This Breaking News Article Is About How The Coronavirus Pandemic Is Affecting The Mortgage Process

As we approach a new week during this coronavirus COVID-19 pandemic, Americans are still in panic

mode.

- We are seeing the epicenter New York city grow in panic

- The White House coronavirus task force is continuing to hold press conferences to keep the American people up to date on the situation

- We are all monitoring this very closely and hope nothing but the best for those who are sick

- In this blog, we will give a brief update on how the COVID-19 coronavirus outbreak continues to affect the mortgage business

- We will also update you on the latest developments on how the coronavirus pandemic has impacted the housing and mortgage market

- Pharmaceutical giants Pfizer and Moderna developed and got FDA approval on a coronavirus vaccine that is supposed to be 95% effective

- As of today, the coronavirus outbreak continues to spread

- However, life goes on and society is trying to find the best ways and methods of surviving the coronavirus outbreak

In this breaking news article, we will discuss and cover How The Coronavirus Pandemic Is Affecting The Mortgage Process and how the mortgage market is today.

National Emergency In Developing Cure For The Coronavirus

The White House coronavirus task force has been giving Americans insight into the global pandemic throughout 2020:

- President Donald Trump still seems to be in favor of the anti-malaria drug hydroxychloroquine to help flatten the curve of this pandemic

- He seems to be using the approach “what do we have to lose?” when lab studies have shown that the drug blocks the coronavirus from entering cells

- Of course, this is just a lab study and not a full-scale clinical study, but we don’t have time for a full-scale clinical study in time of crisis

- Keep in mind, President Trump is not a medical expert

- A medical expert such as Dr. Fauci is not going to endorse a drug without a full-scale clinical test with proven results over a long period of time

But reports out of Spain and Italy also are showing this drug having an impact on the COVID-19 coronavirus. At times like this, the world must come together and share any information they have.

How The Coronavirus Pandemic Is Affecting The Mortgage Process And Housing Market

The U.S. Surgeon General Jerome Adams was also part of the task force briefing.

- He related this tragedy to some horrible times for America

- He mentioned September 11 and Pearl Harbor

- He also let Americans know we should brace ourselves for one of the saddest weeks in American history

- The death toll and new cases are projected to go up astronomically this week

- Jerome Adams also encouraged Americans to wear protective masks whenever possible outside of their homes

- Not wasting medical-grade masks, but something as simple as an old shirt or handkerchief can help flatten the curve throughout the United States

- He called on every American to pitch in and do their part to help get past this as soon as possible

That is the ultimate goal as we need to get our economy trucking forward again and get millions of Americans back to work.

Rising Cases And Death-Toll Causing Panic

As of yesterday, it is estimated that 1.67 million COVID-19 coronavirus tests been completed worldwide.

- That’s an astonishing number

- As of Sunday night, there were approximately 337,000 confirmed coronavirus cases

- The death toll is slightly below 10,000 according to John Hopkins University

- This number is projected to go up quite a bit

The White House coronavirus task force said their experts plan to see about 100,000 US citizens far to this virus in the next weeks to months. That is a tough number to compute.

How The Coronavirus Pandemic Is Affecting The Mortgage Process While The Economy Is At A Standstill

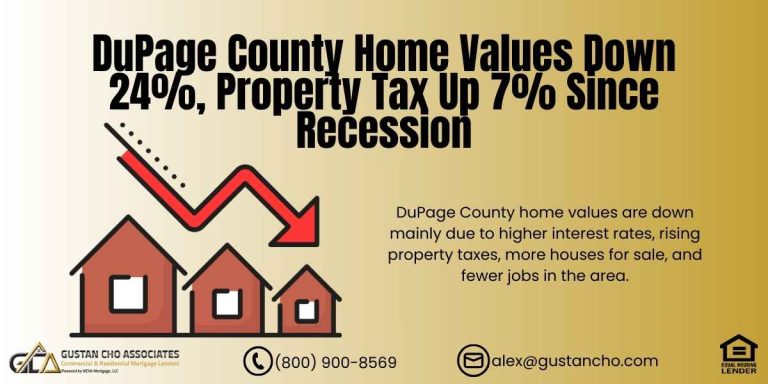

Mortgage news has been somewhat status quo over the past few days.

- Millions of Americans are off work and will not be able to pay their mortgage

- That is why the mortgage industry and housing associations call for a liquidity facility for mortgage servicers

- Mortgage servicers are calling on the government to follow up on the CARES ACT for mortgage forbearance

- These mortgage servicers are going to need some help to continue to stay in business

- Nothing in this world is free, if you give somebody forbearance, somewhere along the lines the system will break down

- The real estate sector has always been a major pillar in the United States economy

- We must see the government step up to save hundreds of mortgage companies

- If you currently have a mortgage on your property and are experiencing financial hardship due to the COVID-19 coronavirus outbreak, you may request a mortgage forbearance

Little documentation is required from your mortgage servicer. So, if your family is in dire straits, please reach out to your mortgage servicer.

How The Coronavirus Pandemic Is Affecting The Mortgage Process On Non-QM Loans

We expect to hear some news on NON-QM mortgage lending next week sometime.

- Unfortunately, this sector of the mortgage industry was seemingly wiped out overnight

- Most NON-QM mortgage clients are self-employed individuals or individuals who had financial hardships in the past

- Most of our NON-QM investors are non-existent as of today

- Meaning even loans that were in the pipeline are not being funded by the investors. this is putting many customers in a tough spot

Many Americans rely on these mortgages to complete debt consolidation refinance transactions. Without those being funded, those Americans will find themselves in a top financial situation.

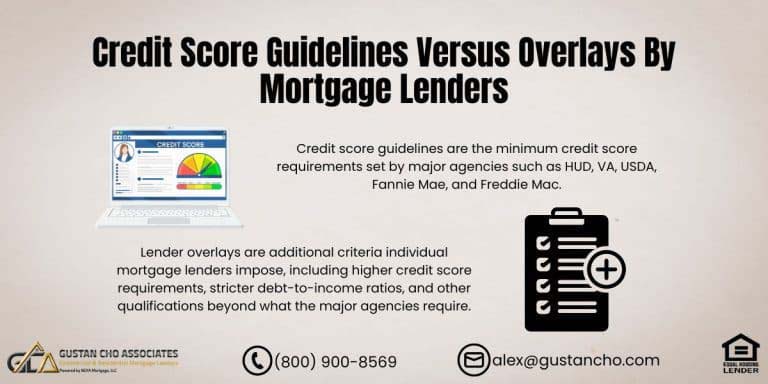

Agency Mortgage Guidelines Versus Lender Overlays

Once again, we want to reiterate that most of our investors have raised their minimum credit score

requirements:

- However, we still have a few outlets that do not have added LENDER OVERLAYS

- We are still able to help clients who are currently in an active chapter 13 bankruptcy

- Some borrowers may require a manual underwrite, and still go to agency minimum credit score requirements

If you have been turned down by your current lender, we suggest you give us a call. You may call Mike Gracz on (800) 900-8569 or send an email to gcho@gustancho.com.

How The Economy Is Impacted By The Pandemic

As we all continue to social distance, Trump met with the leaders of most sports leagues around the

country.

- The outcome of the meeting seems to have a projected date of August or September before fans can gather in the masses to attend a major sporting event

- What this means for sports like major league baseball is yet to be known

- The NHL and NBA were rapidly approaching the playoffs for the 2019 – 2020 season

- I have not heard any announcements of a cancellation of the season yet

But my prediction is, we may not finish this season and move right into next season in the NHL and NBA.

As we prepare for what could be one of the deadliest weeks in the pandemic, we must stay focused on

the end result. Most Americans are looking forward to getting life back as we knew it. Being able to attend

major events such as sports, concerts, religious gatherings, and time with extended family. We strongly

encourage all Americans to follow the guidelines set forth by the White House. Social distancing and

limiting gatherings should help flatten the curve sooner than later. Gustan Cho Associates are still

working everyday so feel free to contact us with any mortgage questions.

January 10th, 2021 UPDATE On How The Coronavirus Pandemic Is Affecting The Mortgage Process

This article on How The Coronavirus Pandemic Is Affecting The Mortgage Process was updated on January 10th, 2021. It has been a tough 2020. Many changes transpired in 2020 that affected individuals, families, businesses, politics, and the economy. The coronavirus pandemic has crushed the U.S. economy. However, the economic recovery seems to recover faster than expected. The secondary mortgage bond market did not crash as economists and analysts expected. The Federal Reserve Board lowered interest rates to zero percent which plummeted mortgage rates at historic lows. Joe Biden won the 2020 Presidential election. President Donald Trump alleged voter fraud. There was more than enough proof of voter and election fraud. However, the fight against election fraud seemed like it was going nowhere. Over 60 judges, including the U.S. Supreme Court, ruled against the Trump Administration’s lawsuits against voter and election fraud even though sworn statements and affidavits from witnesses were provided. The housing market is expected to be strong in 2021. Record low mortgage rates are expected throughout 2021 into 2022. Loan level pricing adjustments on government and conventional loans have been removed for the most part. Non-QM loans are back in the market.