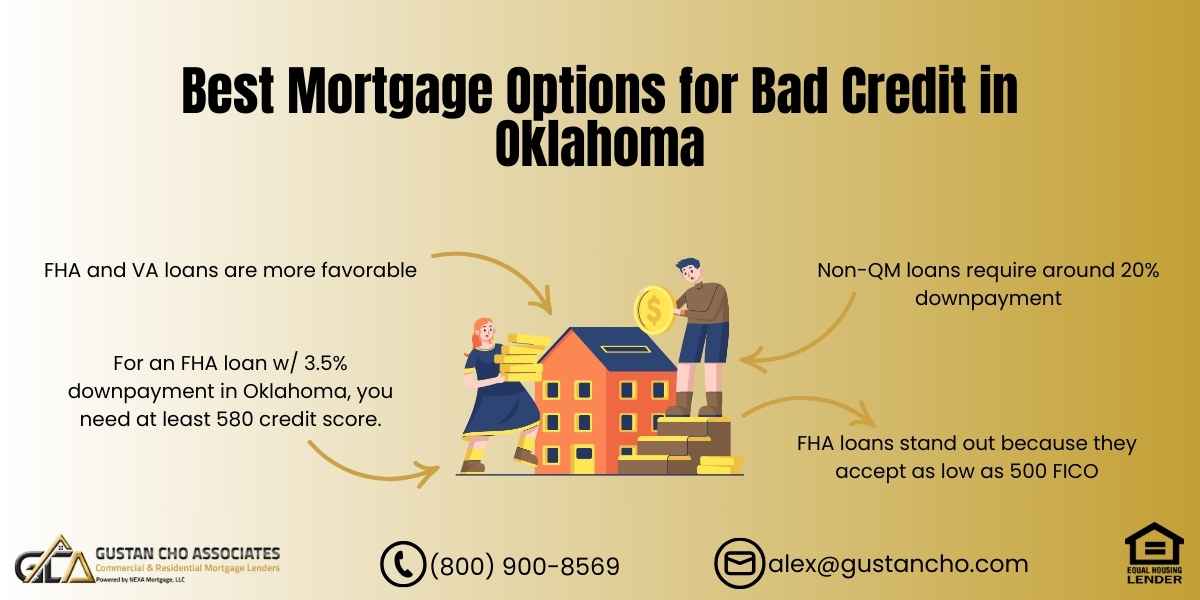

This article will explore the Best Mortgage Options For Bad Credit in Oklahoma in 2024. Gustan Cho Associates can guide the optimal mortgage options for those with bad credit in Oklahoma. FHA and VA loans stand out as the most favorable among these options due to their low down payment requirements.

It’s worth noting that VA loans are exclusively available to eligible veterans holding a certificate of eligibility. Let’s delve into FHA loans, which we consider the premier mortgage choice for individuals with bad credit in Oklahoma this year. While several mortgage options are tailored for individuals with poor credit in Oklahoma, FHA loans shine as they demand only a modest down payment and accept credit scores as low as 500 FICO.

Click Here To Qualify For A Mortgage With 500 FICO

What is the lowest credit score I can get for a mortgage in Oklahoma?

Qualifying for a home purchase FHA loan with a 3.5% down payment in Oklahoma hinges on meeting a minimum credit score requirement 580. Notably, HUD, the governing body of FHA, extends eligibility to borrowers with credit scores as low as 500 FICO. On the other hand, VA loans offer a more flexible approach, waiving any minimum credit score prerequisite, provided applicants secure an AUS approval or qualify for manual underwriting.

Non-QM loans emerge as a promising mortgage alternative when you look at the best mortgage options for bad credit in Oklahoma for 2024. Despite their appeal, these loans mandate a substantial 20% down payment, ensuring a degree of financial commitment from borrowers. Exploring the best mortgage options for bad credit in Oklahoma underscores the importance of understanding each choice’s eligibility criteria and financial implications.

FHA Loans For Bad Credit in Oklahoma

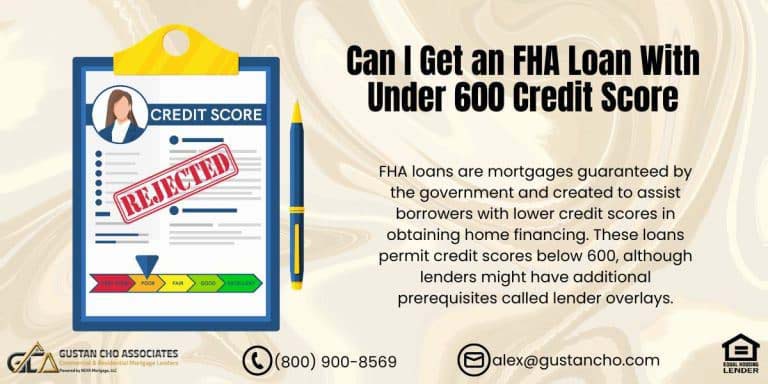

FHA loans are a favorable choice when finding the best mortgage options for bad credit in Oklahoma. FHA loan guidelines specifically cater to borrowers with less-than-ideal credit scores, allowing those with scores as low as 500 FICO to qualify. This accessibility makes FHA loans an attractive solution for individuals in Oklahoma who are struggling with poor credit but still aspire to own a home.

However, it’s crucial to recognize that securing FHA loans for bad credit in Oklahoma entails various considerations, including how credit scores can influence debt-to-income ratio requirements. Navigating these intricacies with the guidance of a knowledgeable lender can help borrowers maximize their chances of approval and secure the financing they need to achieve homeownership.

In Oklahoma, where credit challenges may hinder traditional mortgage options, FHA loans emerge as a hope for prospective homebuyers with less-than-perfect credit histories. These loans offer a pathway to homeownership by providing accessible terms and qualifying criteria, making them one of the best mortgage options for individuals grappling with bad credit.

Nevertheless, borrowers in Oklahoma need to approach the process with an awareness of the nuances involved. Borrowers can make informed decisions and improve their financial standing over time by understanding how credit scores affect eligibility and loan terms. With diligence and the right support, even those with bad credit can explore viable avenues toward securing a mortgage and realizing their homeownership dreams in Oklahoma.

FHA Loans With High Debt To Income Ratio in Oklahoma

When looking for the best mortgage options for bad credit in Oklahoma, FHA loans are reliable choices. These loans cater to borrowers with less-than-ideal credit scores, offering accessible terms and requirements. Consumers with challenging credit histories can benefit from the flexibility of FHA loans in accommodating varying debt-to-income ratios.

However, it’s important to note that the approval process heavily relies on automated underwriting systems, which assess applicants based on various factors, including credit scores and income levels.

Understanding the intricacies of FHA loans is essential for those exploring the best mortgage options for bad credit in Oklahoma. While these loans provide a pathway to homeownership for individuals with less-than-perfect credit, they also come with specific requirements and considerations.

Lenders consider the debt-to-income ratio when approving loans, so responsible debt management is important for borrowers. By familiarizing themselves with the criteria set forth by FHA loans and working to improve their financial standing, borrowers can navigate the mortgage landscape more effectively and secure the best possible terms for their circumstances.

Talk To A Loan Officer About Your Debt-To-Income Ratio Today

FHA Loans With 500 FICO in Oklahoma

Credit scores are crucial in determining various aspects of FHA loans, including the required down payment. To qualify for a home mortgage loan with a 3.5% down payment, a credit score of at least 580 is mandated by HUD, the overseeing body of FHA. Consumers with credit scores ranging between 500 and 579 may still be eligible for FHA loans.

However, they must make a higher down payment of 10%. It’s important to note that credit scores also influence mortgage rates across all loan programs.

Now, let’s delve into the best mortgage options for bad credit in Oklahoma and the recommended loan programs.

Best Mortgage Lenders For Bad Credit With Best Rates For Low Credit Scores

When securing the best mortgage options for bad credit in Oklahoma, it’s important to understand how credit scores affect loan rates. FHA loans tend to be more forgiving of lower credit scores than conventional loans. For conventional loans, optimal rates typically require a credit score of 740 or above.

However, rates may incrementally rise for every 20-point decrease below this threshold. Lenders and creditors generally perceive higher credit scores as indicative of lower risk, resulting in more favorable terms. In comparison, lower credit scores may be associated with higher risk, potentially leading to less favorable rates.

Comparing Mortgage Rates on FHA vs Conventional Loans in Oklahoma

Given that the Federal Housing Administration backs FHA loans to mitigate the risk of default for Oklahoma FHA-approved lenders, credit score considerations are less stringent than for conventional loans. This explains why FHA Loans are less sensitive to credit scores. Achieving the best FHA mortgage rates typically requires a credit score of 680 or higher.

Individuals with credit scores below 640 can expect higher mortgage rates. It is essential to comprehend these dynamics to discover the optimal mortgage alternatives for individuals with poor credit in Oklahoma.

Oklahoma FHA Loans With Under 600 Credit Scores

For individuals looking for the best mortgage options for bad credit in Oklahoma, it’s crucial to note that credit scores below 600 often result in higher mortgage rates and the potential requirement to pay discount points. Due to strict regulations in the mortgage industry, FHA loans typically cap mortgage rates for borrowers with credit scores under 600 FICO at 4.75%.

It’s rare to find lenders offering rates exceeding 6.0%, and even a 5.0% rate is uncommon. Additionally, there are mandated maximum caps on FHA loan charges, ensuring lenders cannot excessively increase rates regardless of borrowers’ low credit scores.

FHA Loans With High DTI in Oklahoma

Credit scores influence the debt-to-income ratio requirements for FHA-insured mortgage loans. In Oklahoma, prospective homebuyers aiming for a 3.5% down payment FHA loan should have a FICO score of at least 580. It is important to note that there is a significant difference in the qualification criteria for FHA loans when the credit score falls below 620.

Although the minimum credit score requirement for a 3.5% down payment home purchase loan is 580, it does not guarantee automatic approval for borrowers with this score. Those with credit scores under 620 must meet mandatory criteria to secure approval through the automated underwriting system.

Despite these considerations, FHA loans stand out as one of the best mortgage options for individuals with bad credit in Oklahoma for 2024.

DTI Versus Credit Scores on FHA Loans

The primary consideration for individuals seeking the best mortgage options for bad credit in Oklahoma is their credit score, particularly for those with scores under 620. HUD mandates that for scores below this threshold, the debt-to-income ratio (DTI) requirement decreases to 43% for approval through automated underwriting.

On the other hand, for those with credit scores of 620 or above, FHA loan eligibility sets the back-end DTI requirement at 46.9% front end and 56.9% back end for approval via automated underwriting.

FHA Loans is the Best Mortgage Options For Bad Credit in Oklahoma With Low FICO

For individuals in Oklahoma seeking the best mortgage options for bad credit, one challenge they might face is the verification of rent. This verification process hinges on specific criteria to be considered valid. Firstly, renters must have consistently paid their monthly rent by check or bank wire for the preceding 12 months.

Any payments made in cash with a landlord receipt are not accepted. Additionally, payment punctuality is crucial, as any late payments could jeopardize the validity of the verification.

Can I Get an FHA Loan With 530 FICO and High DTI?

When seeking the best mortgage options for bad credit in Oklahoma, it’s important to note that those with credit scores below 620 might be required to demonstrate one month’s reserves per the automated underwriting system’s assessment.

To qualify for a loan, borrowers must have reserves equivalent to one month’s PITI. These reserves must come from the borrower’s funds and cannot be given as a gift. They are not mandated to be held in escrow and can be maintained in the borrower’s bank account.

Alternatively, assets such as investment accounts or 401k retirement savings can be utilized as reserves. It’s worth mentioning that there’s no ongoing enforcement of reserves once borrowers have closed on their home loans.

What Type of Home Loan Is Easiest To Qualify For in Oklahoma?

Finding the best mortgage options for bad credit in Oklahoma can be challenging, particularly when navigating FHA Credit Score Requirements. Homebuyers, particularly first-timers, often encounter confusion because not all mortgage lenders adhere to the same standards.

Despite FHA Home Loans being government-backed, individual lenders may impose higher credit score requirements, known as lender overlays. Understanding that being turned down by one lender doesn’t necessarily mean you won’t qualify elsewhere is crucial.

While many homebuyers initially approach their local bank for a mortgage, most banks demand a credit score 640, even though the FHA Credit Score Requirements stand at 580. This discrepancy is attributable to lender overlays.

Do Lenders Have Different Requirements on Same Mortgage Program?

There are two sets of FHA Guidelines:

- Agency Guidelines mandated by the U.S. Department of Housing and Urban Development

- Lender Overlays

All lenders need to meet Agency Guidelines mandated by HUD. However, every lender has a right to have its own lender overlays that are above and beyond those of the minimum agency guidelines. For example, HUD requires a 580 credit score for homebuyers to qualify for FHA Loans with a 3.5% down payment.

However, most banks will not accept any borrowers without a 640 credit score. This higher lending guideline imposed by lenders is called lender overlays. Gustan Cho Associates Mortgage Group is one of the very few national lenders with no overlays on government and conventional loans. Over 75% of our borrowers are folks who could not qualify at other lenders due to their strict overlays on top of agency guidelines.

FAQ: Best Mortgage Options For Bad Credit in Oklahoma For 2024

- 1. What are the best mortgage options for bad credit in Oklahoma in 2024? If you’re seeking the best mortgage options for bad credit in Oklahoma, Gustan Cho Associates can guide you towards optimal solutions. FHA and VA loans are particularly favorable due to their low down payment requirements.

- 2. What credit score do I need to qualify for a mortgage in Oklahoma? For an FHA loan with a 3.5% down payment in Oklahoma, you generally need a credit score of at least 580. However, VA loans offer more flexibility, often waiving minimum credit score requirements, depending on Automated Underwriting System (AUS) approval or manual underwriting eligibility.

- 3. What are Non-QM loans, and how do they fit into mortgage options for bad credit in Oklahoma? Non-QM loans are another option for those with poor credit in Oklahoma, but they typically require a larger down payment of around 20%.

- 4. Why are FHA loans considered the premier mortgage choice for bad credit in Oklahoma? FHA loans stand out because they accept credit scores as low as 500 FICO and require only a modest down payment, making homeownership more accessible to individuals with bad credit.

- 5. How do FHA loans accommodate high debt-to-income ratios in Oklahoma? FHA loans offer flexibility in debt-to-income ratio requirements, particularly for borrowers with lower credit scores. However, applicants must meet certain criteria for approval through the automated underwriting system.

- 6. What is the significance of credit scores in securing favorable mortgage rates in Oklahoma? Credit scores play a crucial role in determining mortgage rates. Generally, higher credit scores result in more favorable rates, while lower scores may lead to higher rates due to perceived risk.

- 7. How do FHA loans compare to conventional loans regarding credit score requirements in Oklahoma? FHA loans are generally less sensitive to credit scores than conventional ones, making them more accessible to individuals with lower credit scores.

- 8. What are the challenges associated with credit scores under 600 when seeking mortgage options in Oklahoma? Credit scores below 600 may result in higher mortgage rates and potential requirements for additional fees or points, but there are caps on how much lenders can increase rates based on credit scores.

- 9. How do credit scores and debt-to-income ratios influence FHA loan eligibility in Oklahoma? Credit scores and debt-to-income ratios are both crucial factors in FHA loan eligibility. While the minimum credit score requirement for a 3.5% down payment is 580, borrowers with scores below 620 may face stricter criteria for approval.

- 10. What verification processes are involved in securing an FHA loan with low credit in Oklahoma? Verification of rent is essential for FHA loan applicants in Oklahoma, and certain criteria must be met to ensure the validity of rent payments.

- 11. What reserves are required for FHA loan applicants with credit scores below 620 in Oklahoma? Borrowers with credit scores below 620 may be required to demonstrate one month’s reserves per the automated underwriting system’s assessment, which must come from the borrower’s funds and cannot be gifted.

- 12. Do lenders have different requirements for the same mortgage program in Oklahoma? Yes, lenders can impose additional requirements, known as lender overlays, on top of the minimum agency guidelines mandated by HUD. These overlays may include higher credit score requirements or other criteria for loan approval.

If you have any questions on Best Mortgage Options For Bad Credit in Oklahoma For 2024, please contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

This blog about the Best Mortgage Options For Bad Credit in Oklahoma For 2024 was updated on February 21, 2024.

Contact Us To Find The Best Mortgage Options For Bad Credit In Oklahoma