Buying House While In Chapter 13 Bankruptcy

This blog post will explore Buying House While In Chapter 13 Bankruptcy. Chapter 13 Bankruptcy involves a structured five-year repayment…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This blog post will explore Buying House While In Chapter 13 Bankruptcy. Chapter 13 Bankruptcy involves a structured five-year repayment…

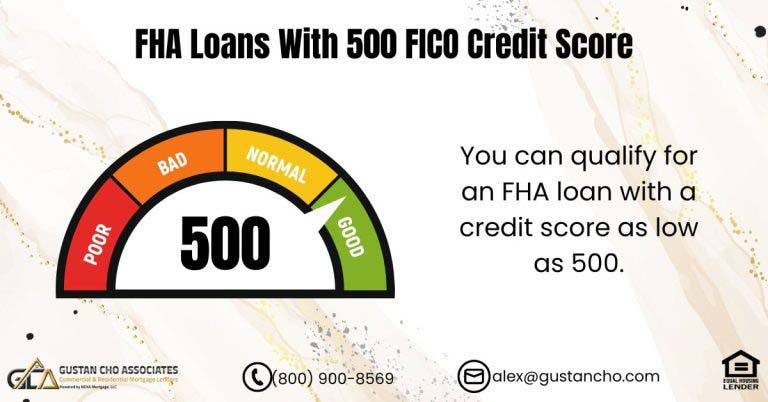

HUD, the parent of FHA, allows borrowers down to a 500 credit score to qualify for an FHA loan. However, for borrowers with under a 580 credit score, a 10% down payment is required.

This guide explains the requirements for obtaining two FHA loans at the same time. This is important information for those…

This guide covers how credit repair works during the mortgage process. A substantial percentage of my borrowers are folks who…

This guide covers the loan officer document checklist. This article on the Loan Officer Document Checklist is a series of…

Gustan Cho Associates has no lender overlays on VA loans. VA loans do not have a minimum credit score requirement nor a maximum debt to income ratio cap as long as the borrower can get an approve/eligible per automated underwriting system.

In this blog, we will cover employer distance requirements on primary home mortgages. Employer Distance Requirements On Primary Home Mortgages…

This guide covers how underwriters qualify income to approve mortgage loans. Many mortgage loan applicants do not have the role…

This blog will cover Fannie Mae and Freddie Mac guidelines on qualifying for a conventional loan with non-occupant co-borrower. Non-Occupant…

This article will discuss the guidelines for VA property tax exemption related to VA home loans. The VA has created…

This guide covers using rapid rescore in the mortgage process. What is a rapid rescore? It’s a service accessible only…

This blog post will explore the revised mortgage guidelines on Using Property Tax Prorations For Down Payment on a House….

This blog will cover Fannie Mae Collection Guidelines on Conventional loans. Fannie Mae and Freddie Mac are the two mortgage…

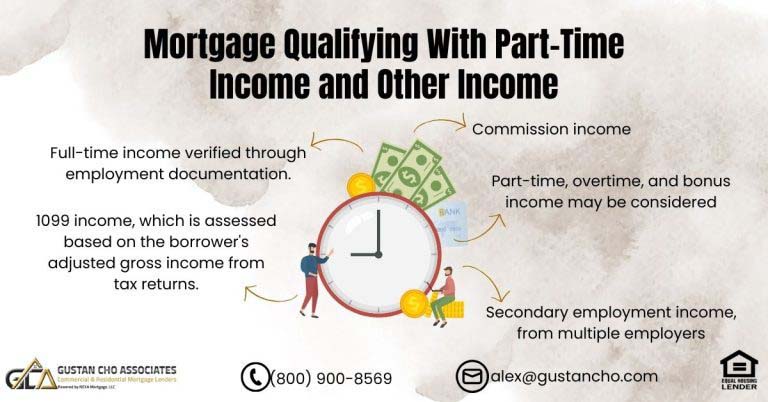

In this blog post, we’ll delve into Mortgage Qualifying With Part-Time Income and Other Income and explore lending guidelines regarding…

Many agency guidelines list extenuating circumstances as reasons for getting qualified for a mortgage when otherwise they would not qualify. However, borrowers need to understand

This guide covers qualifying for a home loan downsizing to a smaller home. It makes no sense in having a…

This article cover no waiting period on short sale mortgage guidelines. For those who were homeowners during the economic meltdown…

In this article, we will discuss and cover homebuyers qualifying for bad credit mortgage loans Alabama. Qualifying for bad credit…

This guide addresses common inquiries regarding the possibility of maintaining two FHA loans due to expanding family size. Typically, individuals…

This ARTICLE cover the types of homes eligible with residential loans. Government loans are for owner occupant one to four-unit…

This blog will share some helpful tips about VA credit dispute guidelines. VA loans are often seen as one of…

This manual provides information on Job Relocation Mortgage Guidelines for individuals purchasing homes in a different state. According to these…