Automated Underwriting System Findings On Home Mortgages

In this blog, we will cover and discuss the automated underwriting system approval, which is also referred to as AUS…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

In this blog, we will cover and discuss the automated underwriting system approval, which is also referred to as AUS…

This guide cover the struggle of car loans during the mortgage process. Looking to buy a new car? Like most…

This guide covers FHA versus conforming loan limits on home purchase and refinance transactions. FHA versus conforming loan limits on…

Closing costs on the Loan Estimate versus Closing Disclosure will most likely be different. The itemized closing costs on the…

In this blog, we will cover and discuss how to shop for a mortgage in today’s housing market. Just over…

In this blog, we will discuss and cover the warehouse line of credit used by mortgage bankers and correspondent lenders….

This guide covers home mortgage case scenarios for homebuyers. Many borrowers have trouble qualifying for conventional and FHA mortgage financing….

In this blog, we will cover and discuss how do mortgage underwriters qualify borrowers. Credit scores and income is what…

This ARTICLE On 15 Year Versus 30 Year Fixed Rate Mortgages On Loan Programs. All residential mortgage loan programs have…

This blog post will explore and elaborate on the Texas Cash-Out Refinance Guidelines in home mortgages. Gustan Cho Associates, a…

If you’re married and you buy a home in a community property state, you’ll face different rules for qualifying. Most of these rules come into play if you finance your home with a government-backed home loan like the FHA, VA or USDA programs.

This guide covers understanding the basics on what is a mortgage. We will cover and discuss the meaning of what…

This guide covers the difference between FHA and Conventional mortgage guidelines. Many homebuyers, especially first-time buyers shopping for homes often…

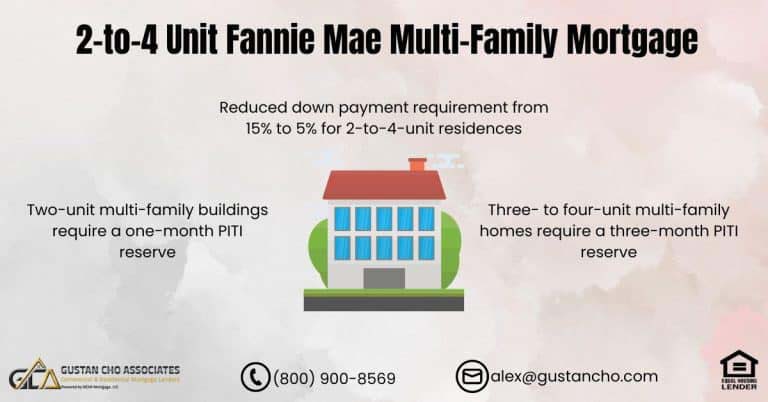

This manual addresses the modifications in down payment and self-sufficiency for multi-family properties designated as owner-occupant primary residences by the…

This guide covers the truth in lending disclosure during the mortgage process. Mortgage disclosures are required to be disclosed to…

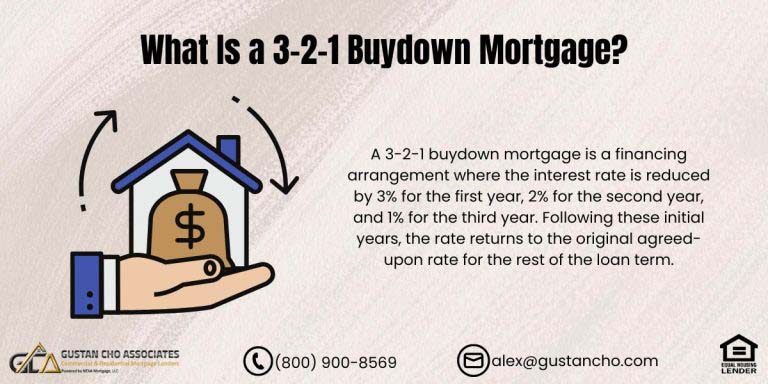

In this blog, we will cover what a 3-2-1 buydown mortgage is. We will also discuss the differences between a…

In this blog, we will cover and discuss buying house near airport. Homebuyers need to consider the benefits and…

Gustan Cho Associates are experts when analyzing consumer credit reports. Since we do not have lender overlays, we see all…

In this article, we will cover and discuss how credit disputes affect mortgage process and cause loan denial. The pre-approval…

This guide provides clear information about Fannie Mae’s rules for Community Property States, helping people looking for mortgage information. It…

Every mortgage borrower is different. Your income, debts, credit rating, savings, and goals are unlike anyone else’s. The best mortgage for your neighbor might be the worst home loan for you.

This guide covers the benefits of paying mortgage balance early before end of loan term. Paying mortgage balance early before…