Getting Faster Mortgage Approvals and Closing on Time

Borrowers should not stress during the mortgage process. . There is no reason why there should be stress during the mortgage process.

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Borrowers should not stress during the mortgage process. . There is no reason why there should be stress during the mortgage process.

This guide covers what is the definition of net tangible benefits for refinancing. When mortgage rates were at a 3-year…

This guide covers the steps in mortgage process for closing home loan on time. Homebuyers looking to purchase a new…

This guide covers how to close on home loan after losing job during mortgage process. We will show you qualifying…

This guide covers mortgage underwriter errors causing borrowers a loan denial. Mortgage underwriter errors do happen. Underwriters are human and…

Dozens of non-QM loan programs have been created and launched in recent years. A large percentage of homebuyers who cannot qualify for traditional loans gravitate towards non-QM loans.

This guide covers the difference between FHA and Conventional mortgage guidelines. Many homebuyers, especially first-time buyers shopping for homes often…

This guide covers the truth in lending disclosure during the mortgage process. Mortgage disclosures are required to be disclosed to…

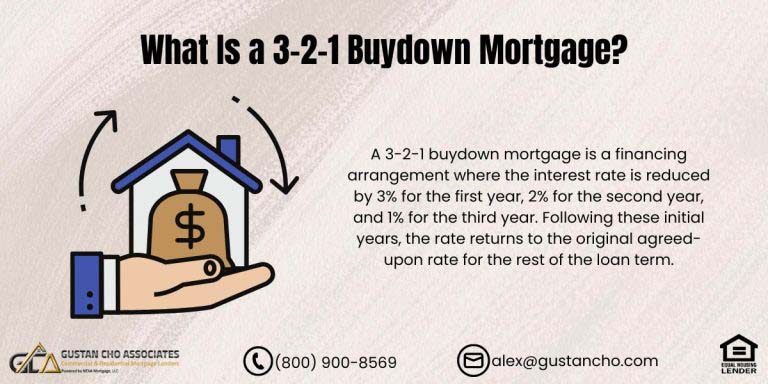

In this blog, we will cover what a 3-2-1 buydown mortgage is. We will also discuss the differences between a…

Non-qualifying mortgages, commonly known as Non-QM loans, cater to borrowers seeking alternative home loan programs that diverge from the parameters…

FHA mortgage loans stand out as the leading choice among borrowers in the United States. The Federal Housing Administration (FHA)…

This article delves into the lending prerequisites and regulations concerning mortgage with new job. It addresses the misconception that one…

This blog addresses the eligibility criteria for obtaining a mortgage and securing approval despite having experienced employment gaps within the…

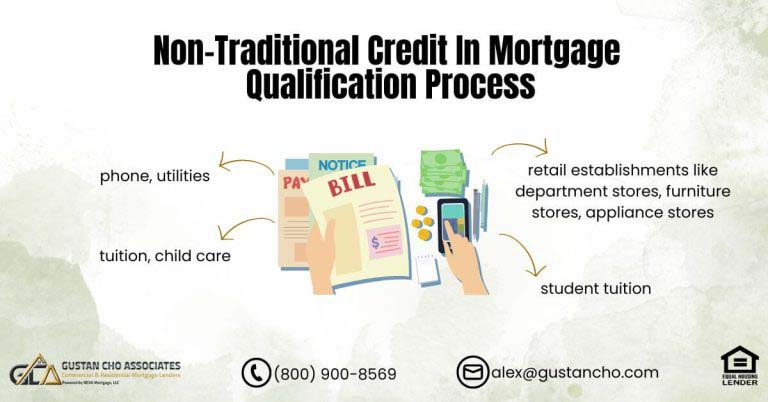

This blog delves into the significance of non-traditional credit in mortgage qualification process, particularly focusing on scenarios where borrowers lack…

This article delves into Mortgage For College Graduates Lending Guidelines, shedding light on established norms and recent changes that may…

This guide covers avoiding home loan denial during the mortgage process. We will go deeply in giving our viewers tips…

How To Get Refer To Approve-Eligible Per AUS To Qualify For Mortgage: There are ways of trying to get a refer/eligible findings to an approve/eligible per automated underwriting system.

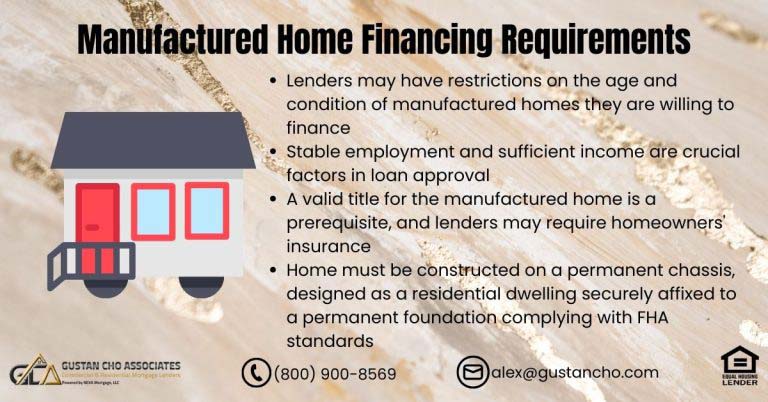

This guide covers manufactured home financing requirements. Many home buyers of manufactured home financing have a difficult time getting it….

Every mortgage borrower is different. Your income, debts, credit rating, savings, and goals are unlike anyone else’s. The best mortgage for your neighbor might be the worst home loan for you.

This guide covers VA credit agency guidelines versus lender overlays on VA loans. Understanding VA Credit Score Agency Guidelines is…

This guide covers the benefits of paying mortgage balance early before end of loan term. Paying mortgage balance early before…

This guide explains Fannie Mae second home guidelines, especially vacation properties. As of 2025, a minimum down payment of 10%…