Types of Homes Eligible With Residential Loans

This ARTICLE cover the types of homes eligible with residential loans. Government loans are for owner occupant one to four-unit…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This ARTICLE cover the types of homes eligible with residential loans. Government loans are for owner occupant one to four-unit…

This blog will share some helpful tips about VA credit dispute guidelines. VA loans are often seen as one of…

This manual provides information on Job Relocation Mortgage Guidelines for individuals purchasing homes in a different state. According to these…

This blog post will explore the implications of Buying House Near Apartment Community or Commercial Areas. Buying a house near…

This article delves into the Mortgage Payment Shock Underwriting Guidelines and its underwriters’ assessment. Maintaining a payment that suits both…

If you’re married and you buy a home in a community property state, you’ll face different rules for qualifying. Most of these rules come into play if you finance your home with a government-backed home loan like the FHA, VA or USDA programs.

This guide covers modular homes mortgage guidelines on purchase and refinance transactions. Modular homes are becoming more and more popular…

This guide aims to understand Income-Based Repayment Student Loan Mortgage Guidelines clearly. The daunting task of outstanding student loans presents…

This article covers reasons why hiring realtor on home purchase is important. Getting hooked up with the right real estate…

This guide covers things that can delay your mortgage loan closing. A mortgage loan should be able to close in…

This article will explore the Best Mortgage Options For Bad Credit in Oklahoma in 2024. Gustan Cho Associates can guide…

In this blog, we will cover the Fannie Mae Chapter 13 dismissal guidelines on conventional loans. One of the most…

This guide covers FHA MIP versus conventional PMI for mortgage borrowers. Mortgage Insurance is mandatory on all FHA loans and…

This guide covers HUD guidelines versus lender overlays on FHA loans. There have been notable changes for HUD guidelines versus…

This guide covers preparing for a VA loan with a lender with no overlays. Preparing for a VA loan with…

This guide covers understanding the basics on what is a mortgage. We will cover and discuss the meaning of what…

Self-employed borrowers are now eligible to get an approve/eligible per automated underwriting system with one-year income tax returns.

You must first be eligible. Only servicemembers, honorably-discharged veterans and sometimes their families are eligible. VA underwriting guidelines are flexible, with no minimum credit score an no minimum down payment.

This guide outlines the advantages of Non-QM loans and Non-Traditional Mortgages. Gustan Cho Associates serves as your reliable ally for…

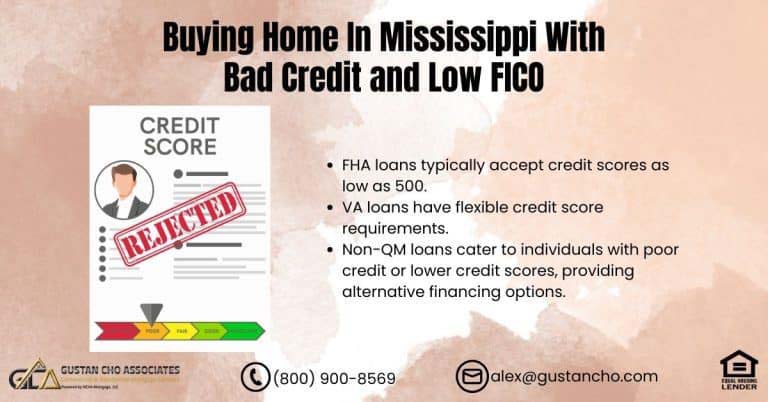

Is Possible To Buying Home In Mississippi With Bad Credit With Lender With No Overlays? Yes, it is at Gustan Cho Associates. Gustan Cho Associates is a mortgage company licensed in Mississippi.

Borrowers should not stress during the mortgage process. . There is no reason why there should be stress during the mortgage process.

This guide covers what is the definition of net tangible benefits for refinancing. When mortgage rates were at a 3-year…