FHA Bankruptcy Waiting Periods After Chapters 7 And 13

This article is about FHA Bankruptcy waiting periods after Chapters 7 and 13. FHA Bankruptcy wqiting period requirements were release…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This article is about FHA Bankruptcy waiting periods after Chapters 7 and 13. FHA Bankruptcy wqiting period requirements were release…

This guide covers how credit card balance affect debt-to-income ratio for mortgage borrowers. We will discuss the negative impact how…

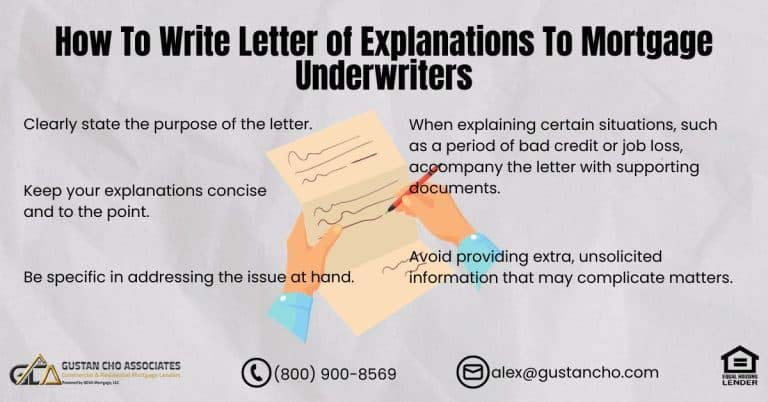

In this blog, we will cover how to write a letter of explanation to mortgage underwriters. Borrowers planning on applying…

This guide covers manual underwriting versus automated approval. There are two types of Automated Underwriting Systems (AUS): Fannie Mae’s Automated…

This guide covers the mortgage process leading to closing for borrowers. The home buying and mortgage process leading to closing…

This article covers Freddie Mac foreclosure guidelines on Conventional loans. Fannie Mae and Freddie Mac is the nations largest buyers…

Unlock Your Dream Home with Doctor and Medical Professional Mortgage Loans Are you a medical professional dreaming of buying your…

Mortgage Underwriters will require one or more compensating factors for borrowers with higher debt to income ratio on manual underwrites to offset the risk of the higher DTI.

This guide covers getting a mortgage with student loans with high debt-to-income ratio. Getting a mortgage with student loans can…

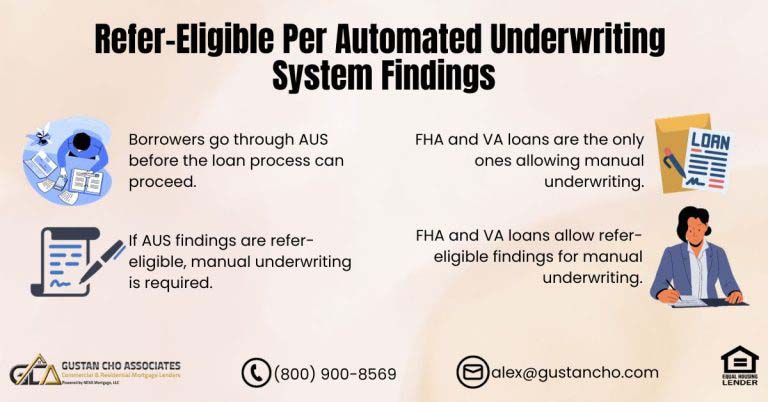

This article will cover and discuss refer-eligible per automated underwriting system findings. All mortgage loan applicants need to go through…

This guide covers VA late payment after bankruptcy mortgage guidelines on VA loans. VA loans were created and implemented to…

This guide covers mortgage rates after bankruptcy on government and conventional loans. There are loan level pricing adjustments (LLPA) charged…

This guide cover how long is a pre-approval valid when shopping for a home. A pre-approval letter is a ticket…

This guide covers how credit scores affect conventional loans. Two of the most popular mortgage loan programs today are FHA…

This guide covers the importance of debt-to-income ratio in mortgages. Borrowers need to keep in mind the importance of debt-to-income…

This guide covers setting up written payment agreements with creditors and collection agencies so you can qualify and get pre-approved…

In this blog, we will cover and discuss the agency mortgage guidelines from the U.S. Department of Veterans Affairs for…

This guide covers qualifying for a home mortgage after forbearance. Borrowers can qualify for a home mortgage after forbearance. The…

This guide covers the first payment after closing for mortgage loan borrowers. One of the most common questions new homebuyers…

This guide covers mortgage rates and terms compared to credit scores and loan-to-value. Homebuyers planning on buying a home should…

This guide covers the DTI overlays lenders require on government and conventional loans. DTI overlays are imposed on home mortgage…

This guide covers mortgage approval with bad credit and late payments. Many consumers have had a period in their lives….