12 Home Buying Mistakes To Avoid By First-Time Homebuyers

12 Common Home Buying Mistakes and How to Avoid Them (2026 Guide) Buying a home is one of the biggest…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

12 Common Home Buying Mistakes and How to Avoid Them (2026 Guide) Buying a home is one of the biggest…

Home Loan After Foreclosure: 2026 Waiting Period Guidelines and Options Losing a home to foreclosure can feel like the end…

Conforming Loan Underwriting Guidelines: What You Need To Know in 2025 If you’re considering buying a home and want a…

In this guide, we will cover self-employed mortgage borrowers with no income tax returns required on a home purchase. Many…

Kentucky’s economy is booming, especially the housing market. Many individual taxpayers and businesses are making Kentucky their home due to low state taxes and affordable housing and low property taxes. Homebuyers are finding home priced reasonably and home prices are beginning to creep up.

This guide covers why underwriters issue denials on mortgage loans. The mortgage process should not be a stressful process and…

Preparing Credit Profile to Qualify for Mortgage: 2025 Guide Buying a home is exciting, but getting approved for a mortgage…

Steps of the Home Mortgage Process: A Simple Guide to Get Approved Fast Are you thinking about buying a home…

Are you preparing to qualify for conventional loans? Many homebuyers want to avoid FHA loans because of mortgage insurance, stricter…

Buying a home in Florida is a dream for many people. Sunshine, beaches, no state income tax, and year-round outdoor…

In this blog, we will cover and discuss FNMA waiting period guidelines after foreclosure for 2025. Conventional loans are often…

Veteran administration loans are one of the most powerful mortgage options available to the men and women who served our…

In this blog, we will discuss and cover the bankruptcy mortgage guidelines on government and conventional loans. All mortgage loan…

Many Americans are familiar with the terms Fannie Mae and Freddie Mac, but may not know exactly what they represent….

In this article, we will discuss and cover how FHA credit score determines mortgage rate pricing on FHA loans. FHA…

In this blog, we will cover and discuss qualifying for FHA jumbo loans while in Chapter 13 Bankruptcy repayment plan….

Homebuyers have many mortgage options when looking for home loans in Virginia for bad credit and low credit scores. The…

Gustan Cho Associates is a mortgage broker licensed in 48 states (Not licensed in NY, MA) with a wholesale lending…

Subprime mortgages never really disappeared—they evolved. Today, they live under labels like “non-prime” or “non-QM” (non–qualified mortgage), but the core…

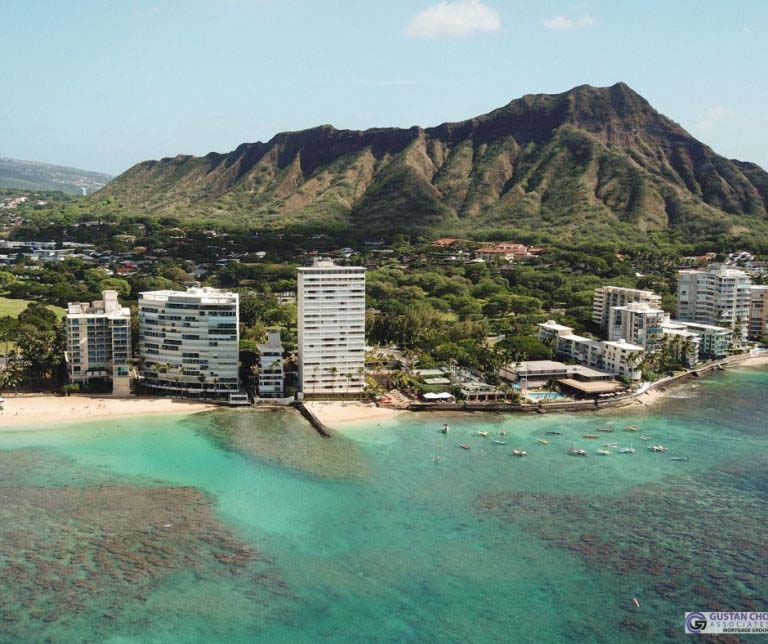

The latest data of the top 10 most expensive states to buy a house in 2026 has been released and…

Active and/or retired members of the United States Armed Services and eligible surviving spouses of eligible veterans in Kentucky can…

When you hear the phrase recommended lender by realtors, it usually means one thing: this lender has already proven they…