The bankruptcy manual underwriting guidelines on FHA and VA loans are covered in this guide, which focuses on the exclusive mortgage programs that permit manual underwriting. Manual underwriting occurs when a borrower fails to receive an approve/eligible status via the automated underwriting system and necessitates human underwriter assessment.

Dale Elenteny is a loan officer at Gustan Cho Associates. He explains the difference between getting approved through an automated and manual underwriting system.:

If the automated underwriting system (AUS) cannot ascertain if the borrower meets HUD or VA guidelines for an AUS approval, the file receives a refer/eligible status, potentially leading to manual underwriting. Manual underwrites mandate one year of timely payments on all VA loans and two years on all FHA loans.

Files with a refer/eligible status from AUS may qualify for a manual underwrite on FHA or VA loans, adhering to manual underwriting guidelines. Both FHA and VA loans share similar manual underwriting guidelines. Many lenders opt for manual underwriting for AUS-approved files, considering them riskier loans. Gustan Cho Associates specializes in FHA and VA manual underwriting processes.

Mortgage After Chapter 7 Bankruptcy

Focusing on Bankruptcy Manual Underwriting Guidelines, this guide will dive into obtaining a mortgage post Chapter 7 Bankruptcy and securing approval. Are you contemplating a mortgage application after Chapter 7 bankruptcy? If yes, you might feel overwhelmed and uncertain about approval prospects. However, there’s no need to worry!

By adopting the right mindset, developing a strategic approach, and preparing effectively, as per Bankruptcy Manual Underwriting Guidelines, it’s entirely feasible to successfully apply for a loan after bankruptcy. In this article, we’ll offer valuable tips and insights, aligning with Bankruptcy Manual Underwriting Guidelines, to help you navigate the process, improve your chances of mortgage approval post Chapter 7 Bankruptcy, and achieve financial stability.

Looking to rebuild your credit after Chapter 7 bankruptcy? It’s important to do so before applying for a loan, following Bankruptcy Manual Underwriting Guidelines. With dedication, your credit score can improve and lead to financial success. Initiating a budget, ensuring timely bill payments, and avoiding risky financial decisions such as opening new lines of credit or accumulating excessive debt are vital starting points.

Bankruptcy Doesn’t Mean You Can’t Get a Mortgage

FHA and VA loans allow manual underwriting after bankruptcy. See If You Qualify for Manual Underwriting After Bankruptcy Today!Manual Underwriting Explained

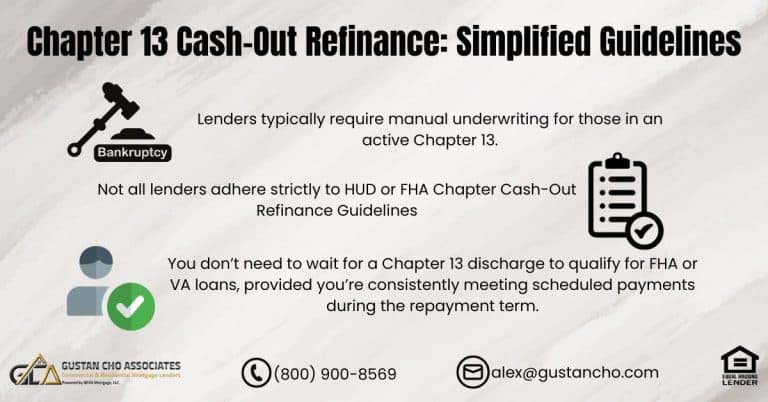

Mortgage borrowers who cannot receive an approve/eligible status through the automated underwriting system may have their file shifted to manual underwriting. FHA and VA Loans are the sole loan programs permitting manual underwriting for government and conventional loans. Income and credit remain the pivotal factors for mortgage qualification. It’s noteworthy that homebuyers can be eligible for FHA and VA Loans even during a Chapter 13 Bankruptcy Repayment Plan, subject to trustee approval. Chapter 13 Bankruptcy doesn’t necessitate discharge but mandates manual underwriting. The guidelines of Bankruptcy Manual Underwriting apply in such cases.

Understanding your financial standing is crucial for making well-informed decisions regarding the most suitable loan product. Consulting with a knowledgeable local financial advisor can be immensely beneficial. They can provide insights into available loan products and their alignment with your long-term financial plan.

Lenders consider various factors beyond your financial situation when evaluating loan applications. Your employment history, income level, credit score, and other essential aspects collectively influence the approval decision.

Ensuring that all necessary documents are ready before applying is essential. Having everything organized will streamline the process and enhance your chances of success. Following these steps can facilitate approval for a loan post-bankruptcy, paving the way towards financial stability.

Overview of Getting Approved For a Mortgage After Bankruptcy

Bankruptcy Manual Underwriting Guidelines play a crucial role in the mortgage process for individuals who have gone through bankruptcy. These guidelines outline the specific criteria and procedures for evaluating mortgage applications for borrowers with a bankruptcy history. Understanding Bankruptcy Manual Underwriting Guidelines is essential for borrowers seeking mortgage approval post-bankruptcy.

Mortgage Guidelines After Chapter 7 Versus Chapter 13 Bankruptcy

Suppose an individual does not meet the requirements for Chapter 7 bankruptcy. In that case, they might consider filing for Chapter 11, also known as reorganization bankruptcy. Chapter 11 bankruptcy allows for the restructuring of debts and establishing a repayment plan.

To be eligible for Chapter 11 bankruptcy, one must exhibit a stable source of income and the capacity to pay off some of their debts. Chapter 12 bankruptcy, on the other hand, is designed specifically for farmers and fishermen seeking reorganization. To qualify for Chapter 12 bankruptcy, these individuals must have a documented farm or fishing operation plan and a consistent income from these activities.

Chapter 13 bankruptcy, known as wage earners’ reorganization, is available to individuals with regular income. They can create a repayment plan with their creditors based on their disposable income. Regardless of the type of bankruptcy filed, there are long-term consequences, including bankruptcy remaining on the credit report for up to 10 years, which can impact future credit opportunities. These aspects are important to consider when navigating Bankruptcy Manual Underwriting Guidelines.

How Does Bankruptcy Work

Navigating through bankruptcy can result in the repossession of assets pledged as loan collateral. For individuals in this situation wondering about loan approval post-bankruptcy, the key lies in understanding the Bankruptcy Manual Underwriting Guidelines. While obtaining a loan and finding a lender after bankruptcy is feasible, it’s essential to grasp these guidelines before applying.

Understanding The Basics of Bankruptcy

First, it’s essential to understand the very basics of bankruptcy and how it works. Bankruptcy is a complex and sometimes lengthy legal process that allows people or businesses to erase and eliminate some or all of their debt. There are two types of known bankruptcy: Chapter 7 and Chapter 13. Chapter 7 bankruptcy is also known as liquidation bankruptcy because it involves selling off your assets to pay back your creditors. After you go through Chapter 7 bankruptcy, your remaining debts will be discharged, so you won’t have to pay them back.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy is also called reorganization bankruptcy ( or regrouping) because it allows you to reorganize your finances, put them in order, and develop a repayment plan. With Chapter 13, you’ll make monthly payments to your creditors over three to five years. Any remaining debt can be discharged at the end of the repayment period.

Now that you understand the basics of bankruptcy, let’s talk about getting a loan after chapter bankruptcy. First, you need to know that most lenders will be cautious or hesitant to approve you for a loan if you’ve recently gone through bankruptcy. This is because they see bankruptcies as a sign of financial instability.

Benefits of Applying for a Mortgage After Chapter 7 Bankruptcy

Applying for a loan after Chapter 7 bankruptcy has plenty of benefits. First, it can help you reestablish your credit. Individuals should make on-time payments to improve their credit scores and show future lenders that they’re responsible borrowers. Second, a loan can give you financial stability, reestablish your credit, and help you recover after bankruptcy. It can help you catch up on bills, repair your home or car, and cover other expenses. Third, a loan can help relieve the stress of financial insecurity.

After bankruptcy, it’s common to feel like you’re constantly one step away from disaster. A loan can provide peace of mind by giving you a safety net in case of an unexpected expense. A loan can help you build a better future.

By using the money from your loan wisely and making wise financial decisions, you can build yourself back up for success in the years to come. No matter your financial situation, applying for a loan after bankruptcy can be a great way to secure the funds you need and get back on track. Again if f you’ve recently gone through Chapter 7 bankruptcy, let us recap some strategies to help you qualify for a loan. In contrast, it may seem like a difficult, long task, but getting approved for a loan after bankruptcy is possible.

Denied for a Mortgage After Bankruptcy? Manual Underwriting May Be Your Solution

We specialize in FHA and VA manual underwrites—even during Chapter 13. Talk to a Bankruptcy Mortgage Expert Now!Advice for Improving Your Chances of Getting Approved.

If you’re considering applying for a loan after chapter bankruptcy, there are some steps you can take to repair and improve your chances of getting approved. Ensure you have a solid plan for repaying the loan. Rebuild your credit score by making timely payments and keeping your balances low. Put savings together to get as much money as possible for a down payment, showing lenders that you’re serious and reliable about repaying the loan.

Before choosing a lender, shop for the best interest rates and terms online and in person. By following these tips, you’ll be in an excellent position to get approved for a loan after bankruptcy.

Bankruptcy Manual Underwriting Guidelines on Fluctuations In Income

For consumers who get an increase in income after a Chapter 7 Bankruptcy discharge, it does not matter with the courts. If the petitioner knows they will get a large income increase, which is why they filed for bankruptcy, they may be in trouble for not disclosing it.

They must have filed Chapter 13 versus Chapter 7 bankruptcy if a likely increase was in the works. Chapter 13 Bankruptcies are not as simple as Chapter 7. Income normally changes during Chapter 13 Bankruptcy repayment plans. If income goes down during the plan, consumers may be able to lower the payments.

Consumers can still cure mortgage default, auto loans, and other payments without extending the plan beyond 60 months. If income increases during the plan, the bankruptcy trustee may file a motion to increase monthly payments to creditors.

Losing Job During Chapter 13 Bankruptcy Plan

This section will discuss what Bankruptcy Attorney James Miller of Miller and Miller Bankruptcy Attorneys of Milwaukee, Wisconsin says about consumers losing a job during Chapter 13 Bankruptcy Plans. If you think the loss of income is only temporary, you can file a motion to suspend your payments temporarily. Or, you seek the help of a family member or friend that can assist with payments. It is important to understand that as long as payments are made, no one will seek to dismiss your case due to the loss of income.

Jaime Miller of Miller and Miller, LLC of Milwaukee says the following:

In some situations, it is advisable to let the trustee dismiss your case for non-payment and re-file a new case once you obtain new employment. You can pay your post-petition mortgage payments outside of your bankruptcy plan, and I usually recommend that individuals do so. Although I rarely recommend paying your automobile loan outside our plan, it is an option.

Usually, paying a car loan through the plan allows you to lower your payments and free up funds to cure your mortgage default or other debt, such as non-dischargeable debt. In addition, you could continue to pay someone, such as a family member or family doctor, outside of your plan if you have the means to do so, and under certain situations, this may be permissible by the court. However, you must commit all of your disposable income to your plan payments, so every situation needs to be evaluated on a case-by-case basis.

Filing Bankruptcy With or Without a Spouse

However, if the spouse is a co-signer on a debt, the creditor can come after the co-signer if the main borrower files for bankruptcy. This issue is something you need to go over with your bankruptcy attorney. Most bankruptcy attorneys charge the same, whether an individual bankruptcy or a joint bankruptcy filing with the spouse.

Cases of Co-Signers and Bankruptcy

The co-signer topic is very important for those who intend to file for bankruptcy. What happens to the co-signers of the petitioner? Will co-signers be liable for the debts of the main petitioner? This topic is a legal question, so we asked Milwaukee, Wisconsin, Bankruptcy Attorney Jamie Miller this question. Attorney James Miller responded with the following statement:

The co-signer, just like in a situation of a non-filing spouse, would be responsible for the debt. There is a co-debtor stay that protects a co-borrower from collection efforts when the other co-debtor files for bankruptcy. However, once the bankruptcy is completed, whether Chapter 7 or Chapter 13, the creditor can come after the non-filing co-borrower.

Furthermore, there may be some negative impact on the credit score of the non-filing borrower if they do not make the requisite payments.

One other unique situation that I have had presented to me is the situation where the filing of bankruptcy by one co-borrower triggers an automatic default of the note as to the other co-borrower and thereby causes the note to be accelerated. Although there may be a co-borrower automatic stay that protects the non-filing borrower, the impact can be adverse. Reviewing such loan documents before filing and discussing any possible implications with the non-filing borrower is important.

FHA And VA Bankruptcy Manual Underwriting Guidelines

FHA and VA Bankruptcy Manual Underwriting Guidelines are very similar. Co-signers who co-signed to help the bankruptcy petitioner may get impacted if the main petitioner files for bankruptcy. However, this only holds if the creditor comes after the co-signer. It depends on the creditor. This is a very important topic that needs to be addressed and discussed with the bankruptcy attorney before filing bankruptcy.

Homebuyers can qualify for FHA and VA loans during Chapter 13 Bankruptcy Repayment Plan per FHA and VA Manual Underwriting Guidelines. However, borrowers must have been in the repayment plan for at least one year and have made 12 timely payments to the bankruptcy trustee.

They do not have to have Chapter 13 Bankruptcy discharged. Per FHA and VA Bankruptcy Manual Underwriting Guidelines, no waiting period is required after the Chapter 13 Bankruptcy discharge date. However, bankruptcies not seasoned two years after the discharge date need manual underwriting. Manual underwriting means that a human mortgage underwriter needs to underwrite the file. Bankruptcy Manual Underwriting Guidelines apply.

Does FHA Allow Manual Underwriting?

Yes, FHA loans can be manually underwritten. This typically happens when a borrower needs to meet the standard automated underwriting requirements. Manual underwriting involves a more thorough review of the borrower’s financial situation, including income, credit history, and debt-to-income ratio. Flexibility is provided when the automated underwriting process fails to capture the complete borrower’s ability to repay the loan.

What is the DTI for Manual Underwrite on FHA Loans?

The debt-to-income (DTI) ratio guidelines for manual underwriting on FHA loans are generally stricter than loans that go through automated underwriting. While the standard maximum DTI ratio for FHA loans is 43%, manual underwriting may allow DTI ratios up to 31% for the front-end ratio (housing expenses) and up to 43% for the back-end ratio (total monthly debt payments). However, lenders may have overlays and require lower DTI ratios for manual underwriting to mitigate risk. It’s essential to check their specific DTI requirements for manual underwriting on FHA loans with your lender.

What are Compensating Factors for FHA?

Compensating factors for FHA loans are additional strengths or positive aspects of a borrower’s financial profile that can offset certain weaknesses or risks. These factors are considered during the manual underwriting process to determine the borrower’s ability to repay the loan. Some common compensating factors for FHA loans include:

- Significant cash reserves: Demonstrating financial stability and reducing the risk of default can be achieved by having substantial savings or assets that can cover several months of mortgage payments.

- Stable employment history: A consistent work history with the same employer or in the same field can show reliability and the likelihood of continued income.

- Low debt-to-income (DTI) ratios: While the standard maximum DTI for FHA loans is 43%, having a lower DTI ratio, especially below 31%, can be a strong compensating factor.

- High credit scores: While FHA loans are more lenient with credit requirements, a higher credit score (typically above 640) can strengthen the borrower’s creditworthiness.

- Positive payment history: Demonstrating a history of on-time payments for rent, utilities, and other obligations can show responsible financial behavior.

- Minimal increase in housing payment: If the new mortgage payment is slightly higher than the borrower’s current housing payment, it may be considered a compensating factor.

- Down payment: While FHA loans require a minimum down payment of 3.5%, making a larger down payment is a positive factor.

- Low loan-to-value (LTV) ratio: A lower LTV ratio, which is the loan amount compared to the appraised value of the property, can reduce the lender’s risk and be a compensating factor.

These compensating factors help lenders assess the overall risk of the loan. They may allow borrowers to qualify for FHA loans even if they don’t meet all standard underwriting guidelines.

FHA and VA Loans With Manual Underwriting Are Made for Borrowers Rebuilding

We help you qualify with flexible guidelines and real-life understanding. Check Your Eligibility for a Manual Underwrite Mortgage After BankruptcyCan You Do a Manual Underwrite on a VA Loan?

Yes, manual underwriting is also possible for VA loans. Like FHA loans, manual underwriting for VA loans is used when the borrower’s financial situation doesn’t meet the standard automated underwriting requirements. The process of manually underwriting VA loans involves thoroughly evaluating the borrower’s credit, income, and other financial aspects to ascertain their eligibility for a VA loan.

FHA and VA Bankruptcy Manual Underwriting Guidelines and Requirements

FHA and VA Guidelines for qualifying for a mortgage during and after Chapter 13 Bankruptcy are similar. However, all FHA and VA Loans during Chapter 13 Plans and borrowers without two years of seasoning after the Chapter 13 discharge date needs to be manual underwriting.

Here are FHA and VA Manual Underwriting Guidelines. With trustee approval, borrowers can qualify for FHA and VA Loans during the Chapter 13 Repayment Plan one year into their payment plan.

There is no waiting period after the Chapter 13 Bankruptcy discharge date. The maximum debt-to-income ratio on manual underwriting is 40% front end and 50% back end with two compensating factors. With VA Loans, the underwriter can limit maximum debt-to-income ratios on manual underwriting to 55% back end.

Verification of rent is required on all manual underwrites. A payment shock of less than 5% or $100 is considered a compensating factor. Manual underwriting requires one month’s reserves of principal, interest, taxes, and insurance (PITI). Gustan Cho Associates exempts rent verification if borrowers live rent-free with a family member. The rent-free form provided by the lender will need to be completed, signed, and dated.

There is no waiting period after the Chapter 13 Bankruptcy discharge date. The maximum debt-to-income ratio on manual underwriting is 40% front end and 50% back end with two compensating factors. With VA Loans, the underwriter can limit maximum debt-to-income ratios on manual underwriting to 55% back end.

Borrowers who need to qualify for a mortgage during or after Chapter 13 Bankruptcy with a national mortgage company with no overlays on government and conventional loans can contact us at Gustan Cho Associates at 800-900-8569 or text us for faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

FAQ: Bankruptcy Manual Underwriting Guidelines on FHA and VA Loans

-

1. Can You Do a Manual Underwrite on a VA Loan? Yes, manual underwriting is possible for VA loans. When a borrower’s financial situation doesn’t meet automated underwriting requirements, manual underwriting involves a thorough evaluation of credit, income, and other financial aspects to determine eligibility for a VA loan.

-

2. What is the DTI for Manual Underwrite on FHA Loans? The debt-to-income (DTI) ratio for manual underwriting on FHA loans can be stricter, allowing up to 31% for the front-end ratio (housing expenses) and up to 43% for the back-end ratio (total monthly debt payments). However, lenders may require lower DTI ratios.

-

3. What are Compensating Factors for FHA? Compensating factors for FHA loans include significant cash reserves, stable employment history, low DTI ratios, high credit scores, positive payment history, minimal increase in housing payment, down payment, and low loan-to-value (LTV) ratio.

-

4. What Are FHA and VA Loan Eligibility During and After Chapter 13 Bankruptcy? With trustee approval, borrowers can qualify for FHA and VA loans during Chapter 13 Bankruptcy Repayment Plans one year into the plan. There’s no waiting period after the Chapter 13 discharge date for manual underwriting, and the maximum DTI ratios vary for FHA and VA loans under manual underwriting.

-

5. How Do Bankruptcy Manual Underwriting Guidelines Apply to FHA and VA Loans? FHA and VA loans allow manual underwriting during Chapter 13 Bankruptcy Repayment Plans and for borrowers without two years of seasoning after discharge. Manual underwriting requires a thorough evaluation of financial aspects and adherence to specific guidelines for DTI ratios, compensating factors, and rent verification.

-

6. Can Borrowers Qualify for a Mortgage After Chapter 7 Bankruptcy? Yes, borrowers can apply for a mortgage after Chapter 7 bankruptcy. By rebuilding credit, demonstrating responsible financial behavior, and following necessary steps, borrowers can increase their chances of approval for a mortgage post-bankruptcy.

-

7. What Are Some Tips for Improving Approval Chances After Bankruptcy? Strategies for improving approval chances after bankruptcy include solid repayment plans, rebuilding credit with timely payments and low balances, saving for a down payment, comparing lenders for the best terms, and ensuring all essential documents are ready before applying.

-

8. What Should Co-Signers Know About Bankruptcy Implications? Depending on the creditor’s actions, co-signers may be impacted if the main petitioner files for bankruptcy. Bankruptcy attorneys can provide guidance on co-signer liabilities and legal implications.

-

9. What Are Some Considerations for Bankruptcy Manual Underwriting Guidelines on Fluctuations in Income? Fluctuations in income during Chapter 13 Bankruptcy repayment plans may require adjustments to payments. Discussing income changes with the bankruptcy trustee and understanding legal implications can help navigate these situations.