Moving To Another Owner-Occupied Home Without Selling

In this blog, we will cover and discuss buying and moving to another owner-occupied home without selling their first home….

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

In this blog, we will cover and discuss buying and moving to another owner-occupied home without selling their first home….

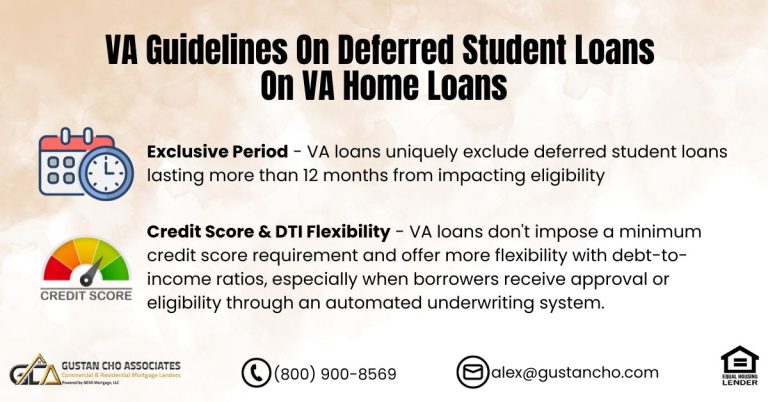

This article explores the VA Guidelines on Deferred Student Loans and their influence on the debt-to-income ratio in the context…

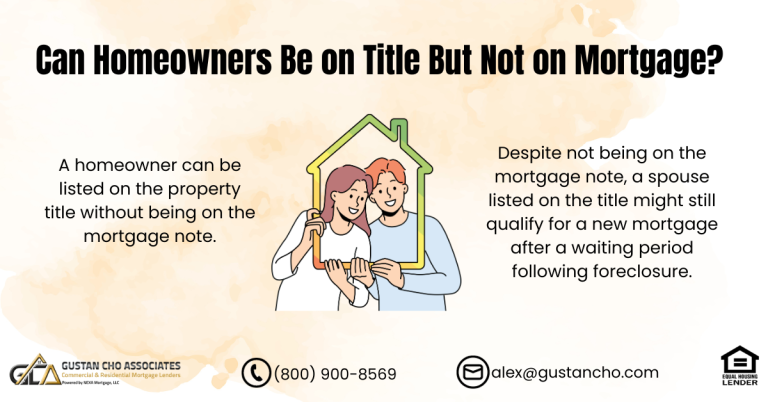

The primary emphasis of this blog centers around the waiting period obligations that individuals face after foreclosure, specifically those on…

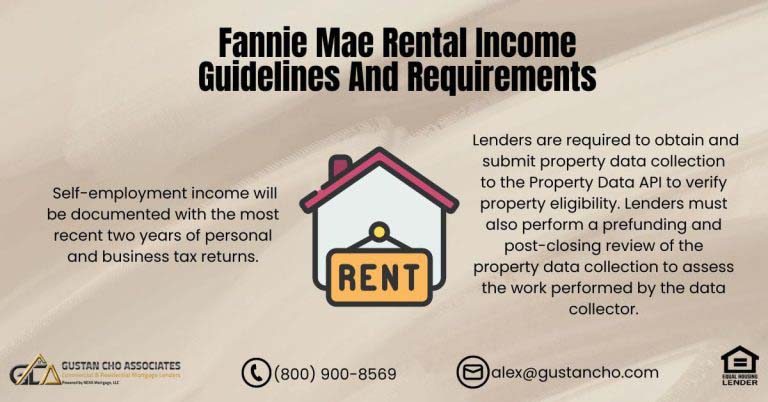

This blog post will explore Fannie Mae rental income guidelines and lending requirements. We will focus on elucidating the latest…

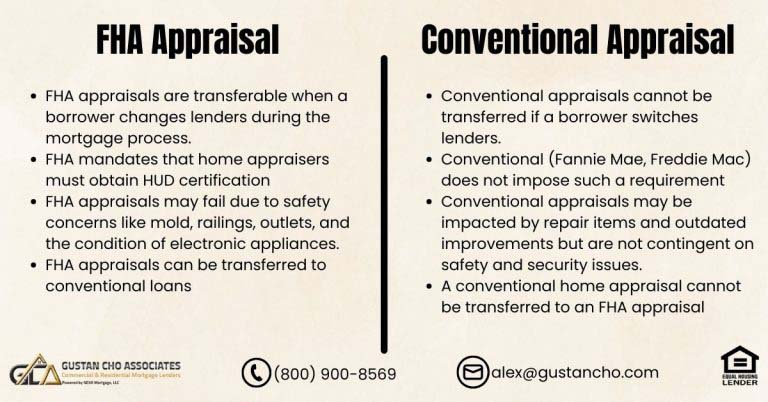

This article examines and clarifies the criteria for FHA Appraisals Versus Conventional Appraisals. There are significant differences in the guidelines…

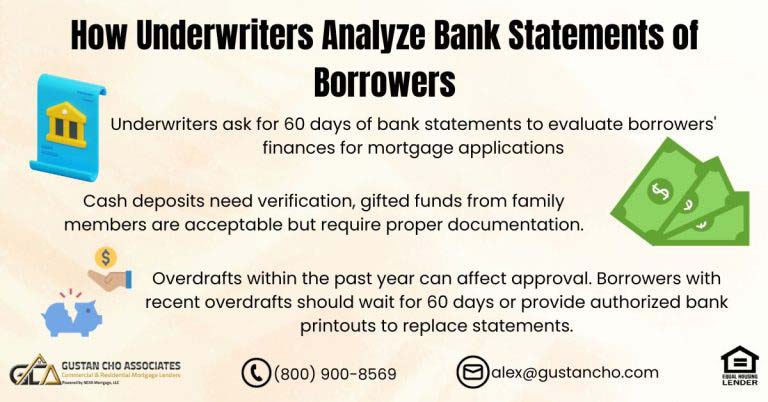

This article delves into how underwriters analyze bank statements of borrowers. When individuals seek a mortgage loan, underwriters deem 60…

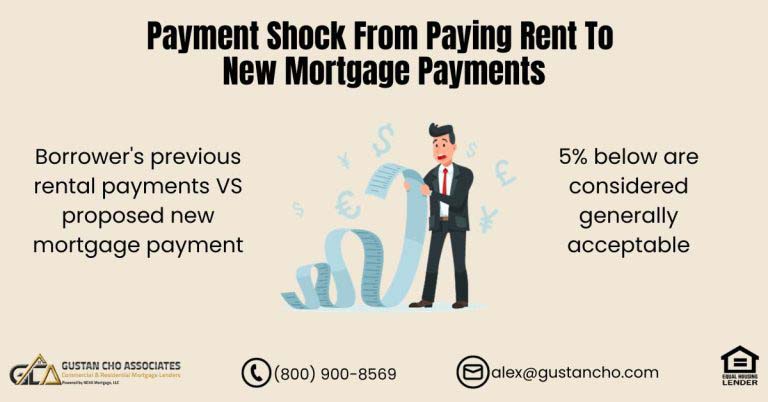

In this blog, we will discuss payment shock from paying rent as a renter to paying a mortgage as a…

Mortgage lenders must adhere to the Ability to Repay (ATR) rule when underwriting. That means they must make sure that borrowers can afford the loan before they approve it.

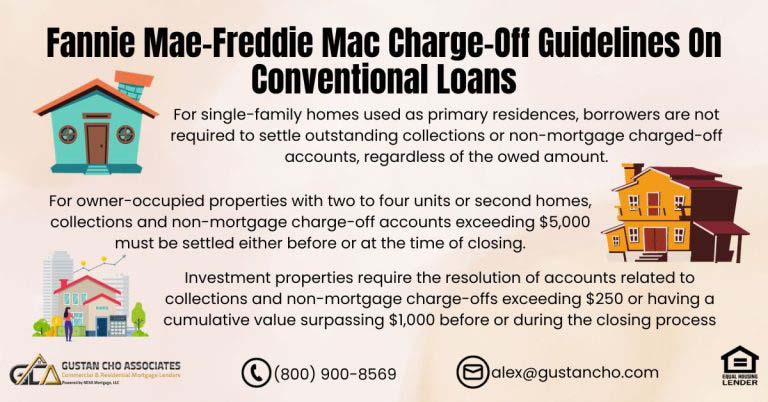

This blog post will explore the Fannie Mae-Freddie Mac charge-off guidelines applicable to conventional loans. Gustan Cho Associates has recently…

In this blog, we will cover and discuss qualifying for a mortgage during and after divorce on purchase and refinance…

There are strict rules regarding the part-time income to full-time income mortgage guidelines. For part-time income to be used, borrowers…

This blog will cover and discuss the FHA case number on new FHA mortgage applications. We will also discuss transfers…

In this article, we will cover and discuss the comparison between jumbo loan vs conventional loan programs and the…

This guide covers overlays on debt-to-income ratio on FHA loans. Homebuyers who got issued pre-approval from a mortgage loan originator…

This guide covers eliminating FHA mortgage insurance premium by refinancing FNMA. Borrowers taking out an FHA insurance mortgage loan, besides…

This guide covers non-QM down payment guidelines on home purchase. Non-QM down payment guidelines on home purchase for homebuyers on…

In this article, we will cover and discuss when you can get a mortgage approval after bankruptcy dismissal. There are…

The conventional loan waiting period after deed-in-lieu of foreclosure and short sale of four years is shorter than the 7-year…

This guide covers investor cash-flow mortgage for investment properties. Gustan Cho Associates now offers investor cash-flow loan programs on investment…

In this blog, we will cover and discuss the mortgage guidelines after bankruptcy on home purchases and refinance transactions. There…

This guide covers lender overlays on credit tradelines by mortgage underwriters. Do all mortgage companies have lender overlays on credit…

In this blog, we will discuss and cover VA refer-eligible findings versus AUS approval guidelines. The United States Department of…