Fannie Mae HomePath Mortgage Loans

This Article On Fannie Mae HomePath Mortgage Was PUBLISHED On May 10, 2024. Fannie Mae is now offering the Fannie…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This Article On Fannie Mae HomePath Mortgage Was PUBLISHED On May 10, 2024. Fannie Mae is now offering the Fannie…

Home loans are still available to borrowers with collections, charged-off accounts, or late payments. Lenders are generally willing to approve…

In this blog, we’ll explain the qualifying credit score that lenders use for mortgages. Mortgage underwriters determine this score by…

This guide covers qualifying for a home loan without spouse mortgage guidelines. There are many reasons why home buyers want…

This guide covers why underwriters issue denials on mortgage loans. The mortgage process should not be a stressful process and…

This guide covers comparison of mortgage rates on purchase and refinance loans. Mortgage rates have been steadily going up to…

In this blog, we’ll explore the process of working with a loan officer during your mortgage application. Choosing a loan…

Many homebuyers have substantial value on their 401k. They can use up to 60% of the value of their 401k for their down payment and/or closing costs on their home purchase. The amount used from their 401k is not used for their debt to income ratio calculations.

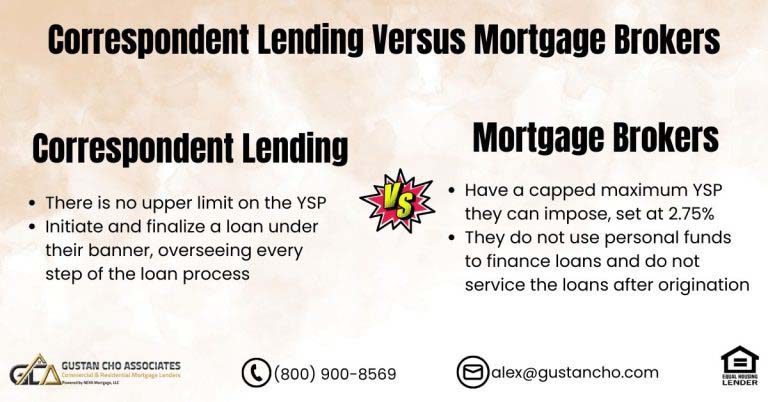

This blog aims to explore the difference between correspondent lending and mortgage brokers. A common inquiry we receive regularly pertains…

All mortgage loan programs require a maximum front debt-income ratio and back debt to income ratio. However, conventional loans do not require a front debt to income ratio. VA loans do not have a debt to income ratio requirements. Lenders can have lender over lender overlays on debt to income ratios.

The Federal Housing Administration (FHA), a segment of the United States Department of Housing and Urban Development, was established in…

In this blog, we will cover ARM versus fixed-rate mortgages. ARM stands for an adjustable-rate mortgage. Adjustable-Rate Mortgage is when…

California FHA loans are a preferred mortgage solution for various borrowers, including first-time homebuyers, individuals with poor credit, and those…

Lenders can offer 100% with no mortgage insurance at competitive low mortgage rates on VA loans due to the government guarantee against loss or foreclosure on VA loans. VA loans have no maximum debt-to-income ratio cap on VA loans.

There is no sign of any housing market crash, especially in Florida. Home prices are booming with no signs of any correction.

This article will tackle the Community Property States Mortgage Guidelines On DTI. Understanding marital property rights can be intricate, especially…

This article will discuss buying home near railroad tracks and its negative impact on appreciation and resale value. No doubt…

Transitioning from monthly to bi-weekly mortgage loan payments can be a strategic move for homeowners looking to expedite their mortgage…

This blog will cover how mortgage underwriters look at credit report vs credit scores. Minimum credit scores are required to…

This article will cover HUD DACA mortgage guidelines on FHA loans for DREAMERS. Gustan Cho Associates have some good news…

This guide covers how qualified mortgages affect borrowers and lenders on residential loans. To avoid another 2008 financial crisis, Congress…

Congrats on your new home purchase! We’ll guide you through the exciting process of Furnishing Your New Home Purchase Prior…