VA Derogatory Credit Mortgage Guidelines on VA Loans

This guide covers VA derogatory credit mortgage guidelines on VA loans. VA derogatory credit mortgage guidelines on VA loans are…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers VA derogatory credit mortgage guidelines on VA loans. VA derogatory credit mortgage guidelines on VA loans are…

Homebuyers can qualify for VA loans bad credit Tennessee with under 620 credit scores. The United States Department of Veterans…

This guide covers the different types of residential lending for homebuyers with bad credit out in todays marketplace for owner-occupant…

This guide deep dives into the significance of the FHA and VA Amendatory Clause. We will explore the implications of…

HUD oversees the Federal Housing Administration (FHA) and helps homebuyers in buying a home in Tennessee with bad credit and…

This guide covers property tax proration VA guidelines on VA home loans. There are certain states where property taxes are…

This blog post will explore Buying House While In Chapter 13 Bankruptcy. Chapter 13 Bankruptcy involves a structured five-year repayment…

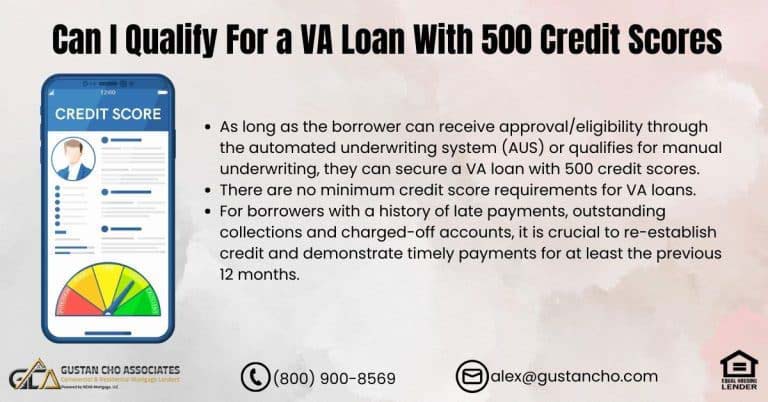

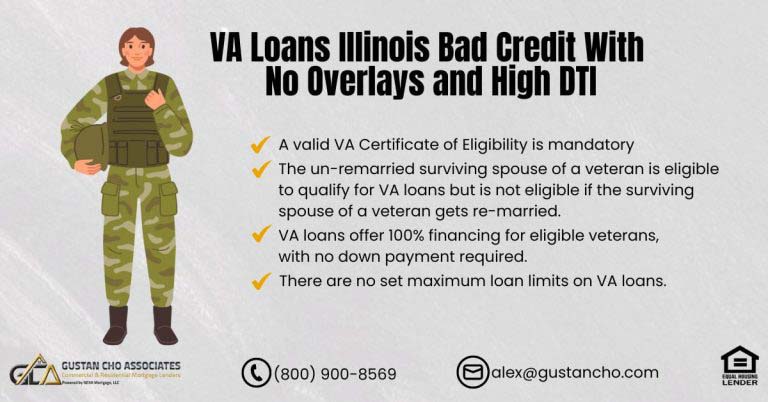

Gustan Cho Associates has no lender overlays on VA loans. VA loans do not have a minimum credit score requirement nor a maximum debt to income ratio cap as long as the borrower can get an approve/eligible per automated underwriting system.

This article will discuss the guidelines for VA property tax exemption related to VA home loans. The VA has created…

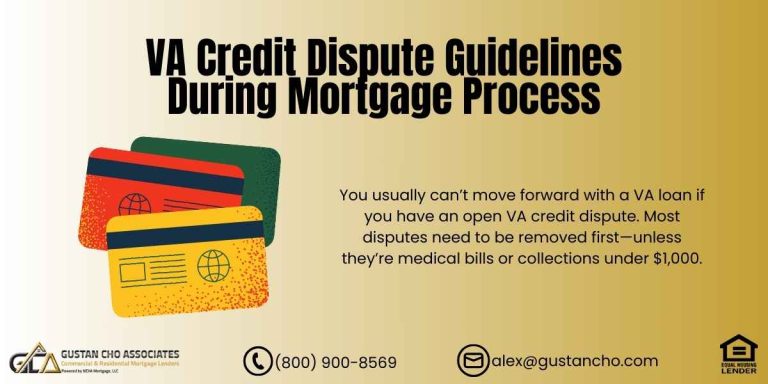

This blog will share some helpful tips about VA credit dispute guidelines. VA loans are often seen as one of…

This guide covers modular homes mortgage guidelines on purchase and refinance transactions. Modular homes are becoming more and more popular…

This guide covers preparing for a VA loan with a lender with no overlays. Preparing for a VA loan with…

You must first be eligible. Only servicemembers, honorably-discharged veterans and sometimes their families are eligible. VA underwriting guidelines are flexible, with no minimum credit score an no minimum down payment.

Can an individual with a credit score of 500 be eligible for a VA loan? Absolutely. The Veterans Administration (VA)…

This blog post will discuss VA loans with no credit scores in detail and examine the DTI (Debt-to-Income) requirements. VA…

This guide covers VA credit agency guidelines versus lender overlays on VA loans. Understanding VA Credit Score Agency Guidelines is…

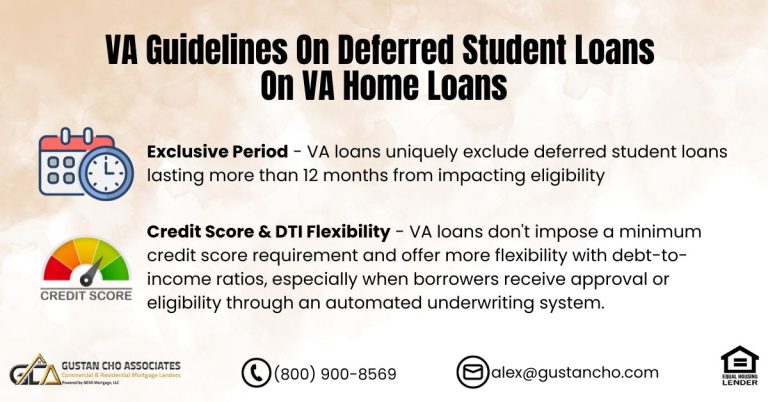

This article explores the VA Guidelines on Deferred Student Loans and their influence on the debt-to-income ratio in the context…

In this blog, we will discuss and cover VA refer-eligible findings versus AUS approval guidelines. The United States Department of…

This article covers getting a VA loan denial due to overlays and qualifying with a different lender. In this article,…

This guide covers VA guidelines on seller concessions to cover closing costs. VA loans is hands down the best mortgage…

This article covers Conforming versus government-backed loans. FHA, VA, and USDA loans are called government-backed loans. This is because lenders…

This article Is about qualifying for VA loans Illinois bad credit with no overlays and high debt-to-income ratio. VA loans…