Employer Distance Requirements on Primary Home Mortgages

In this blog, we will cover employer distance requirements on primary home mortgages. Employer Distance Requirements On Primary Home Mortgages…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

In this blog, we will cover employer distance requirements on primary home mortgages. Employer Distance Requirements On Primary Home Mortgages…

This guide covers how underwriters qualify income to approve mortgage loans. Many mortgage loan applicants do not have the role…

In this blog post, we’ll delve into Mortgage Qualifying With Part-Time Income and Other Income and explore lending guidelines regarding…

This manual provides information on Job Relocation Mortgage Guidelines for individuals purchasing homes in a different state. According to these…

Gustan Cho Associates has mortgage with no income documentation, no tax returns, and low credit scores. Many folks who have…

This guide covers how to close on home loan after losing job during mortgage process. We will show you qualifying…

This article delves into the lending prerequisites and regulations concerning mortgage with new job. It addresses the misconception that one…

This blog addresses the eligibility criteria for obtaining a mortgage and securing approval despite having experienced employment gaps within the…

This guide covers mortgage guidelines for remote workers on home purchase. Mortgage Guidelines For Remote Workers have been lightened up…

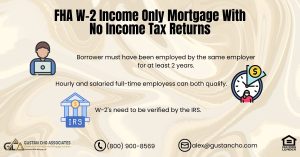

The FHA W-2 Income Only Mortgage Lending Guidelines provide a pathway for borrowers to qualify for an FHA loan based…

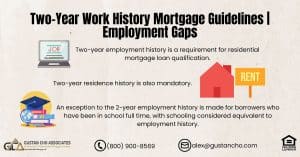

This blog post delves into the crucial aspects of the Two-Year Work History Mortgage Guidelines. It explores the significance of…

This article will discuss and cover qualifying for a mortgage after unemployment. Homebuyers do not need a two-year employment history…

Borrowers cannot qualify for a mortgage with defaulted federal student loans until the student loans are out of default.

This blog examines the eligibility requirements for FHA loans after unemployment or employment gaps. Prospective FHA loan applicants now have…

This article delves into how underwriters analyze bank statements of borrowers. When individuals seek a mortgage loan, underwriters deem 60…

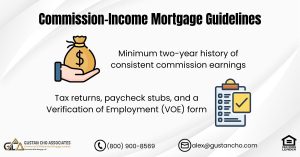

There are special rules for commission income when applying for a mortgage:

These rules apply to anyone who earns at least 25% of their compensation from commissions.

In general, you must earn commission income for at least two years to use it for mortgage qualification. But there are exceptions.

Because commission income is variable, lenders average it according to certain rules.

Mortgage lenders must adhere to the Ability to Repay (ATR) rule when underwriting. That means they must make sure that borrowers can afford the loan before they approve it.

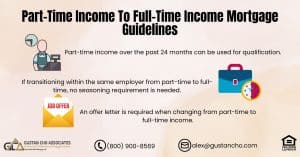

There are strict rules regarding the part-time income to full-time income mortgage guidelines. For part-time income to be used, borrowers…

In this blog, we will discuss and cover qualifying for home loan with job offer letter. One of the frequently…

Borrowers can qualify for a self-employed mortgage with a single year’s tax return.

Most guidelines require lenders to average the most recent two years of income to qualify applicants.

Some programs allow borrowers with newer businesses if they have experience in their field and their income is at least what it was as a salaried employee.

Underwriters use an adjusted taxable income to qualify self-employed borrowers, not the gross income.

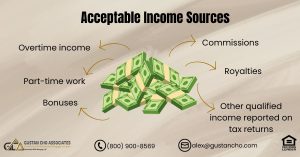

Can I Use Overtime Income As Qualified Income To Qualify For A Mortgage? You can use overtime and part-time income as qualified income as long as those other income has been seasoned for at least two years.

This guide covers home buyer concerns buying their first-home. A home purchase is most people’s single largest investment in their…