Is Homeownership The Best Way To Build Wealth?

This blog will cover how to build wealth by owning versus renting a home. We will show you how quickly…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This blog will cover how to build wealth by owning versus renting a home. We will show you how quickly…

In this blog, we will discuss and cover high-cost guidelines on government and conventional loans. Some states have high-cost rules….

This guide covers Indiana police hiring fired Chicago cops. This breaking news was updated on March 23rd, 2024. Breaking News:…

In this blog, we will cover and discuss qualifying with non-QM mortgage lenders in Connecticut for borrowers who cannot qualify…

This guide cover the struggle of car loans during the mortgage process. Looking to buy a new car? Like most…

This guide covers approved mortgage after short sale in Chicago FAQ and answers. Sonny Walton covers getting approved for a…

Closing costs on the Loan Estimate versus Closing Disclosure will most likely be different. The itemized closing costs on the…

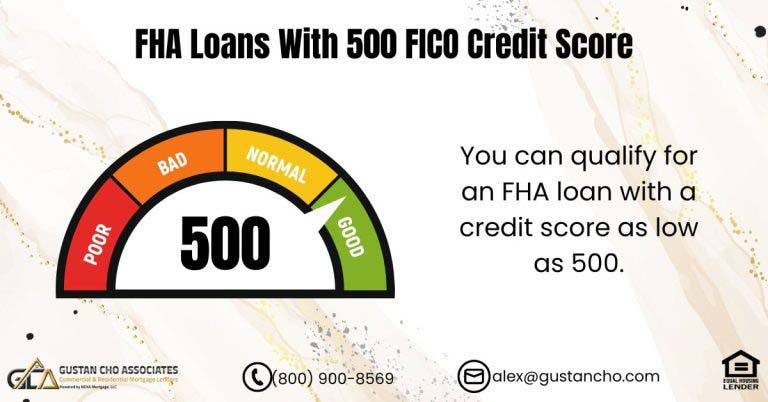

This guide covers how to buy a house with bad credit. Many folks assume you cannot get a mortgage loan…

HUD, the parent of FHA, allows borrowers down to a 500 credit score to qualify for an FHA loan. However, for borrowers with under a 580 credit score, a 10% down payment is required.

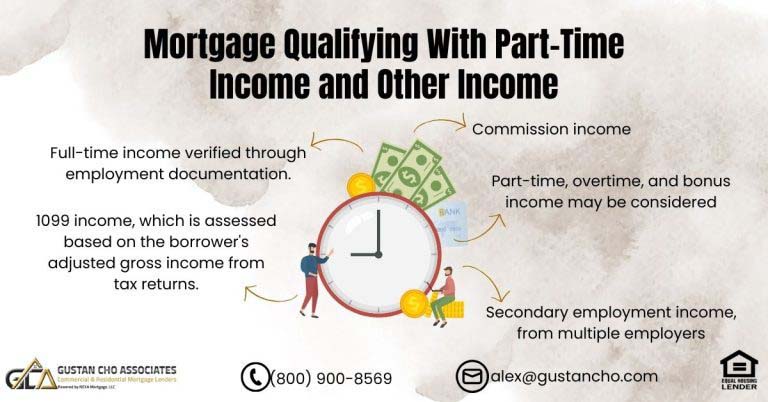

In this blog post, we’ll delve into Mortgage Qualifying With Part-Time Income and Other Income and explore lending guidelines regarding…

This article cover no waiting period on short sale mortgage guidelines. For those who were homeowners during the economic meltdown…

This blog will share some helpful tips about VA credit dispute guidelines. VA loans are often seen as one of…

This manual provides information on Job Relocation Mortgage Guidelines for individuals purchasing homes in a different state. According to these…

If you’re married and you buy a home in a community property state, you’ll face different rules for qualifying. Most of these rules come into play if you finance your home with a government-backed home loan like the FHA, VA or USDA programs.

This guide covers understanding the basics on what is a mortgage. We will cover and discuss the meaning of what…

In this blog post, we’ll delve into the most recent methods to update credit report fast using rapid rescore to…

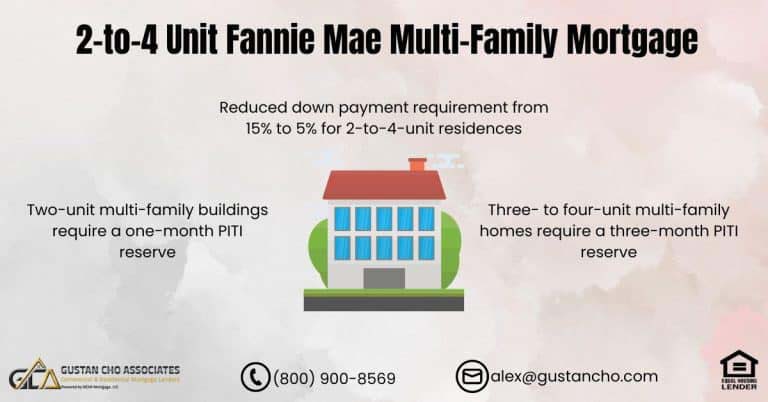

This manual addresses the modifications in down payment and self-sufficiency for multi-family properties designated as owner-occupant primary residences by the…

Mississippi has one of the hottest housing markets in the nation. The housing market in the state has been booming for many years.

In this blog, we will discuss and cover the FHA appraisal transfer from your old lender to a new mortgage…

This blog post delves into the crucial aspects of the Two-Year Work History Mortgage Guidelines. It explores the significance of…

In this article, we will delve into the credit tradelines requirements essential for mortgage loan application eligibility. The credit tradelines…

This guide covers low appraisal on home purchase and solutions for mortgage borrowers. We will discuss solutions to low appraisal…