This guide will cover finding the best mortgage lenders for the best rates. Buying a home is a significant milestone, a dream-come-true to many. However, this process can be overwhelming! Not all mortgage lenders have the same mortgage rates. There are mortgage lenders for the best rates. We will show you how to shop for mortgage lenders for the best rates. Joe Betro, an associate contributing editor at Gustan Cho Associates and wholesale account representative at The Loan Store, made the following statement:

One of the most important decisions you will make is choosing a mortgage. With so many options available, finding the right loan, much less an affordable one, might seem like a challenging task. Securing a mortgage with the lowest rates will save you a lot of dollars over the life of the loan.

But the big question is, how can you secure the lowest mortgage rate? How do you choose the best mortgage lenders for the best rates? In this article, we will explore the tips and tricks for finding the most affordable mortgage that fits your unique financial situation.

How Can You Shop For The Best Mortgage Rates

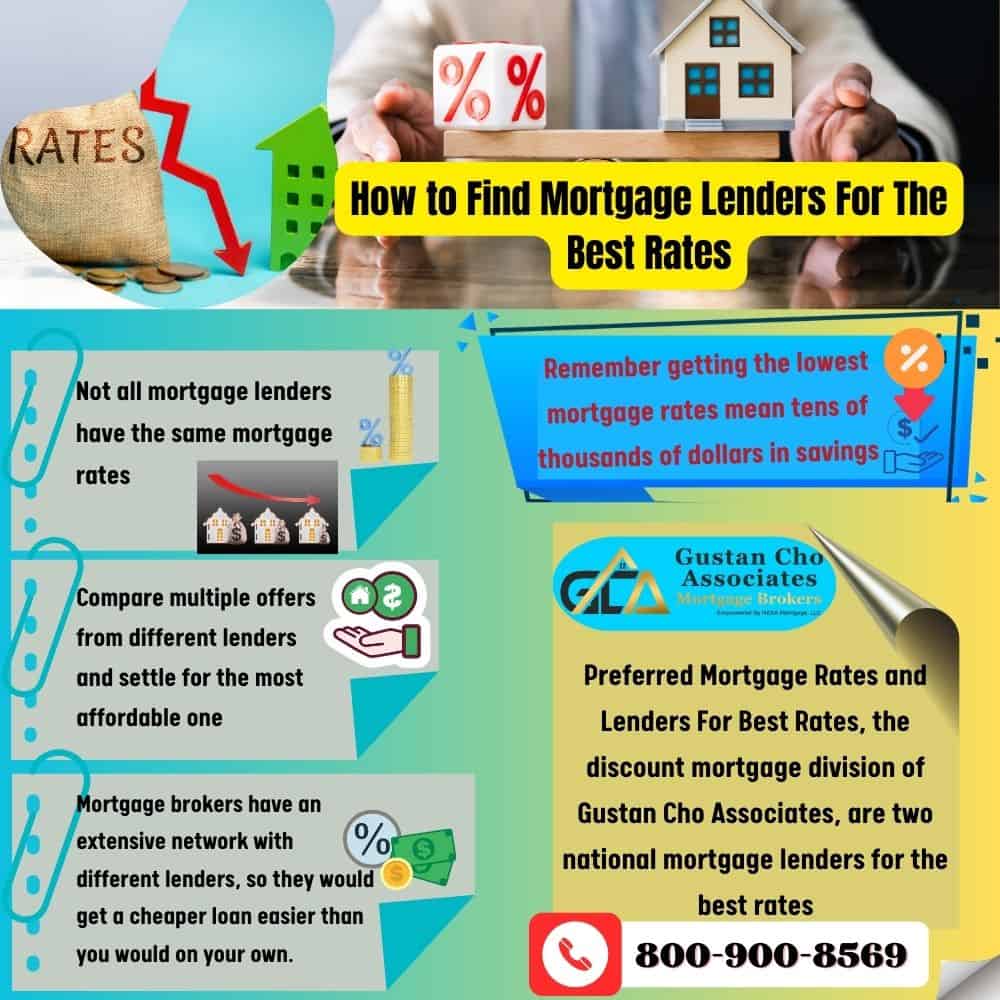

Remember getting the lowest mortgage rates mean tens of thousands of dollars in savings. Also, remember that not all mortgage lenders have the same rates. Shopping for mortgage lenders for the best rates can be boring and time-consuming. It is not sexy and fun like shopping for a new car. There are mortgage lenders for the best rates.

Always remember that the cheapest mortgage isn’t the best for you, so you must consider all factors involved before making the final decision. By following these tips, you can take control of your mortgage search and get the most suitable and affordable loan possible.

Whether you are a first-time homebuyer or looking to refinance your existing mortgage, read on to find out how to save some dollars. We will show you how to choose mortgage lenders for the best rates. The following paragraphs will cover steps in finding mortgage lenders for the best rates.

Steps to Finding Mortgage Lenders For The Best Rates

Not all mortgage lenders have the same rates for borrowers with the same credit and income profiles. A 640 credit score borrower can get quoted a 7.25% rate with 1.5% discount points from lender A and a 6.25% with no discount points from Lender B on a conventional loan. How can that be? It is mainly due to lender compensation or yield-spread premium. The higher the lender compensation, the higher the mortgage rate charged to a borrower. Eric Jeanette, the co-founder of Preferred Mortgage Rates and Lenders For Best Rates, said the following:

All mortgage lenders can have the lowest rates by lowering their lender compensation. However, many lenders cannot lower rates to become discount mortgage lenders for the best rates, like Preferred Mortgage Rates and Lenders For Best Rates. Preferred Mortgage Rates and Lenders For Best Rates have the lowest rates because the lender compensation is not greater than 150 basis points.

What we mean by getting a cheap mortgage is getting a loan with the best interest rates possible. To get a reasonable rate, you must set yourself up as best as possible to ace the loan application and score. With that said, there are a few steps you can take to improve your chances of getting a cheap mortgage. They are as follows:

Maximize Your Credit Scores To Get The Best Mortgage Rates

Before you start looking for a mortgage, you must ensure that your credit reports don’t have any errors; if any, you must fix them immediately. When shopping for a mortgage, due your diligence and maximize your credit scores. Besides maximizing your credit scores, make sure you do not have any errors on your credit reports, says Eric Jeanette of Preferred Mortgage Rates, a discount mortgage lender with a national reputation for being one of the top mortgage lenders for the best rates:

Credit reports include information that goes into your credit score, which the lenders examine to determine the rate you will get. Any incorrect or negative information on the report can easily impact your ability to get a good mortgage. In addition, you may want to boost your credit score, especially if it is low.

A low credit score, even though it may not necessarily hinder you from obtaining a loan, can seriously hinder your ability to get a less expensive mortgage. With low scores, the interest rates are usually high as lenders view such borrowers as a risk, so they must protect themselves, which is why they hike the interest rates. You should start paying your bills on time and eliminate your credit card balances to improve your credit score.

Compare Fixed Versus Adjustable-Rate Mortgages

the type of loan, in terms of the term limit, is also crucial in determining whether you get a cheap loan. For instance, if you want to buy a home where you plan to stay for over a decade, a 30-year fixed-rate loan would be the best bet, as it usually comes with relatively low monthly payments.

If you can afford to make larger payments and would like to have cleared the loan sooner, a 15-year fixed loan would be ideal. 15-year fixed-rate mortgages features low-interest rates, which means you could save thousands of dollars.

In addition, a shorter-term adjustable-rate mortgage enables you to lock in a lower rate for an introductory period. An example is a 7/1 adjustable loan where the rate remains unchanged for seven years, and after that, the rate is adjusted based on the market rates. But it can only rise by a maximum of five percentage points above the initial rate. However, the adjustable-rate mortgage may not be the perfect option if you plan to be in the property for a long time, especially if the rates continue to trend higher.

Shopping For Mortgage Lenders For The Best Rates

When looking for a cheap mortgage, you may want to compare multiple offers from different lenders and settle for the most affordable one.

There are a variety of lenders, including banks, mortgage brokers, online originators, and aggregators. And with these many lenders offering mortgages at different rates, you should do your homework to identify the lender offering the best terms. Go to their websites and fill out preliminary forms to get interest rate estimates, or make calls and get quotes. With quotes from different lenders, you can compare to find the best deals.

And as you are looking for the lender, you also need to decide the kind of home you want to buy and the type of mortgage you want. This is crucial as it also informs you of the type of mortgage you will apply for. Remember also to notify the lender where you are in your investment. Once you finally get the loan, you must fill out and verify many aspects of your financial and personal life. So, you need to have all your necessary paperwork in hand.

Small Mortgage Lenders For The Best Rates

Besides the big banks and online lenders, consider the smaller lenders such as credit unions and community banks. These smaller lenders typically have better mortgage rates, and they usually offer better terms and rates to borrowers with variable income streams, such as self-employed individuals. This is because, unlike larger lenders, they don’t sell these loans in the secondary market.

Preferred Mortgage Rates and Lenders For Best Rates, the discount mortgage division of Gustan Cho Associates, are two national mortgage lenders for the best rates. The lender compensation on Preferred Mortgage Rates and Lenders For Best Rates is no larger than 150 basis points where standard mortgage brokers charge 275 basis points and average compensation for mortgage bankers is over 500 basis points. Remember, the higher the lender compensation, the higher the rates for consumers.

Save up for a down payment – a down payment is always a key determiner of the type of loan you get or how cheap the loan can be. The truth is, putting more money down can help you obtain a lower mortgage rate, which will, in turn, make your mortgage cheap. A 20% or above payment would be the most ideal. This is not to say that lenders won’t accept a lower down payment, it would, but the loan will now be a bit expensive, as you will have to pay for mortgage insurance.

Mortgage Brokers For Mortgage Lenders For The Best Rates

A mortgage broker could be handy when looking for a cheap mortgage, as they can easily shop for a better one. Most of these brokers have an extensive network with different lenders, so they would get a cheaper loan easier than you would on your own.

When hiring a mortgage broker, you must be careful to hire the right one. Maybe try getting recommendations from friends or colleagues. A mortgage broker will be invaluable to borrowers with variable income sources as they specialize in circumstances outside the mainstream.

As we conclude, finding the cheapest mortgage requires effort and research, but it’s worth it in the long run. By shopping around, comparing rates and terms, and being aware of all the fees involved, you can save thousands of dollars over the life of your mortgage.