Home Loan Approval After Denied By a Bank For Your Mortgage

This guide covers getting a home loan approved after denied by a bank for your mortgage. There should be no…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers getting a home loan approved after denied by a bank for your mortgage. There should be no…

In this article, we will cover and discuss finding the best mortgage lenders for bad credit in Arkansas to qualify…

FHA Spot Loans enables condo buyers to purchase a condo unit in a non-HUD-Approved Condo Complex with an FHA loan.

Gustan Cho Associates Has Special Tricks On Ways Of Boosting Credit Before Applying For Mortgage. Do not hire any credit repair companies if you are planning on applying for a mortgage. Credit repair does more harm than good during the mortgage process. You cannot have credit disputes during the mortgage process.

In this article, we will cover and discuss applying for mortgage with another lender when denied by the original lender….

This guide covers DTI calculations in community property states mortgage guidelines. DTI calculations in community property states are calculated differently…

The asset-depletion mortgage loan program benefits higher net worth individuals who do not have a regular steady income. Non-QM loans are becoming increasingly popular and benefit borrowers who need alternative nontraditional mortgage loan programs.

This guide coverss temporary unemployment mortgage guidelines on home purchases. The coronavirus pandemic that hit the United States sent millions…

In this blog, we will cover and discuss qualifying with non-QM mortgage lenders in Connecticut for borrowers who cannot qualify…

This guide covers bad credit mortgage guidelines on home purchase and refinance. Mortgage borrowers can qualify for home loans with…

This guide covers how to keep loan pre-approval valid for home purchase. One of the many questions home buyers often…

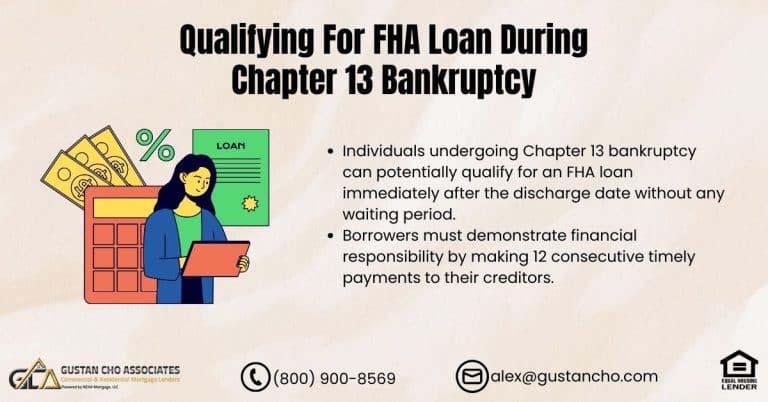

In this article, we’ll explore the process of Qualifying For FHA Loan During Chapter 13 Bankruptcy. Homebuyers can secure an…

In this blog, we will cover the role of mortgage underwriter during the mortgage process. The role of mortgage underwriter…

In this blog, we will cover the debt collection laws in community property states and qualifying for a home mortgage….

This guide covers how do mortgage underwriters calculate income of borrowers. Income is the most important aspect of qualifying for…

In this blog, we will discuss and cover mortgage after foreclosure with no waiting period with non-QM loans. Non-QM loans…

In this article, we will cover and discuss using future rental income to qualify for a mortgage. Some first-time home…

This guide addresses the issue of credit tradelines not reporting to credit bureaus. When faced with this situation, finding solutions…

This guide covers VA derogatory credit mortgage guidelines on VA loans. VA derogatory credit mortgage guidelines on VA loans are…

This guide covers common credit score questions from first-time homebuyers. What does a “good credit or good FICO” really mean…

HUD, the parent of FHA, has increased FHA loan limits in Chicago for six consecutive years due to rising home…

This blog will cover the FHA Total Scorecard and how it works. The United States Department of Housing and Urban…