This GUIDE covers debt-to-income ratio limit to qualify for a mortgage loan. Home loans and debt-to-income ratio limit. Every mortgage loan program has a debt-to-income ratio limit (DTI). FHA loans have a more lenient debt-income ratio requirements than any other mortgage loan program. Debt-to-income ratios is calculated by taking the sum of all minimum monthly debt payments that report on the credit report and dividing it by the borrower’s monthly gross income.

HUD allows back end debt-to-income ratio limit to be capped at 46.9% front end DTI and 56.9% back end DTI to get an approve/eligible per Automated Underwriting System

There are two types of debt-to-income ratios: Front-end debt-to-income ratio: This ratio is taking the proposed housing payment (PITI) and dividing it by the borrowers’s monthly gross income. Back-end debt-to-income ratio: The back-end debt-to-income ratio is the sum of the proposed housing payment PLUS all other monthly debt payments and dividing it by the borrower’s gross income.

Debt-To-Income Ratio Limit on Conventional Loans

Fannie Mae has debt-to-income ratio limit capped at 45% on conventional loans to get an approve/eligible per Automated Underwriting System. Freddie Mac can go up to 50% DTI on conventional loans. There is no front end debt-to-income ratio requirements. Front-end DTI requirements on Conventional loans is up to the individual lender as part of their lender overlays.

What this means is that the total monthly payments divided by total monthly gross income cannot exceed 50% with Fannie Mae and Freddie Mac.

If gross monthly income is $10,000, the total monthly payments cannot exceed $4,500 which includes proposed housing expenses ( principal, interest, taxes, insurance, homeowners association). However, Freddie Mac will extend the 45% debt-to-income ratio up to 49.9% with Freddie Mac. For those with high debt-to-income ratio who exceed conventional loan debt-to-income ratio limits, FHA loans might be an option.

Approve/Eligible for convention loan , click here

FHA Loan Debt-to-Income Ratio Limit

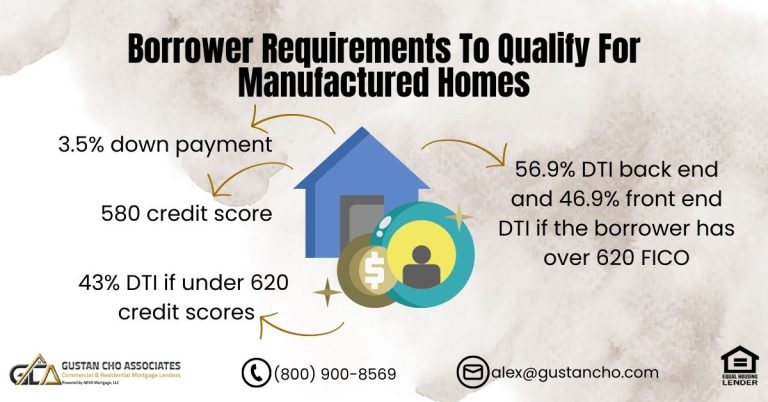

FHA debt-to-income ratio Limit depends on the borrower’s credit scores: FHA’s maximum debt-to-income ratio is as high as 56.9% back end and 46.9% DTI front end to get an approve/eligible. However, if borrowers credit scores are lower than 620 FICO, FHA loan debt-to-income ratio limits debt-to-income ratio to 43% to get an approve/eligible per AUS. The Gustan Cho Team has no lender overlays so as long as front end DTI is 46.9% DTI and back end DTI is 56.9% with credit scores over 620 FICO. For those whose debt-to-income ratio is higher than 56.9%, HUD allows non-occupied co-borrowers. HUD, the parent of FHA, allows unlimited non-occupant co-borrowers to be added on an FHA lan. Adding non-occupant co-borrowers is one of the many advantages of borrowers who exceed the 56.9% debt-to-income ratio.

VA Loans Debt-to-Income Ratio Limit

VA Loans do not have a maximum debt-to-income ratio limit. However, most lenders cap debt-to-income ratio limit on VA Loans between 45% to 50%. This cap is not a VA Guidelines On DTI but rather a lender overlay on each individual VA Lender. I have gotten VA borrowers approved with 580 credit scores and 60% debt-to-income ratio. It all depends on the Automated Underwriting System. The Gustan Cho Team has no lender overlays on VA Loans and will just go off AUS Findings. If the findings render an approve/eligible with 60% DTI with under 600 credit scores and the veteran borrower can meet the conditions of the automated approval, we can go ahead with the VA Loan Process and close

Jumbo Loans Debt-to-Income Ratio Limit

With jumbo loans, which are mortgage loans that exceed $766,250, the maximum debt-to-income ratio is normally set at 43%. Most jumbo loan lenders are pretty set on their 43% debt-to-income ratio requirements and exceptions are normally not made in most circumstances

Conventional Loan To FHA Loan

In some cases, conventional loan borrowers convert to FHA mortgage loan programs because they have high debt-to-income ratios. One major disadvantage with FHA loans compared to conventional loans is that mortgage insurance premium is mandatory for the life of the loan. Due to new FHA regulations, effective June 3, 2013, FHA mortgage insurance is mandatory no matter what the loan to value is on the subject property

Before the new FHA rule came into effect, FHA mortgage insurance premium was only required for a minimum for 5 years and was automatically canceled once the loan to value of the home reached 78%.

Now, the FHA mortgage insurance premium is required as long as you have the FHA loan. The only way out of FHA Mortgage Insurance Premium is either to pay off the loan or refinance it to an 80% loan to value conventional mortgage loan

Get a free quote for your FHA or Conventional Loans, Click here

How Deferred Student Loans And IBR Payments Affect DTI

Deferred Student Loans and student loan payments on IBR are no longer exempt with FHA Loans. Most lenders will take 1.0% of the student loan balance and use it as a monthly debt payment. This will often disqualify many home buyers. Deferred Student Loans that are deferred for 12 or more months are exempt from DTI calculations only with VA Loans. However, there is a solution

Debt To Income Ratios Are More Important Than Credit Scores

The number one reason why borrowers get last-minute loan denials or stress during the mortgage process is that they were not properly qualified by their loan officers. Loan officers need to thoroughly qualify mortgage applicants prior to issuing a pre-approval letter. Loan officers should thoroughly review borrowers’ credit reports. The mortgage loan originator should carefully look at the overall credit payment history. They should see if there are any credit disputes. Check to see if all credit items are correct with no errors. Double-check recorded date of foreclosures, deed in lieu, short sale. Make sure that there are no late payments after bankruptcy and/or foreclosures.

One of the main reasons why borrowers with high credit scores and high income get denied for a mortgage is because their debt-to-income ratios is too high. Make sure that the lender the loan officer works for does not have any overlays on debt to income ratios.

Front End Debt To Income Ratio Required For Mortgage

Lenders are concerned not only with credit profile but also with the housing expense and overall monthly expenses compared to the gross monthly income. This is called Debt To Income Ratio Required For Mortgage. There are two types of debt to income ratios. The first is the housing Debt To Income Ratio Required For Mortgage. DTI is calculated by taking the monthly housing expenses divided by the borrower’s monthly gross income.

For example, let’s take a case scenario:

- if the mortgage payment, property taxes, association dues, mortgage insurance (if any), and homeowners insurance payment is $3,000 per month

- and the borrower monthly gross income is $10,000 per month

- the housing expense to income ratio is $3,000 divided by $10,000

- this yields a 30% housing debt to income ratio

HUD allows a maximum of 46.9% front-end debt to income ratio to get an approve/eligible per AUS FINDINGS for borrowers with credit scores of 620 FICO or higher. Both Fannie Mae and Freddie Mac do not have front-end debt to income ratio requirements.

Back End Debt To Income Ratio Required For Mortgage

The second debt-to-income ratio Debt To Income Ratio Required For Mortgage that lenders are concerned about is the total monthly expenses to your monthly gross income ratio.

This ratio is known as the back-end ratio. The back end ratio is the sum of the housing expenses plus all other minimum monthly payments divided by the borrower’s total monthly gross income

The monthly expenses that include in calculating the back end debt to income ratio are the following:

- monthly credit card payments

- automobile payments

- student loan payments

- child support payments

Other fixed monthly payments like the following:

- second home mortgage payments

- motorcycle payments (if any)

- and the proposed new mortgage payment

- homeowners association dues (if any)

- property taxes

- private mortgage insurance premium (if any)

- and homeowners insurance

All of these combined monthly expenses divided by gross monthly income will yield the back end combined debt to income ratio:

For example, if the total combined monthly debt expenses are $5,000 and the monthly income is $10,000, the back-end debt to income ratio will be 50%. The front-end DTI allowed by HUD is 46.9% and 56.9% back-end on FHA loans. Fannie Mae and Freddie Mac do not have a front-end debt to income ratio requirement. The maximum debt to income ratio allowed on Fannie Mae and Freddie Mac is 50% DTI. There is no debt to income ratio cap on VA loans. USDA requires a maximum front end of 29% and 41% back-end DTI. Gustan Cho Associates have traditional jumbo loans that allow up to a 50% debt to income ratio. Most non-QM loans cap DTI at 50% to 55%.

Contacting The Student Loan Provider To Get Lower Monthly Student Loan Payments

Borrowers with high student loan balance that is deferred can contact the student loan provider and tell the student loan provider that they are applying for a mortgage. Request a fully amortized monthly payment over an extended payment plan which is normally 25 years. It normally turns out to be 0.50% of the student loan amount.

Borrowers do not have to change the student loan terms and can just keep the student loan terms deferred or on an IBR payment plan. All that is required is a hypothetical written statement what if the deferred student loan were out of deferment.

Needs to be a written statement from the student loan provider. If the student provider gives a hard time, please contact us and we can do a three-way conference call with the student loan provider and ask for a supervisor. Conventional loans does allow IBR student loan payments.. Homebuyers who have higher debt to income ratio and need to qualify for a mortgage with a lender with no lender overlays, please contact us at 1-800-900-8569 or text us for faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, evenings, weekends, and holidays so click here for free quote.