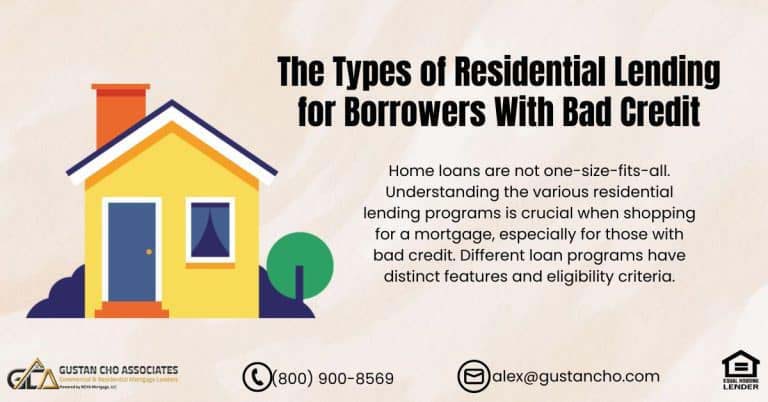

This blog examines the eligibility requirements for FHA loans after unemployment or employment gaps. Prospective FHA loan applicants now have the opportunity to qualify, even if they have faced periods of unemployment or breaks in their employment history.

Contrary to a widespread misconception that obtaining these loans necessitates an uninterrupted two-year work history with no employment gaps, Mike Gracz from Gustan Cho Associates provides insights into the specific guidelines for securing FHA loans after unemployment.

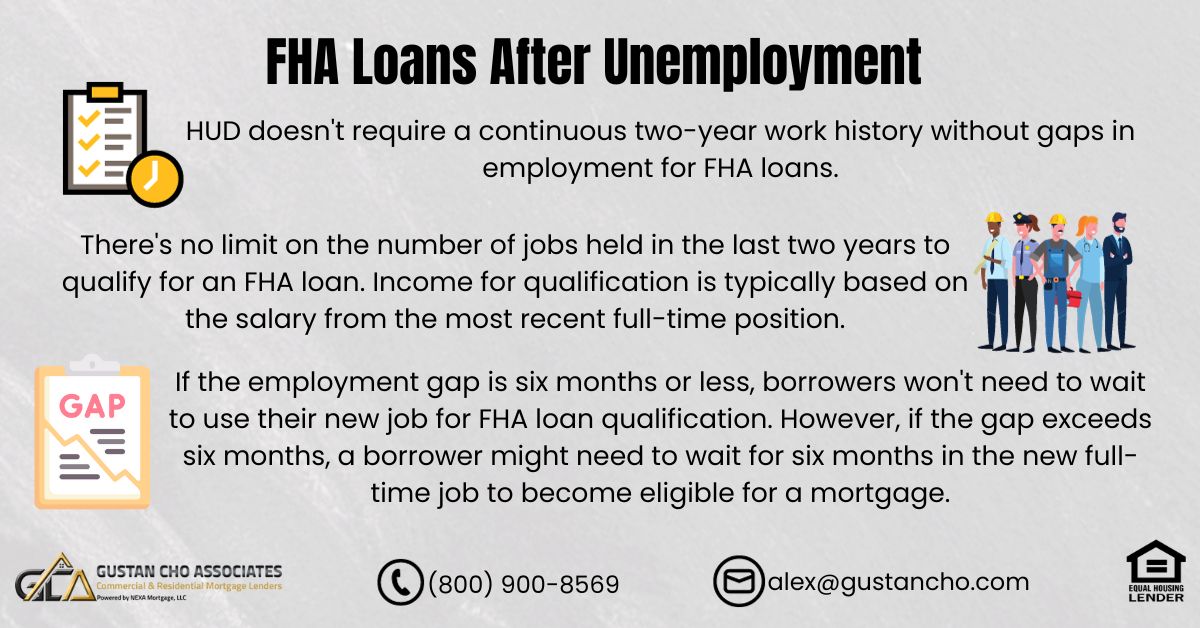

HUD does not mandate a consistent two-year employment history as a prerequisite for FHA loan eligibility. Even with intermittent unemployment or employment gaps within the last two years, you can still meet the criteria and secure pre-approval for an FHA loan.

The Department of Housing and Urban Development (HUD), which is responsible for overseeing FHA, sets the criteria for agency mortgages, specifically concerning FHA loans after unemployment. As outlined in the HUD Agency Guidelines, individuals may qualify for a mortgage even if they have experienced periods of unemployment within the past two years. The following sections will explore FHA loans for individuals who have faced unemployment and subsequent employment gaps.

How Many Jobs Can You Have In The Past Two Years To Get an FHA Loan?

There is no restriction on the number of jobs you’ve held in the last two years. The income considered for qualification will be based on the salary from your most recent full-time position. If someone experiences a gap in employment of six months or fewer, they won’t need to wait to use their new job to qualify for FHA loans after unemployment. John Strange from Gustan Cho Associates sheds light on the timeline for qualifying for FHA loans after commencing a new job:

Most lenders will require 30 days of paycheck stubs for the borrower to be able to close on their loan. The employer will require a written letter of employment and employment verification.

If a borrower experienced an employment gap exceeding six months, they must wait for six months in their new full-time job to become eligible for a mortgage. Borrowers are allowed employment gaps within the past two years and can transition to a different career field while still qualifying for a mortgage.

Recently Unemployed? See If You Can Still Get Approved for an FHA Loan Now

Apply Online And Get recommendations From Loan ExpertsQualifying For an FHA Loans After Unemployment

Many homebuyers think they cannot get FHA loans after being unemployed unless they have worked in their current jobs for two years. However, this is not true according to FHA guidelines. Alex Carlucci from Gustan Cho Associates explains how you can qualify for FHA loans after being unemployed and having gaps in your job history:

If you have been unemployed for less than six months, you can qualify for an FHA loan 30 days after starting a new job. You need to provide two paycheck stubs, which usually cover 30 days. If you have been unemployed for over six months, you must wait six months after starting your new job to qualify.

Borrowers can get FHA loans after unemployment or employment gaps without needing to stay in their current jobs for two years. The FHA guidelines on employment gaps are clear: they do not require two years of steady employment.

How Long Do You Have To Be Employed To Get an FHA Loan?

The HUD mandates a two-year work history, permitting breaks in employment within that period. I’m frequently approached with this query from prospective homebuyers seeking mortgage qualification. Angie Torres from Gustan Cho Associates delineates the distinction between a consistent work history and periods of employment gaps:

HUD requires a two-year employment history which means a comprehensive job history. Employment history differs from employment gaps. You can have gaps in employment and do not need continuous employment history in the past two years.

Lenders require two years of tax returns and two years of employment history. How about cases where a mortgage loan borrower has been laid off during the past two years? Fannie Mae and Freddie Mac have the same guidelines on gaps in employment on conventional loans as HUD Agency Guidelines.

Can I Get FHA Loans After Unemployment If I Changed Jobs To a Different Field?

HUD and other mortgage agencies normally prefer borrowers to be in the same field if they change. However, that is not required. There are many cases where people change jobs to a different field. Dale Elenteny explains how to qualify for an FHA loan after starting a new job in a different field:

Each lender can have higher lending requirements higher than HUD’s minimum agency guidelines on FHA loan called lender overlays.. Lenders can refuse to lend due to their lender overlays. Lenders can require borrowers to have the same job for the past two years as part of their overlays.

For example, we have many teachers, police officers, firefighters, and other public service workers who retire and change fields to the private sector in a different field.

Can I Have Employment Gaps In The Past Two Years To Get an FHA Loan?

You can have gaps in employment in the past two years and qualify for conventional loans. As with FHA loans, if the borrower has been unemployed for six or more months, the borrower needs to be on a new job for six or more months.

You can have multiple jobs in the past two years and qualify for an FHA loan. You do not need to be on the same job for the past two years continuously. However, you do need a full-time salary or hourly job to qualify for an FHA loan.

If the employment gap is less than six months, there is no waiting period after getting a new job on FHA, VA, USDA, and conventional loans. FHA loans require that you be in the job for 30 days. 30 days of paycheck stubs are required.

Buying a Home After a Job Loss?

Apply Online And Talk to an FHA Loan Expert & Explore Your OptionsFHA Loans After Unemployment of More Than 6 Months

If a borrower has been laid off for less than six months, the borrower will qualify without any problems. The borrower can be laid off for no more than six months and start a job with another company.

Lenders can have higher lending requirements above and beyond the minimum agency mortgage guidelines of HUD, VA, USDA, Fannie Mae, and Freddie Mac.

The borrower will have no problem qualifying for a mortgage loan. The borrower can even be in a different line of work. All that is needed is 30 days of paycheck stubs from their new employer before closing on the mortgage.

FHA Loans After Unemployment With Multiple In The Past Two Years?

This section will cover a case scenario on how a borrower can qualify for FHA loans after unemployment with multiple jobs and employment gaps over the past two years. For example, here is a case scenario:

- If the borrower was a school teacher for over 20 years

- Got laid off six months or less

- I just got a job as an automobile mechanic

- The borrower can still qualify for a mortgage loan

- The new pay as the auto mechanic will be used as the new income

- An offer letter of employment is normally required

They can still qualify for a mortgage despite a gap in their employment history in the past two years.

What Is an Overlay From Lenders on a Home Loan?

Lenders must ensure borrowers follow the minimum mortgage guidelines set by agencies like FHA, VA, USDA, Fannie Mae, and Freddie Mac. These guidelines allow borrowers to qualify for a mortgage despite job gaps in the last two years. Alex Carlucci from Gustan Cho Associates talks about lender overlays.

Many homebuyers think that the FHA loan guidelines from one lender (Bank A) are the same as those from another lender (Lender B). This isn’t true. All lenders must meet the minimum HUD agency guidelines for FHA loans.

Each mortgage lender can have their own requirements that are stricter than the minimum guidelines, known as lender overlays. Most lenders impose these overlays. It is up to each lender to decide what types of overlays to apply to their borrowers.

Different Mortgage Lenders Have Different Requirements?

Most lenders have lender overlays on employment gaps. They require borrowers to have zero employment gaps in the past two years to qualify with them. John Strange explains how not all mortgage lenders have the same lending requirements:

It is important borrowers understand not all lenders have the same mortgage lending requirements on government and conventional loans. One lender may require a 620 credit score on an FHA loan while another requires a 580 FICO.

This holds true even though FHA, VA, USDA, Fannie Mae, and Freddie Mac allow employment gaps. This is called lender overlays on gaps of employment by lenders. Gustan Cho Associates has no lender overlays on government and conventional loans.

Case Scenario on Getting FHA Loans After Unemployment

For cases where the mortgage loan borrower has been unemployed for six or more months, mortgage lenders want to see a six-month continuous job history before qualifying them for a mortgage home loan. Here is a case scenario:

- So if the school teacher has been unemployed for one year

- The borrower just got a job as an automobile mechanic recently

- He or she must work on their current job for six months before they would qualify for a mortgage loan

If you have any questions about FHA loans after unemployment, have been previously unemployed, just started a new job, and want to see if you qualify for a mortgage, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com. Our mortgage professionals can review options and work together to get a mortgage after unemployment. We also have access to NON-QM Loans and alternative financing solutions like bank statement mortgage loans.

How Long After Unemployment Can You Get an FHA Loan?

Apply Online And Get recommendations From Loan ExpertsFAQs About FHA Loans After Unemployment

Q: Is a Continuous Two-Year Work History Required for FHA Loan Eligibility?

A: Contrary to a common misconception, the Department of Housing and Urban Development (HUD) does not mandate a consistent two-year employment history. Despite intermittent unemployment or employment gaps within the last two years, applicants can still qualify for FHA loans after unemployment.

Q: How Many Jobs Can I Have in the Past Two Years to Get an FHA Loan?

A: There is no restriction on the number of jobs held in the last two years. The income considered for qualification is based on the salary from the most recent full-time position.

Q: What is the Timeline for Qualifying for FHA Loans After Starting a New Job?

A: If the employment gap is six months or fewer, applicants can qualify for FHA loans after unemployment, 30 days after starting a new job. A six-month continuous job history in the new position is required for gaps exceeding six months.

Q: Can I Qualify for an FHA Loan After Changing Jobs to a Different Field?

A: Yes, borrowers can qualify for FHA loans even if they change fields. While some lenders may have additional requirements (lender overlays), the HUD guidelines do not mandate continuous employment in the same field for two years.

Q: Can I Have Employment Gaps in the Past Two Years and Still Qualify for an FHA Loan?

A: Yes, applicants can have employment gaps in the past two years and still qualify for FHA loans after unemployment. If the gap is less than six months, there is no waiting period required.

Q: How Long do I have to be Employed to Get an FHA Loan?

A: HUD mandates a two-year work history, allowing for breaks in employment within that period. Continuous employment history in the past two years is not required.

Q: Do Different Mortgage Lenders have Different Requirements for FHA Loans After Unemployment?

A: Yes, lenders may have their lending requirements, known as lender overlays. While government agencies set minimum guidelines, individual lenders may impose additional criteria.

Q: What is an Overlay from Lenders on a Home Loan?

A: Lender overlays are additional requirements lenders impose on top of the minimum agency guidelines. These overlays vary among lenders, and borrowers must adhere to them to qualify for a mortgage.

Q: What if I’ve Been Unemployed for an Extended Period?

A: For cases where a borrower has been unemployed for six or more months, most lenders would typically require a continuous job history of six months in the new position before qualifying for FHA loans after unemployment.

This article on FHA loans after unemployment was updated on February 17th, 2025.