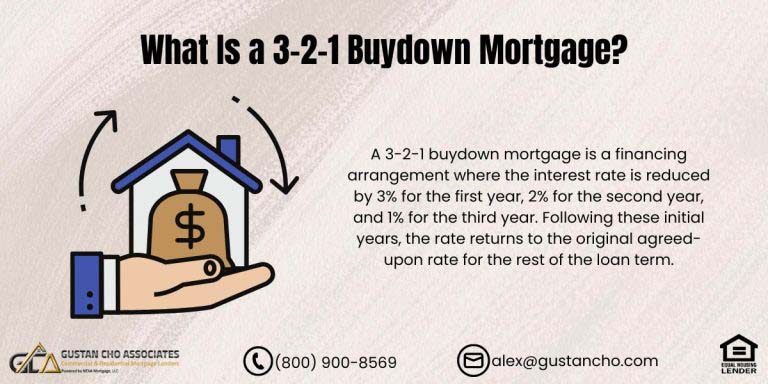

What Is a 3-2-1 Buydown Mortgage?

In this blog, we will cover what a 3-2-1 buydown mortgage is. We will also discuss the differences between a…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

In this blog, we will cover what a 3-2-1 buydown mortgage is. We will also discuss the differences between a…

This guide will cover the Texas housing market forecast for 2023 going into 2024. The Texas housing market is booming…

This guide covers mortgage rates on non-QM loans and no-doc mortgages. Current Home Mortgage Rates after the election of President…

In this blog, we will discuss lender versus borrower paid mortgage transactions. Mortgage brokers can often opt to go with…

When saving money buying a house, remember one key thing, low rates with FICO credit scores. This article will cover…

This guide covers interest rate buydowns with seller concessions on purchases. Interest Rate Buydowns are when borrowers pay DISCOUNT POINTSto…

This guide covers the first payment after closing for mortgage loan borrowers. One of the most common questions new homebuyers…

This guide covers mortgage rates and terms compared to credit scores and loan-to-value. Homebuyers planning on buying a home should…

This guide covers getting more house for your money with low property taxes. Getting more house for your money is…

This guide covers refinancing home loans with low rates. Thousands of homeowners were ready to refinance their mortgage loans last…

This guide covers things that determines your mortgage rates on home loans. Mortgage rates are the interest rates that you…

This guide covers how inflation affects the housing and mortgage markets. Whenever you turn on the news, you hear “inflation.”…

This guide covers when the right time to buy a home with high mortgage rates, skyrocketing home prices, and soaring…

Many borrowers are confused about how lenders price mortgage rates. How can mortgage rates just under 3.0% just a little…

In this article, we will discuss and cover the borrower review of Gustan Cho Associates. Just this past June 2,…

This guide will cover finding the best mortgage lenders for the best rates. Buying a home is a significant milestone,…

In this article, we will cover and discuss how mortgage lenders determine interest rates. Many home buyers and homeowners often…

In this article, we will discuss and cover the rising mortgage rates in hot housing market for homebuyers with skyrocketing…

This Article Is About Credit Score Improvement In Mortgage Process Benefits Rates Credit scores are the biggest determinant of what…

This Article Is About Calculating Annual Percentage Rate On Home Mortgage Transactions An FHA Loan or VA loan, which typically adds…

This Article Is About Mortgage Rates Are Still At Historic Lows On Purchase And Refinance: The Dow Jones Industrials have…

You’ve probably seen a few television ads promoting LendingTree or other mortgage lead sites. These sites promise to get you the best mortgage rate by making lenders compete for your business. But do they really deliver the lowest mortgage rates to consumers?