Remote Wage-Earner Mortgage Guidelines on Home Loans

This guide covers remote wage-earner mortgage guidelines on home loans. Remote Wage-Earner Mortgage Guidelines On Home Loans allow borrowers who…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers remote wage-earner mortgage guidelines on home loans. Remote Wage-Earner Mortgage Guidelines On Home Loans allow borrowers who…

FHA Work History Guidelines: Can You Qualify with Gaps in Employment? If you’ve been dreaming of owning a home but…

This guide covers continuation of income guidelines of mortgage lenders. The ability to repay is one of the most important…

This guide covers the types of income that mortgage lenders consider qualifying income can use for mortgage loans. Not all…

This guide covers how to buy a house with bad credit. Many folks assume you cannot get a mortgage loan…

This guide explains the requirements for obtaining two FHA loans at the same time. This is important information for those…

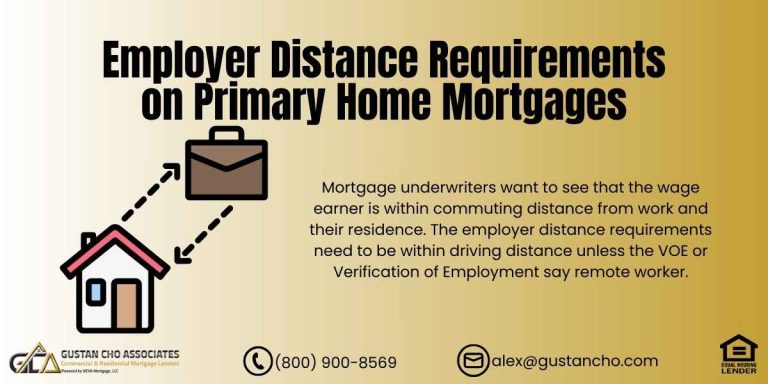

In this blog, we will cover employer distance requirements on primary home mortgages. Employer Distance Requirements On Primary Home Mortgages…

This guide covers how underwriters qualify income to approve mortgage loans. Many mortgage loan applicants do not have the role…

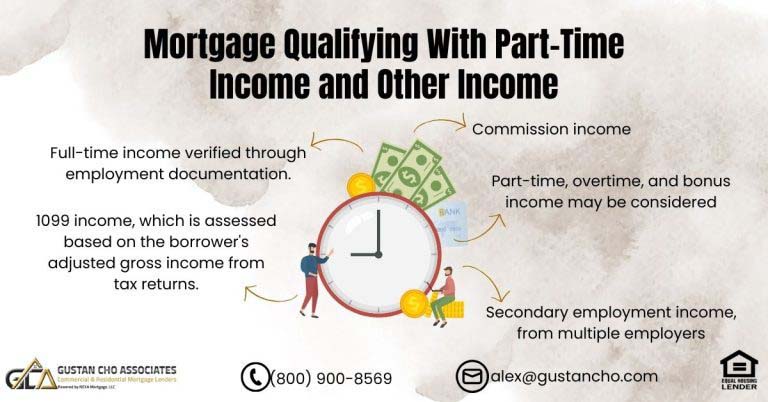

In this blog post, we’ll delve into Mortgage Qualifying With Part-Time Income and Other Income and explore lending guidelines regarding…

This manual provides information on Job Relocation Mortgage Guidelines for individuals purchasing homes in a different state. According to these…

This guide covers how to close on home loan after losing job during mortgage process. We will show you qualifying…

This article delves into the lending prerequisites and regulations concerning mortgage with new job. It addresses the misconception that one…

This blog addresses the eligibility criteria for obtaining a mortgage and securing approval despite having experienced employment gaps within the…

This blog post delves into the crucial aspects of the Two-Year Work History Mortgage Guidelines. It explores the significance of…

This article will discuss and cover qualifying for a mortgage after unemployment. Homebuyers do not need a two-year employment history…

Borrowers cannot qualify for a mortgage with defaulted federal student loans until the student loans are out of default.

This article delves into how underwriters analyze bank statements of borrowers. When individuals seek a mortgage loan, underwriters deem 60…

Mortgage lenders must adhere to the Ability to Repay (ATR) rule when underwriting. That means they must make sure that borrowers can afford the loan before they approve it.

There are strict rules regarding the part-time income to full-time income mortgage guidelines. For part-time income to be used, borrowers…

In this blog, we will discuss and cover qualifying for home loan with job offer letter. One of the frequently…

Most guidelines require lenders to average the most recent two years of income to qualify applicants. Some programs allow borrowers with newer businesses if they have experience

Can I Use Overtime Income As Qualified Income To Qualify For A Mortgage? You can use overtime and part-time income as qualified income as long as those other income has been seasoned for at least two years.