Investor Cash-Flow Mortgage For Investment Properties

This guide covers investor cash-flow mortgage for investment properties. Gustan Cho Associates now offers investor cash-flow loan programs on investment…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers investor cash-flow mortgage for investment properties. Gustan Cho Associates now offers investor cash-flow loan programs on investment…

In this blog, we will cover and discuss the mortgage guidelines after bankruptcy on home purchases and refinance transactions. There…

This guide covers lender overlays on credit tradelines by mortgage underwriters. Do all mortgage companies have lender overlays on credit…

In this blog, we will discuss and cover VA refer-eligible findings versus AUS approval guidelines. The United States Department of…

This GUIDE covers debt-to-income ratio limit to qualify for a mortgage loan. Home loans and debt-to-income ratio limit. Every mortgage…

This guide covers mortgage rates on non-QM loans and no-doc mortgages. Current Home Mortgage Rates after the election of President…

Homeowners With FHA Loans Should Consider A Conventional Refinance Loan While Mortgage Rates Are At Historic Lows And Avoid Paying FHA MIP. Mortgage rates are at historic lows and many home values have skyrocketed in the past several years. Many homeowners with FHA loans can benefit by refinancing to a conventional mortgage and avoid paying LPMI.

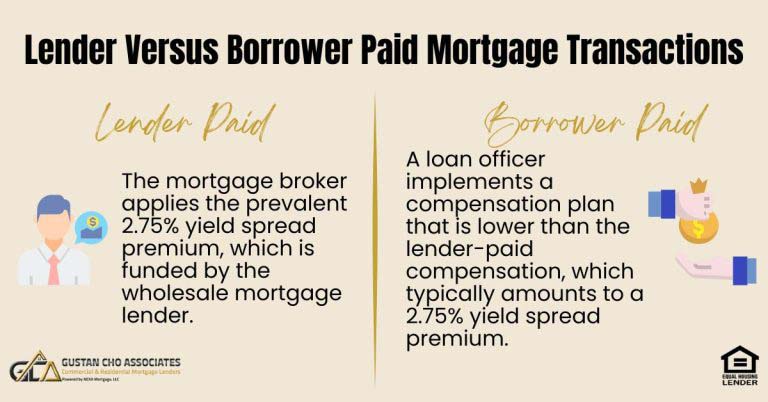

In this blog, we will discuss lender versus borrower paid mortgage transactions. Mortgage brokers can often opt to go with…

This guide covers the importance of mortgage qualification and pre-approval. A pre-approval is when a home buyer or homeowner has…

In this blog, we will discuss and cover qualifying for home loan with job offer letter. One of the frequently…

In this article, we will cover and discuss new mortgage programs for homebuyers and real estate investors. We have over…

In this article, we will cover qualifying for the Profit and Loss Statement Only Mortgage Loans with no-income verification and…

Most guidelines require lenders to average the most recent two years of income to qualify applicants. Some programs allow borrowers with newer businesses if they have experience

This guide covers Fannie Mae and HUD Guidelines on conventional versus FHA loans. Fannie Mae and HUD guidelines on conventional…

This guide covers things to avoid when repairing your credit for a mortgage approval. There are things to avoid when…

This article covers getting a VA loan denial due to overlays and qualifying with a different lender. In this article,…

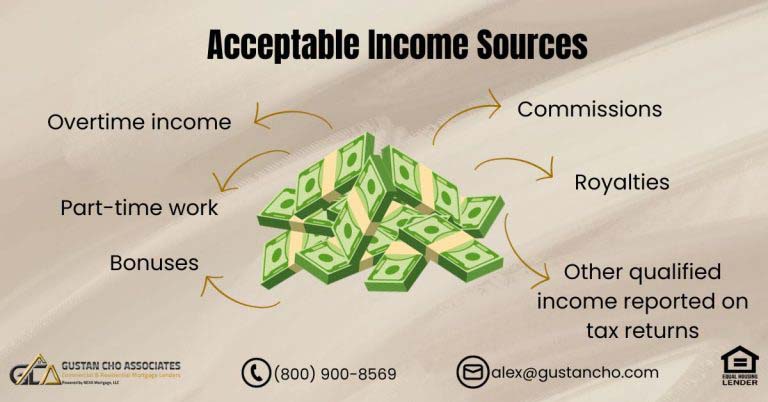

Can I Use Overtime Income As Qualified Income To Qualify For A Mortgage? You can use overtime and part-time income as qualified income as long as those other income has been seasoned for at least two years.

This guide covers VA guidelines on seller concessions to cover closing costs. VA loans is hands down the best mortgage…

This guide covers protecting home with insurance for home appliances. Insurance for home appliances might be a good idea for…

This guide covers home maintenance for first time home buyers and homeowners. A home purchase is a life-changing event for…

This guide covers the five C’s of mortgage underwriting leading to clear-to-close. With mortgage loans, the risk analysis is critically…

This article covers Conforming versus government-backed loans. FHA, VA, and USDA loans are called government-backed loans. This is because lenders…