Non-QM Loan Requirements and Mortgage Options

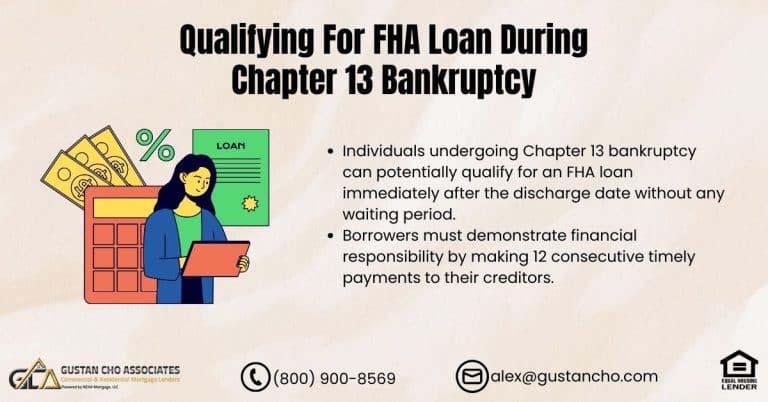

The asset-depletion mortgage loan program benefits higher net worth individuals who do not have a regular steady income. Non-QM loans are becoming increasingly popular and benefit borrowers who need alternative nontraditional mortgage loan programs.