How To Study For NMLS Exam And Pass It The First Time

Embarking on a career in mortgage lending is an exciting endeavor, but before you can fully dive into the industry,…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Embarking on a career in mortgage lending is an exciting endeavor, but before you can fully dive into the industry,…

This guide cover FHA versus conventional mortgage after bankruptcy. There are differences in when and how you can qualify for…

This guide covers VA late payment after bankruptcy mortgage guidelines on VA loans. VA loans were created and implemented to…

This guide covers mortgage rates after bankruptcy on government and conventional loans. There are loan level pricing adjustments (LLPA) charged…

This guide covers homeowner tax benefits versus renting. There are so many advantages of buying versus renting a home. One…

This guide covers how lender overlays prevent mortgages for homebuyers. The Federal Reserve Board announced that almost a third of…

This guide cover how long is a pre-approval valid when shopping for a home. A pre-approval letter is a ticket…

This guide covers how credit scores affect conventional loans. Two of the most popular mortgage loan programs today are FHA…

This guide covers how to become a real estate agent in today’s competitive housing market. A career in real estate…

This guide covers how homeowners insurance deductibles work. Homeowners insurance deductibles used to be straightforward. It was the dollar amount…

This guide covers the importance of debt-to-income ratio in mortgages. Borrowers need to keep in mind the importance of debt-to-income…

This guide covers setting up written payment agreements with creditors and collection agencies so you can qualify and get pre-approved…

In this blog, we will cover and discuss the agency mortgage guidelines from the U.S. Department of Veterans Affairs for…

This guide covers qualifying for a home mortgage after forbearance. Borrowers can qualify for a home mortgage after forbearance. The…

This guide covers the first payment after closing for mortgage loan borrowers. One of the most common questions new homebuyers…

This guide covers mortgage rates and terms compared to credit scores and loan-to-value. Homebuyers planning on buying a home should…

This guide covers the DTI overlays lenders require on government and conventional loans. DTI overlays are imposed on home mortgage…

This guide covers mortgage approval with bad credit and late payments. Many consumers have had a period in their lives….

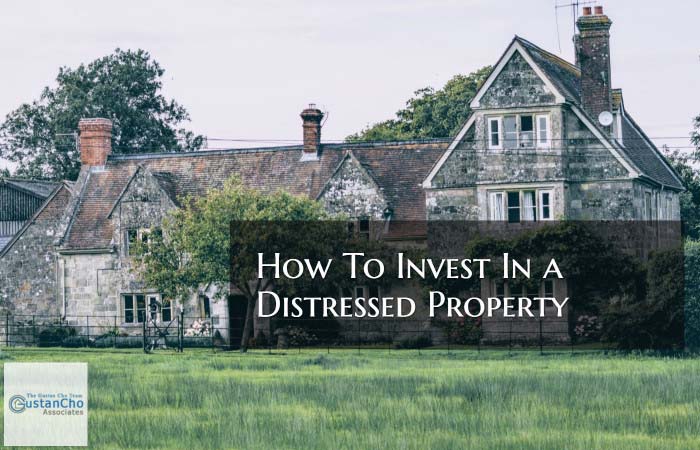

This guide covers investing in a distressed property and what you need to know. Distressed properties refer to properties for…

This guide covers the credit scores required for FHA and VA loans. Many borrowers are confused about the credit scores…

This guide covers verified funds for home closing before clear-to-close. Failure to provide verified funds for home closing before clear-to-close…

This guide covers qualifying for a mortgage after college education versus work experience mortgage guidelines. We will further cover why…