In this article, we will discuss VA AUS approval versus manual underwriting on VA loans. VA loans are the best loan program for owner-occupant home buyers. The Department of Veterans Affairs, The VA, is the government agency that insures VA Loans to private lenders who originate and fund VA loans. The Veterans Administration does not originate nor fund VA loans. Automated Underwriting Systems:

Automated Underwriting Systems evaluate loan applications automatically based on certain criteria, including credit scores, DTI, income stability, and other financial factors.

Gaining VA (Veterans Affairs) Automated Underwriting System (AUS) approval with low credit scores and high debt-to-income (DTI) ratios can be challenging, but it’s not impossible. The VA loan program is designed to be flexible and accommodating for veterans, factoring in their unique financial situations. Here’s a general overview of how you can increase your chances of approval. The VA loan program is known for its lenient credit requirements and lack of required down payment, which makes it an attractive option for many veterans.

Key Factors for VA AUS Approval

While the VA does not require a specific minimum credit score, most lenders do. Typically, lenders look for scores of 620 or higher, but some may accept lower scores. The DTI ratio is another crucial factor. VA guidelines typically prefer a DTI ratio under 41%. However, with a strong application, some lenders may accept higher ratios.

Strategies to Improve Your Application

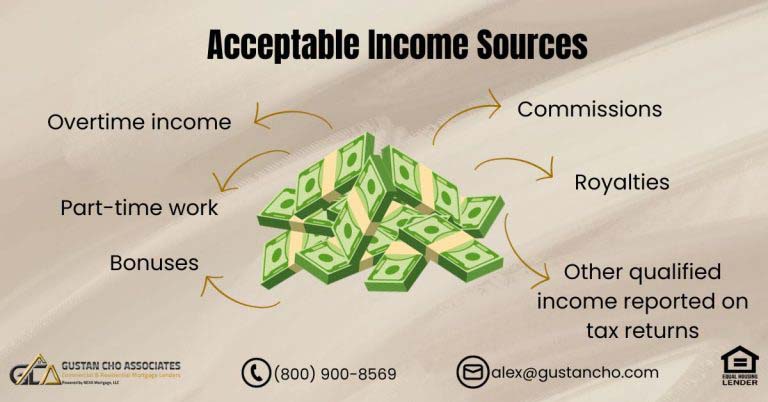

Compensating Factors: Highlight compensating factors such as long-term employment, a stable income, or significant savings. These can sway lenders to approve a loan despite lower credit scores or a higher DTI. Before applying, take steps to improve your credit score. This can include paying down debts, correcting any inaccuracies on your credit report, and ensuring your current bills are paid on time. Provide additional documentation that might help your case, such as proof of additional income, a letter of explanation for past credit issues, or similar supportive documents.

Worried About Low Credit Scores and High DTI? We Can Help You Get VA AUS Approval!

Contact us today to learn how we can help you navigate the process and get you approved for a VA loan.

Special Considerations Manual Underwriting

If the automated system declines your application, you can ask for manual underwriting. This process involves a human reviewing your application, which might be beneficial if you have compensating factors that an automated system cannot assess. Approval for a VA loan with low credit scores and a high DTI is not guaranteed, but the VA’s flexibility allows many veterans to secure financing even with financial challenges. It’s advisable to work closely with a lender who has experience with VA loans to navigate this process effectively.

Who Originates and Qualifies VA Loans?

VA Mortgages are originated and funded by private VA-Approved Lenders. In the event borrowers default their VA loans and the property goes into foreclosure, the VA will partially guarantee the loss the lender sustains. Due to this government guarantee by The VA, lenders can offer 100% financing at very low rates on VA loans. In this blog, we will discuss VA AUS Approval Versus Manual Underwriting on VA loans.

VA Guidelines and Getting VA AUS Approval

The Automated Underwriting System (AUS) is a sophisticated automated system that analyzes the specific agency mortgage guidelines within a matter of seconds and renders an automated decision. The three decisions the automated underwriting system (AUS) will render the following decisions. Borrowers who meet all agency mortgage guidelines will get an approve/eligible per AUS. Refer/Eligible means the automated underwriting system cannot render an automated underwriting system approval but the file is eligible for manual underwriting. Refer with caution means the borrower does not qualify. Getting VA AUS Approval is key. Lenders who get VA AUS Approval can get their VA Loans processed and closed if they can meet the conditions rendered by the automated underwriting system. The AUS has the algorithms of VA Mortgage Guidelines.

Eligibility Requirements on VA Loans To Get VA AUS Approval

Here are the basic VA Mortgage Guidelines. Borrowers who meet the following VA eligibility requirements should get an automated underwriting system (AUS) approval. The 100% financing means no down payment is required on VA Loans. The VA does not have a minimum credit score requirement. Borrowers with 500 FICO can get a VA AUS Approval. The VA does not have a maximum debt to income ratio requirement if the borrower has a residual income. Outstanding collections and charge-off accounts do not have to be paid off to get a VA AUS Approval.

Timely Payments in the Past 12 Months is Key in Getting AUS Approval

Timely payments in the past 12 months in getting an automated underwriting system approval. There are no credit tradeline requirements but credit tradelines are positive in getting AUS approval. Reserves and down payments are considered compensating factors for manual underwriting and/or borrowers with lower credit scores. The 2-year waiting period after Chapter 7 Bankruptcy discharged date, foreclosure, deed in lieu of foreclosure, short-sale. The VA understands that many active and retired veterans of the armed services may have lower credit profiles than their civilian counterparts. Soldiers may have difficulty paying their bills timely when they are deployed overseas. Gustan Cho Associates have gotten countless of VA AUS Approval of borrowers with credit scores in the 500 FICO and debt to income ratios over 60% DTI.

Lender Overlays Versus VA Agency Guidelines

Gustan Cho Associates is a mortgage company licensed in multiple states with no lender overlays on VA loans. As long as the borrower gets a VA AUS Approval and they can meet the conditions of the AUS, then the loan will close. However, not all lenders are like Gustan Cho Associates. Most lenders have overlays on VA Loans. What lender overlays are mortgage guidelines that are above and beyond VA Lending Guidelines. For example, the VA does not have a minimum credit score requirement.

Lender Overlays on VA Loans

Most lenders will require a 620 credit score. The 620 credit score requirement is a lender overlay by the particular lender. The VA does not have a maximum credit score requirement. However, it is typical for a lender to have a 45% to 50% DTI requirement as part of their lender overlays. The bottom line is many lenders will require additional lending requirements on VA loans even though the borrower has a VA AUS Approval. Gustan Cho Associates has no lender overlays on government and conventional loans.

Struggling with Low Credit and High DTI? We Specialize in VA AUS Approvals!

Reach out today to see how we can assist you with VA AUS approval.

Manual Underwriting Guidelines on VA Loans

VA and FHA Loans are the only two loan programs that allow manual underwriting. If a borrower gets a refer/eligible per automated underwriting system (AUS), the file can be manually underwritten. VA Manual Underwriting Guidelines state the following:

- Meet all VA Mortgage Guidelines.

- Timely payments in the past 12 months.

- Borrowers who are in a current Chapter 13 Bankruptcy Repayment Plan can qualify for VA Loans via manual underwriting with Trustee Approval.

- There are no waiting period requirements after the Chapter 13 Bankruptcy discharged date.

- Any bankruptcy discharge that has not been seasoned for at least 2 years needs to be manually underwritten.

- Maximum debt to income ratio requirement with no compensating factors on manual underwriting is 31% front end DTI and 43% back end DTI.

- Maximum DTI with one compensating factor is 37% DTI front end and 47% DTI back end.

- The maximum debt to income ratio with two compensating factors is 40% DTI front end and 50% DTI back end.

Please Read This Blog On VA Compensating Factors On Manual Underwriting

Starting The Mortgage Process With An Experienced Mortgage Loan Officer

One or two recent late payments are not a deal killer if borrowers have extenuating circumstances. For more information in qualifying for VA VA loans with bad credit or manual underwriting, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays. For more detailed guidance, consulting with a VA-approved lender or a financial advisor who specializes in VA loans can provide personalized advice based on your specific financial situation.

FAQ: VA AUS Approval With Low Credit Scores and High DTI

- What are VA loans? VA loans are mortgage loans supported by the Department of Veterans Affairs (VA). They are available to eligible veterans, active service members, and certain National Guard and Reserve members. These loans are designed to help veterans own homes under favorable terms, including no required down payment and no private mortgage insurance.

- What is Automated Underwriting System (AUS) approval? Lenders use the Automated Underwriting System (AUS) to evaluate loan applications. This system analyzes various factors such as credit scores, debt-to-income ratios, and income stability to make lending decisions. For VA loans, getting an AUS approval can streamline the approval process, making it faster and less complex.

- Can you get VA AUS approval with low credit scores or high DTI ratios? Yes, it is possible to get VA AUS approval even with low credit scores and high debt-to-income (DTI) ratios. Although the VA does not set strict minimum credit scores, lenders typically prefer scores of 620 or higher. For DTI, a ratio under 41% is generally favorable, though some lenders may accept higher ratios with strong compensating factors.

- What are compensating factors? Compensating factors are positive aspects of a borrower’s financial profile that can offset risks associated with lower credit scores or higher DTI ratios. Examples include long-term employment, stable income, significant savings, additional income sources, or a history of making timely payments.

- What happens if AUS declines a VA loan application? Borrowers can request manual underwriting if the AUS declines a VA loan application. This process involves a human underwriter reviewing the application, which can be beneficial if there are compensating factors that the automated system might not fully appreciate.

- What is manual underwriting? Manual underwriting is an alternative to automated systems. In this approach, an underwriter personally reviews the loan application. This approach is often used when the AUS does not approve an application or when the borrower’s financial situation requires a more detailed assessment.

- What are the advantages of manual underwriting for VA loans? Manual underwriting can benefit borrowers who may not meet automated criteria but have strong compensating factors. It allows for a more personalized review of financial circumstances, such as recent credit issues, lower credit scores, or higher DTI ratios.

- Are there different guidelines for manual underwriting? Yes, manual underwriting follows specific guidelines. VA loans may include lower maximum allowable DTI ratios unless there are compensating factors. For instance, without compensating factors, the maximum DTI ratios might be set at 31% front-end and 43% back-end, which can increase with one or two compensating factors.

- What should you do if you’re considering a VA loan? If you’re considering a VA loan, you should start by consulting with a VA-approved lender or a financial advisor specializing in VA loans. This can help you understand your eligibility, the application process, and how to improve your chances of approval, whether through AUS or manual underwriting.

Don’t Let Low Credit and High DTI Stop You from VA AUS Approval!

Reach out today to learn how we can help you get approved for a VA loan.