Rapid Rescore During Mortgage Process And How It Works

In this blog post, we will discuss the concept and procedure of rapid rescore during mortgage process. Consumer credit profiles are…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

In this blog post, we will discuss the concept and procedure of rapid rescore during mortgage process. Consumer credit profiles are…

This guide covers buying an investment property using a conventional loan. Buying an investment property using a conventional loan with…

This guide covers home inspection before proceeding with the mortgage process. A home inspection is an inspection of a home…

In this article, we will discuss VA AUS approval versus manual underwriting on VA loans. VA loans are the best…

This guide covers what is earnest money on home purchase. Earnest money is a deposit a homebuyer submits with the…

In this blog, we will discuss and cover HUD waiting period guidelines after Chapter 13 on FHA loans. Why is…

In this article, we will be covering the topic on are all mortgage lenders the same. Choosing the right mortgage…

In this blog, we’ll explore the process of working with a loan officer during your mortgage application. Choosing a loan…

We will be covering qualifying and getting approved for VA mortgage loans in Arizona. Arizona is one of the most…

In this blog, we will discuss and cover qualifying for a VA loan with prior mortgage included in bankruptcy. VA…

This guide covers credit scores and mortgage rates versus pricing adjustments. Credit scores and mortgage rates go side by side….

This guide covers what is PMI on conventional loans. What Is PMI? One of the most common questions I often…

Many homebuyers have substantial value on their 401k. They can use up to 60% of the value of their 401k for their down payment and/or closing costs on their home purchase. The amount used from their 401k is not used for their debt to income ratio calculations.

This guide covers housing demand strong despite highest mortgage rates and surging inflation numbers. Home sales throughout the United States…

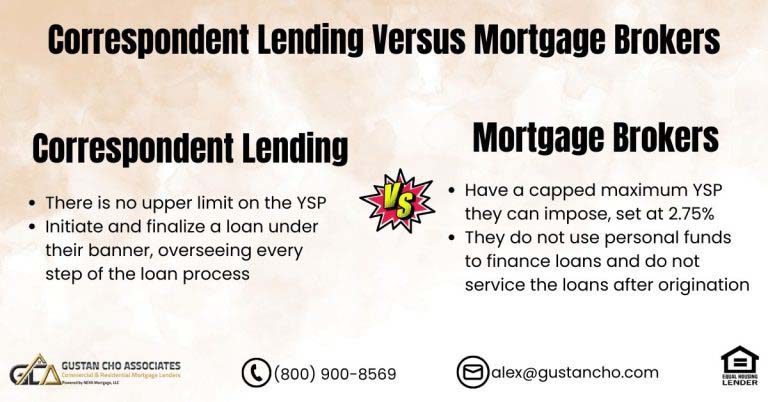

This blog aims to explore the difference between correspondent lending and mortgage brokers. A common inquiry we receive regularly pertains…

All mortgage loan programs require a maximum front debt-income ratio and back debt to income ratio. However, conventional loans do not require a front debt to income ratio. VA loans do not have a debt to income ratio requirements. Lenders can have lender over lender overlays on debt to income ratios.

In this blog, we will cover the Freddie Mac HomeOne Mortgage Loan Program. Fannie Mae and Freddie Mac are the…

This guide covers qualifying for the lowest FHA mortgage rates on FHA loans. Qualifying for the lowest FHA mortgage rates…

This article explores the Factors Affect Pre-Approval And Stress During Mortgage Process. Once individuals decide to purchase a home, the…

This guide covers home purchase and refinance Jumbo loan mortgage loan options. There are traditional and non-qm jumbo loans for…

Brent Norkus, an insurance agent for Goosehead Insurance covers property homeowners insurance in this extensive guide. Property homeowners insurance is…

This guide covers mortgage loan options with bad credit after bankruptcy on home purchase and refinance loans. One of the…