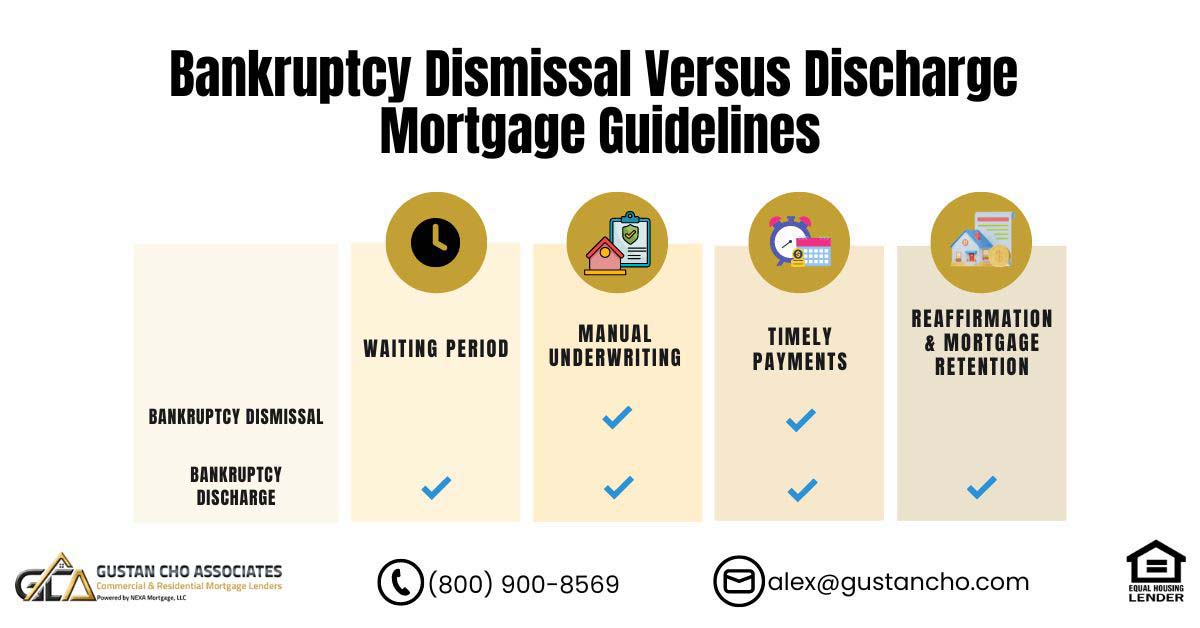

In this blog, we will cover and discuss the difference when qualifying for a mortgage after bankruptcy dismissal versus bankruptcy discharge mortgage guidelines. There are waiting period differences when qualifying for FHA loans after bankruptcy dismissal versus bankruptcy discharge.

Bankruptcy, whether a dismissal or a discharge, can have significant implications for your mortgage and financial situation. Let’s explore the key differences between bankruptcy dismissal and discharge in the context of mortgage guidelines.

There is no waiting period after FHA loans after bankruptcy dismissal versus bankruptcy discharge. This is only if the consumer has the Chapter 13 Bankruptcy has been dismissed voluntarily by the petitioner and all payments have been on time. Needs to be manual underwriting. The Key is timely payments for the past 12 months.

Bankruptcy Dismissal Versus Bankruptcy Discharge

Bankruptcy discharge is the favorable outcome of completing a bankruptcy case. It typically occurs in Chapter 7 or Chapter 13 bankruptcy. Chapter 7 bankruptcy, eligible debts (including unsecured debts like credit card debt) are discharged. Chapter 13 bankruptcy, you enter a repayment plan to pay off some or all of your debts over a specified period (usually three to five years). At the end of the plan, any remaining eligible debts are discharged. Mortgage implications: If your mortgage was included in the bankruptcy, and you completed your bankruptcy case, you may be eligible to keep your home if you continue making mortgage payments. Discharging other debts can free up resources to help with your mortgage payments.

Difference Between Bankruptcy Dismissal Versus Bankruptcy Discharge

Bankruptcy dismissal occurs when the court terminates your bankruptcy case before you receive a discharge. This can happen for various reasons, such as failure to comply with court orders or not meeting bankruptcy requirements. Mortgage implications: If your bankruptcy case is dismissed, you do not receive the benefits of debt discharge. This means you remain fully responsible for all your debts, including your mortgage. You may need to resume making regular mortgages or negotiate with your lender to avoid foreclosure.

Dismissal or Discharge — We Help You Understand the Difference

Whether your bankruptcy was dismissed or discharged, we’ll show you what it means for your mortgage options.

Mortgage Guidelines on Bankruptcy Dismissal Versus Bankruptcy Discharge

Mortgage lenders have specific guidelines and eligibility criteria for borrowers who have gone through bankruptcy, whether it is bankruptcy dismissal versus bankruptcy discharge. Typically, there is a waiting period after a bankruptcy discharge before you can qualify for a new mortgage loan. The length of this waiting period varies depending on the type of bankruptcy and the lender’s policies. Bankruptcy dismissals can negatively impact your credit score and financial standing, making it more challenging to qualify for a new mortgage in the short term.

Manual Underwriting Guidelines During Chapter 13 Bankruptcy

After filing for bankruptcy, there are specific waiting periods that must be observed. These waiting period requirements differ depending on whether the bankruptcy case was dismissed or discharged. Notably, FHA and VA loans are the exclusive mortgage programs permitting borrowers to qualify for a mortgage during or after Chapter 13 Bankruptcy.

FHA and VA loans are the sole mortgage programs allowing manual underwriting. When it comes to qualifying for a mortgage following bankruptcy dismissal or discharge, FHA loans stand out with their lenient guidelines.

Each loan program has its own set of waiting period requirements post-bankruptcy dismissal or discharge. Given the more forgiving guidelines of FHA loans, we will utilize them to illustrate the comparison of mortgage eligibility requirements between bankruptcy dismissal and discharge.

Manual Underwriting Guidelines After Chapter 13 Bankruptcy Dismissal

The exclusive mortgage programs offering manual underwriting are FHA and VA loans. These two options stand out as they impose no waiting period requirements following the discharge of Chapter 13 Bankruptcy.

If Chapter 13 Bankruptcy is not seasoned two years post-discharge, manual underwriting becomes necessary. VA and HUD manual underwriting guidelines require a 12-month history of on-time payments to be eligible.

FHA loans, specifically, allow mortgage underwriters to assess up to 24 months of timely payment history when qualifying during and after Chapter 13 Bankruptcy. Notably, Gustan Cho Associates places no overlays on FHA loans in the periods surrounding and following the Chapter 13 Bankruptcy discharge date.

FHA Guidelines on Bankruptcy Dismissal Versus Bankruptcy Discharge

Here are HUD Guidelines on FHA loans after bankruptcy dismissal versus bankruptcy discharge. If borrowers are 1 year out of Dismissal of a Chapter 13 Bankruptcy then the following applies:

- Cannot have more than 2X30 late on any debt

- This includes the 1X30 on Chapter 13 Bankruptcy that caused the dismissal

- Borrowers who have more than this then will need to wait until they are 2X30 last 24 months

Receiving Motion To Dismiss Chapter 13 Repayment Plans

Frequently, the Chapter 13 Bankruptcy Trustee initiates a motion to dismiss, often prompted by individuals failing to fulfill their scheduled monthly payments or experiencing delays in confirming the repayment plan.

While there may be various reasons behind such dismissal motions, it’s essential to dispel the misconception that they involve numerous bureaucratic hurdles. In reality, rectifying and updating these motions is a straightforward process.

If petitioners receive a notice of a motion to dismiss due to missed payments, promptly making the overdue payments is crucial to rectify the default and maintain a favorable standing. Similarly, if the motion is filed before plan confirmation, it is imperative to bring payments up to date. For motions filed after plan confirmation, making efforts to become current is highly advisable.

Can You Get a Mortgage After Bankruptcy? Yes—Here’s How

FHA, VA, and non-QM loans allow options after both dismissal and discharge. We’ll help you find the right fit.

Mortgage After Chapter 13 Dismissal

After the voluntary dismissal of Chapter 13 Bankruptcy, there is no waiting period, provided that the petitioner maintained timely payments up to the dismissal date. It is crucial to seek guidance from a Bankruptcy attorney before taking any action. An attorney may explore plan modifications to prevent default.

If a motion for dismissal is initiated due to delays, it serves as the trustee’s way of highlighting unresolved issues that must be addressed before recommending the confirmation of the repayment plan.

Such dismissal motions are not uncommon, so there’s no need to be overly concerned. In certain situations, the Chapter 13 Trustee may request documentation from the attorney rather than the petitioners. Other motion types include those related to dismissal based on payment plan terms or feasibility issues.

Difference on Motion To Dismiss Bankruptcy Dismissal Versus Bankruptcy Discharge

If a motion to dismiss is granted or there is a modification to the plan’s term, it signifies that the current payment amount is insufficient for the plan to be successfully executed within a sixty-month timeframe. To address this situation, one can rectify it by submitting an amendment to restructure the plan, necessitating an increase in the payment to ensure completion within the stipulated 60 months. Such situations frequently arise when creditors challenge the confirmed bankruptcy repayment plan.

Motion To Dismiss For Feasibility

A request for dismissal based on feasibility pertains to the inadequacy of the existing budget to support a sufficient income for the proposed repayment plan. This typically arises when individuals facing home loan delinquencies discover that the mortgage exceeds the initially declared amount.

Potential solutions involve reducing monthly expenses to make a higher payment plan manageable. Another strategy is to contest a substantial claim to render the plan unworkable.

This scenario often occurs in cases involving Internal Revenue Service (IRS) proof of claims, particularly when petitioners lack income tax returns, leading to an estimation of the consumer’s debt. A successful approach involves re-filing income tax returns for the relevant tax year and subsequently challenging the proof of claim.

Are There Refunds on Payments Made To Trustee If Chapter 13 Is Dismissed?

Chapter 13 Bankruptcy Trustees, appointed by the U.S. Bankruptcy Court System, are private attorneys tasked with the role of Trustees. Their earnings are linked to the funds disbursed during the active period of the payment plan. In cases where creditors, including auto finance companies, received payments for debtor protection before Chapter 13 Bankruptcy dismissal following the confirmation of the payment plan, no refunds will be issued. This is because creditors are compensated based on the terms outlined in the Chapter 13 Bankruptcy repayment plan.

Reaffirming Mortgage After Filing Bankruptcy to Keep Home

Homeowners have the option to declare bankruptcy, and if they have the financial means to continue paying their mortgage and retain ownership of their homes, they can choose to reaffirm their mortgage.

Reaffirmation typically occurs in the context of Chapter 7 Bankruptcy filings by consumers. This process involves a mutual agreement between homeowners and lenders after the bankruptcy petition has been filed.

Reaffirming a mortgage is a common practice, enabling homeowners to retain ownership of their homes despite the bankruptcy proceedings. This process is not limited to mortgages; individuals filing for bankruptcy can also reaffirm other assets, such as a car. The reaffirmation process involves the mortgage company being notified of the homeowner’s bankruptcy. This communication initiates the discussion and agreement between the homeowner and the lender, allowing for the reaffirmation of the mortgage and the retention of the property.

How The Process of Reaffirming of Creditors Work

The lender will prepare the agreement by stating the following:

-

- home loan balance

- maturity date

- monthly payments

- interest rate

- other terms of the loan

How Does The Reaffirmation Written Agreement Get Processed To Exclude Home From Bankruptcy

The reaffirmation agreement will be dispatched to the homeowner’s legal representative. The attorney will finalize the document by incorporating details related to the borrowers’ income and monthly expenses, as outlined in the Chapter 13 Bankruptcy Payment Schedules provided to creditors. Once the agreement is prepared by the bankruptcy attorney, the borrower is required to endorse it before it is transmitted to the mortgage company.

The Ability To Pay Your Mortgage

If the consumer’s budget falls short of adequate income for repaying debts, the case is escalated to a court hearing. During this hearing, the petitioner must present their case to a judge, outlining their strategy for retaining ownership of the home and demonstrating their ability to meet mortgage payments. If the homeowner chooses to reaffirm the mortgage, they are obligated to continue making their monthly housing payments as agreed.

What Happens If You Do Not Reaffirm Your Mortgage

If the petitioner decides against reaffirming the mortgage, the property will enter foreclosure, absolving the homeowner of any further liability. Instances exist where homeowners opt not to reaffirm their mortgage post-bankruptcy, yet continue making regular mortgage payments. In such scenarios, lenders may prolong the foreclosure proceedings as long as homeowners consistently meet their monthly payment obligations.

Bankruptcy Questions? We’ve Got Answers

Our team specializes in helping borrowers move forward after bankruptcy—dismissal or discharge, we can guide you.

Refiling After Bankruptcy Dismissal Versus Bankruptcy Discharge

Mortgage lenders tend to perceive unfavorably a history of repeated bankruptcies, whether it’s a bankruptcy dismissal or a bankruptcy discharge. Despite this, consumers have the option to file for multiple bankruptcies. In cases where an individual has had two Chapter 13 Bankruptcies pending within the last 12 months, the automatic stay concludes 30 days after the initial bankruptcy filing.

To extend the automatic stay, petitioners and their bankruptcy attorneys must file a motion and provide a rationale to the U.S. Bankruptcy Courts, demonstrating why they believe the current case will succeed in contrast to the previous unsuccessful cases.

Petitioners Filing Multiple Bankruptcies: Multiple Dismissals and Refiling

For individuals with several ongoing cases (bankruptcy dismissal or bankruptcy discharge) in the last 12 months, an automatic stay will not be granted upon filing a new case. It is imperative for petitioners to submit a motion for an automatic stay, articulating persuasive reasons to the courts for the viability and distinctiveness of the newly filed case compared to the prior ones.

How Lenders View Bankruptcy Dismissal Versus Bankruptcy Discharge

Mortgage lenders maintain an impartial stance regarding bankruptcy, treating both dismissal and discharge with equal consideration. In the eyes of lenders, bankruptcy is a uniform concept, and the distinction between bankruptcy dismissal and discharge primarily centers on the waiting period required post-bankruptcy resolution.

The waiting period after bankruptcy becomes a critical factor influencing an individual’s eligibility for obtaining a mortgage. You cannot be late on any payments after a bankruptcy discharge.

Essentially, while the nature of bankruptcy itself is constant, the temporal aspects following the resolution play a pivotal role in shaping the potential for securing a mortgage loan. Consequently, individuals navigating the aftermath of bankruptcy should be attuned to these temporal nuances, as they significantly impact the timeline for re-entering the realm of mortgage eligibility.

What Happens If I Withdraw My Chapter 13?

Judges typically extend the benefit of the doubt to petitioners when considering the approval of a new case, provided there is a valid explanation. In cases of bankruptcy, individuals filing petitions are permitted to reclaim certain exempt properties at their market value, including items like cars, irrespective of the outstanding balance on such assets.

This practice is particularly prevalent with vehicles. For instance, if a vehicle has a market value of $5,000 but the outstanding balance is $15,000, petitioners have the option to redeem it for $5,000. To facilitate the redemption of the vehicle, petitioners may receive a $5,000 gift from a relative, friend, or family member.

Filing Chapter 13 Bankruptcy To Catch Up on Property Taxes For Homeowners

Judges typically extend the benefit of the doubt to petitioners when considering the approval of a new case, provided there is a valid explanation. In cases of bankruptcy, individuals filing petitions are permitted to reclaim certain exempt properties at their market value, including items like cars, irrespective of the outstanding balance on such assets.

This practice is particularly prevalent with vehicles. For instance, if a vehicle has a market value of $5,000 but the outstanding balance is $15,000, petitioners have the option to redeem it for $5,000. To facilitate the redemption of the vehicle, petitioners may receive a $5,000 gift from a relative, friend, or family member.

Refiling After a Prior Bankruptcy Dismissal Versus Bankruptcy Discharge

Individuals are eligible for a Chapter 7 Bankruptcy discharge once every 8 years, while there is no restriction on the number of Chapter 13 Bankruptcy discharges. It is possible for consumers to file for Chapter 13 Bankruptcy and/or Chapter 7 Bankruptcy immediately following a Chapter 13 Bankruptcy discharge. The waiting period for FHA Loans is only relevant to the most recent bankruptcy when determining eligibility.

Don’t Wait If You Don’t Have To

Even after a dismissal, you may still qualify for a mortgage under flexible loan programs.

Bankruptcy Dismissal Versus Discharge Mortgage Guidelines

If a borrower has recently received a discharge from Chapter 13 Bankruptcy, there is no mandatory waiting period if the bankruptcy was dismissed voluntarily. Despite the absence of waiting period requirements in HUD Guidelines, many home buyers often face rejection for FHA loans immediately following the discharge date of Chapter 13 Bankruptcy.

Although most lenders typically impose a two-year waiting period for FHA loan eligibility after the discharge date, it’s important to note that Gustan Cho Associates Mortgage does not have additional requirements or restrictions on government and conventional loans.

FHA Waiting Period After Chapter 13 Bankruptcy

Gustan Cho Associates has no waiting period requirements after the Chapter 13 Bankruptcy discharged date. Borrowers can qualify for FHA Loans one year into a Chapter 13 Repayment Plan with Gustan Cho Associates Mortgage. To start the qualification and pre-approval process, please contact us at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

Getting a Mortgage Approval With a Bankruptcy: Bankruptcy Dismissal Versus Bankruptcy Discharge

FAQs: Bankruptcy Dismissal Versus Discharge Mortgage Guidelines

What is the main difference between bankruptcy dismissal and discharge in the context of mortgage guidelines? Bankruptcy discharge occurs upon completing a Chapter 7 or Chapter 13 bankruptcy case, where eligible debts are either discharged or repaid through a specified plan. On the other hand, bankruptcy dismissal terminates a case before receiving a discharge due to various reasons, such as non-compliance with court orders.

Is there a waiting period for FHA loans after bankruptcy dismissal? FHA loans have no waiting period after bankruptcy dismissal, provided the Chapter 13 bankruptcy was dismissed voluntarily, and all payments were made on time. Manual underwriting is required, with a key emphasis on a 12-month history of timely payments.

What are the waiting period requirements for FHA loans after bankruptcy discharge? FHA loans typically involve waiting periods after bankruptcy discharge. The length of these waiting periods varies depending on the type of bankruptcy and the lender’s policies. Gustan Cho Associates, however, places no overlays on FHA loans, offering more lenient guidelines.

What is the significance of manual underwriting during Chapter 13 bankruptcy? Manual underwriting is essential during Chapter 13 bankruptcy, and FHA and VA loans are the exclusive mortgage programs permitting such underwriting. FHA loans, in particular, stand out with their accommodating guidelines, allowing mortgage underwriters to assess up to 24 months of timely payment history.

What is the process of reaffirming a mortgage during Chapter 7 bankruptcy? Reaffirming a mortgage during Chapter 7 bankruptcy involves a mutual agreement between homeowners and lenders after filing the bankruptcy petition. The reaffirmation process includes specifying the home loan details, and the lender prepares the agreement and dispatches it to the homeowner’s legal representative.

What happens if a petitioner decides not to reaffirm their mortgage post-bankruptcy? If a petitioner decides against reaffirming the mortgage, the property may enter foreclosure, absolving the homeowner of further liability. However, in some cases, lenders may prolong foreclosure proceedings if homeowners consistently meet their monthly payment obligations.

How do lenders view bankruptcy dismissal versus bankruptcy discharge? Mortgage lenders maintain an impartial stance regarding bankruptcy, treating dismissal and discharge equally. The critical factor influencing eligibility is the waiting period post-bankruptcy resolution.

Is it possible to qualify for an FHA loan after withdrawing from Chapter 13 Bankruptcy? Yes, it is possible to qualify for an FHA loan after withdrawing from Chapter 13 Bankruptcy if the withdrawal was not in arrears and meets the necessary criteria. However, if the bankruptcy was dismissed due to non-payment, two years is required before qualifying for an FHA loan.

How frequently can individuals file for bankruptcy, and what is the waiting period for FHA Loans? Individuals are eligible for a Chapter 7 Bankruptcy discharge once every eight years, with no restriction on the number of Chapter 13 Bankruptcy discharges. For FHA loans, the waiting period is only relevant to the most recent bankruptcy when determining eligibility.

This blog about Bankruptcy Dismissal Versus Discharge Mortgage Guidelines was updated on January 28th, 2024.

Discharged or Dismissed? It Makes a Big Difference

Mortgage waiting periods vary depending on how your bankruptcy ended. Let us review your situation for free.