Technology For Students at College Campuses

Technology for Students at College Campuses in 2025 The Changing Scope of Technology for Students Technology has revolutionized education by…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Technology for Students at College Campuses in 2025 The Changing Scope of Technology for Students Technology has revolutionized education by…

This article is about the story of a veteran who served in the U.S. military. A decorated Vietnam veteran and…

This guide covers re-building credit after foreclosure to qualify for home loans. A foreclosure can drop credit scores by at least…

South Dakota FHA Lenders for Under 600 FICO: How to Get Approved for a Mortgage in 2025 Are you looking…

This guide covers the 27-second effect research data and effects on driving. If you’re like most people, you probably need…

Lawsuit During the Mortgage Process: What You Need to Know to Get Approved If you’re in the middle of a…

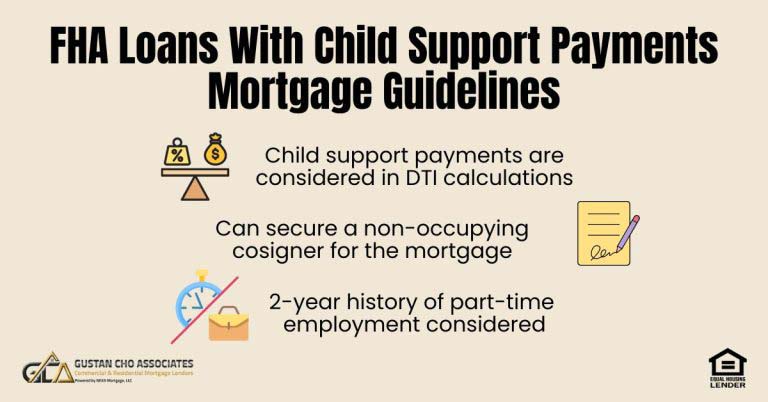

FHA Loans with Child Support Payments: How to Qualify in 2025 Child support payments can significantly affect your ability to…

Buying a home as a single parent may seem tough, but there are home loans for single moms that can…

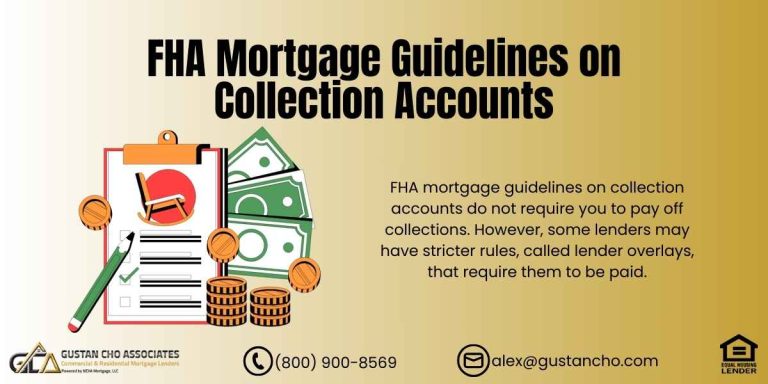

FHA Mortgage Guidelines on Collection Accounts: How to Qualify for a Home Loan in 2025 Buying a home with collection…

1099-Income Versus W-2 Income: How It Affects Your Mortgage Approval When applying for a mortgage, the type of income you…

ThIs guide covers housing numbers increase despite higher mortgage rates. This guide is an update of the original guide on…

Delegated Versus Nondelegated Mortgage Underwriting: What You Need to Know Understanding how mortgages are underwritten can feel overwhelming, especially when…

Fannie Mae Guidelines on Second Homes: What You Need to Know in 2025 Thinking about buying a second home? Here’s…

Gustan Cho Associates and Great Community Authority Forums News are updating a new updated guide on the Southern California Gas…

This article covers how to choose the best property management company. There are numerous factors you need to keep in…

Does Co-Signing Affect In Buying Home? Understanding How Co-Signing a Loan Impacts Your Future Have you ever considered co-signing a…

A two-year employment history does not necessarily mean two consecutive years at the same job. You can have gaps in employment and/or multiple jobs in the most recent two years and still qualify for mortgage approval. In some cases, you can qualify for a mortgage with 12 months employment history.

Housing Economic Outlook and how it impacts Homebuyers (Updated January 26, 2025) Introduction Housing Economic Outlook: Market activity at the…

This guide covers growing up in the inter-city of Chicago as a homeowner: The Story of John Strange. Escaping and…

This guide covers what happens when the Federal Reserve Board increases interest rates. This guide is an update of an…

Your mortgage lender checks your credit when you apply for a home loan. Your credit score determines your mortgage rate and also if you qualify for a loan.

Buying Home Near Railroad Tracks: Bargain or Bad Investment in 2025? Buying a home near railroad tracks can stir up…