Using Rapid Rescore in The Mortgage Process

This guide covers using rapid rescore in the mortgage process. What is a rapid rescore? It’s a service accessible only…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers using rapid rescore in the mortgage process. What is a rapid rescore? It’s a service accessible only…

This blog will cover Fannie Mae Collection Guidelines on Conventional loans. Fannie Mae and Freddie Mac are the two mortgage…

Many agency guidelines list extenuating circumstances as reasons for getting qualified for a mortgage when otherwise they would not qualify. However, borrowers need to understand

This guide covers qualifying for a home loan downsizing to a smaller home. It makes no sense in having a…

This article cover no waiting period on short sale mortgage guidelines. For those who were homeowners during the economic meltdown…

In this article, we will discuss and cover homebuyers qualifying for bad credit mortgage loans Alabama. Qualifying for bad credit…

This guide addresses common inquiries regarding the possibility of maintaining two FHA loans due to expanding family size. Typically, individuals…

This blog will share some helpful tips about VA credit dispute guidelines. VA loans are often seen as one of…

This manual provides information on Job Relocation Mortgage Guidelines for individuals purchasing homes in a different state. According to these…

This blog post will explore the implications of Buying House Near Apartment Community or Commercial Areas. Buying a house near…

If you’re married and you buy a home in a community property state, you’ll face different rules for qualifying. Most of these rules come into play if you finance your home with a government-backed home loan like the FHA, VA or USDA programs.

This guide covers modular homes mortgage guidelines on purchase and refinance transactions. Modular homes are becoming more and more popular…

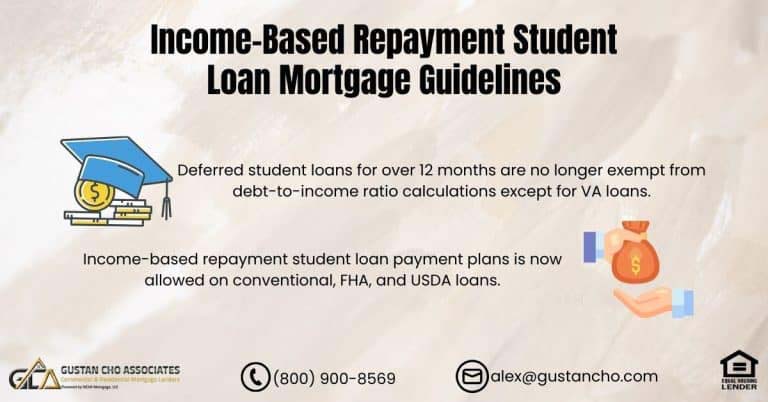

This guide aims to understand Income-Based Repayment Student Loan Mortgage Guidelines clearly. The daunting task of outstanding student loans presents…

This article covers reasons why hiring realtor on home purchase is important. Getting hooked up with the right real estate…

This guide covers things that can delay your mortgage loan closing. A mortgage loan should be able to close in…

In this blog, we will cover the Fannie Mae Chapter 13 dismissal guidelines on conventional loans. One of the most…

This guide covers FHA MIP versus conventional PMI for mortgage borrowers. Mortgage Insurance is mandatory on all FHA loans and…

This guide covers HUD guidelines versus lender overlays on FHA loans. There have been notable changes for HUD guidelines versus…

This guide covers preparing for a VA loan with a lender with no overlays. Preparing for a VA loan with…

This guide covers understanding the basics on what is a mortgage. We will cover and discuss the meaning of what…

Self-employed borrowers are now eligible to get an approve/eligible per automated underwriting system with one-year income tax returns.

You must first be eligible. Only servicemembers, honorably-discharged veterans and sometimes their families are eligible. VA underwriting guidelines are flexible, with no minimum credit score an no minimum down payment.