Chicago mortgage loans for self-employed individuals. Many folks in the Chicago Area are business owners and self-employed. If you are one of the many self-employed borrowers who had difficulty qualifying for a mortgage loan over the years, you are in luck. The great news is Gustan Cho Associates now offers bank statement loans and Non-QM loans for self-employed borrowers. There is no private mortgage insurance required. Non-QM loans have no maximum loan limits. This blog will discuss the basics of our bank statement mortgage program for self-employed borrowers.

What’s The Scoop on Mortgages For Self-Employed Borrowers?

Mortgage loans for self-employed individuals used to be challenging until now. Gustan Cho Associates now have home mortgages for self-employed borrowers. NON-QM Loans and Bank Statement Mortgage Loans are designed for Chicago mortgage loans for self-employed individuals.

Federal income tax returns are not required on non-QM loans. Most self-employed individuals write off as much as possible to minimize paying taxes.

Writing off business expenses and utilizing as many deductions as possible is one of the many advantages of being self-employed. This is because you get away with paying a lot of taxes. Chicago mortgage loans for self-employed individuals now do not require tax returns; we can just go off 12 months’ bank statements.

Types of Chicago Mortgage Loans For Self-Employed Individuals

Ensure your credit score is in good shape, as this will play a significant role in the mortgage approval process.

Pay attention to your credit report, resolve any discrepancies, and work on improving your credit score if needed. As a self-employed individual, you’ll likely need to provide more detailed documentation of your income. This can include tax returns, profit and loss statements, and bank statements. Lenders typically look for a consistent and stable income history.

Traditional Chicago Mortgage Loans For Self-Employed Individuals

e prepared to provide at least two years of personal and business tax returns. Lenders may also request a year-to-date profit and loss statement to assess your current financial situation. Keep detailed profit and loss statements for your business.

Save for a down payment. While there are mortgage programs that allow for lower down payments, having a substantial down payment can strengthen your application.

This helps lenders understand the financial health of your business and assess your ability to make mortgage payments. Lenders will evaluate your debt-to-income ratio, which compares your monthly debt payments to your gross monthly income. Keeping this ratio within acceptable limits will increase your chances of loan approval.

Speak With Our Loan Officer for Getting Mortgage Loans For Self-EmployedWork with a Mortgage Broker

Consider working with a mortgage broker who has experience with self-employed individuals. They can help you find lenders who are more open to working with self-employed borrowers and guide you through the application process. Ensure that your financial records are well-organized. This includes keeping business and personal expenses separate, maintaining a business bank account, and providing clear documentation for any deductions on your tax returns.

Alternative Documentation Loans

Some lenders offer “alternative documentation” or “bank statement” loans for self-employed individuals. These loans may rely on your bank statements and business cash flow rather than tax returns. Explore working with government-backed loans.

Government-backed loans, such as those insured by the Federal Housing Administration (FHA) or guaranteed by the Department of Veterans Affairs (VA).

Government-backed loans have more flexible requirements for self-employed individuals. Before making any decisions, it’s crucial to consult with a mortgage professional or financial advisor to get personalized advice based on your specific financial situation and goals. Keep in mind that the mortgage landscape may change, so staying informed about the latest lending practices and requirements is essential.

Speak With Our Loan Officer for Getting Mortgage Loans For Self-Employed

Financing For Self-Employed Individuals With Bank Statement Loans

Income for Chicago Mortgage Loans For Self-Employed Individuals is calculated with deposits. A lender will go off what the self-employed worker has filed for income on their tax returns. Lenders require two years of tax returns and will average the two years’ income from the tax returns.

If the latter year’s income is greater than the previous year with substantial increase of monthly bank statement deposites, the two income off the tax returns is averaged.

If the latter year’s income is less than the previous year’s income on the tax return, the lender will use the lesser income amount. However, with our new Chicago Mortgage Loans For Self-Employed Individuals, only deposits from bank statements qualify for income. Deductions from tax returns do not matter. Income tax returns are not required with bank statement loans for self-employed borrowers.

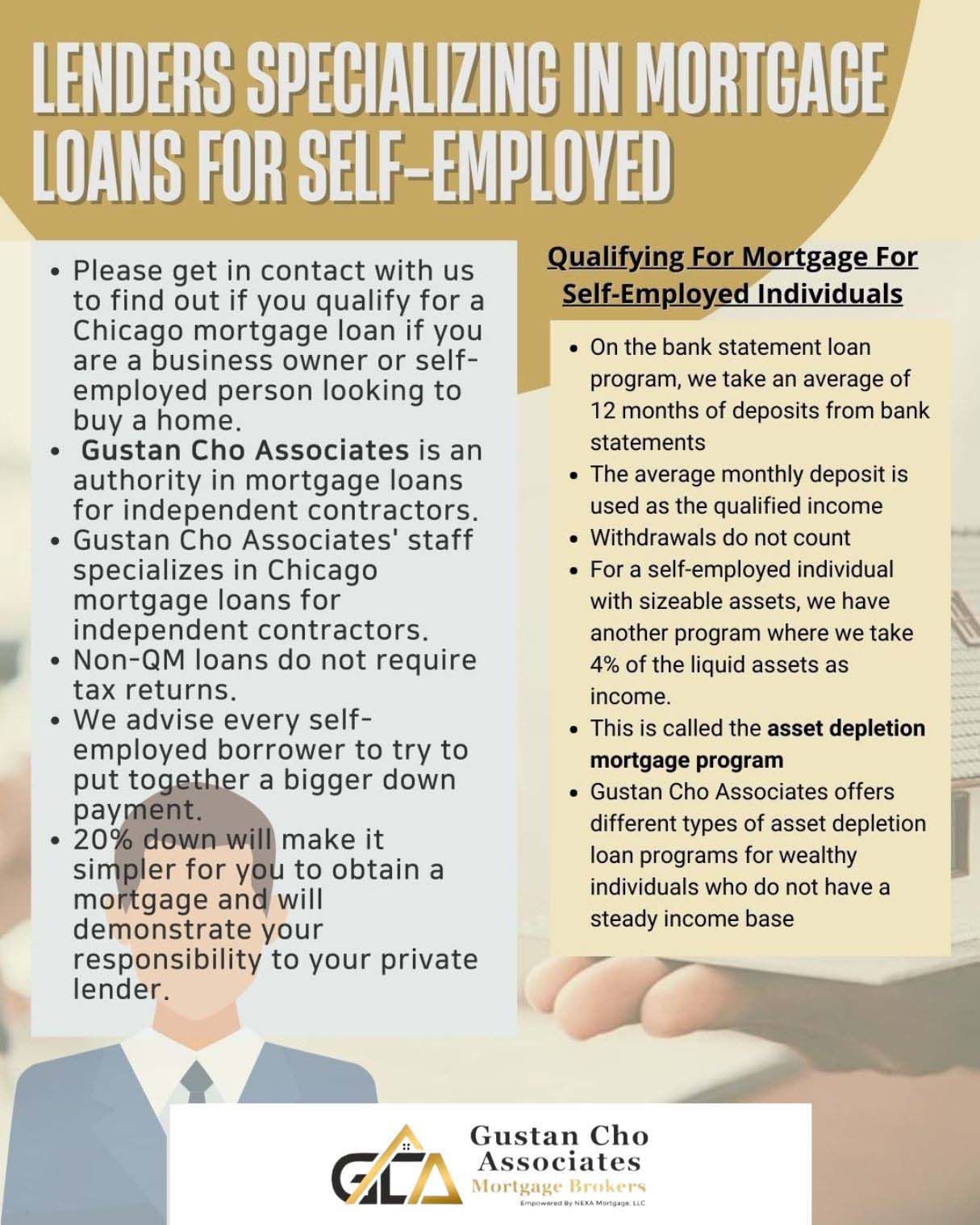

Lenders Specializing In Mortgage Loans For Self-Employed

Business owners and self-employed individuals who own businesses looking to purchase a home and are seeking a Chicago mortgage loan, please contact us to get qualified. Gustan Cho Associates are experts in mortgage loans for self-employed individuals.

The team at Gustan Cho Associates specializes in Chicago mortgage loans for self-employed individuals. No Tax Returns are Required on non-QM loans.

Tax returns are interpreted differently by each mortgage lender. Some lenders will add depreciation from Schedule C back to income. Some lenders will consider rental income as part of your income. Others will only take 75% of your rental income as additional income. Now with our Chicago Mortgage Loans For Self-Employed Individuals, deductions or tax returns will no longer matter.

Qualifying For Mortgage For Self-Employed Individuals

For those self-employed folks who started a new business and had a stellar recent year, the previous year was not such a hot one. Look no further. We can help. We offer multiple mortgage loan programs for self-employed borrowers. Here is how the loan program generally works: On the bank statement loan program, we take an average of 12 months of deposits from bank statements.

The average monthly deposit is used as the qualified income. Withdrawals do not count. For a self-employed individual with sizeable assets, we have another program, called asset depletion mortgage loans, where we take 4% of the liquid assets as income.

For example, if a self-employed individual has $500,000 worth of cash and stocks, we can use 4% of the $500,000, or $20,000, as additional income. This is called the asset depletion mortgage program. Gustan Cho Associates offers different types of asset depletion loan programs for wealthy individuals who do not have a steady income base

Best Chicago Mortgage Lenders For Self-Employed Individuals

The team at Gustan Cho Associates specializes in Chicago mortgage loans for self-employed individuals. If you have any questions, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com, or you can visit us at www.gustancho.com.

Gustan Cho Associates are mortgage brokers and correspondent lenders licensed in 48 states, including Puerto Rico, Washington, DC, and the U.S. Islands and is available seven days a week.

The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays. Gustan Cho Associates is a mortgage company licensed in multiple states with no lender overlays on government and conventional loans. We also have dozens of lending relationships with non-QM wholesale lenders.