In this article, we will discuss and cover the borrower review of Gustan Cho Associates. Just this past June 2, 2023, I received a frantic call from a home buyer who was extremely disturbed. This was because she learned from multiple mortgage lenders in her community that she could not qualify for a conventional loan due to her having a loan modification one year ago. Angie Torres, the National Operations Director at Gustan Cho Associates, explains her thoughts about the homebuying and mortgage process at Gustan Cho Associates:

There is not reason why the mortgage process should be stressful. Over 80% of our clients are borrowers who could not qualify at other lenders due to a last-minute loan denial or because the lender did not have the loan program best suited for the borrower. At Gustan Cho Associates, we do not issue a pre-approval unless we can close the mortgage loan. We strive not just to close the loan but close it on time.

We get hundreds of borrower reviews of Gustan Cho Associates. We are honored by the number of positive borrower reviews of Gustan Cho Associates. The team at Gustan Cho Associates does everything we can for borrowers to give them a positive experience. We get many borrowers who write us their experience with us and send us a positive borrower review of Gustan Cho Associates. We want to have all of our borrowers experience a five-star experience to want to give a positive borrower review of Gustan Cho Associates. In the following paragraphs, we will cover how we get so many positive borrower reviews of Gustan Cho Associates.

How Gustan Cho Associates Can Approve Mortgage Loans Other Lenders Cannot

The home the homebuyer wanted to purchase is priced at $450,000. It is not that buyers wanted to purchase a higher-priced home, but because her family needed to live in an area where their children could remain in the same school district. Unfortunately, the lowest-priced home in the area she is looking for a home purchase is no less than $600,000.

Due to extenuating circumstances, the homebuyer needed to close on the home no later than late August. I calmed her down as much as I could. I was on the phone with her for well over an hour, looking at possible solutions to see if there was any way that our team of loan officers and I could help her. Her credit report had many loopholes, but I discovered her loan was doable.

What Makes Gustan Cho Associates Different Than Other Lenders

It was not a rock-solid deal. However, on shaky high-risk borrowers, we always need plan B. After interviewing this borrower, we found Plan B and Plan C. So if Plan A does not turn out, we can proceed with either Plan B or Plan C. I issued the buyer a pre-approval letter today so she can enter into a real estate purchase contract.

Borrower Review Of Gustan Cho at Gustan Cho Associates

Borrower Review of Gustan Cho Associates and testimonials who share their experiences with us are priceless. Normally folks write us reviews when we close on their home purchase. I was pleasantly surprised to get a review on YELP just a few minutes ago. Customer reviews are priceless, which motivates all of us to work harder. I am not mentioning this borrower’s name due to privacy reasons. I would tell her my staff and not let her and her family down. She is looking forward to closing her loan.

Message To All Mortgage Loan Officers

Not many people go through the mortgage process throughout their lifetimes. Over 80% of our borrowers have gotten a last-minute loan denial or cannot meet the closing date on their home loan closing. This is because their mortgage loan originator did not properly qualify their borrowers. Dale Elenteny of Gustan Cho Associates explains lender overlays:

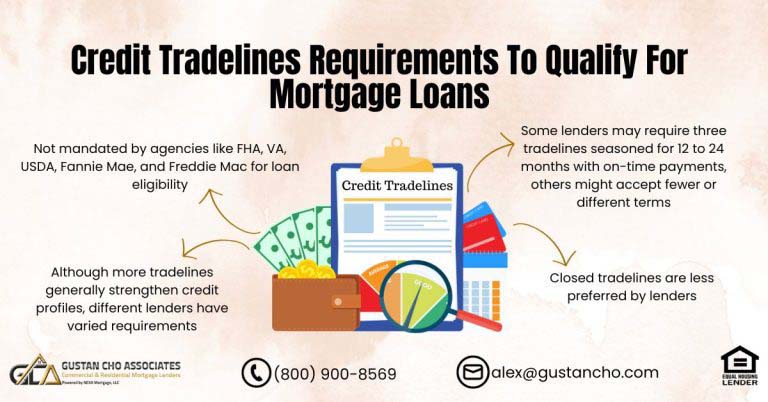

Lender overlays are mortgage requirements higher than the minimum agency guidelines of FHA, VA, USDA, FANNIE MAE, and FREDDIE MAC mortgage guidelines.

Borrowers may meet the agency guidelines of HUD, USDA, VA, USDA, Fannie Mae, or Freddie Mac but do not meet their company’s overlays. Overlays are mortgage lending requirements that each lender sets above and beyond the minimum mortgage guidelines that FHA, VA, USDA, FANNIE MAE, and FREDDIE MAC require.r 90% of lenders have overlays.

What Makes Gustan Cho Associates Different Than The Competition

Since the inception of Gustan Cho Associates, we have had a no-lender overlay on government and conventional loan business models. Lender overlays are additional guidelines above and beyond the agency guidelines of HUD, VA, USDA, Fannie Mae, and Freddie Mac. For example, HUD, the parent of FHA, requires that for a borrower to qualify for a 3.5% down payment home purchase FHA-insured loan, they must have a 580 credit score. A lender may have FHA Overlays on credit scores where they may require a 620 FICO for a 3.5% home purchase FHA loan. There are hundreds of different overlays lenders can implement.

Apply For a Mortgage: Click Here

Case Scenario of a Typical Borrower Who Got a Denial From a Lender

I want to share a lead call I got on Friday morning. I was swamped all week due to dealing with corporate and compliance, but then I got a call from a Florida borrower who was in tears. What I mean by tears, I mean frantic. Her husband is a Hollywood, Florida, police officer. The borrower was a full-time school teacher and had been on the job for four months. Her husband makes $110,000 per year, and she makes $40,000. The area they need to move to due to their children’s home costs is $600,000. You can qualify for an FHA loan one year after a loan modification. They cannot qualify for an FHA loan in Broward County because the FHA loan limit is $472,939. Unfortunately, their down payment was limited, and they could only qualify for a Conventional loan.

Case Scenario of Mortgage Process of Borrowers Who Got Denied From Other Lenders

SOLUTION: Rules and regulations change all the time. I needed help and requested a team meeting with my senior advisors at Gustan Cho Associates. One of my senior advisors takes over and asks the same questions as I did but goes more in-depth. My senior advisor starts dissecting the loan modification and runs a credit report. The credit report does not reflect a loan modification. According to the borrower, she only was late on two payments. Senior Advisor runs DU, and we get approve/eligible. However, the mortgage is not reflected on the credit report. According to the senior advisor, we have a 50/50 shot. PLAN B: While the senior advisor works on this file, I am searching for a PLAN B. I called the borrower back and asked if she had anyone in her family who loved her and could co-sign for her. She told me she has her mom and sister. I ask her to ask her mom and sister if they are willing to be on the loan. I ask her how much her mom makes, but she is clueless. I get a call one hour later, and I have Mom on the phone. Mom has a home worth $300,000 and a $180,000 mortgage with a monthly payment of PITI of $1,500 per month. Mom has social security income of $18,000 per year which can get grossed up by 15%. She also has a full-time job, and she makes $60,000 per year. Since she has more than 25% equity in her existing home, we can take 75% of the potential rental income on a departing residence and calculate her debt-to-income ratio. Her mom spends most of the time with our borrower. Her mom stays over with her daughter because she loves her grandkids. Her mom was going to give her home to her other daughter, who is disabled and lives with her. I asked the buyer’s mother if she would like to buy the new home under her name as an owner-occupant home. She told me she would love to and would do anything to help her daughter. THIS WAS A DONE DEAL. However, the buyer wanted to try it for herself. If the first-case scenario fails, we have a SOLID PLAN B. Plan B was a SOLID DEAL.

Business Platform at Gustan Cho Associates

As many of you know, I am the one that is taking all phone calls from www.gustancho.com. It is not that I do not trust anyone, You have to understand that the calls that come in are all internet shoppers, and if you do not pick up, they will go elsewhere. 100% of them do not leave messages. I call them right back if I am on the phone. If it goes past one hour, I lose the deal. Say you get someone on the phone and find out they do not qualify. Do you hang up? NOT. Start a relationship with them. Ask them questions. Take notes. Interrogate them nicely. Talk to them like a friend and make them feel comfortable with them. Do not talk first. Hear them out. If they ramble on another subject that has nothing to do with mortgages or the subject at hand, hear them out. A good solid initial phone interview may take 30 minutes or not more. It is your job to make them feel comfortable and trust you. All my borrowers become lifetime friends, and some work with me as loan officers. Lol. You need to understand folks that these borrowers are trusting you with all of their financials. You have their tax returns, you have their W2s, you have their credit report, you have all of their asset accounts, and you know all of their financial and personal information. These folks are counting on you, and please do not let them down. I do not expect every loan officer under my wing to work 15-hour days, seven days a week, as I do. Still, your borrowers are entitled to that type of service, so I will have our team devise a plan where if you are not available, he can direct the calls to me, and I will take over after-hours, weekends, and holidays. I had a recent incident where a loan officer contacted a loan officer five times in one hour, and the loan officer was bitching about the borrower. I was shocked and appalled. I wanted to FIRE her on the spot but did talk to the LO and told her nicely to ensure that does not happen again. There are always two sides to the story; however, the borrowers are always right when it comes to borrowers. This does not excuse me, and if Darren and I set up rules for the branch, that applies to all of us, including Darren, me, Greg, and our new Area Sales Manager Lori Garloch. Brian Borchard is our direct boss, and he is banking that we will be MLD MORTGAGE’s number one branch. I like to do that sooner than later. We are with a great company with upper management that supports us. The grass is not greener on the other side. All hard-working full-time loan officers will not worry about making a consistent monthly income. If you work hard and show that you are, you will get branch-qualified leads. Below is the testimonial from the borrower I discussed. This is the first review I have ever gotten from a borrower who did not close on their loan. I hope you guys have a great July 4th. On another note, we will have compliance meetings every week. Our ops team will update you on that.

Testimonial From Our Borrower

We like to share reviews from our clients at Gustan Cho Associates:

Where do I begin???? Gustan Cho is an AMAZING professional and human being!!! He has been able to do what other “professionals” are too lazy or unknowledgeable to do. At first, like many others, I was initially skeptical of the 80+ reviews I read. But I did my due diligence, took a chance, and sent him a message. Just like everyone said, he contacted me immediately. We spoke for over an hour! At my most desperate hour, he was a pillar of strength! When I first spoke to him, I was literally in tears, and he had me laughing before we hung up the phone! He is extremely knowledgeable and hard-working. We had a unique financial situation and couldn’t get the proper help. But Gus was confident, quick, and reliable. He always called, texted, or emailed us promptly. He had an outstanding team of professionals that are available nearly 24/7! And I swear he doesn’t sleep! Do yourself a favor and go to Google and read all his amazing reviews! I did, and now I can confirm they are spot on! Of course, NOBODY can have 100% excellent reviews because you can never always please everyone. There is always someone who will never be happy, even if you bend over backward. But Gus’ motto is “where there is a will. There is a way”! And if there is any glimmer of hope within reason, this man will help you! I will always be eternally grateful for his help and support! I told him he was a “miracle worker”! He is an “angel from heaven”! God Bless Gus!

What Is The Lowest Credit Score To Buy a House?

They may require a 640 credit score even though HUD Guidelines on credit scores is at 580 FICO. This higher credit score requirement is the lender’s credit score guidelines and NOT what HUD requires on FHA loans. So in the above example, the borrower may qualify for an FHA Loan with Gustan Cho Associates. However, the borrower does not qualify with the lender the borrower went to. That lender has a higher credit score requirement than HUD Guidelines. There are dozens of overlays that lenders can impose. The team at Gustan Cho NMLS specializes in government and conventional loans with no overlays. No lender overlays on FHA, VA, USDA, and Conventional loans. Most loans at Gustan Cho Associates close in 21 days or less.

Testimonial From a Recent Loan Officer at Gustan Cho Associates

Not only do we get thousands of borrower reviews of Gustan Cho Associates, but we will also get positive reviews from our loan officers. The team at Gustan Cho Associates has an unconventional management system. The best way to explain it is to read the most recent testimonial from the newest loan officer who joined our team. Here is a testimonial from Wendy:

Please accept this letter as a personal testimonial for Gustan Cho and Gustan Cho Associates. Although Gustan Cho Associates get thousands of borrower review of Gustan Cho Associates, I like to give a testimonial on how it has been a Godsend working for Gustan Cho Associates. I feel that sharing this with you will be clear and undeniable proof of not only Gustan’s character but the type of leader he truly is. When I decided to move my family from upstate New York to Las Vegas in May of 2022, I knew that starting a new career was inevitable.

I have 20 years of finance and general management experience within the automotive industry, but the instability of the current market made me decide on a career change. The vast majority of my experience was as a General Manager of a Multi Franchise Auto Group. I pride myself on being a leader, someone who will not ask an employee to do something that I could not do myself, as well as building camaraderie and unity amongst my staff.

Upon choosing to venture into the world of Mortgages, I started to research the process of becoming licensed as well as places that I felt would be a good fit for me to work at. I reached out to Gustan Cho in May, and explained that I was not licensed yet but explained my intentions. Instead of deterring me he openly offered for us to remain in contact throughout my licensing process.

My family moved to Las Vegas August 1st 2022. I immediately registered for my test and thought it was a good time to reach back out to Gustan Cho. Knowing that the licensing process could take months in Nevada, he still took the time to offer any guidance and advice to help prepare me for the exam. I passed the test and was ready to apply for my license. Before I applied, Gus wanted to make sure that I made the best decision for my family.

Gustan Cho lives by the motto “ I’m not going to tell you what to do and if you have 1 percent doubt, I want you to look elsewhere”. He went one step further and arranged a meeting with another company here in Las Vegas to ensure I do my due diligence. Never once did he try to “sell” me. He truly cared about the well being of me and my family. After the meeting he set up for me, and also talking to other Mortgage professionals, one thing was clear.

There was no one I’d rather work for than Gustan Cho of Gustan Cho Associates. When I called Gustan Cho to give him my position, he felt it necessary to confirm and make sure I had no doubts. He then went above and beyond to help me through the licensing process and I was on my way to being part of GCA. I could write a Novel about Gus and my relationship with him. But in short I will sum it up. Gus is not only a Branch Manager, Team Leader, and Friend- Gus has become part of my family!

The relationship we built both professionally and personally will go on forever. How many employers will pick up an employee’s son at a train station and entertain him for 6 hours? I know one Gustan Cho. Everything that Gus has promised to my family has come to fruition and he is a true man of his word.

Gustan Cho prides himself on his name and character. Wealth can be defined in a multitude of ways, but “character is power; it makes friends, draws patronage and support and opens the way to wealth, honor and happiness”. That quote could not exemplify Gus any better. In conclusion I fully believe that there is NO better leader than Gustan Cho, and I consider my family and I blessed to have Gus in our lives. With the utmost respect and honor.

Stress During Mortgage Process

The mortgage process does not have to be stressful. Most loans at Gustan Cho Associates close in 21 days or less. Below is our streamlined mortgage process at Gustan Cho Associates. The mortgage process can be extremely stressful, but it does not have to be. Mortgage Loan Applicants can see this by reading the Borrower Review of Gustan Cho. Choosing a loan officer to get along with is one of the most important decisions in the home-buying process. Borrowers need to get along with their loan officers, and loan officers need to be available at all times, including evenings, weekends, and holidays.

Why Choose Gustan Cho Associates

All the loan officers at Gustan Cho Associates must be available seven days a week, evenings, weekends, and holidays to answer any calls from their borrowers. Mortgage loan officers need to understand that borrowers depend on them. It is not much to ask to ensure that you return their phone calls or email messages and answer any questions they may have. I launched our website, Gustan Cho Associates, www.gustancho.com, ten years ago.

Thousands of Positive Borrower Review of Gustan Cho Associates

The purpose was to use it as a national mortgage and real estate informational center for all of my viewer’s borrowers and real estate professionals. Our viewers have access to public information that may help them make the right choices in choosing the best mortgage loan programs. Extremely grateful for the countless Borrower Review of Gustan Cho Associates. Viewers of Gustan Cho Associates should not feel obligated that they need to use our team of loan officers or me when they call us.

Staff at Gustan Cho Associates

We have thousands of positive borrower reviews of Gustan Cho Associates from all sections of the nation. Our staff is trained to offer information and option to any of our viewers and should not be under any obligation to go with us as their lender. Home Buyers who have any questions on any loan program, please do not hesitate to contact us at 800-900-8569 or text us for a faster response at 262-716-8151, Or email us at gcho@gustancho.com. The team is available evenings, weekends, and holidays seven days a week.