Identity Theft Process During The Mortgage

This guide covers identity theft process during mortgage application process. Identity theft process is one of the fastest growing crimes…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers identity theft process during mortgage application process. Identity theft process is one of the fastest growing crimes…

This guide covers credit scores and mortgage rates versus pricing adjustments. Credit scores and mortgage rates go side by side….

Many homebuyers have substantial value on their 401k. They can use up to 60% of the value of their 401k for their down payment and/or closing costs on their home purchase. The amount used from their 401k is not used for their debt to income ratio calculations.

This guide covers housing demand strong despite highest mortgage rates and surging inflation numbers. Home sales throughout the United States…

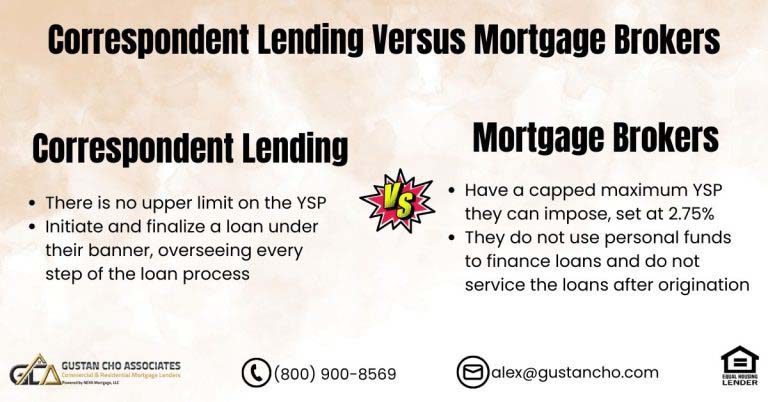

This blog aims to explore the difference between correspondent lending and mortgage brokers. A common inquiry we receive regularly pertains…

This guide covers qualifying for a home mortgage with bad credit. One of the frequently asked questions by our clients…

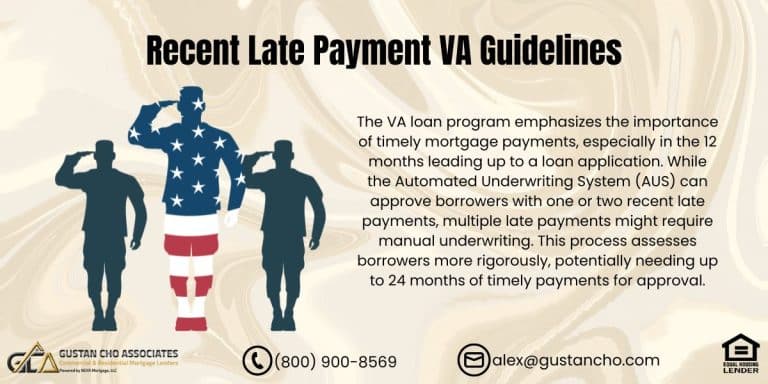

VA home loans are ideal for primary residences, offering 100% financing with no down payment required for those who qualify,…

This guide covers qualifying for the lowest FHA mortgage rates on FHA loans. Qualifying for the lowest FHA mortgage rates…

When considering Home Purchase With Illegal Apartment in Chicago, prospective buyers have access to various financing options through government and…

This article explores the Factors Affect Pre-Approval And Stress During Mortgage Process. Once individuals decide to purchase a home, the…

This guide covers mortgage loan options with bad credit after bankruptcy on home purchase and refinance loans. One of the…

This guide covers the right of rescission mortgage guidelines on refinances. As we have seen interest rates drop over the…

This guide covers credit score guidelines versus overlays by mortgage lenders. There are two types of credit score requirements to…

In this blog post, we’ll explore obtaining an FHA loan with a credit score under 600. Gustan Cho Associates specializes…

This blog post focuses on Fannie Mae 5-10 Financed Properties, which is particularly beneficial for real estate investors. The 2008…

This blog will discuss getting approved for FHA loans in Las Vegas with bad credit and credit scores down to…

The Federal Housing Administration (FHA), a segment of the United States Department of Housing and Urban Development, was established in…

This guide covers 580 score VA financing for eligible veteran homebuyers and homeowners. The team at Gustan Cho Associates are…

Can you get a Freddie Mac mortgage if you have lots of investments or savings but little or no income? In many cases, you can convert assets into income (for mortgage qualifying purposes) by using asset depletion.

After experiencing financial difficulties, it can be overwhelming to navigate the intricacies of mortgage lending. The process can be complex…

This guide covers excluding debts from co-signed loans to qualify for mortgage loans. Mortgage borrowers who are co-signers on debts…

California FHA loans are a preferred mortgage solution for various borrowers, including first-time homebuyers, individuals with poor credit, and those…