This article will discuss and cover qualifying for a mortgage after unemployment. Homebuyers do not need a two-year employment history with the same company. Borrowers can to qualify for a mortgage after unemployment with job gaps in the past two years, says Dale Elenteny of Gustan Cho Associates:

Home mortgage approval is possible for borrowers who have experienced unemployment and employment gaps. Contrary to a common misconception among mortgage loan applicants, it is not a mandatory requirement to have two consecutive years of continuous employment history to qualify for a mortgage loan.

Prospective homebuyers can secure a mortgage after unemployment in the preceding two years. Individuals with sporadic gaps in employment can still qualify for both government-backed and conventional loans. The upcoming segments of this blog will delve into the details of obtaining a mortgage after unemployment, particularly when faced with employment gaps.

Can You Get a Mortgage After Unemployment With Job Gaps in the Past 2 Years?

Having one or more employment gaps in the last 24 months does not disqualify you from obtaining a home mortgage. According to the mortgage guidelines of various agencies such as FHA, VA, USDA, Fannie Mae, and Freddie Mac, individuals can still be eligible for an owner-occupant primary home loan, even if they have experienced periods of unemployment within the past 24 months.

Many lenders may have tougher guidelines regarding gaps in employment in the past two years.

You qualify for a mortgage if you have worked multiple part-time jobs and secured a new full-time job within the last two years. Transitioning from a 1099 wage to becoming a full-time W-2 wage earner also makes you eligible for a mortgage.

Do All Lenders Have The Same Requirements for Mortgage After Unemployment?

Mortgage lenders vary in their requirements for individuals seeking a mortgage after unemployment and job gaps. Opting for a mortgage lender that imposes no additional conditions or overlays on applicants with employment gaps is advisable.

All mortgage lenders need to follow the minimum agency mortgage guidelines of the loan program. However, most lenders have overlays on government and conventional loans. Overlays are additional guidelines by individual lenders above the minimum agency guidelines of HUD, VA, USDA, Fannie Mae and Freddie Mac.

Lenders may impose lending guidelines that surpass the minimum agency mortgage standards, referred to as lender overlays. Consequently, certain lenders might inform you that you are ineligible for a mortgage if you haven’t maintained consistent employment with the same employer for the last two years. This particular employer enforces its lender overlays regarding employment gaps.

Speak With Us For Mortgage After Unemployment, Click Here

How To Qualify For a Mortgage With Bad Credit?

Mortgage requirements can vary among different lenders, especially concerning government and conventional loans. It is common for lenders to stipulate a two-year employment history with no employment gaps.

All mortgage lenders can have higher lending requirements above and beyond the minimum agency mortgage guidelines.

Gustan Cho Associates, as mortgage brokers, do not impose additional requirements on employment gaps, adhering strictly to the minimum agency mortgage guidelines without any additional lender overlays.

Consequently, as per agency guidelines, individuals can qualify for a home mortgage even with employment gaps in the past 24 months. Gustan Cho Associates is committed to honoring these employment guidelines.

Do Lenders Require You To Have The Same Job For Two Years?

Keep in mind that every lender is required to adhere to the basic mortgage guidelines set by FHA, VA, USDA, FANNIE MAE, and FREDDIE MAC. However, it’s important to note that lenders may establish more stringent lending standards, known as lender overlays.

Consequently, the criteria for government or conventional loans may vary among lenders, as they are not all bound by identical requirements.

Not all mortgage lenders have the same guidelines regarding employment history in the past two years. You do not need to have been on the same job in the past two years to qualify for a mortgage.

This is a situation where borrowers often receive contradictory responses to their queries. The guidelines set by agencies permit employment gaps within the last two years. Adhering to these agency guidelines enables you to be eligible for a mortgage despite having held multiple jobs in the past two years.

Nevertheless, whether a specific mortgage lender chooses to follow the agency guidelines or impose more stringent ones is at their discretion.

How Long Is Too Long of an Employment Gap?

Potential mortgage applicants can be eligible for a loan even if they have experienced employment gaps within the last two years. As long as the gap in employment does not exceed six months, it is possible to qualify for a mortgage despite such gaps.

Ideally, lenders prefer applicants to have a job within the same field or in a field where they possess expertise or training. It’s important to note that being deemed ineligible for a mortgage by one lender does not necessarily mean you won’t qualify with another lender.

Borrowers should study the basic agency mortgage guidelines before shopping for a mortgage. This way, they will know if they meet the minimum agency guidelines of the loan program, they are applying for.

If borrowers are informed that they are ineligible, they will be aware that their ineligibility is either a result of not meeting the minimum agency guidelines or not meeting the specific lender’s criteria known as overlays. It’s important to note that Gustan Cho Associates does not impose any lender overlays on government or conventional loans.

Why Do Lenders Have Overlays on Gaps in Employment?

Numerous lenders impose additional criteria regarding employment gaps, often necessitating that borrowers have maintained consistent employment with the same company for the preceding two years.

While FHA, VA, USDA, FANNIE MAE, and FREDDIE MAC permit borrowers to have experienced multiple job changes or employment gaps within the last two years, some lenders hold the belief that a lack of continuity in employment over this period indicates a lack of employment stability and presents a risk to the lender.

Consequently, despite agency guidelines indicating otherwise, many lenders incorporate additional requirements regarding mortgage after unemployment, employment gaps and multiple jobs within the past 24 months.

Do You want to get mortgage loan? Click Here For Qualify for Loans

Can I Qualify For a Mortgage Without Two Years’ Work History?

There is a common misconception that mortgage loan applications always inquire about a two-year employment history. Adding to this, numerous mortgage loan applicants turn to online mortgage blogs, often written by individuals outside the mortgage industry, and end up receiving inaccurate information.

Many ghost blog writers incorrectly claim that a mortgage applicant must have two years of uninterrupted employment history to qualify for a loan. The essential point, however, is that individuals can still qualify for a mortgage even after a period of unemployment.

Can I Qualify For a Mortgage After Unemployment Over Six Months?

If your job gap is less than six months, there is no waiting period for your new job.

Nevertheless, if your job gap extends to six months or more, you are required to stay in your new position for a minimum of six months. There are no waiting period requirements for a job gap longer than six months if you return to the same job you previously held.

How Long Do You Have To Be on The Job To Get a Mortgage After Unemployment?

Borrowers are not required to have a continuous employment history spanning two years. Gaps in employment within the past two years will not result in disqualification for a mortgage.

However, it’s worth noting that certain mortgage lenders may have additional requirements, known as overlays, and may prefer applicants who have maintained a consistent two-year employment history with the same employer.

This preference is often rooted in the belief that employment stability demonstrates financial reliability to the mortgage lender and increases the likelihood of sustained employment for borrowers.

What Do Lenders Consider a Job Gap?

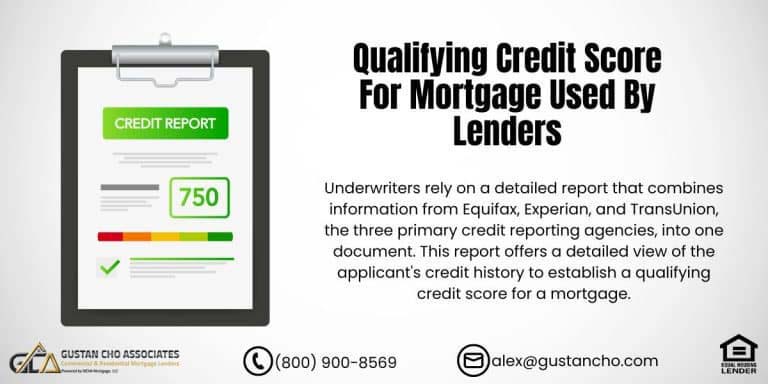

Mortgage after unemployment is subject to rules and regulations concerning employment history and job gaps. To meet mortgage lending guidelines, a two-year employment history is typically required.

It’s important to note that this employment history doesn’t necessarily have to be continuous with the same job. Borrowers are allowed to have held multiple jobs over the past two years with varying pay levels. However, for income qualification, only the current full-time job will be considered.

Verification of Employment With Job Gaps?

Lenders seek evidence of consistent employment and also assess the probability of future employment to ensure borrowers can meet their mortgage obligations on time. Verification of employment from the present full-time employer is necessary, with one of the key inquiries being the likelihood of sustained employment.

Mortgage With New Full-Time Job After Working For Temp Agency

I have processed numerous mortgage loan applications for individuals who held various temporary jobs, experienced employment gaps, worked part-time, or were employed by a temporary agency.

Unexpectedly, a temporary employee secures a stable full-time position with an employer. Dustin Dumestre, a senior loan officer at Gustan Cho Associates, expressed the following:

In some cases, I had borrowers who worked for a temp agency, and the temp agency placed them in full-time permanent jobs. The employer who used the temp worker was so impressed with the work that they hired them full-time when they no longer worked for a temp agency.

Some folks lost their jobs or business due to the Great Recession of 2008 and have been unemployed for many years and finally got a full-time solid job. These folks will qualify for a mortgage despite being unemployed for many years.

Mortgage Guidelines With Multiple Jobs in the Past Two Years?

Borrowers are not required to have maintained continuous employment in the same job over the past two years. It is acceptable for borrowers to have held multiple jobs during this period? While a two-year employment history is necessary, qualifying for a mortgage allows for permissible gaps in employment.

The 2-year employment history means employment history and not continuous employment history.

Consider this scenario: If Borrower A is employed full-time at Company A and has been with the company for six months, but experienced three years of unemployment, Borrower A is required to furnish one and a half years of employment history before the period of unemployment.

Speak With Our Loan Officer for Getting Mortgage Loans

Income and Employment Guidelines For Mortgage After Unemployment

To qualify for a mortgage after unemployment, individuals need to meet specific job longevity criteria. If homebuyers have been unemployed for six months or less and secure a new job, there is no need for a longevity or seasoning requirement on the new job to be eligible for a mortgage.

Thirty days of paycheck stubs before issuance of clear to close is required to close on the loan on FHA loans. Borrowers will qualify when they get a new job, and the employer verifies that the borrower is employed full-time.

Verification of employment is required by the lender. The mortgage underwriter must assess the likelihood of the borrower maintaining employment over the next three years.

Nevertheless, if the home buyer has experienced a period of unemployment lasting six months or more, they must have been in a new full-time job for a minimum of six months to be eligible for a mortgage post-unemployment.

Mortgage Denied Due To Job Gaps

Gustan Cho Associates is one of the very few national lenders with no lender overlays on government and conventional loans. Over 80% of our borrowers at Gustan Cho Associates met the minimum agency mortgage guidelines but could not qualify for a mortgage due to the individual lender overlays.

At Gustan Cho Associates, we go off the automated findings of the automated underwriting system (AUS). Homebuyers who have difficulty qualifying for a mortgage after unemployment with job gaps need to qualify with a national mortgage company licensed in multiple states with no overlays on government or conventional loans.

Contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com. Gustan Cho Associates has zero FHA, VA, USDA, and Conventional Loans overlays. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

FAQ: Mortgage After Unemployment With Job Gaps

Do I need a two-year employment history with the same company to qualify for a mortgage after unemployment? No, having two consecutive years of continuous employment history with the same company is not mandatory to qualify for a mortgage loan after experiencing unemployment. Borrowers can qualify for mortgages even with job gaps in the past two years.

Do all lenders have the same requirements for a mortgage after unemployment? No, mortgage lenders vary in their requirements for individuals seeking a mortgage after unemployment and job gaps.

How long is too long of an employment gap to qualify for a mortgage? Generally, as long as the gap in employment does not exceed six months, it is possible to qualify for a mortgage despite employment gaps.

Can I qualify for a mortgage without a two-year work history? While some mortgage loan applicants believe they need two years of uninterrupted employment history, it is possible to qualify for a mortgage even after unemployment. The key is meeting the minimum agency guidelines of the loan program.

Can I qualify for a mortgage after unemployment lasting over six months? If your job gap is less than six months, there is no waiting period for your new job. However, if the job gap extends to six months or more, you may need to stay in your new position for at least six months.

What do lenders consider a job gap when assessing mortgage eligibility? Lenders typically require a two-year employment history, but it doesn’t have to be continuous with the same job. Borrowers can have held multiple jobs over the past two years. However, only the current full-time job will be considered for income qualification.

What are the income and employment guidelines for a mortgage after unemployment? If you’ve been unemployed for six months or less and secure a new job, there may be no seasoning requirement on the new job to be eligible for a mortgage. However, if the unemployment lasted six months or more, you usually need to be in a new full-time job for at least six months to qualify.

This blog about Mortgage After Unemployment With Job Gaps was updated on February 2nd, 2024.