In this blog, we will discuss lender versus borrower paid mortgage transactions. Mortgage brokers can often opt to go with a borrower paid for by a mortgage borrower to save the borrower’s commissions. There is no such thing as free in the mortgage industry. The way mortgage rates charged is the higher the lender’s compensation, the higher the mortgage rates. Mortgage brokers can only charge a maximum of 2.75% yield spread premium. The yield spread premium is the compensation the mortgage broker makes.

Can Mortgage Brokers Get You Lower Rates?

Lender versus borrower paid, what’s the difference? Mortgage brokers are required to reveal their compensation details in the closing disclosure. In contrast, mortgage bankers are exempt from disclosing their compensation in the closing disclosure as they utilize their funds to finance the loan. It’s worth noting that many mortgage bankers may impose significantly higher compensation than the permissible 2.75% yield spread premium that mortgage brokers can charge.

Difference Between Lender Versus Borrower Paid Mortgage Transactions

Lender-paid and borrower-paid mortgage transactions refer to how the costs of obtaining a mortgage are distributed between the lender and the borrower. These terms are commonly used in the context of mortgage loans. Here’s a brief overview of each:

Lender-Paid Mortgage Transaction

In a lender-paid mortgage transaction, the lender covers some or all of the upfront closing costs of the mortgage loan. These upfront costs may include origination fees, appraisal fees, credit report fees, and other expenses. The lender may charge a higher mortgage interest rate to cover these costs. This means the borrower may have a slightly higher monthly mortgage payment but doesn’t need to pay the upfront fees.

Borrower-Paid Mortgage Transaction

Lender versus borrower paid, what’s the difference? In a borrower-paid mortgage transaction, the borrower is responsible for paying all the upfront closing costs associated with the mortgage. This typically includes the same fees mentioned above, such as origination and appraisal fees. In this scenario, the borrower can secure a slightly lower interest rate on the loan since the lender is not covering these costs upfront. The choice between lender-paid and borrower-paid transactions depends on various factors, including the borrower’s financial situation, preferences, and the terms the lender offers. It’s essential for borrowers to carefully consider the long-term implications of each option, taking into account their financial goals and how long they plan to stay in the home.

Is It Better To Work With a Mortgage Broker or Mortgage Banker For Best Rates?

The mortgage interest rates tend to be more favorable when working with a mortgage broker than a correspondent or mortgage banker. Mortgage brokers can provide borrowers with a cost break by charging a compensation rate lower than the typical 2.75% yield spread premium. If the mortgage broker chooses to apply a compensation rate below the standard 2.75% yield spread premium, the transaction must shift to a borrower-paid model. By transitioning to a borrower-paid structure, the loan officer can levy a fee lower than the usual 2.75% yield spread premium.

Is A Mortgage Lender or Broker Better For Compensated?

Understanding Lender Versus Borrower Paid Mortgage Transactions: Gustan Cho Associates will continue to bring our readers up to date on mortgage announcements throughout the COVID-19 coronavirus outbreak. In this blog, we will detail mortgage lender compensation as the mortgage industry is rapidly changing from this coronavirus outbreak. We will also chat on how to apply for a purchase or refinance mortgage loan at Gustan Cho Associates.

How Are Mortgage Brokers Compensated For Loan Origination?

Lender versus borrower paid, what’s the difference? Mortgage firms receive compensation through either lender versus borrower paid arrangements. These terms might be perplexing for those unfamiliar with the industry. Let’s explore the fundamentals of each compensation structure in this piece. Here, we will delve into the distinctions between lender versus borrower paid mortgage transactions. Lender paid compensation model stands as the prevailing method for mortgage companies. Indeed, numerous borrowers may need help to grasp the intricacies of this system due to its widespread use.

How Does Lender Versus Borrower Paid Compensation Work?

One of the difference between lender versus borrower paid compensation is the terminology and practices related to lender-paid and borrower-paid transactions may vary among lenders and regions. Borrowers should thoroughly review all loan documents and consult with their lender or financial advisor to understand the details of their specific mortgage transaction.

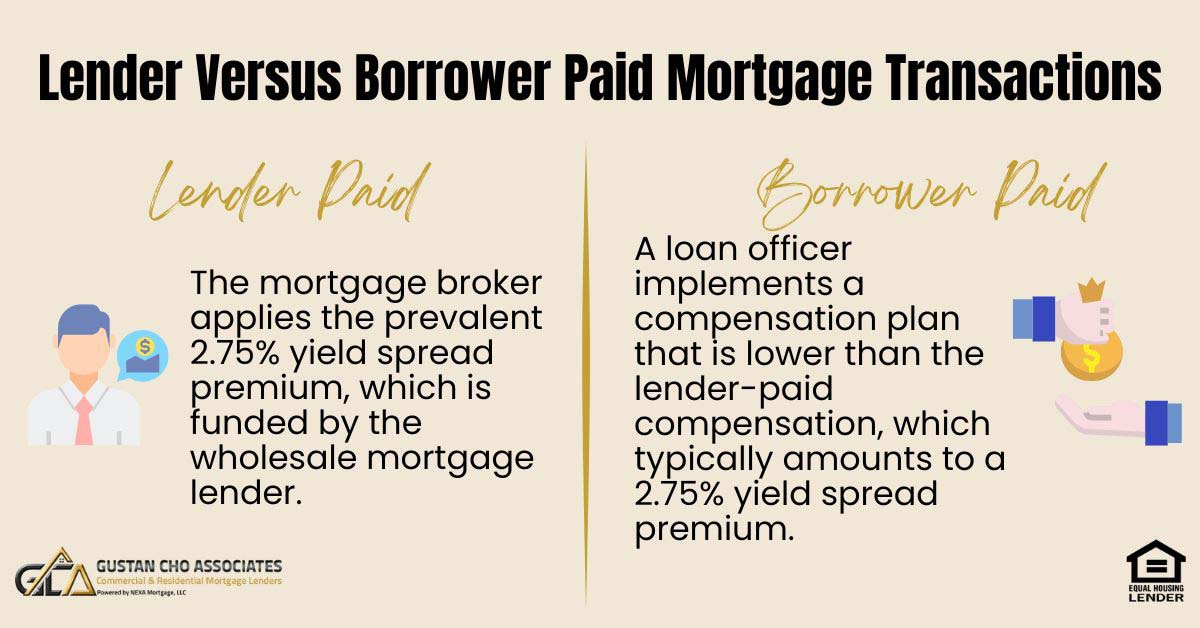

Lender-paid compensation refers to a scenario in which the mortgage broker applies the prevalent 2.75% yield spread premium, which the wholesale mortgage lender funds.

Lender-paid compensation integrates the mortgage company’s remuneration into the offered interest rate. Consequently, upfront fees are reduced, while the interest rate typically experiences an increase. The mortgage company’s compensation is determined based on the chosen interest rate.

Confused About Mortgage Costs?

Learn the Difference Between Lender-Paid & Borrower-Paid Options

Can Mortgage Brokers Get You Better Rates?

The Consumer Financial Protection Bureau (CFPB) has implemented threshold laws governing the compensation of mortgage companies, particularly concerning Yield Spread Premium (YSP). When opting for lender-paid compensation, there are instances where borrowers may choose a slightly higher interest rate in exchange for a closing cost credit, known as a lender credit. This strategy is commonly employed by borrowers with higher credit scores. However, in the fluctuating market conditions resulting from the COVID-19 coronavirus outbreak, lender credits have become less common across the industry.

Lender Versus Borrower Paid Mortgage Transactions

Borrower-paid compensation refers to a scenario where a loan officer implements a compensation plan that is lower than the lender-paid compensation, which typically amounts to a 2.75% yield spread premium. It is crucial to distinguish this form of compensation from the lender-paid counterpart. In the case of borrower-paid compensation, the borrower covers the compensation directly at the closing stage, either through out-of-pocket payments or by utilizing equity in a refinance. Typically, these payments manifest as discount points or origination charges.

Will Borrower Paid Mortgage Transaction Get You Lowest Rate?

The practice of borrowers paying compensation is widespread among those seeking the most favorable interest rates, and it is a common feature in NON-QM mortgage loans as well. Depending on your financial situation, opting for borrower-paid compensation can result in substantial savings, potentially amounting to thousands of dollars throughout the loan’s duration. If you have the upfront funds available to cover the borrower-paid compensation, opting for a lower interest rate on a 30-year mortgage is generally advantageous.

The Mortgage Loan Process Step-By-Step

Initiating a mortgage application through Gustan Cho Associates is an uncomplicated process. Whether you’re aiming to acquire your primary residence, a second home, an investment property, considering refinancing your existing property, or have further questions about lender versus borrower paid mortgage transaction, the procedure remains consistent. The initial step involves reaching out to Alex Carlucci at 800-900-8569 or via email at alex@gustancho.com. Subsequently, you and Alex will engage in a personalized mortgage consultation to discern your overarching objectives for the mortgage transaction.

Home Purchase Mortgage Transactions

For a purchase transaction, you will want to gather the following information:

- Last 60 Days Bank Statements – to source down payment

- Last 30 Days Pay Stubs

- Last Two Years W2’S

- Last Two Years Tax Returns

- Driver’s License

Lender Versus Borrower Paid Mortgage Transactions On Refinance

If you are trying to refinance a property you already own, below is the documentation you will need to gather:

- Driver’s License

- Last 30 Days of Pay Stubs

- Last Two Years Tax Returns

- Last Two Years W2 or 1099s

- Mortgage Statement

- Homeowners Insurance Policy

After you have sent in the information, Alex will hook you up with a licensed loan officer in your state.

Buying a Home? Get Step-by-Step Guidance Through the Mortgage Process

Start the Home Buying & Mortgage Process Today

Understanding Home Buying and Mortgage Process

After establishing a connection with your loan officer, proceed to complete the online application link. This step enables your loan officer to authenticate your credit report and utilize the documentation you provided to finalize your pre-approval. Your loan officer will assess your qualifications by working backward, considering your debt-to-income ratio and credit score to determine your eligibility. While a refinance transaction may follow a slightly different process, your knowledgeable loan officer will guide you through the necessary steps.

Over 80% of Our Clients Could Not Qualify at Other Mortgage Lenders.

Even during times of the COVID-19 coronavirus outbreak, the team at Gustan Cho Associates is always very busy. Our staff works remotely and works extra hours to fulfill our current and future clients’ needs. The real estate sector is a key pillar in the United States and the Global economy. It is important that mortgage companies continue to do all they can to keep the housing industry afloat. You can always contact us for any questions about lender versus borrower paid mortgage transactions.

The U.S. Economy With Record High Inflation

These challenging times have affected many Americans, with a record number of people filing for unemployment in recent weeks. During the Great Depression, approximately 23% of the population was unemployed.

Presently, to my knowledge, around 13% of the United States population is experiencing unemployment, a significant figure considering that unemployment reached an all-time low in the past six months.

In response to these circumstances, it is crucial for us to unite as a community. While practicing social distancing, we encourage everyone to reach out to friends and neighbors to ensure their safety. Overcoming the economic and lifestyle challenges posed by the current situation will require a collective effort. For inquiries related to lender versus borrower paid mortgage transactions, please contact Alex Carlucci at (800) 900-8569.

FAQ: Lender Versus Borrower Paid Mortgage Transactions

1. What is the difference between lender versus borrower paid mortgage transactions?

Lender-paid transactions involve the lender covering upfront closing costs, which may result in a higher interest rate. On the other hand, borrower-paid transactions require the borrower to cover all upfront costs, potentially securing a slightly lower interest rate.

2. Why is it essential for borrowers to understand the difference between lender versus borrower paid mortgage transactions?

Understanding the difference of lender versus borrower paid mortgage is crucial as they determine how upfront costs are distributed and can impact the overall cost of the mortgage. Borrowers must consider their financial situation, preferences, and long-term goals when choosing between these transaction types.

3. What is the role of mortgage brokers in this context?

Mortgage brokers can play a significant role in securing favorable rates for borrowers. The blog suggests that mortgage brokers may offer lower compensation rates than the standard 2.75% yield spread premium, potentially leading to lower costs for borrowers.

4. Can mortgage brokers get borrowers better rates compared to mortgage bankers?

Mortgage brokers may provide more favorable interest rates compared to mortgage bankers. The choice between the two depends on factors such as the borrower’s financial situation and the terms offered by the lender.

5. How does lender-paid compensation work, and what is the common practice related to it?

Lender-paid compensation involves the mortgage broker applying the 2.75% yield spread premium funded by the wholesale mortgage lender. This compensation model integrates the mortgage company’s remuneration into the offered interest rate, potentially reducing upfront fees.

6. Is borrower-paid compensation a common practice, and what are its potential advantages?

Borrower-paid compensation involves the borrower directly covering compensation, potentially resulting in lower interest rates. This practice is common among those seeking the most favorable rates, and it can lead to substantial savings over the loan’s duration.

7. What information is required for a home purchase mortgage transaction, and what about a refinance?

For a home purchase, borrowers must provide bank statements, pay stubs, tax returns, and other documents. Refinancing requires similar documentation, including mortgage statements and homeowners insurance policies.