Using overtime income to fulfill the requirements for mortgage loans is allowed under certain circumstances. Both overtime earnings and alternative income sources are deemed valid for individuals applying for a mortgage.

However, to be eligible, the borrower must exhibit a consistent two-year history of receiving overtime income. Moreover, there should be a reasonable expectation that the overtime income and other supplementary sources will persist for the next three years. It’s crucial to emphasize that meeting the standard requirement of a base income remains a prerequisite.

This blog centers on using overtime income to qualify for mortgage loans and the important things you have to consider when using overtime and supplementary income to get a mortgage.

Using Overtime Income and Other Types of Irregular Non-Traditional Income To Qualify for Mortgage

Understanding the significance of various income streams is crucial when navigating the complexities of mortgage qualification. In this context, using overtime income, income from part-time work, and bonuses are valid sources of additional earnings.

Mortgage underwriters strongly emphasize evaluating the stability of such income, aiming to ensure its continuity over the next three years. This meticulous assessment is integral to the loan approval process, as it provides lenders with confidence in the borrower’s financial capacity to meet mortgage obligations.

In home loan qualification, prospective borrowers must recognize the importance of transparency and documentation regarding overtime income and supplementary earnings. Presenting a track record of consistent extra earnings over an extended period can strengthen one’s application. Moreover, this blog aims to delve into how lenders perceive and assess overtime income, offering valuable insights to individuals seeking to leverage such earnings for their home loan qualification journey.

Using Overtime Income To Count Towards Qualified Verified Income

Lenders strive to confirm that individuals seeking mortgage loans have the financial capability to meet their future housing payment obligations. The key factor inspiring lenders’ confidence is sufficient qualified income, which guarantees a smooth and punctual repayment of the anticipated housing expenses. It is crucial to note that qualified income is the exclusive type of earnings recognized for eligibility in obtaining home loans, and cash income does not meet the criteria within this context.

In securing a mortgage, lenders prioritize assuring borrowers possess the necessary financial means to fulfill their housing payment commitments. The pivotal element instilling confidence in lenders is ample qualified income, ensuring the seamless and timely settlement of upcoming housing-related expenditures. It is essential to emphasize that qualified income is the only accepted form of earnings considered for eligibility in the approval process for home loans, with cash income falling outside the acceptance parameters. Qualified For Secure Home Loans, Click Here

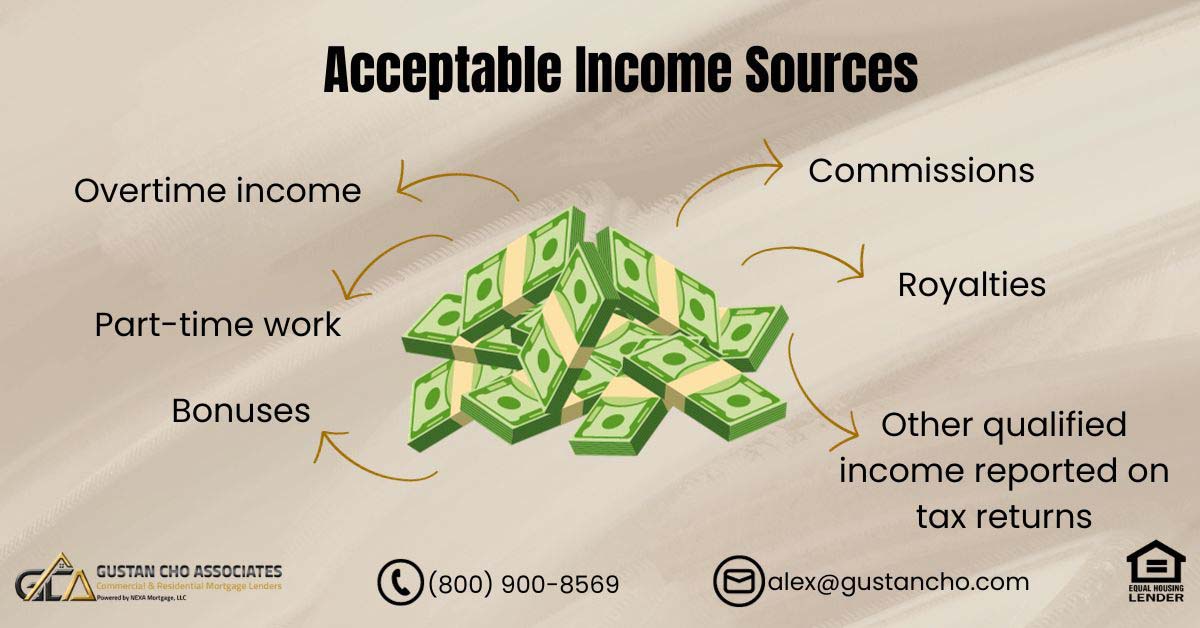

What Types Of Income Can Be Used As Qualified Income For A Mortgage

Borrowers have the flexibility to leverage various sources of income for additional qualification, using overtime income as one of the key contributors. In addition to overtime income, part-time income, bonus income, commission income, royalty income, and other qualified income reported on income tax returns are considered eligible.

However, to include this additional income in the qualification process, it must demonstrate a consistent track record of at least 24 months. Lenders require this stability as a safeguard, ensuring that the income will likely persist for the subsequent three years.

As part of the validation process, employers may be contacted to verify the applicant’s employment status and the reliability of the qualifying income.

How Do Mortgage Lenders Verify Employment

A mortgage processor manages the employment verification process on the mortgage company’s behalf. Loan officers are cautioned against granting pre-approvals to borrowers who rely on alternative income sources without proper employment verification. To facilitate this, lenders typically employ an Employment Verification (VOE) form, which employers must accurately complete.

This form delves into the borrower’s income history over the past two years, scrutinizing the sustainability of overtime, part-time, and bonus earnings for the subsequent three years.

While there is no guarantee, the form aims to gain insights into the potential continuity of this additional income. If the employer indicates ‘NO,’ the supplementary income will not be deemed valid in the mortgage application process. Ensuring the accuracy of employment information is crucial in making informed lending decisions.

Contact For Loan Officer For Your Loan, Click Here

Using Overtime Income That Is Declining And Irregular Income

Mortgage underwriters possess the authority to determine the eligibility of alternate income sources as qualified income. If a borrower encounters a reduction in income from one year to the next, other income is ineligible for consideration as qualified. For example, a significant decrease from $10,000 in overtime income in 2017 to $5,000 in 2018 indicates a noteworthy decline.

The final decision rests with the mortgage underwriter, who has complete discretion in accepting diminishing income. Nevertheless, if the reduction is due to circumstances such as maternity or sick leave, the underwriter may entertain the possibility of acceptance, although this judgment remains subjective. It is important to emphasize that a rejection from one underwriter does not guarantee acceptance from another.

Inconsistencies in overtime earnings, such as alternating periods of high overtime followed by extended breaks, are identified as irregular overtime income. Lenders give preference to a steady stream of overtime or additional earnings. Declines and irregularities in income are viewed unfavorably by lenders.

Exemption To The 2-Year Seasoning Rule

Gustan Cho Associates places significant emphasis on carefully considering overtime income and supplementary earnings as qualifying income for mortgage loans. This thoughtful approach is extended to borrowers who can showcase a steady alternate income source for at least 18 months. The evaluation of this provision occurs on a case-by-case basis, with particular attention given to borrowers boasting strong credit histories and maintaining lower debt-to-income ratios. The ultimate decision lies within the discretion of the mortgage underwriter, who plays a crucial role in determining the eligibility of overtime income in the mortgage qualification process.

For instance, suppose a borrower has consistently earned overtime income of $1,000 per month for at least 18 months. In such cases, specific steps are taken into consideration to determine the viability of this income:

- Calculate the average of the 18 months’ overtime income.

- Divide the calculated average by 24 months.

The resulting figure from this calculation is then utilized as qualified income for mortgage loan purposes. It’s important to note that applying overtime income is subject to underwriting discretion. Suppose the mortgage underwriter deems the overtime and additional income reliable and stable. In that case, it may even lead to a two-year exemption on other income considerations, showcasing the flexibility within the mortgage qualification process at Gustan Cho Associates.

For more information on this topic, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com.

We are mortgage brokers licensed in 48 states with no overlays on government and conventional loans. We are also experts on non-QM, bank statement mortgages, and alternative financing loan programs. Gustan Cho Associates has a network of over 190 wholesale mortgage lending partners with access to thousands of mortgage loan products.

The team at Gustan Cho Associates are experts in originating government and conventional loans with no lender overlays and hundreds of non-QM and alternative non-prime mortgage loan programs. Contact us even holidays and weekend Qualified for mortgage loan, click here

This blog on Using Overtime Income was updated on January 18th, 2024.