This guide covers qualifying for a home loan after multiple foreclosures. Homebuyers can qualify for a home loan after foreclosure. There are waiting periods after foreclosure that are mandatory for every mortgage loan program. For example, there is a mandatory waiting period of three years from the recorded foreclosure date to qualify for an FHA loan.

The waiting period after a deed-in-lieu of foreclosure and a short sale is three years after the recorded date of the deed-in-lieu of foreclosure to qualify for FHA and USDA loans. Three years from the date of the short sale, which is reflected on the HUD settlement statement, to qualify for FHA and USDA loans.

There is a two-year waiting period to qualify for VA home loans after the following, per VA guidelines: Chapter 7 bankruptcy discharge date, recorded date of foreclosure or deed-in-lieu of foreclosure, and date of the short sale. There is a mandatory waiting period of seven years from the recorded foreclosure date to qualify for conventional loans. There is a four-year waiting period after a deed-in-lieu of foreclosure and short sale to qualify for conforming loans.

Lending Guidelines In Qualifying For Home Loan After Multiple Foreclosures

Before the 2008 real estate meltdown, many people owned more than one property. Many hard-working Americans who had no experience in real estate started to invest in real estate, and many had multiple homes. They purchased homes, rehabbed them, and flipped them for handsome profits. Others purchased multiple homes, mortgaged them, and rented them.

Police officers, teachers, firefighters, mortgage brokers, real estate agents, plumbers, electricians, cashiers, small business owners, blue-collar workers, white-collar workers, doctors, lawyers, dentists, and military personnel became real estate investors and made money.

Many people in these professions made so much money in real estate that they ended up quitting their main jobs and becoming professional real estate investors. They thought that the real estate boom would last forever. For almost ten years, real estate prices kept on going up year after year after year with no sign of turning back. Real estate values appreciated so much every year, and many property owners refinanced them every year or every other year.

Real Estate Investments Before The 2008 Financial Crisis

Real estate investors before the 2008 financial crisis did a cash-out refinance and used the cash proceeds from the cash-out refinance to purchase more homes. Many property owners own more than a dozen properties. Real estate financing was extremely easy.

There were many mortgage loan programs where no income verification was required. Many real estate investors can purchase homes with no money down. Others purchase homes with no money down with cash back at closing.

Then 2008 rolled around, and the real estate market crashed like never in the history of the United States. In this article, we will discuss and cover the home loan after multiple foreclosure mortgage guidelines.

Qualifying For FHA Home Loan After Multiple Foreclosures

Homebuyers can qualify for an FHA home loan after multiple foreclosures. They can qualify for an FHA loan three years after the latest recorded foreclosure. The waiting period start date is when the property the homeowner owned changed hands and was foreclosed on and not the date the homeowner turned in their keys.

The deed of the home was transferred out of their name into the lender’s name and recorded on public records or the date of the Sheriff’s Sale is the waiting period start date of the housing event.

Most folks have one foreclosure, short sale, or deed-in-lieu of foreclosure. But how about those who own multiple properties and are now trying to qualify for a home loan after multiple foreclosures? Homebuyers can qualify for a home loan after multiple foreclosures. We will cover some case scenarios in the following paragraphs in this article. Borrowers who had a prior housing event must re-establish credit and not have any late payments after the latest foreclosure.

Qualifying For a Conventional Home Loan After Multiple Foreclosures

Borrowers with multiple foreclosures can qualify for a home loan after multiple foreclosures seven years after their latest recorded foreclosure. The waiting period start date after a housing event is the date when the deed is out of the borrowers’ name:

The deed of the house needs to be transferred from the homeowner’s name into the name of the mortgage lender or new home buyer or the date of the Sheriff’s Sale.

The waiting period after foreclosure to qualify for a conventional loan is seven years from the recorded foreclosure date. There is a four-year period after a short sale to qualify for a conventional loan. There is a four-year period after a short sale to qualify for a conventional loan.

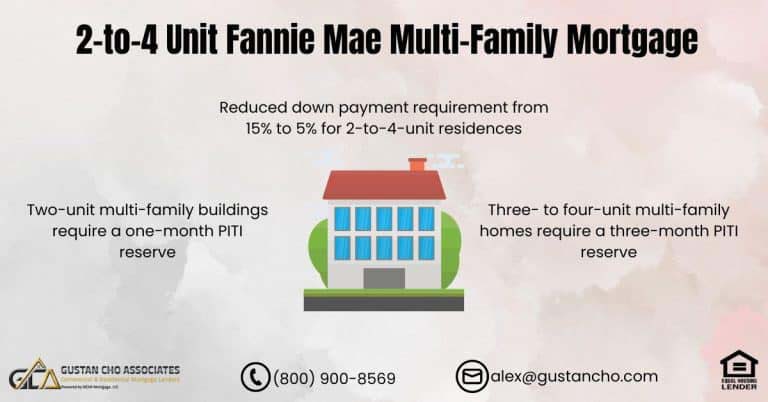

No Waiting Period After Housing Event And Bankruptcy With Non-QM Loans

Homebuyers who did not meet the mandatory waiting period after a housing event or bankruptcy can now qualify for non-QM loans offered by Gustan Cho Associates. A housing event is a foreclosure, deed-in-lieu of foreclosure, or short sale.

There is no waiting period after the housing event or bankruptcy discharge date with non-QM loans. A 10% to 20% down payment is required. There is no private mortgage insurance required on all non-QM loans.

There are no loan limit caps on non-QM loans. Mortgage rates on non-QM loans depend on borrower’s credit scores and the amount of down payment they can put down. The amount of down payment on non-QM loans is dependent on the borrower’s credit score.

Qualifying for a Home Loan After Multiple Foreclosures With a Lender With No Overlays

Gustan Cho Associates are experts on government and conventional loans. We are also experts on non-QM and alternative financing. Gustan Cho Associates has a national five-star reputation due to his no overlays on government and conventional loans and is one of the top non-QM lenders in the country. The team at Gustan Cho Associates are available seven days a week, evenings, weekends, and holidays. Feel free to call or text us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.