Non-QM Mortgage Lenders in Connecticut | Non-QM Loans

In this blog, we will cover and discuss qualifying with non-QM mortgage lenders in Connecticut for borrowers who cannot qualify…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

In this blog, we will cover and discuss qualifying with non-QM mortgage lenders in Connecticut for borrowers who cannot qualify…

This guide covers bad credit mortgage guidelines on home purchase and refinance. Mortgage borrowers can qualify for home loans with…

This guide covers VA derogatory credit mortgage guidelines on VA loans. VA derogatory credit mortgage guidelines on VA loans are…

This guide covers common credit score questions from first-time homebuyers. What does a “good credit or good FICO” really mean…

This guide covers the frequently asked question do I have to pay collections for FHA loan approval. We will discuss…

In this blog, we will discuss and cover shopping for mortgage with poor credit and low credit scores. Shopping for…

In this blog, we will cover and discuss the statute of limitations on collection accounts and charge-offs. We will go…

This article will discuss HUD bankruptcy guidelines following Chapter 7 and Chapter 13 bankruptcy, particularly about FHA loans. HUD Bankruptcy…

This guide covers qualifying for a home loan with a late mortgage payment in the past 12 months. Qualifying for…

This guide covers the different types of residential lending for homebuyers with bad credit out in todays marketplace for owner-occupant…

Trying to cheat the system and not getting building permits when renovating your home can backfire on you when it comes to selling your home.

HUD oversees the Federal Housing Administration (FHA) and helps homebuyers in buying a home in Tennessee with bad credit and…

In this article, we will discuss and cover the FHA credit guidelines on how to get qualified for an FHA…

In this article, we will cover and discuss qualifying for a mortgage with recent derogatory credit with our non-QM loan…

This guide covers how to buy a house with bad credit. Many folks assume you cannot get a mortgage loan…

Many agency guidelines list extenuating circumstances as reasons for getting qualified for a mortgage when otherwise they would not qualify. However, borrowers need to understand

In this article, we will discuss and cover homebuyers qualifying for bad credit mortgage loans Alabama. Qualifying for bad credit…

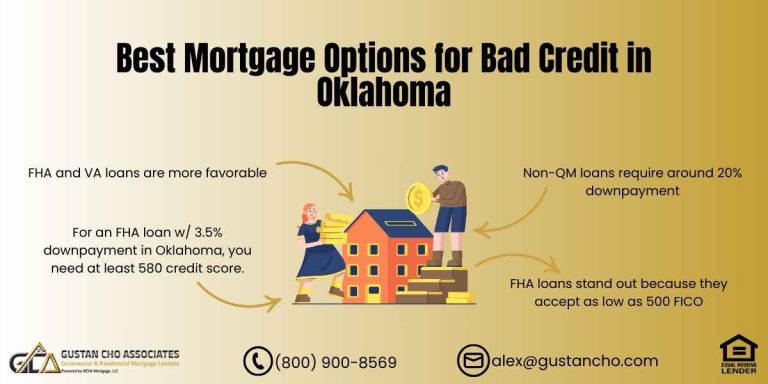

This article will explore the Best Mortgage Options For Bad Credit in Oklahoma in 2024. Gustan Cho Associates can guide…

Is Possible To Buying Home In Mississippi With Bad Credit With Lender With No Overlays? Yes, it is at Gustan Cho Associates. Gustan Cho Associates is a mortgage company licensed in Mississippi.

Can an individual with a credit score of 500 be eligible for a VA loan? Absolutely. The Veterans Administration (VA)…

Mississippi has one of the hottest housing markets in the nation. The housing market in the state has been booming for many years.

The conventional loan waiting period after deed-in-lieu of foreclosure and short sale of four years is shorter than the 7-year…