterans Administration is the federal agency that insures and guarantees lenders on VA loans. VA mortgages were created in 1944 and signed by President Franklin D. Roosevelt. The purpose of Congress creating VA loans was to reward active and retired members of the U.S. Armed Services and eligible surviving spouses of veterans the opportunity to purchase a home.

Congress created and launched VA loans. VA loans are mortgage loans backed by the federal government with 100% financing and lenient mortgage guidelines. The VA loan program is commonly referred to as the GI Bill. VA mortgages have been successful since their launch in helping veterans realize the dream of homeownership.

VA loans have helped millions of veterans and their families realize the dream of homeownership becoming a reality. Not all veterans qualify for VA loans. Members need to have full entitlement. Only members with a certificate of eligibility with full entitlement qualify for VA loans. Eligible members can use their VA loan benefits multiple times. There are instances where veterans can have more than one VA loan simultaneously.

Not All Florida VA Lenders Have The Same Loan Requirements on VA Loans

There are thousands of Florida VA lenders. However, not all Florida VA lenders have the same VA loan requirements on VA loans. Most lenders have higher lending requirements above the minimum agency mortgage guidelines. These higher VA loan requirements by individual lenders are called lender overlays.

The team at Gustan Cho Associates proudly serves our United States Armed Services members with VA loan programs in Florida with zero lender overlays. Gustan Cho Associates has no lender overlays on VA loans.

We have helped thousands of active and retired members of our U.S Military get approved and close on VA loans with credit scores as low as 500 FICO, borrowers with bad credit, homebuyers in Chapter 13 Bankruptcy repayment plans, and borrowers who were denied VA loans from other mortgage companies.

Understanding VA Guidelines Versus Overlays By Florida FHA Lenders

VA loans have more lenient mortgage requirements than any other mortgage loan program. However, most lenders have higher lending requirements that exceed the minimum agency mortgage requirements mandated by the Veterans Administration on VA loans.

Over 80% of our borrowers at Gustan Cho Associates could not qualify at other mortgage companies due to their lender overlays or gotten a last-minute mortgage loan denial. Gustan Cho Associates has a national reputation for being able to do VA loans other lenders cannot do.

It is very important to understand the basic VA loan requirements of the Veterans Administration for borrowers who are applying for a VA loan. Borrowers meeting the agency VA loan requirements who are told they do not qualify from a lender but meet the agency guidelines can qualify for a VA loan at a lender with no overlays. Gustan Cho Associates is one of the few mortgage companies licensed in Florida with no lender overlays on VA loans.

Minimum VA Guidelines on VA Loans

Gustan Cho Associates has zero lender overlays on VA mortgages. We go off the minimum VA loan requirements by the Veterans Administration and have zero lender overlays on VA loans. Over 80% of our borrowers at Gustan Cho Associates could not qualify at other mortgage companies due to lender overlays. The team at Gustan Cho Associates has helped countless borrowers with credit scores down to 500 FICO qualify for VA loans in Florida.

VA loans have one of the most lenient agency mortgage guidelines versus other government and conventional loans. However, most Florida VA lenders impose higher lending standards on VA loans. Florida VA lenders can have any lender overlays on VA loans. It is up to the individual mortgage company to set the lender overlays on guidelines they feel are too risky for them.

Gustan Cho Associates get countless calls from qualified veterans who were told by other lenders they do not qualify for a VA loan due to not having a 620 or 640 credit score. The credit score requirement is not the requirement mandated by the VA. It is the individual lender that requires this credit score. The lender can have higher lending requirements above and beyond the minimum guidelines of the VA.

Lender Overlays On Credit Scores By Florida VA Lenders

Most lenders have a 620 or higher credit score requirement on VA loans. This holds true even though VA loans have no minimum credit score requirements. The credit score requirements are called lender overlays by the individual mortgage company. Gustan Cho Associates has zero lender overlays on VA loans.

There are no minimum credit score requirements on VA mortgages. As long as the borrower can get an approve/eligible per automated underwriting system, lenders with no lender overlays can approve and fund the VA loan.

We go off the automated findings of the automated underwriting system. Borrowers who cannot get approve/eligible per AUS can qualify for a VA loan via manual underwriting. VA manual underwriting guidelines apply. Borrowers can qualify for VA loans with outstanding collections and charged-off accounts. However, many VA Florida lenders have overlays on collection accounts and require borrowers to pay them off.

Debt-To-Income Ratio Caps in VA Loans

There is no maximum debt-to-income ratio on VA loans. Even though VA does not have a maximum DTI cap on VA loans, most lenders will impose a 40% to 50% debt-to-income ratio cap on VA loans. The Veterans Administration mandates agency mortgage guidelines on VA loans and does not require a minimum credit score requirement on VA loans.

Gustan Cho Associates has gotten countless automated underwriting system approvals for borrowers with under 600 credit scores and debt-to-income ratios that surpass 60% DTI.

The key to getting an approve/eligible per automated underwriting system is residual income. Borrowers with high residual income can get an approve/eligible per automated underwriting system with debt to income ratio exceeding 60% DTI.

VA Manual Underwriting Guidelines

VA and FHA loans are the only two home mortgage loan programs that allow manual underwriting. Manual underwriting is when a human underwriter analyzes and underwrites the file. Borrowers with refer/eligible per AUS are candidates for VA manual underwriting.

The only major difference between manual and automated findings underwriting is the debt-to-income ratio caps. VA manual underwriting caps debt-to- income ratio depending on the number of compensating factors the borrower has.

HUD’s manual underwriting and the VA’s manual underwriting guidelines are the same. However, VA manual underwriting guidelines are much more lenient than HUD’s FHA manual underwriting guidelines.

Florida VA Manual Underwriting on VA Loans

Here is the debt-to-income ratio on manual underwritten VA loans:

- 31% front-end and 37% back-end debt-to-income ratio with zero compensating factor

- 37% front-end and 47% back-end debt-to-income ratio with one compensating factors

- 40% front-end and 50% back-end debt-to-income ratio with two compensating factors

Mortgage underwriters have a lot of underwriter discretion on VA manual underwrites. Underwriters can approve borrowers above the recommended manual underwriting debt-to-income ratio guidelines if the borrower has strong compensating factors. Underwriters can approve a manual underwriting file exceeding 50% debt to income ratio if they feel the borrower has strong compensating factors.

VA Mortgage Guidelines on Compensating Factors

History of the borrower’s job longevity, education training, and constant promotion. History of payment patterns over the past two years. Low credit card balances. History of the borrower’s saving habits and reserves. Having a second job that is seasoned for at least a year but not used as qualifying income.

The borrower has a non-borrowing spouse with a full-time job, and income not used as qualifying income is a compensating factor. Large down payment on home purchase even though there is no down payment required on VA loans. Mortgage underwriters have a lot of power and discretion in manual underwriting.

VA Manual Underwriting Guidelines on Late Payments

One of the great benefits of manual underwriting on VA loans is mortgage underwriters will look at files carefully, and letters of explanation will be carefully analyzed and reviewed. Manual underwrites require 24 months of timely payments and no late payments after bankruptcy or foreclosure. If you have late payments after bankruptcy or late payments in the past 24 months, the mortgage underwriter may allow that with a great letter of explanation and documentation. Gustan Cho Associates have helped many borrowers with late payments in the past 24 months and late payments after bankruptcy or a housing event on manual underwriting borrowers. Many Florida FHA lenders will not do manual underwriting as part of their lender overlays.

VA Loans After Bankruptcy And Foreclosure

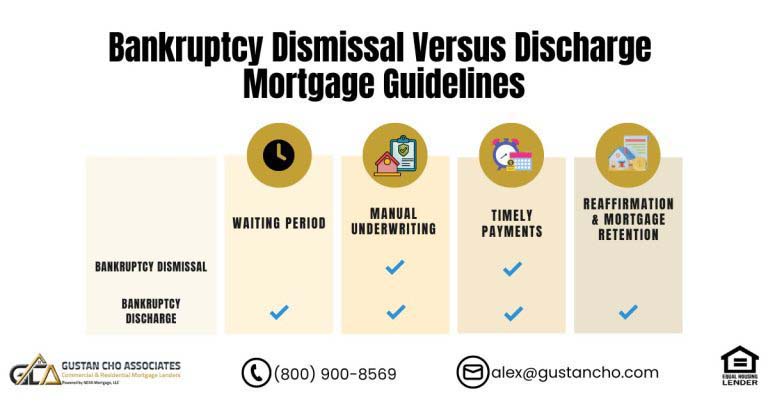

There is a two-year waiting period to qualify for VA loans after the Chapter 7 Bankruptcy discharge date, recorded foreclosure date, deed-in-lieu of foreclosure, and short-sale.

Borrowers can qualify for a VA loan during the Chapter 13 Bankruptcy repayment plan with trustee approval and manual underwriting. There is no waiting period after the Chapter 13 Bankruptcy discharge date.

It must be a manual underwrite if the Chapter 13 Bankruptcy discharge date has not been seasoned for twenty-four months. The team at Gustan Cho Associates are experts in helping homebuyers after bankruptcy or a housing event.

Florida VA Lenders With No Lender Overlays On VA Loans

Gustan Cho Associates is a mortgage company licensed in multiple states, including Florida, with no lender overlays on VA loans. Due to lender overlays, over 75% of our borrowers could not qualify at other mortgage companies.

The team at Gustan Cho Associates has helped thousands of borrowers qualify and get approved for VA loans with credit scores down to 500 FICO, prior bad credit, over 60% debt-to-income ratio, and other types of credit/income issues.

If you have any questions about the content on this blog or need to qualify for a VA loan with a no overlay lender in Florida, please get in touch with us at 800-900-8569 or email us at gcho@gustancho.com. Text us for a faster response. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.