Top Cities in The United States To Invest in Real Estate

This guide will cover the top cities in the United States in which to invest in real estate. It is…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide will cover the top cities in the United States in which to invest in real estate. It is…

This guide covers mortgage lender overlays on FHA and VA loans. Mortgage lender overlays are mortgage lending guidelines above and…

This guide covers the importance of credit reports in the mortgage application process. Our society is credit-driven. Almost every aspect…

The Best Wholesale Mortgage Lenders for Non-Prime Loans: Your Complete Guide in 2025 Are you a borrower with less-than-perfect credit,…

This guide covers mortgage rate adjustments (LLPAs) for higher-risk borrowers. The lower your credit scores, the higher your mortgage rates….

This article will cover what escrow hold back is in the mortgage loan process. We will discuss escrow hold back…

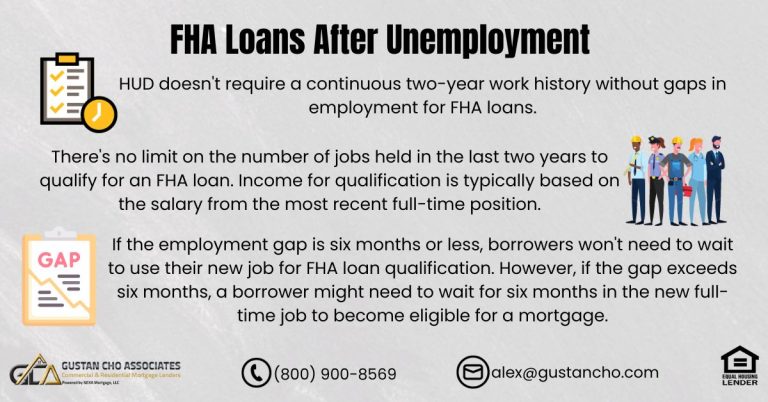

This blog examines the eligibility requirements for FHA loans after unemployment or employment gaps. Prospective FHA loan applicants now have…

FHA Debt-To-Income Ratio Requirements: What You Need to Know If you’re applying for an FHA loan, one of the most…

There is no reason why a pre-approved borrower should ever get a last-minute mortgage denial by a mortgage underwriter. The main reason why borrowers get a last-minute mortgage

In this blog, we will cover and discuss qualifying and getting a mortgage approval for home purchase on acreage in…

FHA Loan with Recent Late Payments: A Guide to Qualifying Suppose you’ve had recent late payments on your credit report….

Appraisal Transfer Policy: How to Transfer a Home Appraisal to a New Lender If you’re changing mortgage lenders and have…

Most mortgage lenders really don’t like seeing overdrafts in bank statements. If they spot an overdraft, it can make them…

What Are Hard Money Lenders? A Simple Guide for Real Estate Investors and Borrowers If you’ve been turned down by…

Qualifying for Mortgage With Irregular Income: 2025 Guide for Homebuyers Are you worried that your irregular income might stop you…

Every Mortgage Loan Program Has Its Own Agency Guidelines When It Comes To Qualifying For A Mortgage With An Outstanding Tax Lien And/Or Judgment

Mortgage Insurance Premium on Non-QM Mortgage Loans: What You Need to Know When buying a home, mortgage insurance premium often…

Bankruptcy and foreclosure both damage your credit and can make it difficult or impossible to buy or refinance a home. But one is worse than the other.

Steps in the Underwriting Process: What Borrowers Need to Know in 2025 If you’re buying a home or refinancing your…

AUS Approval On Conventional Loans Versus Refer-Eligible Per AUS: There are ways and tricks of the trade to get an approve eligible per automated underwriting system on conventional loans.

Buying a home with a well and septic system can feel confusing, mainly if you’ve never dealt with private utilities…

Buying a house can be exciting, but feeling a bit nervous about the mortgage process is normal. One big question…