Buying A House With Tenants Who Are Still Occupants

Buying a House With Tenants: Everything You Need to Know Buying a house with tenants already living there can be…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Buying a House With Tenants: Everything You Need to Know Buying a house with tenants already living there can be…

In this guide, we will cover getting 15-year vs 30-year FHA loans. We will compare and contrast 15-year vs 30-year…

Can you buy a house with bad credit? One of the most frequently asked questions we get is can you…

Mortgage One Day Out of Foreclosure: How to Get Approved Fast in 2025 Are you trying to get a mortgage…

Can You Close Your Investment Property Under A Limited Liability Corporation? Many wholesale real estate investors will not allow borrowers of investment properties to close

This guide covers the minimum lending requirements with getting approved for a mortgage after bankruptcy. Bankruptcy is a federal law…

This guide covers short sale home purchase process by homebuyers. Due to the financial and credit collapse of 2008, foreclosures…

This guide covers mortgage rate forecast and outlook seem promising with the election of a new President. Mortgage rate forecast…

Non-QM Loans for Real Estate Investors: A Smart Alternative to Hard Money in 2025 If you’re a real estate investor…

This guide covers the Fannie Mae guidelines on conventional loans with a waiting period after mortgage part of bankruptcy. Many…

In this guide, we will cover front-end debt-to-income ratios mortgage guidelines. There are two different types of debt-to- income ratios:…

Fannie Mae and Freddie Mac Explained: What’s the Difference? If you’re considering purchasing or refinancing a home, you’ve likely heard…

This guide covers factors influencing credit scores when applying for a mortgage. There are five Factors Influencing credit scores. The…

This guide covers primary home status when qualifying for a mortgage. When a mortgage loan borrower applies for a residential…

This guide will cover the top cities in the United States in which to invest in real estate. It is…

This guide covers mortgage lender overlays on FHA and VA loans. Mortgage lender overlays are mortgage lending guidelines above and…

This guide covers the importance of credit reports in the mortgage application process. Our society is credit-driven. Almost every aspect…

The Best Wholesale Mortgage Lenders for Non-Prime Loans: Your Complete Guide in 2025 Are you a borrower with less-than-perfect credit,…

This guide covers mortgage rate adjustments (LLPAs) for higher-risk borrowers. The lower your credit scores, the higher your mortgage rates….

This article will cover what escrow hold back is in the mortgage loan process. We will discuss escrow hold back…

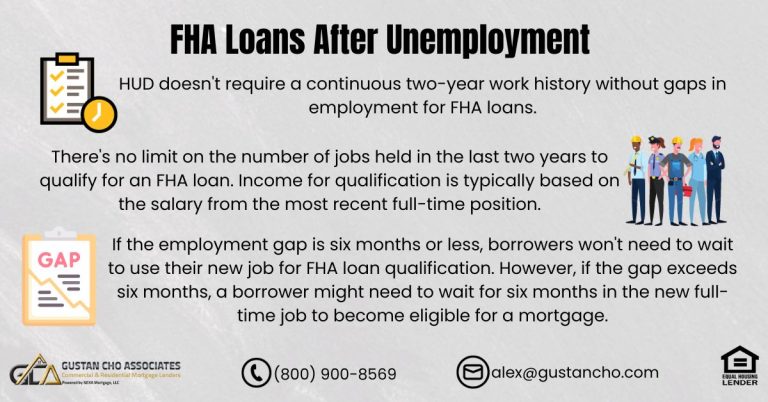

This blog examines the eligibility requirements for FHA loans after unemployment or employment gaps. Prospective FHA loan applicants now have…

FHA Debt-To-Income Ratio Requirements: What You Need to Know If you’re applying for an FHA loan, one of the most…