Things To Know Before Filing Bankruptcy

This guide cover the things to know before filing bankruptcy for future homebuyers. There are things to know before filing…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide cover the things to know before filing bankruptcy for future homebuyers. There are things to know before filing…

This guide covers the types of income that mortgage lenders consider qualifying income can use for mortgage loans. Not all…

This guide covers HUD mortgage guidelines on having multiple FHA loans at the same time. One of the most frequently…

This guide covers changing lenders during underwriting process before closing. The mortgage approval process does not have to be stressful…

This guide covers how to buy a house with bad credit. Many folks assume you cannot get a mortgage loan…

This blog post will explore and elaborate on the Texas Cash-Out Refinance Guidelines in home mortgages. Gustan Cho Associates, a…

This blog post will explore Buying House While In Chapter 13 Bankruptcy. Chapter 13 Bankruptcy involves a structured five-year repayment…

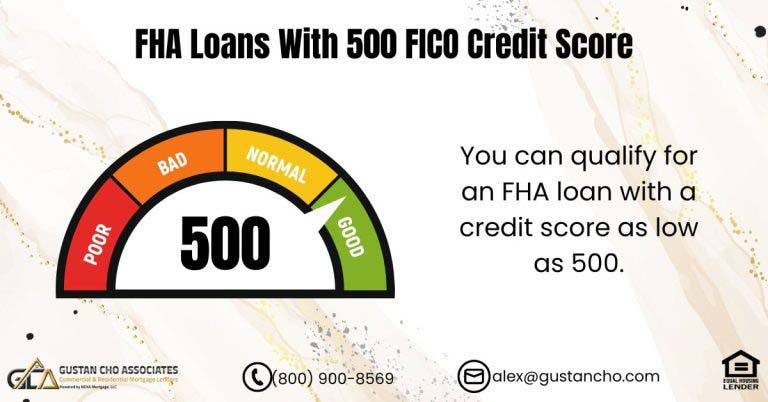

HUD, the parent of FHA, allows borrowers down to a 500 credit score to qualify for an FHA loan. However, for borrowers with under a 580 credit score, a 10% down payment is required.

This guide explains the requirements for obtaining two FHA loans at the same time. This is important information for those…

This guide covers how credit repair works during the mortgage process. A substantial percentage of my borrowers are folks who…

This guide covers the loan officer document checklist. This article on the Loan Officer Document Checklist is a series of…

Gustan Cho Associates has no lender overlays on VA loans. VA loans do not have a minimum credit score requirement nor a maximum debt to income ratio cap as long as the borrower can get an approve/eligible per automated underwriting system.

In this blog, we will cover employer distance requirements on primary home mortgages. Employer Distance Requirements On Primary Home Mortgages…

This guide covers how underwriters qualify income to approve mortgage loans. Many mortgage loan applicants do not have the role…

This blog will cover Fannie Mae and Freddie Mac guidelines on qualifying for a conventional loan with non-occupant co-borrower. Non-Occupant…

This article will discuss the guidelines for VA property tax exemption related to VA home loans. The VA has created…

This guide covers using rapid rescore in the mortgage process. What is a rapid rescore? It’s a service accessible only…

This blog will cover Fannie Mae Collection Guidelines on Conventional loans. Fannie Mae and Freddie Mac are the two mortgage…

Many agency guidelines list extenuating circumstances as reasons for getting qualified for a mortgage when otherwise they would not qualify. However, borrowers need to understand

This guide covers qualifying for a home loan downsizing to a smaller home. It makes no sense in having a…

This article cover no waiting period on short sale mortgage guidelines. For those who were homeowners during the economic meltdown…

In this article, we will discuss and cover homebuyers qualifying for bad credit mortgage loans Alabama. Qualifying for bad credit…