This blog will cover and discuss the FHA case number on new FHA mortgage applications. We will also discuss transfers from one lender to a new lender. FHA loans are the most popular loan program in the U.S. Borrowers with lower prior bad credit scores can benefit from FHA loans compared to conventional loans. Not all lenders have the same lending guidelines. Mortgage lenders can have lender overlays.

Lenders will consider your debt-to-income ratio on your ability to repay your mortgage loan. HUD guidelines generally allow for a higher debt-to-income ratio than other loan programs.

HUD, the parent of FHA, created and launched FHA loans so first-time homebuyers and buyers with less than-perfect credit can qualify for a home loan. HUD’s mission is to promote homeownership to hard-working American families by making homeownership affordable. In the following paragraphs, we will cover what the FHA case number is and how the FHA case number process works.

What is the Definition of an FHA Case Number

An FHA case number is a unique identifier assigned to a specific FHA-insured mortgage loan. The Federal Housing Administration (FHA) uses case numbers to track and manage the various loans it insures. When a borrower applies for an FHA-insured home loan, the lender initiates the loan process by obtaining an FHA case number. The FHA case number is crucial for tracking and managing the loan. It is used in various documents and systems related to the FHA-insured loan, including endorsements, claims, and other administrative processes.

Confused About FHA Case Numbers?

Contact us today to learn more about what an FHA case number is and how it impacts your home loan!How Does the FHA Case Number Process Work

Here’s how the FHA case number process generally works: The borrower applies for an FHA-insured mortgage loan through a HUD-approved lender. The lender submits the necessary information of the borrower and the loan to the FHA for approval. This includes details such as borrower information, property details, and terms.

Once HUD receives the loan information, it assigns a unique case number to that specific loan application. HUS reviews the loan application and, if everything meets its requirements, provides approval for the loan.

With FHA approval, the lender can proceed with processing and underwriting the loan. If the loan is approved and closes, it becomes an FHA-insured loan, and the FHA case number remains associated with that loan throughout its life. Borrowers and lenders use the FHA case number for reference when communicating with the FHA or accessing loan information. It helps ensure that all parties can easily identify and track the specific FHA-insured loan.

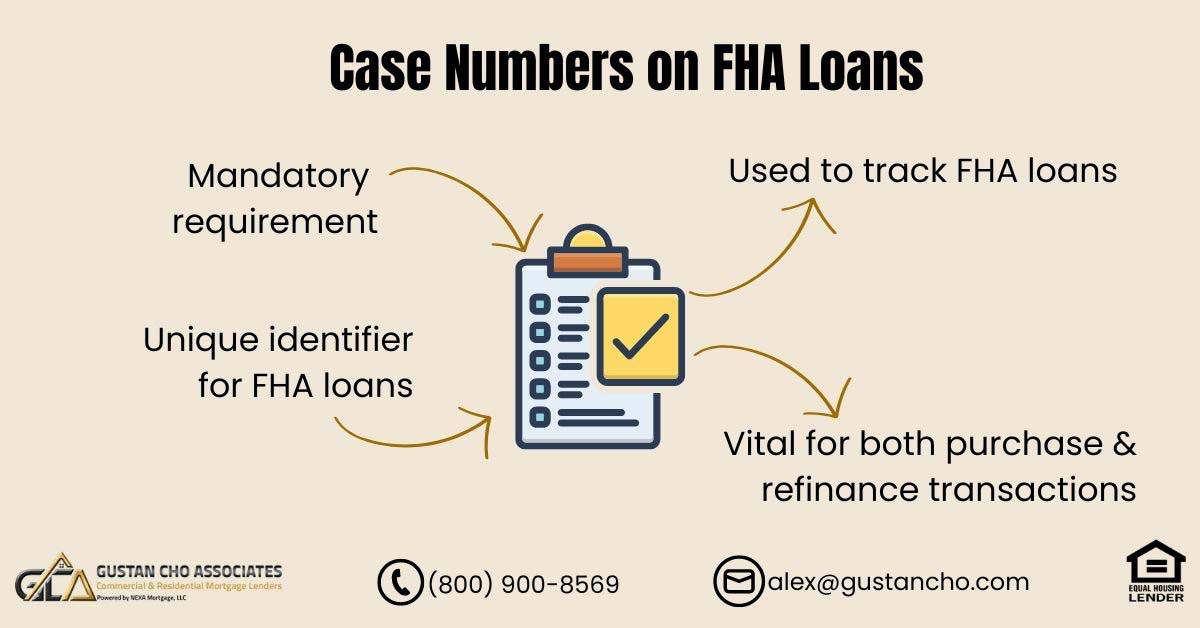

Importance of Case Numbers on FHA Loans

A mandatory requirement for all FHA loans is the inclusion of Case Numbers. The FHA Case Number, a distinctive 10-digit identifier, is allocated to each borrower’s loan file. The assignment of the Case Number is carried out through the case number assignment on FHA Connection. The term “case” refers to the specific FHA loan to which this number is assigned. Irrespective of whether it is a purchase or refinance, the Case Number is obligatory for every FHA loan and is assigned when a borrower applies for such loans.

How To Read FHA Case Number

The FHA case number is important because it helps identify a home’s location. The first three digits tell us about the area, like which county and state the home is in. The last three digits show the parts of the FHA program where insurance was given for that home. You can find the FHA case number at the top of every page in a completed FHA home appraisal.

If the house is sold to a new buyer, that person can use the same case number.

But if the buyer moves to a different home, they cannot take the old number. Each house has its own unique FHA Case Number.

How HUD Case Number Connections Work

Once a home buyer, pre-approved for an FHA loan, initiates the FHA loan process, the lender must acquire a Case Number for the property specified in the buyer’s contract. Nevertheless, the Case Number becomes null and void if the buyer opts not to proceed with the home purchase.

Getting a New FHA Case Number

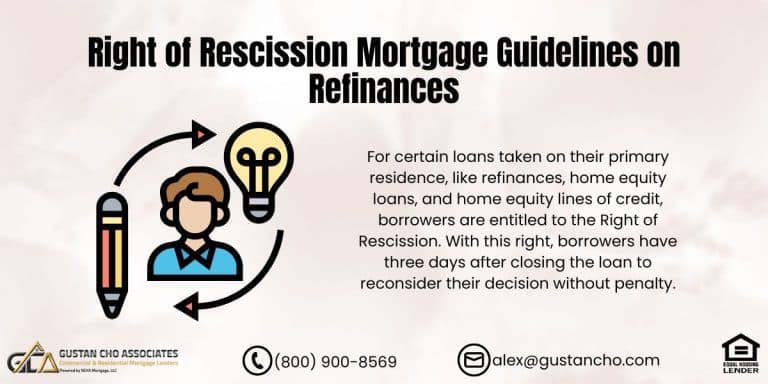

If a borrower opts to acquire an additional property, obtaining a new Case Number for the second property becomes necessary. In the given scenario, should a different homebuyer wish to buy the initial property previously canceled by the initial borrower, the only requirement is for the new homebuyer to have the Case Number for the initially canceled property transferred to them. In cases where multiple lenders are involved, it can lead to delays in the mortgage process. Lenders holding the original case numbers must facilitate the release of the case Numbers to the new lender.

How Long Is The FHA Case Number Valid

If an FHA loan with an assigned case number does not close within six months, the initial FHA case number will be voided. In the scenario where FHA modifies the HUD 4000.1 FHA Handbook, replacing it with a revised HUD Handbook that includes changes such as an increase in FHA MIP.

The changes on the updated revised HUD 4000.1 FHA Handbook, the alterations become effective for case numbers assigned on or after the date of the updated FHA programs and guidelines.

FHA case numbers assigned before this date will continue to be underwritten based on the guidelines before the changes as long as the FHA Loan closes within six months.

Benefits of FHA Loans

HUD established mortgage guidelines that are accommodating in terms of down payments and credit requirements. As the overseeing entity of the FHA, HUD aims to enable diligent Americans to achieve homeownership. FHA loans prove advantageous for those with limited funds for a down payment, lower credit scores, higher debt-to-income ratios, bankruptcy or a prior housing event.

Thanks to the government guarantee, lenders have the flexibility to provide FHA loans for home purchases with a minimal 3.5% down payment.

Homebuyers need a credit score as low as 580, all while offering attractive mortgage rates. FHA loans are popular among homebuyers, especially those with less-than-perfect credit and lower credit scores. Remember that guidelines may be subject to change, so it’s essential to verify the latest update on the HUD 4000.1 FHA Handbook with a mortgage professional.

Need Help with Your FHA Case Number?

Reach out now for expert guidance on how to navigate this part of the process and get your loan approved!HUD Down Payment Requirements on FHA Loans

The down payment requirement on FHA loans differs depending on the credit score. If you have at least a 580 credit score, the down payment required is 3.5% of the purchase price. If your credit scores fall under 580 and down to 500, a 10% down payment is required on FHA loans. The low down payment requirement makes it possible for renters with a small down payment to become homeowners.

HUD Mortgage Insurance Premium (MIP)

FHA loans necessitate the payment of two forms of mortgage insurance. Initially, you are required to pay an upfront mortgage insurance premium (UFMIP) at the time of closing. This charge safeguards the lender if you fail to repay the loan. In addition, you will be required to pay an annual mortgage insurance premium (MIP) for every year the loan is active.

The FHA determines loan limits according to the county, which are updated annually. The highest amount you can borrow is contingent on the location of your property.

FHA 203(k) Rehabilitation Loans

The HUD 203(k) program helps homebuyers pay for buying and fixing up a property with one mortgage. To get started, you need to check if you’re eligible. This usually means showing proof of your income and credit score and that the property meets certain standards.

The basic steps involved include:

1. Find a Lender: Seek out lenders experienced with FHA loans and the 203(k) program.

2. Pre-Approval: Get pre-approved for a loan, allowing you to understand your budget.

3. Property Search: Look for a suitable property that meets HUD’s requirements.

4. Loan Application: Submit an application, including the details of the renovations you plan.

5. Approval and Closing: Once approved, you’ll close on the loan, which disburses funds for both the purchase and renovation.

It’s important to seek advice from a mortgage expert and carefully examine the rules since different lenders may have distinct requirements.

HUD Agency Guidelines on FHA Loans

Applicants will be assigned an FHA Case Number to obtain an FHA loan. The basic criteria require a 3.5% down payment for individuals with a credit score of 580 or above. People with credit scores ranging from 500 to 579 can still qualify but must provide a 10% down payment.

Individuals who have previously experienced bankruptcy or foreclosure may still be eligible if they adhere to the required waiting period. Understanding that you don’t have to settle outstanding collections and charged-off accounts to qualify is important. The mission of HUD is to promote homeownership for a diverse range of buyers, and each borrower is allowed to have just one FHA case number.

Qualifying For FHA Loans

FHA loans are the most popular loan program in the U.S. FHA loans are popular with first-time home buyers, home buyers with outstanding collections and charge-offs, buyers with higher debt-to-income ratios, and homebuyers with little to no credit. Here are the basic HUD guidelines on FHA loans:

- 580 FICO credit score

- 3.5% down payment

- 46.9% front end and 56.9% back end DTI

- Non-Occupant Co-Borrowers allowed

- 100% of the down payment can be gifted

- No Closing Costs: Closing Costs can be covered with seller concessions or lender credit

HUD requires that the property meets HUD agency standards and will be habitable to be eligible for an FHA loan. The HUD appraiser will assess the property to ensure it meets HUD’s minimum property requirements. To qualify for an FHA loan, don’t hesitate to contact us at Gustan Cho Associates at 1-800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com. The Gustan Cho Associates Mortgage Group team is available 7 days a week, evenings, weekends, and holidays.

Unlock the Mystery of FHA Case Numbers

Call us now for a simple explanation and to move forward with your FHA loan!FAQs: What is an FHA Case Number on FHA Home Loans

-

1. What is an FHA Case Number, and why is it important? An FHA Case Number is a unique identifier assigned to a specific FHA-insured mortgage loan. It is crucial for tracking and managing the loan throughout its life. The case number is used in various documents and systems related to FHA-insured loans, including endorsements, claims, and administrative processes.

-

2. How does the FHA Case Number process work? The borrower applies for an FHA-insured mortgage through a HUD-approved lender. The lender submits necessary information to the FHA for approval, and a unique case number is assigned upon approval. This number remains associated with the loan, helping parties easily identify and track the specific FHA-insured loan.

-

3. What are the benefits of FHA loans? FHA loans are advantageous for those with limited funds for a down payment, lower credit scores, and higher debt-to-income ratios. They offer a minimal 3.5% down payment requirement, lower credit score thresholds, and flexibility for borrowers with past financial challenges.

-

4.What are the down payment requirements for FHA loans? The down payment requirement on FHA loans varies based on credit score. A credit score of at least 580 requires a 3.5% down payment, while scores below 580 to 500 require a 10% down payment. The low down payment makes homeownership accessible for those with limited funds.

-

5. What is the HUD Mortgage Insurance Premium (MIP)? FHA loans require borrowers to pay an upfront mortgage insurance premium (UFMIP) at closing and an annual mortgage insurance premium (MIP) throughout the loan’s life. This insurance protects lenders in case of default.

-

6. How are FHA Case Numbers connected to property purchases? The assigned case number pertains to the property purchased using an FHA loan. While case numbers can be transferred from one borrower to another, they cannot be transferred from one property to another.

-

7. How long is an FHA Case Number valid? If an FHA loan with an assigned case number does not close within six months, the initial case number becomes void. Changes in FHA guidelines or programs after the case number assignment date will only apply to loans closing after six months.

-

8. What are the basic HUD guidelines for qualifying for FHA loans? Basic HUD guidelines for FHA loans include a minimum FICO credit score of 580, a 3.5% down payment, front-end DTI of 46.9%, back-end DTI of 56.9%, allowance for non-occupant co-borrowers, and the option for 100% gifted down payment.

-

9. Can FHA loans be used for property rehabilitation? Yes, FHA offers a 203(k) rehabilitation program that allows borrowers to finance a home’s purchase and renovation costs in one loan.

This blog about What is an FHA Case Number on FHA Home Loans was updated on January 25th, 2024.